What Is Lido Staked Ether (STETH)?

Lido Finance is a protocol for liquid staking. The essence of its work is the ability to deposit cryptocurrency and receive derivative tokens in equal share in return. Thus, cryptocurrency owners can continue to use tokens locked in staking for financial transactions.

Although Lido Finance supports the staking of many cryptocurrencies, its popular product among users is ETH, for which it has a derivative ERC-20 token called stETH. Users receive stETH in exchange for their staked ETH. The stETH token came into existence in 2020 in anticipation of Ethereum's transition from PoW to PoS. Since then, the Lido Staked Ether (STETH) user base has continued to grow.

Source & Copyright Lido

Though originally registered in the Cayman Islands, Lido Finance is now controlled by the DAO and uses the LDO token for governance. The success of the launch on Ethereum has led to Lido expanding to other blockchains such as Terra, Solana, Polygon, Kusama and Polkadot.

Who Are the Founders and Investors of Lido Staked Ether?

Vasily Shapovalov, Konstantin Lomashuk and Jordan Fish are behind the creation of the Lido project. Shapovalov has many years of experience in software development, Lomashuk has a PhD in finance, and Fish has been involved in cryptography since 2012. Lido and LDO tokens were launched on December 19, 2020, after successful testing on the Goerli network. The protocol is managed by a decentralized autonomous organization. Important decisions are made by voting. The security and operability of the project is verified by leading blockchain firms.

Early investors included ParaFi Capital, Synthetix founder Kain Warwick, Aave CEO Stani Kulechov, MakerDAO creator Rune Christensen, Semantic Ventures, Terra, Stakefish and Staking Facilities. Lido has raised about $2 million in funding. Paradigm Fund invested 15,200 ETH and received LDO in return. In 2022, Lido received a $70 million investment from Andreessen Horowitz. Lido is also partnering with various blockchain ecosystem projects, including Neutron and Axelar, to connect its stETH tokens with other networks such as Cosmos.

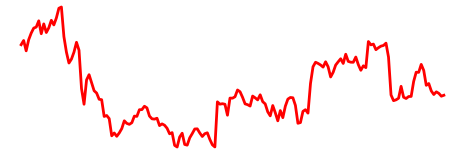

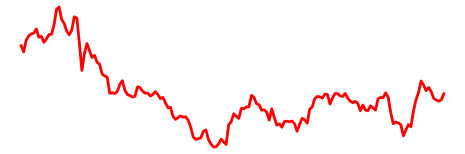

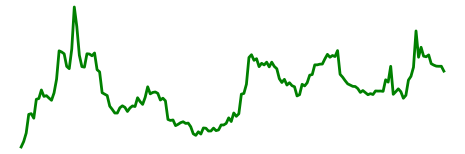

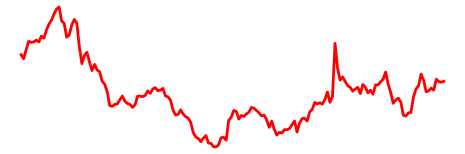

What Is Lido Staked Ether Price Today?

Today, the price of stETH is $2,537.37 and the trading volume for the last 24 hours is $23,912,876. It is believed that the price of stETH is pegged to ETH so that when ETH is unlocked, users can exchange their stETH for an equivalent amount. This was the case until June 2022, when stETH lost its peg to ETH due to several events. Celsius lost 35,000 ETH in staking due to the loss of a private key, causing users to worry about refunds. Then a whale sold 19,998 stETH, which caused the stETH/ETH exchange rate to drop by nearly 10%, triggering more panic in the market. Since then, the peg has not been restored, but it has maxed out at 0.97.

Source & Copyright TradingView

What Is the All-time High for Lido Staked Ether (STETH)

On November 16, 2021, stETH recorded its all-time high at $4,982.43. This happened amid the crypto boom and the rapid growth of the DeFi trend.

What Is the All-time Low for Lido Staked Ether (STETH)

On December 24, 2020, stETH recorded its all-time low at $551.78. This month marked the beginning of the transition to Ethereum 2.0. Despite such a significant event for the Lido protocol, several issues were discovered that caused the price of stETH to drop.

