What Is Tether (USDT)?

Tether (USDT) is the largest stablecoin pegged to the U.S. dollar. It is a fiat-collateralized cryptocurrency and its value is designed to mirror the U.S. dollar, offering a shield against the volatility often seen in other digital assets like Bitcoin. Stablecoins, like Tether, provide traders a means to seamlessly transition between different cryptocurrencies and fiat currencies without the typical fluctuations.

Originating as RealCoin in July 2014, it underwent rebranding to Tether by November the same year. While initially built on the Bitcoin blockchain using the Omni Layer protocol, Tether has since expanded its support into other blockchains like Ethereum, TRON, EOS, Avalanche, Algorand, Solana among others.

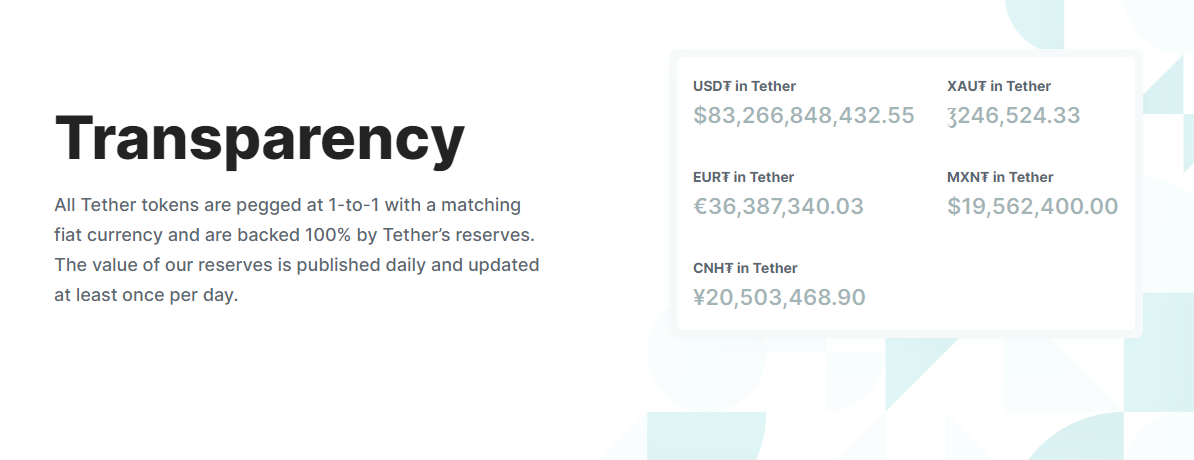

Beyond just the U.S. dollar (USDT), Tether provides stablecoins tied to various fiat currencies, such as the Euro (EURT), Mexican pesos (MXNT), and Chinese renminbi (CNHT), as well as commodities like gold (XAUT). This diversification eases cross-border payments, reducing the losses typically seen in traditional currency exchanges.

Tether's stability is maintained through a reserve of assets, including cash, bonds, loans, commodities, and other digital tokens.

Tether is owned by Hong Kong-registered firm iFinex, which also possesses the crypto exchange BitFinex. Tether stands as the third-largest cryptocurrency, following Bitcoin and Ethereum, solidifying its position as the dominant stablecoin in the market.

How Does USDT Work?

Tether (USDT) is a stablecoin designed to counteract the volatility of the cryptocurrency market by anchoring its value to the US dollar. By bridging the gap between traditional fiat and digital currencies, Tether offers a consistent and digital store of value. It minimizes the risk of slippage, which is the potential change in value from the initiation to the execution of a transaction.

