About DAI

DAI is an algorithmic stablecoin issued by an Ethereum-based protocol MakerDAO. To keep its value steady relative to the US dollar, DAI stablecoin relies on cryptocurrency collateral stored in the smart contracts of the Maker Protocol. Unlike many of its stablecoin counterparts, which are centrally issued and controlled, DAI stands out as the native token of the Maker Protocol.

DAI's collateralization process significantly differentiates it from other stablecoins. While many stablecoins are collateralized against a single fiat currency or cryptocurrency, DAI has the capacity to leverage a variety of cryptocurrencies as collateral.

Initially, the Maker Protocol only supported ether as collateral. However, in November 2019, the protocol expanded to include other crypto assets, establishing the multi-collateral DAI system prevalent today. The MakerDAO community continues to add new collateral options through a voting process.

The Maker Protocol implements a dual-token system. The first, Dai, is a stablecoin underpinned by collateral. Secondly, there is MKR, a governance token which empowers stakeholders to manage DAI. The holders of MKR are responsible for setting the DAI Savings Rate (DSR) and act as guarantors for DAI. In the event of a system crash, their MKR tokens can be liquidated. This structure motivates guarantors to monitor the functionality of the DAI system and its collateralized tokens.

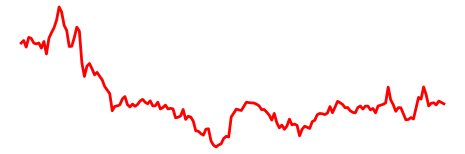

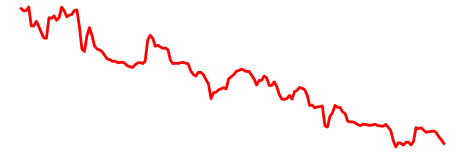

DAI Price

The current DAI priceis $0,999627 USD with a market cap of $4 597 752 475 USD. It has a circulating supply of 4 599 466 593 DAI coins with no maximum supply.

DAI can be purchased on variety of centralized and decentralized exchanges including OKX, Bitrue, Bybit, Binance, Uniswap, SushiSwap and many more.

How Does DAI Work?

DAI emerged as the pioneering stablecoin to recognize and accept digital assets as collateral. This was made possible through the implementation of an overcollateralized model, which lets users borrow DAI against other Ethereum-based assets.

The rate at which this occurs is determined by a vote within the MakerDAO community and can fluctuate based on the specific asset. Despite this variability, the model remains appealing to a large proportion of DeFi users as they gain a stable asset to leverage in their trading strategies without being forced to relinquish their holdings.

Collateral assets are securely housed within smart contracts known as Maker Vaults for the duration of the loan. A unique vault is created for each supported asset type. Once locked, the vault generates a designated amount of DAI in return for the collateral, which is then transferred directly to the user. In order to reclaim the collateral, the user must settle their debt along with a stability fee, which is always paid in DAI. The vault's closure effectively obliterates all the DAI tokens it backed.

These Maker Vaults operate on a non-custodial basis, meaning users interact directly with them via smart contracts. The Maker Protocol does not possess any assets stored within its vaults. This model provides borrowing flexibility within the MakerDAO system. For example, a partial retrieval of the collateral is possible by returning a certain amount of DAI. Conversely, the vault's owner may add more collateral either to acquire additional stablecoins or as a preemptive action to circumvent potential liquidation.

The Maker's smart contracts utilize several mechanisms to stabilize the cryptocurrency's value around its peg to the US dollar. This includes reliance on 'Keepers' - third-party participants, often automated, which buy DAI when it falls below its $1 target and sell it when it exceeds the $1 target. This constant arbitrage exerts continuous pressure on the price of the stablecoin, ensuring it remains within a narrow band.

Maker also employs four types of auctions to stabilize the stablecoin's market price:

Collateral Auctions - the protocol presents assets from liquidated accounts for sale to the platform's broader user base, subtracting a penalty.

Reverse Collateral Auctions - if more tokens are bid on in collateral auctions than necessary to cover a liquidated Vault owner's debts, the excess is returned to the original owner.

Debt Auctions - in situations where there are insufficient buyers in a collateral auction, the protocol sells freshly-minted MKR (Maker’s cryptocurrency) to platform users.

Surplus Auctions - when the stability fees accrued by the system reach a certain threshold, the surplus tokens are sold to users in exchange for MKR, which is subsequently burned.

What is DAI Used For?

The fundamental aim of the DAI stablecoin is to function analogously to traditional currency. By pegging itself to the US dollar, DAI strives to attain a digital equivalence that makes it a popular choice in trading pairs on crypto exchanges.

DAI primarily serves as a representation of a stable-value, readily exchangeable asset within the sphere of digital transactions. This makes it an attractive choice for cryptocurrency users who, rather than buying or selling other tokens with USD on exchanges, may choose to trade the stablecoin for other cryptocurrencies due to its user-friendliness.

Beyond this, DAI can serve as collateral for loans on decentralized lending protocols or be deposited into liquidity pools in protocols. Within the Maker ecosystem itself, DAI is used to settle loans, pay the stability fee, and participate in debt auctions.

Management

Established in 2014, MakerDAO is the brainchild of Danish entrepreneur Rune Christensen and Wouter Kampmann. They were later joined by the smart contract developer and investor Mariano Conti, further bolstering the project's strength.

MakerDAO's governance is characterized by a democratic framework where decisions about the platform, including MakerDAO, Maker Protocol, and DAI, are subject to votes by MKR holders. The influence of an individual's vote corresponds to the quantity of Maker tokens they hold.

Throughout its history, MakerDAO has attracted significant investment. In 2017, Andreesen Horowitz, Polychain Capital, among others, purchased roughly $12 million worth of MKR from the MakerDAO Development Fund. A year later, in September 2018, Andreesen Horowitz further invested in the project, acquiring an additional 6% of MKR's total supply for $15 million. This investment significantly bolstered the project's valuation, raising it to an estimated $250 million.