What is the Market Cap of Lido Staked Ether (STETH)

Lido Staked Ether (stETH) has a market capitalization of $24,289,179,665. It is calculated by multiplying the current price by their number in circulation. Currently, there are about 8.8 million tokens. Market capitalization can change. It is important to follow the price dynamics in order to make reasonable investment decisions.

How and Where to Buy Lido Staked Ether?

The stETH tokens can be obtained in two ways:

- By sending ETH to a staking exchange using the Lido protocol;

- Buy stETH on an exchange.

Here's a step-by-step guide on how to get stETH via ETH staking:

- Go to https://lido.fi/, select Ethereum and click "Stake now".

- Enter the necessary amount of your ETH and click "Connect Wallet"

- Send your amount to the staking pool

- Get stETH.

stETH is supported by many centralized and decentralized exchanges. For example:

- Curve

- OKX

- Bybit

- Gate.io

- HTX

- MEXC

Here's a step-by-step guide on how to buy stETH on the exchange:

- Choose any exchange on which stETH is listed, create an account and pass KYC verification.

- Fund your account via available methods (e.g. bank card, wire transfer or other type of transfer supported by the exchange).

- Go to the stETH trading page and select the number of coins you want to buy.

- Check the transaction details and confirm the purchase.

- Your stETH coins will appear in the wallet of the exchange.

In general, the process of buying stETH is the same on any exchange, but there could be minor differences.

How to Sell Lido Staked Ether Coin?

In order to sell stETH, you need to:

- Choose any exchange where stETH is listed, create an account and pass KYC verification.

- Transfer your coins from your wallet to the exchange if they are not already there.

- Go to the stETH trading page and select the number of coins you want to sell.

- Verify the transaction details and confirm the sale.

- Withdraw the funds to your bank account/e-wallet.

In general, the process of selling stETH is the same on any exchange, but there could be minor differences.

Is Lido Staked Ether (STETH) Coin Legit?

Lido Finance is a legitimate platform. However, as with any cryptocurrency, there are risks with investing in Lido products, such as market volatility or fraud. The legality of using Lido products, including stETH, is a matter of research on its own, depending on the jurisdiction.

Be aware and research the legislation in your region.

What Makes Lido Staked Ether Unique?

The uniqueness of Lido, as an entire protocol, lies in solving the problems of existing blockchains. Specifically for Ethereum, Lido solves the following problems:

- Provides liquidity for staking;

- Bypasses the 32 ETH limit to start staking, allowing anyone to start staking and earn daily income thanks to the stETH derivative token;

- Allows stETH to be used in other DeFi protocols, bypassing the rule against locking funds during staking.

- Lido ensures that ETH is delegated to trusted validators.

Overall, the protocol is designed to improve the Ethereum ecosystem. The developers are constantly working on the development of Ethereum.

How to Mine Lido Staked Ether Coin?

Mining stETH in the classical sense (creating blocks using special rigs and getting rewarded) is impossible. Users receive stETH when staking ETH via the Lido protocol.

In addition, the LDO management token cannot be mined either, as it is an asset of the staking protocol. 1 billion LDOs have been issued.

How to Keep Your Lido Staked Ether Safe?

The following wallets can be used to store stETH:

- MetaMask

- Ledger

- MyEtherWallet

Pros and Cons of Lido Staked Ether Safe

| Pros Lido Staked Ether (STETH) | Cons Lido Staked Ether (STETH) |

| Simplifies the ETH staking process | Risks of asset loss when using decentralized solutions |

| Security | Risk of loss of pegging |

| Ensuring liquidity of users' assets | Market volatility |

| Decentralized management structure |

Summary

Lido Finance is a unique liquid staking protocol that not only solves Ethereum's problems resulting from the transition from PoW to PoS, but also simplifies the ETH staking process. The protocol is governed by DAOs and LDO tokens. And smart contracts are used for security and transparency of activity. The expansion of Lido to other blockchains indicates increased trust on the part of cryptocurrency market participants.