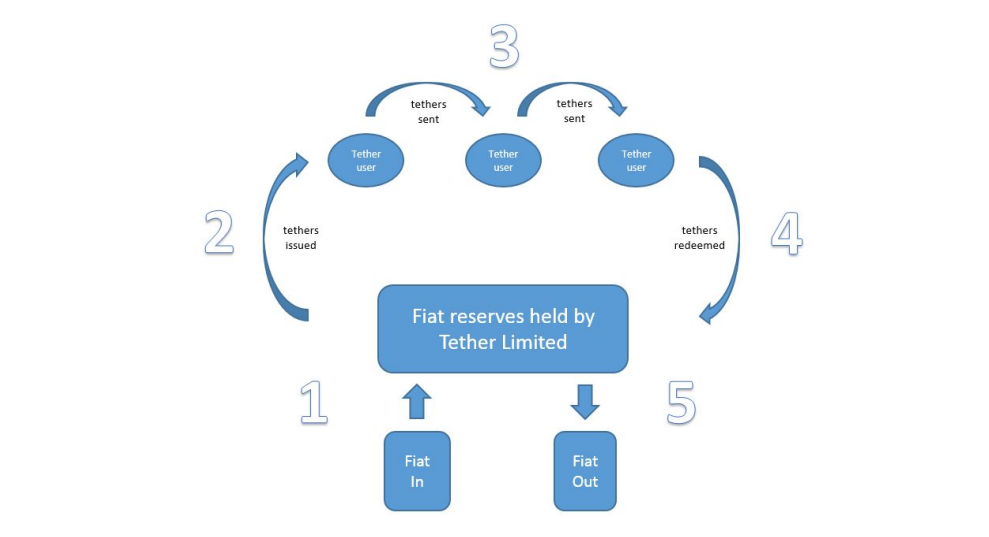

The fundamental stability of Tether stems from its reserves. Tether Limited, the entity behind the stablecoin, claims that for every USDT in circulation, they hold an equivalent or greater value in assets, such as cash or short-term financial instruments like bonds. Regular reports outlining the reserve status versus the outstanding USDT tokens are published on their website, aiming to provide transparency.

However, it's important to note that holders of USDT may not always be able to redeem it directly from Tether Limited for U.S. dollars. Instead, most users trade USDT on cryptocurrency exchanges.

Tether operates under a centralized framework, with Tether Limited overseeing the issuance and burning of USDT tokens based on demand. Simplified, the process functions as follows: when a user deposits a US dollar into Tether's account, Tether Limited produces a corresponding Tether token.

Source & Copyright: Tether Whitepaper

Who Are The Founders and Investors of Tether?

Established in July 2014 by Brock Pierce, Craig Sellars, and Reeve Collins, Tether (USDT) stands as a pioneering stablecoin. Its foundation rests on the Mastercoin (Omni) protocol, a precursor that brought the idea of stablecoins to light in 2012. Tether introduced the fiat-collateralized stablecoin model and has since become the predominant stablecoin in circulation.

The inception of Tether aimed to address two primary challenges within the cryptocurrency: significant volatility and the seamless convertibility between fiat and cryptocurrencies.

Bitfinex became the first among crypto exchanges to introduce Tether trading in January 2015. Notably, while Bitfinex and Tether Limited operate as distinct entities, the 2017 Paradise Papers leak unveiled that Bitfinex officials were instrumental in founding Tether Limited. Subsequently, in 2018, a representative confirmed that the two companies are helmed by the same CEO.

What Is USDT Price Today?

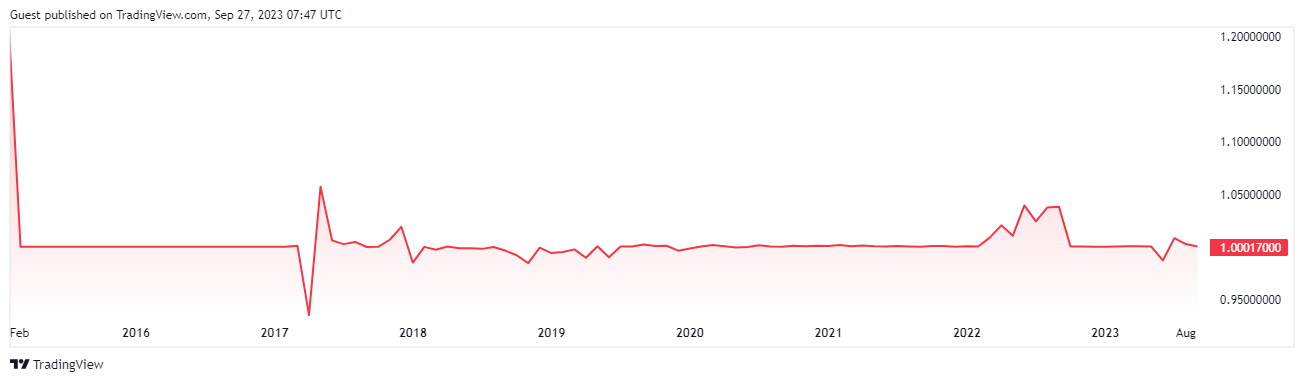

While Tether asserts that its tokens are safe from the typical market volatility that affects other cryptocurrencies, USDT has indeed seen price fluctuations throughout its history. Thus, similar to other cryptocurrencies, it's essential to conduct thorough research before making investment decisions, keeping in mind that it's impossible to predict USDT prices with certainty.

