USD Coin (USDC) is a stablecoin that is fully backed by U.S. dollars or dollar-denominated assets.

This article provides an overview of USDC, exploring its features, advantages, and disadvantages. We'll also discuss how USDC can be used in the world of cryptocurrency. Whether you're a seasoned investor or just getting started in the world of crypto, this article has something for everyone.

What is USD Coin?

USDC is a stablecoin that is backed entirely by U.S. dollars or assets denominated in dollars. This makes it a digital asset that maintains a stable price. The value of one USDC coin is pegged to one U.S. dollar, meaning it remains unaffected by price fluctuations, unlike other cryptocurrencies. The reserve assets of USDC are kept in separate accounts with regulated financial institutions in the U.S. These accounts are overseen by Grant Thornton, an accounting firm, which provides monthly reports. USDC is often viewed as a model for digital currency architecture.

Who Are the Founders and Investors of USDC?

USD Coin was launched in September 2018 and is managed by a consortium called Centre, which was founded by Circle and includes members from the cryptocurrency exchange Coinbase and Bitcoin mining company Bitmain.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of digital currency. It was founded in October 2013 by Jeremy Allaire and Sean Neville. USDC is issued by a private entity and should not be confused with a central bank digital currency (CBDC). The majority of USDC's stablecoin collateral is held in short-term U.S. government securities. USDC is fully transparent and audited, and its reserves are held in the management and custody of leading U.S. financial institutions, including BlackRock and BNY Mellon.

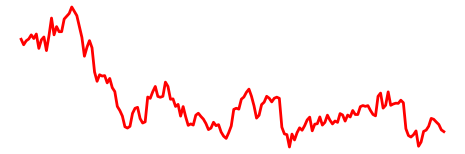

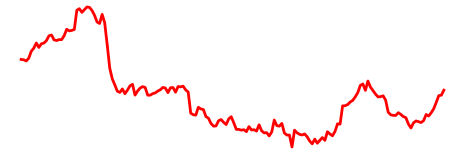

Source and Copyright © Circle.com

Source and Copyright © Circle.com

USDC has received significant investments from major players in the financial industry, including BlackRock, Fidelity Management and Research, Marshall Wace, and Fin Capital. In April 2022, Circle announced a $400 million funding round, which included investments from BlackRock, Fidelity, Marshall Wace, and Fin Capital.

BlackRock has also entered into a strategic partnership with Circle to be its primary asset manager of USDC cash reserves and explore capital market applications for its stablecoin, among other objectives. Circle has raised over $550 million in venture capital from four rounds of investments from 2013 to 2022.

What Is USDC Price Today?

