What Is Cardano (ADA)?

Cardano is a blockchain platform developed by former BitShares, Ethereum and Ethereum Classic co-founder Charles Hoskinson and Input Output Hong Kong (IOHK). The blockchain was named after Italian mathematician Gerolamo Cardano, and the native cryptocurrency ADA was named after English mathematician Ada Lovelace. Cardano aimed to launch smart contracts, decentralized applications and sidechains.

Built on Haskell, Cardano is a third-generation blockchain protocol. The blockchain builds on the foundation laid by Bitcoin and Ethereum. Cardano is powered by the Proof-of-Stake Ouroboros consensus, which provides for all ADA holders to participate in voting. According to the developers, the security of Ouroboros can be proven mathematically. The research approach in the creation of Cardano and strong partnerships in academic circles set it apart from other blockchain platforms.

Source & Copyright Cardano.org

The cryptographically protected metadata in Cardano meets the requirements of financial regulators while preserving the privacy of cryptocurrency holders. Cardano's global goal is to bring cryptocurrency into the global economy.

Who Are the Founders and Investors of Cardano?

Amid disagreements over the further development of Ethereum, Charles Hoskinson left the project in 2014 and founded IOHK together with Jeremy Wood. Cardano's development began, and on February 7, 2017, the dev team submitted the Ouroboros protocol white paper. On September 29, 2017, Cardano was launched in Japan and token trading began on October 1 of the same year.

In April 2021, Hoskinson and the Ethiopian government signed an agreement to collaborate and use Cardano to create an electronic citizen identification infrastructure. In the same year, FD7 Ventures opened an office and a $270 million fund in India. The fund is aimed at investing in the development of Cardano.

Cardano did not have large venture capital investors from the very beginning. The project was in the hands of the community all along. Cardano immediately put most of its assets into circulation (57.6%), leaving a small percentage to developers (11.5%). Charles Hoskinson actively interacts with the community, and informative videos are regularly released on the Cardano 360 platform. All this shows that Cardano is one of the transparent projects in the industry.

At the moment, three organizations are involved in the development of Cardano: Cardano Foundation, IOHK and Emurgo.

Cardano Foundation is a non-profit organization in Switzerland. Its main objective is to support the Cardano community and to interact with authorities on regulatory and commercial issues. The Foundation influences and promotes the Cardano protocol.

IOHK is a technology company seeking to use peer-to-peer innovation to provide financial services to the world's three billion unbanked people.

Emurgo is a global blockchain technology solutions company for developers, startups, enterprises, and governments.

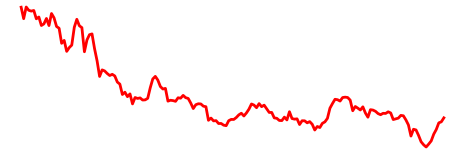

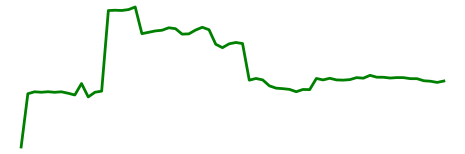

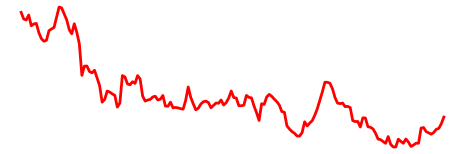

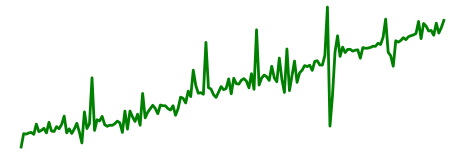

What Is Cardano Price Today?

Today ADA's price is $0.579029 and its trading volume in the last 24 hours is $444,036,808. The token has a limited issue of 45 billion tokens. In total, there are about 35 billion tokens in circulation. This approach minimizes the risk of coin depreciation.

Source & Copyright TradingView

Interesting fact: there is an official Daedalus Wallet for storing ADA. The wallet also allows you to track transactions, encrypt keys, and more.

What Is the All-time High for Cardano (ADA)

On September 2, 2021, ADA recorded its all-time high at $3.08. This can be explained by the general trend of cryptocurrency growth.