As of now, the Tether USDT price stands at $0.999907 with a 24-hour trading volume of $64,430,833,274. Please check this page for the up-to-date price and trading volume.

Source & Copyright: TradingView

What Is the All-time High for Tether (USDT)?

Tether reached its all-time high of $1.32 on July 24, 2018. USDT does not experience "all-time highs" in the same manner that other cryptocurrencies do due to its design and purpose.

However, there have been instances in which USDT has traded slightly above its $1 peg due to market dynamics, demand, and liquidity concerns; however, these instances are typically brief, and the price typically returns close to $1 within a short period of time.

On average, USDT fluctuates between $0.98 and $1.02 based on exchange liquidity, market sentiment, and any concerns regarding Tether's financing or operations.

What Is the All-time Low for Tether (USDT)?

Tether reached its all-time low of $0.5683 on March 2, 2015, shortly after trading on Bitfinex had just begun. In October 2018, USDT's price deviated from its typical $1 peg, dropping to around $0.85-$0.90 on some exchanges due to speculation about Tether Limited's banking stability and doubts over USDT being fully backed 1:1 by U.S. dollars. Moreover, leaks about Bitfinex being closely linked with Tether fueled withdrawal causing further mistrust. These factors led to panic selling of USDT.

What Is the Market Cap of Tether (USDT)

It currently holds a market capitalization of $152,953,400,000. There are 152,913,418,919 of USDT coins in circulation. Check this page regularly to stay updated on USDT's market cap.

How and Where to Buy USDT?

Buying Tether (USDT) is an easy process that is similar to buying other cryptocurrencies. First thing you need to do is to choose a cryptocurrency exchange. Some of the most popular centralized and decentralized exchanges where USDT is available include Binance, Coinbase Exchange, Kraken, Uniswap, PancakeSwap, and many others. When choosing an exchange, consider factors like fees, security, user interface, and the region/country of operation.

Once you've chosen an exchange, create an account, deposit funds (fiat or other cryptocurrencies), and exchange it directly for USDT. Some platforms also allow you to buy USDT using a credit or debit card.

How to Sell USDT?

Selling your Tether (USDT) is as intuitive as buying it. If you've previously purchased USDT, you likely already have an account on a crypto exchange. Most platforms that support USDT buying also support selling.

If your USDT is in a private wallet, you'll need to transfer it to your chosen exchange. Once your USDT has been deposited, go to the trading section of the exchange. Here, you can set up a sell order. You can choose a market order to sell immediately at the current market price or a limit order to specify a price at which you wish to sell.

After selling USDT, you'll have the fiat currency or another cryptocurrency in your exchange account. Navigate to the withdrawal or cash-out section to transfer your funds to your bank account or to another destination of your choice.

Is USDT Coin Legit?

The legitimacy of Tether (USDT) has been a topic of extensive debate within the crypto community. Here are some important factors to consider.

Since its founding in 2014, Tether has been the subject of ongoing controversy due to the failure of Tether to provided audited financial statements proving it has adequate reserves backing USDT.

Tether originally claimed that for every USDT token in circulation, there was an equivalent amount of U.S. dollars held in reserve. This supposedly guaranteed that each USDT would always maintain a value close to $1 USD. Skeptics raised concerns about the veracity of Tether’s claims. Tether Limited's reluctance, at times, to provide a full, transparent audit of its reserves fueled these suspicions.

In 2019, Tether changed the language on its website. Originally, it claimed that each USDT was backed by "traditional currency". However, this was revised to state that USDT was backed by "reserves", which might include assets other than U.S. dollars. This led many to believe that Tether's backing might include assets that were not as liquid or stable as the U.S. dollar.

Eventually, details emerged suggesting that Tether's reserves weren't solely traditional bank deposits but included a mix of cash, cash equivalents, and other assets, potentially including loans to affiliate companies.

Concerns were raised that the issuance of new USDT was correlated with increases in the price of Bitcoin. Some speculated that USDT might be used to buy Bitcoin and prop up its price artificially.