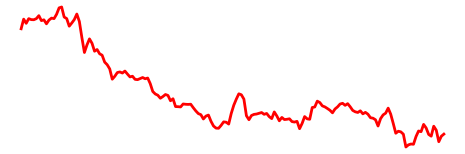

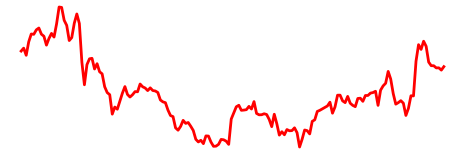

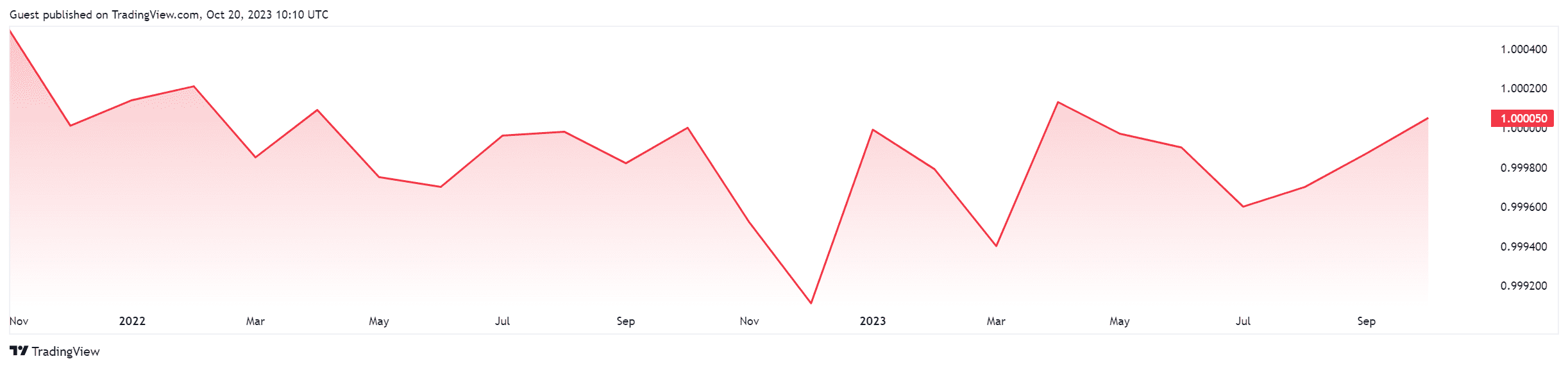

Source and Copyright © TradingView

The current Price of USDC is $0.999865. The total trading volume of USDC is $7,394,646,755.

According to Binance, the value of USDC may increase by +5% and reach $3.734453 by 2050. Gov Capital predicts that USDC will have a price forecast of $1.6626621198803 for 2024.

It's important to note that cryptocurrency prices are subject to high market risk and price volatility, and these price forecasts are not guaranteed. Investors should do their own research and consult with a financial advisor before making any investment decisions.

What Is the All-time High for USDC?

The all-time high for USDC was $1.19, which was recorded in May 2019. However, other sources report different all-time highs for USDC. For example, CoinGecko reports that the highest price paid for USDC was $1.17, which was also recorded in May 2019. It is important to note that the price of USDC can be prone to mild changes and can vary depending on supply and demand. Overall, USDC is designed to maintain a stable value unlike other typically volatile cryptocurrencies.

What Is the All-time Low for USDC?

The all-time low for USDC was $0.8774, which was recorded in March 2023. However, other sources report different all-time lows for USDC. Meanwhile, CoinCodex reports that the lowest price was recorded on March 11, 2023, when it was trading at its all-time low of $0.880000. It is important to note that the price of USDC can be prone to mild changes and can vary depending on supply and demand. Overall, unlike other cryptocurrencies that are usually volatile, USDC is intended to keep a steady value.

What is the Market Cap of USDC?

The market cap of USDC is $61,205,925,130 with total circulating supply of 61,217,837,661 and total supply of 61,237,063,689. However, the market cap of USDC can be prone to mild changes and can vary depending on supply and demand.

It is important to note that the market cap of USDC is a measure of its total value and is calculated by multiplying the current price of USDC by its circulating supply. The market cap of USDC can be used to compare its value to other cryptocurrencies and assets in the market.

What Influences on the USDC Price?

Several factors are currently affecting the price of USD Coin (USDC), including:

- SVB Crash: In March 2023, USDC holders suspected potential consequences from the Silicon Valley Bank (SVB) crash and quickly redeemed over $1 billion of USDC for U.S. dollars, causing the USDC market capitalization to drop to the lowest point over the past year.

- Depegging Risk: Deviation from the pegged value is one of the most significant risks for stablecoins, including USDC.

- Regulatory Scrutiny: USDC's plunge comes as the stablecoin sector has been severely tested by increasing regulatory scrutiny.

- Circulating Supply: As the supply of a stablecoin decreases, its scarcity may result in increased demand from investors and traders. If the demand for USDC remains high, it could lead to an increase in price.

- US Financial Risks: Circle's CEO Jeremy Allaire has signaled that risks in the US are impacting USDC's stability, as investors push to "de-risk out of the US" amid concerns about the country's financial risks.

- Supply and Demand Dynamics: The supply and demand dynamics of USDC are the same as any other cryptocurrency, thus creating prices higher or less than $1 at any given time.

How and Where to Buy USDC?

