CommEX

-

Table of Contents

- Binance's exit from the Russian market

- What is known about CommEX Exchange?

- CommEX security

- User Interface

- Withdrawing funds from the CommEX exchange

- CommEX Support Service

- Which countries can you use in CommEX?

- Who owns CommEX?

- The link between CommEX and Binance

- Importance of the Russian market for Binance

- Conclusion

The new cryptocurrency exchange CommEX attempts to fill the market void left by Binance, which leaves the Russian market. As a result, CommEX exchange is gradually becoming a more frequent choice for those looking for an alternative place to trade cryptocurrencies. In this article, we gathered currently available information about the new trading platform and the relationship between CommEX and Binance.

In September 2023, the largest cryptocurrency exchange, Binance, announced its gradual exit from the Russian market, and CommEX received the Russian assets of Binance.

Binance's exit from the Russian market

While Binance is shutting down its exchange services and businesses in Russia, CommEX allows users to transfer their assets free of charge until January 31, 2024.

New users who have completed KYC registration in Russia will be redirected to CommEX. Simultaneously, it is not mandatory to move on to this exchange.

What is known about CommEX Exchange?

The CommEX Exchange is owned by CommEX Holding Ltd., a company registered in Seychelles. According to Who.is, the domain name commex.com was registered in November 2017 and renewed on September 22, 2023. As such, traders on the CommEX exchange can trade in both the spot and futures markets, and their functionality is similar to any other major cryptocurrency exchange.

CommEX security

CommEX security measures include two-factor authentication, IP address protection, withdrawal with email confirmation, blocking of withdrawals if personal details change, real-time risk control, code audits and encryption. Most assets are stored in cold wallets for enhanced protection, supported by multi-signature mechanisms in the TSS wallet.

User Interface

The CommEX exchange has a relatively simple and straightforward interface. This makes it attractive to both novice and experienced traders. Currently, CommEX can be accessed via a website or mobile app for Android (an IOS app has not yet been developed).

Source and copyright © CommEX

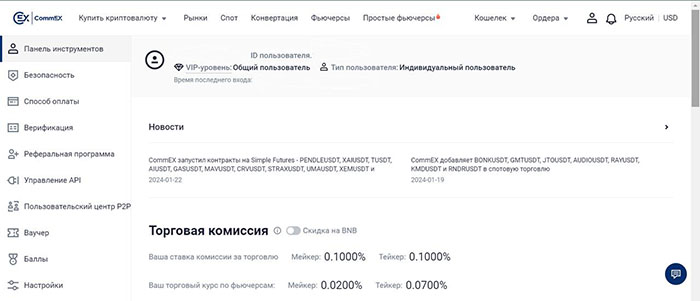

All the necessary functions are displayed on the main page. At the top are the typical buttons for accessing P2P, spot, and futures trades. At the top, you can access wallets and pages for transactions with funds.

The menu provides information on security, payment methods, and verifications. The page also displays the latest news exchange and information regarding the CommEX trading commissions.

Withdrawing funds from the CommEX exchange

The commission depends on the token or cryptocurrency from which you withdraw. The following is information on withdrawal fees for some coins.

- BTC. Minimum withdrawal of 0.0015 BTC. Withdrawal fee: USD 0.00085.

- USDT TRC-20. Minimum withdrawal cost of USD 10. Service fee is 1 USDT.

- BNB. Minimum withdrawal 0.01. Cash out fee is 0.0005.

- ETH. Minimum withdrawal: 0.0008 (via Arbitrum). Withdrawal fee 0.00015.

Fiat-currency withdrawals are also available. The commission rate for RUB withdrawals was 2%. The maximum daily withdrawal limit in RUB is 1500000, but it is possible that the limits will change in the future; you can follow the current information on the CommEX website.

CommEX Support Service

The CommEX technical support service works around the clock and helps with any problems or questions related to the platform use. The exchange also has a Telegram channel and chat rooms in Russian and English, where active communication with users takes place. Support staff will respond promptly to the questions asked.

Which countries can you use in CommEX?

The company states that its main markets are in Asian and CIS countries. The official website also states that account registration and services will not be available to the citizens of the USA and most EU countries.

Who owns CommEX?

According to the project team, CommEX is "a startup consisting of dozens of passionate professionals with diverse professional backgrounds,” including "experts who previously worked at Binance and bring deep knowledge of cryptocurrencies and technology to the team.”

The company claims that neither Binance nor its affiliates have any ownership or control over CommEX, and stresses that Binance is, therefore, not the owner of the new exchange. The company's executives, on the other hand, "prefer to remain non-public figures.”

The link between CommEX and Binance

It is impossible to verify information regarding who owns CommEX with certainty. Some experts believe that the possibility that former managers of Binance's Russian operations are in contact with CommEX and that monitoring its activities cannot be ruled out.

There are several reasons for this finding. For example, there are similarities in privacy policies: in the relevant text on the CommEX website, some phrases and clauses are almost identical to those of Binance. The same can be said for the terms on the use page. The crypto community also notes similarities in the layouts of the Binance and CommEX websites.

Some in the crypto community draw parallels between CommEx in Russia and Binance's US branch, Binance.US, questioning its claims to operate independently of Binance.

Importance of the Russian market for Binance

Russia ranked first in terms of visits to Binance.com, accounting for 6.3% of the total visits. This demonstrates the significant benefit of having presence in the market. At the time of writing, Russia was fourth on the list, accounting for 4% of total visits.

However, in a post on X (formerly Twitter) dated September 28, 2023, Binance CEO Changpeng Zhao states that there are no buyback options in this deal and that he does not own CommEX shares.

Conclusion

The CommEX exchange has made a positive impression on us. Its user-friendly and familiar interface, high liquidity, focus on the Russian market, possibility of P2P trading, and availability of spot and futures contracts make it an attractive choice for many investors.

Additionally, a high level of security increases credibility. We are confident that CommEX has the potential to become a significant participant in the Russian crypto market and take its rightful place there, including replacing the Binance exchange, which has left the market.