What Is the All-time Low for Cardano (ADA)

March 13, 2020 marked an all-time low for ADA at $0.01925275. Related to the general decline in the stock and cryptocurrency markets this month. Bitcoin's sharp drop to $3,830 caused the rest of the cryptocurrency market to fall.

What is the Market Cap of Cardano (ADA)

Cardano (ADA) has a market capitalization of $21,480,822,875. It is calculated by multiplying the current price by their number in circulation. There's 36,110,476,425 coins in circulation right now. The market capitalization can change. It is important to follow the price dynamics in order to make reasonable investment decisions.

How and Where to Buy Cardano?

ADA is supported by many centralized and decentralized exchanges. For example:

- Binance

- Coinbase

- KuCoin

- Kraken

- Bitstamp

- PancakeSwap

Here's a step-by-step guide on how to buy ADA on an exchange:

- Choose any exchange on which ADA is listed, create an account and go through KYC verification.

- Fund your account through available methods (e.g. bank card, wire transfer or other type of transfer supported by the exchange).

- Go to the ADA trading page and select the number of coins you want to buy.

- Check the transaction details and confirm the purchase.

- Your ADA coins will appear on the exchange's wallet.

In general, the process of buying ADA is the same on any exchange, but there may be minor differences.

How to Sell Cardano?

In order to sell ADA, you need to:

- Choose any exchange where ADA is listed, create an account and go through KYC verification.

- Transfer your coins from your wallet to the exchange if they are not already there.

- Go to the ADA trading page and select the number of coins you want to sell.

- Verify the transaction details and confirm the sale.

- Withdraw the funds to your bank account/e-wallet.

In general, the process of selling ADA is the same on any exchange, but there may be minor differences.

Is Cardano (ADA) Coin Legit?

Cardano is a legitimate blockchain platform, and most importantly a secure one. The unique blockchain architecture not only prevents hacker attacks, but also meets the requirements of regulators and preserves the privacy of cryptocurrency owners. However, as with any cryptocurrency, there are risks with investing, such as market volatility. The legality of using Cardano, depending on the jurisdiction, is a matter of research on its own.

Be aware and research the legislation in your region.

What Makes Cardano Unique?

The uniqueness of Cardano is as follows:

- High scalability is realized by the unique Ouroboros protocol, which subdivides the network into epochs and slots within epochs. Scaling is realized by adding slots to epochs or by running multiple epochs in parallel.

- Secure and interoperable with other blockchains through the use of KMZ. This is a protocol that is functionally similar to cross-chain bridges, but it is much more secure.

- New ADA development technology, making it double-layer. This increases the speed and does not compromise the security of the operation.

- The blockchain architecture meets the demands of regulators, which could lead to global adoption of ADA as a means of payment.

- Further developments are aimed at reducing dependence on external factors, people, and companies.

How to Mine Cardano Coin?

One of the easiest ways to steak ADA is to store the cryptocurrency in an official Daedalus wallet. To do this, you need to:

- Download the wallet from the official website https://daedaluswallet.io/en/download/ and install it.

- Create your own wallet and deposit it

- Go to the "Delegate" section and select a validator.

- Confirm ADA staking.

Another way is to choose a reliable staking pool. You can read more about it in our dedicated article.

How to Keep Your Cardano Safe?

The following wallets can be used to store ADA:

- Ledger

- Daedalus

- Yoroi

Pros and Cons of Cardano

| Pros Cardano (ADA) | Cons Cardano (ADA) |

| Dedicated development team | Slow project development |

| The network is supported by academia and includes academic assessments | Cardano is not fully decentralized yet |

| Solves the problem of scalability and provides high transaction speeds | The development process is less transparent than other cryptocurrencies |

| Several layers are used: settlement and computational | |

| Cardano is an open source platform written in the Haskell programming language | |

| Cardano's security is ensured by the PoS protocol | |

| Cardano can host assets with no need for smart contracts |

Summary

Cardano is a unique blockchain project, one of a kind, as it has an academic base. It is one of the reliable projects in the crypto industry and is among the top 10 in terms of market capitalization. Despite the long development process, this is only a positive aspect for Cardano in the long run. Cardano's vision is not limited to the development of the financial industry only. Cardano's technologies are used by brands and entire nations.