USDC is a stablecoin that is pegged to the US dollar and can be bought on various platforms. Here are some of the platforms where you can buy USDC:

- Coinbase: USDC can be bought on Coinbase by creating an account, adding a payment method, and selecting USDC from the list of assets. On Coinbase.com, click the Buy panel to search and select USDC. On the Coinbase mobile app, search for USDC by typing “USDC” into the search bar. Once the order processes, you’ll be taken to the confirmation screen.

- Kraken: USDC can be bought on Kraken with a credit card or bank account on the Kraken app.

- MoonPay: USDC can be bought on MoonPay with a credit card, and it offers a fast and easy way to purchase USDC. Go to the MoonPay website and enter the amount of USDC you want to purchase. Enter your USDC wallet address and verify your email and basic information. Once you have completed the purchase, store your newly purchased USD Coin in your preferred wallet.

- Bybit: USDC can be bought on Bybit, a one-stop trading platform where you can buy, sell, trade, stake, and hold USDC securely and easily.

- BitPay: USDC can be bought on BitPay with a credit card, debit card, Apple Pay, or Google Pay. Go to the BitPay website and select "Buy Cryptocurrency". Then, select "Buy USD Coin (USDC)" and choose your payment method. Once you have completed the purchase, the USDC will be delivered to your wallet.

- Crypto Exchanges: USDC can be bought and traded on various crypto exchanges, including Binance, Bitfinex, and Huobi

USDC can be stored in various wallets, including cold wallets like Ledger and Trezor, and hot wallets like MyEtherWallet and MetaMask. It's important to note that cryptocurrency prices are subject to high market risk and price volatility, and investors should do their own research and consult with a financial advisor before making any investment decisions.

How to Sell USDC?

Here are the steps to sell USDC on different exchanges:

- Kraken: On Kraken.com, click the Sell panel to search and select USDC. Enter the amount of USDC you want to sell and choose your preferred payment method. Once the order processes, you’ll be taken to the confirmation screen.

- Paxful: On the Paxful website, click Sell and select Sell USDC. Set how much you want to sell, the currency, and how you want to cash out. Tick the box to confirm that you have read and agree to the terms of the trade. Once you have found a buyer, complete the trade and release the USDC from escrow to the buyer's wallet.

- Zipmex: On the Zipmex website, select Sell USD Coin and enter the amount of USDC you want to sell. Choose your preferred currency and type of order, and enter your asset sales amount. Once you have completed the sale, the funds will be transferred to your bank account.

- Independent Reserve: On the Independent Reserve website, select Sell USD Coin and enter the amount of USDC you want to sell. Transfer your USDC to your Independent Reserve account and sell it at the current market price or set your own price. Once the sale is complete, you can transfer the cash straight to your bank account.

- Mt Pelerin: On the Mt Pelerin website, connect your USDC wallet and confirm the amount you want to sell. Choose your preferred currency and confirm the transaction. Once the sale is complete, the funds will be transferred to your bank account.

- Bit2Me: On the Bit2Me website, select Sell USD Coin and enter the amount of USDC you want to sell. Choose your preferred payment method and complete the sale. Once the sale is complete, you can store the funds as long as you want, send them to people, use them to buy other cryptocurrencies, or withdraw them to your bank account.

It is important to note that fees may apply when selling USDC, and the availability of USDC may depend on your location and payment method. It is also important to choose a reputable exchange or platform to sell USDC to and to store your USDC in a secure wallet.

Is USD Coin Legit?

USD Coin (USDC) is a legitimate stablecoin that is backed by actual US dollars held in reserve by the issuer and is issued by regulated financial institutions. USDC is known for its transparency, security, and stability, and enjoys wide acceptance on exchanges and among merchants who accept cryptocurrency payments.

However, be careful and sure to study the laws of your country before any transactions with USD Coin, because in some countries it may be illegal.

What Makes USDC Unique?

USD Coin (USDC) is a stablecoin that is unique in several ways, including:

- Stability: USDC is designed to maintain a stable value of $1 USD, which makes it a reliable store of value and a useful medium of exchange.

- Transparency: USDC is backed by actual US dollars held in reserve by the issuer, which are held in segregated accounts with regulated US financial institutions. This provides transparency and security for users.

