What is Launchpool and How to Invest?

In this guide, you’ll understand what a Launchpool is and learn how to invest in launchpools, and earn excellent rewards from the most promising crypto projects.

Before new crypto projects go public, one of the most significant requirements is the issue of fundraising to kick-start their activities. Initially, the only method for fundraising was ICOs or Initial Coin Offerings, which started as far back as 2013. ICOs offered fundraising efficiency for startups, were very accessible to investors, and provided high potential interest within a short investment period.

However, they weren’t without their loopholes. For instance, token prices were highly volatile, and investors were very impatient. They could withdraw their funds at will, and participants were very prone to malicious occurrences such as rug pulls and a high risk of collapse of ICO projects.

As a result, alternative fundraising platforms were invented, such as Launchpads and Launchpools. Although they are both funding methods, they work differently. In this guide, we’ll answer the question of “What is launchpool?” and enumerate launchpad and launchpool key differences.

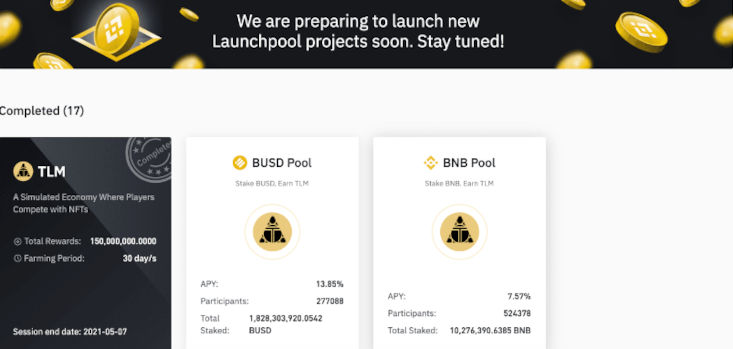

Source and Copyright © Binance (here and later in this article)

What Is a Crypto Launchpool?

A crypto launchpool is one of the methods of raising funds for early-stage crypto projects by allowing investors to deposit their funds in a liquidity pool. In return for their crypto investments, participants will get interest on their deposits. Such an investment arrangement is called Yield Farming and is based on an already determined APY (Annual Percentage Yield) system.

To understand Launchpools better, think about bank savings accounts that yield a certain percentage of interest on your funds over a given period. However, they generally yield higher interests than what’s obtainable with banks. And users’ token earnings depend on the percentage of their investment or stake in the whole pool.

Project launchpools are run by centralized exchanges where they list only properly scrutinized and highly promising crypto projects. That way, they clamp down on crypto scams, rug pulls, and all kinds of fraud that usually beset young projects. They also provide an efficient and trustworthy fundraising mechanism.

Who Can Join a Crypto Launchpool?

You can join a launchpool if you have an account with the exchange hosting it and have completed their KYC (Know Your Customer) process. Also, participants must have a certain amount of tokens in their wallets up to the minimum amount required to stake in a given launchpool.

Staking Period

Launchpool staking periods are usually between 7 days and 30 days. So, when you stake in a launchpool, you can expect to earn throughout the staking period.

Can users unstake their assets anytime?

Yes, users can un-stake their crypto assets from the liquidity pool whenever they so desire. However, leaving your staked tokens for the entire launchpool staking period is more profitable so that you can earn more yields.

Earnings Calculation

Launchpool earnings follow an easy and transparent calculation technique. New token earnings from launchpools are calculated on an hourly basis from the time a user stakes their tokens. And the number of crypto tokens you earn daily is directly proportional to your percentage contribution to the pool. In other words, your earnings depend on the number of tokens you’ve staked against the total number of tokens in the entire pool.

Once the token is open for trading, usually within some days of farming (usually 7 days), users can trade the tokens they’ve earned from the day of staking. Also, they can claim their pending rewards from the farming pool whenever they want.

Steps to Earn with Launchpool

Different launchpool platforms may differ in their participation and earning processes. However, here are some of the general steps to participate and earn from a launchpool:

Step 1. Set up an account with Binance

Start by setting up a trading account with the host exchange for the launchpool you want to participate in. Also, complete their KYC verification process to be eligible to participate in the pool.