The New York Attorney General's Office (NYAG) initiated an investigation into Tether Limited and its affiliate, Bitfinex. The probe was concerned with a cover-up of an $850 million loss by Bitfinex, with allegations that funds from Tether's reserves were used to mask the loss.

In 2021, the NYAG concluded its investigation by reaching a settlement with Tether and Bitfinex. The firms agreed to pay $18.5 million in penalties and to cease any further business with New Yorkers. Notably, the settlement did not include an admission or denial of wrongdoing.

Even as recently as 2023, the company provided little information about its reserves. Tether's website once simply said, "All Tether tokens are pegged at 1-to-1 with a matching fiat currency and are 100% backed by Tether's reserves".

Source & Copyright: Tether.to

Despite the controversies, USDT remains one of the most widely used and accepted stablecoins in the cryptocurrency world. Its integration into major exchanges and its volume of trade underscore its prominence in the market.

Tether's resilience against market fluctuations and regulatory scrutiny has been proven time and again. Being based in the crypto-accommodating environment of Hong Kong provides it an edge against potential regulatory challenges seen in countries like the United States. This strategic positioning safeguards it against the unpredictable nature of political and regulatory shifts.

What Makes Tether (USDT) Unique?

Tether (USDT) stands as a prominent figure in the crypto space, boasting legitimacy and acceptance. With widespread adoption across various blockchain ecosystems, it has established itself as a preferred method of payment and exchange.

Tether's extensive reserves shield it from significant market risks, such as Black Swan events. Moreover, like other cryptocurrencies, it benefits from features like peer-to-peer trading and PoW or PoS security, making it an attractive option for both casual traders and institutional investors.

The core function of USDT is to offer liquidity and act as a buffer against market volatility. It's designed to neither appreciate nor depreciate in value, with its worth tied directly to Tether's reserves. In essence, as long as Tether upholds its 1:1 backing, USDT will always equate to 1 US Dollar.

Its availability spans across major blockchains; this vast accessibility means that the majority of crypto exchanges pair their assets with USDT. Without such pairing, traders might find themselves restricted, potentially needing to swap stablecoins at a disadvantage. Therefore, the market cap of Tether serves as an indicator for traders on the most efficient stablecoin to utilize.

How to Keep Your Tether Safe?

Store your USDT in trusted and secure wallets. There are both hardware wallets and software wallets that support USDT. Hardware wallets are generally considered more secure as they are offline and less vulnerable to hacking.

Always activate Two-Factor Authentication (2FA) on any exchange or wallet platform.

For any crypto-related account, use a password that is long, unique, and combines numbers, symbols, and both lowercase and uppercase letters. Consider using a reputable password manager to keep track of your credentials.

Always backup your wallets and securely store recovery phrases offline. These phrases are crucial for regaining access to your funds if you lose your device or forget your password.

Pros and Cons of Tether

| Pros of USDT | Cons of USDT |

| USDT's value is designed to be pegged to the U.S. dollar, offering a stable price point in the volatile crypto market. | Tether has faced legal challenges and increased regulatory scrutiny. |

| USDT is one of the most widely traded cryptocurrencies and provides liquidity across numerous exchanges. | Unlike decentralized stablecoins, USDT is issued by a centralized entity (Tether Limited). |

| USDT is available on multiple blockchains | Given its size and significance, any disruption to USDT could impact the broader crypto market. |

| USDT can be easily used on most major exchanges, making it convenient for trading and hedging against volatility | Transparency concerns. Tether Limited provides little information about its reserves. |

Summary

Tether (USDT) is a pioneering stablecoin introduced in 2014, aiming to provide stability in the volatile cryptocurrency market by pegging its value to the U.S. dollar. Originating as RealCoin and later rebranded as Tether, it serves as a bridge between fiat and cryptocurrencies, allowing seamless transitions without significant price fluctuations. While its foundations lie in the Bitcoin blockchain, USDT has extended its presence across various platforms like Ethereum, TRON, and EOS.

USDT is backed by a reserve of assets, including cash and short-term financial instruments, maintained by Tether Limited, the Hong Kong-registered company also associated with Bitfinex, a prominent crypto exchange. Despite its vast adoption and prominence as the third-largest cryptocurrency, Tether has been surrounded by controversies concerning its reserves and the veracity of its 1:1 U.S. dollar peg.