Step 2. Click the navigation button “Launchpad”

Step 3. Scroll down to “Launchpool” for available and completed projects

Step 4. Stake the minimum crypto amount for this launchpool

Visit the launchpool and select the project you want to stake your funds in, click the Stake button and enter the amount you want to stake. When you see a pair like “Flamingo BNB,” it means that you can stake BNB to earn FLM.

Step 5. Claim your rewards anytime or when the launchpool period ends

You can now redeem your yields or rewards anytime to your crypto wallet without restrictions.

Launchpool KYC

Centralized crypto exchanges usually carry out KYC verification to keep records of their customers’ identities to prevent fraudulent activities such as money laundering and other unlawful financial transactions. Users must provide details and identification information like a passport or government-issued ID.

Users must complete their KYC verification to participate unrestrained in activities on exchanges like Binance, Phemex, Coinbase, etc. Doing so will enable them to enjoy high-level security and improved trading features, such as higher trading volumes at zero fees.

Launchpools, despite being a new technology, are very favorable to project owners and investors. Because while a crypto project amasses liquidity to enhance its development, crypto holders can earn passive income by staking their funds in the liquidity pool.

Launchpools powered by centralized exchanges are now excellent crowdfunding platforms for some of the best-performing projects in the crypto space. They blend DeFi features of staking and yield farming with the security and ease-of-use of centralized exchanges in the following ways:

- Protection from crypto fraud: although launchpools, like other crowdfunding platforms, may have their inherent investment risks, the scrutiny and strict review process run by these exchanges significantly minimize the risk of rug pull or scam projects ripping off investors.

- Easy process of earning passive income: all you need to do is buy and stake the token through the host exchange, and you can start earning passive income all at no cost.

Launchpad vs Launchpool

Launchpads and launchpools are both designed to help raise crypto funds for new projects in the crypto ecosystem. And although they improve the efficiency of investment in blockchain projects, their operational techniques are miles apart.

The table below summarizes some of the key differences between a crypto launchpad and a launchpool:

| Launchpad | Launchpool |

|---|---|

| Lottery-based method of token distribution to participants. | Token distribution depends on the percentage of staked tokens against the entire pooled tokens. |

| Instant trading for tokens acquired. | There’s a given period before you can trade claimed tokens. |

| Investors are susceptible to the risk of project failure. | Higher guarantee with minimal risks involved. |

| Lottery-based system limits the amount of tokens you can have. | There’s no limit to the amount of tokens you can claim based on your investment. |

Launchpool Pros and Cons

Here are some general advantages and disadvantages of launchpools as crypto crowdfunding platforms:

Pros:

- You can un-stake your tokens anytime. One of the favorite reasons launchpools stand out is the flexibility it allows investors to un-stake their tokens whenever they wish.

- Low-risk Investment. As a user, all you need to do is stake the required tokens. You don’t necessarily need expert trading knowledge. Also, coupled with the security measures of CEXs, there’s minimal risk of fraud.

- Profitable Investment. Because of their APY model, they often yield attractive returns, which can be withdrawn at your convenience.

Cons:

- If the price of the token, you’re staking drops while it’s in the pool, it may cause you to lose some money.

- Short staking period. Launchpools usually have a maximum staking period of 30 to 60 days, which may not be enough time for users that are interested in yield farming and earning passive income over a longer period.

- Few available projects. There aren’t many launchpool projects available, so because they are highly popular, it may be hard to get a variety and high volume of tokens.

Frequently Asked Questions

Can a user trade tokens they have earned?

Yes, users can trade their pool earnings or rewards. However, it’s usually not instant, as it may take a few days, say seven days, for trading to be available for the tokens.

Is there a limit to the amount I can stake?

No, there’s no limit to the number of tokens you can stake in a launchpool platform, so long as you are staking above the pool’s minimum amount.

Can I participate in both a launchpool and a launchpad for a particular crypto project?

Yes, you can participate in both the launchpad and launchpool for the same crypto project because they are two different fundraising techniques. Some users may join in launchpads and buy tokens cheaper; then, they’ll stake in launchpools and earn rewards.

Can you earn money from Binance Launchpool?

Yes, you can make money from Binance Launchpool by investing your assets in new crypto projects’ launchpools and earning passive income or yield in return. You can farm new assets and redeem new token rewards by staking BNB, BUSD, or other assets for free.