- Compatibility: USDC is compatible with several autonomous blockchains, which makes it a way to integrate payment systems and applications across blockchains.

- Accessibility: USDC can be used to send funds across borders, and recipients can store USDC without using a bank account or being concerned about price volatility. This makes it a useful tool for remittances and for people who do not have access to traditional banking services.

- Regulation: USDC is issued by regulated financial institutions, such as Circle and Coinbase, and is well-regulated. This makes it a trustworthy and reliable stablecoin.

- Widespread adoption: USDC is one of the most popular stablecoins on the market today and enjoys wide acceptance on exchanges and among merchants who accept cryptocurrency payments.

Overall, USDC is a unique stablecoin that offers stability, transparency, compatibility, accessibility, regulation, and widespread adoption. These features make it a useful tool for a variety of purposes, including remittances, cross-border payments, and integration with different blockchains.

How to Mine USDC Coin?

Mining USD Coin (USDC) is not a typical process like mining other cryptocurrencies such as Bitcoin or Ethereum. USDC is a stablecoin that is pegged to the US dollar, which means that it is not mined in the traditional sense. Instead, USDC is issued by regulated financial institutions, such as Circle and Coinbase, and is backed by actual US dollars held in reserve by the issuer. However, there are some apps and platforms that claim to offer USDC cloud mining or remote mining services. It is important to note that these services may not be legitimate or may be scams, and it is important to do thorough research and exercise caution before investing any money or providing personal information.

In conclusion, mining USD Coin (USDC) is not a typical process like mining other cryptocurrencies. USDC is issued by regulated financial institutions and is backed by actual US dollars held in reserve by the issuer. While there are some apps and platforms that claim to offer USDC cloud mining or remote mining services, it is important to exercise caution and do thorough research before investing any money or providing personal information.

How to Keep Your USDC Safe?

Here are some ways to keep your USDC safe:

- Choose a reputable exchange or platform: When buying or selling USDC, it is important to choose a reputable exchange or platform that is well-regulated and has a good reputation for security and reliability.

- Store your USDC in a secure wallet: It is important to store your USDC in a secure wallet that is protected by strong passwords and two-factor authentication. Hardware wallets, such as Ledger and Trezor, are considered to be some of the most secure options for storing USDC.

- Regularly audit your reserves: If you are holding USDC, it is important to regularly audit your reserves to ensure that they are fully backed by US dollars held in reserve by the issuer. This can help to mitigate risk and ensure the stability and safety of your USDC.

- Diversify your reserves: To further mitigate risk, it is important to diversify your reserves across multiple institutions. This can help to ensure that your USDC remains stable and secure even if one institution fails or experiences problems.

- Be aware of risks: While USDC is considered to be a safe and reliable stablecoin, it is important to be aware of the risks associated with stablecoins in general. These risks include losing access to reserves, the issuer's inability to maintain its peg, and lack of FDIC insurance.

Overall, keeping your USDC safe involves choosing a reputable exchange or platform, storing your USDC in a secure wallet, regularly auditing your reserves, diversifying your reserves, and being aware of the risks associated with stablecoins.

Pros and Cons of USDC

As with any financial investment, USDC has either Pros and Cons of investments. Let’s see both sides of this issue:

| Pros of USDC | Cons of USDC |

| Price Stability: USDC is pegged to the US dollar, making it a stablecoin that is not subject to the price volatility of other cryptocurrencies. | No Potential for Price Appreciation: USDC is designed to maintain a stable value and does not offer the potential for price appreciation. |

| Liquidity: USDC is widely available and can be traded on various platforms, making it a highly liquid asset. | Regulatory Risks: The regulatory landscape surrounding digital currencies and stablecoins is constantly evolving, and there is a risk that government regulations could have a negative impact on USDC. |

| Accessibility: USDC can be used by anyone with an internet-connected device and a wallet that supports ERC-20 tokens, making it accessible to people who don't have access to traditional financial systems. | Centralization: USDC is managed by a consortium, which some critics argue makes it more centralized than other cryptocurrencies. |

| Fast and Low-cost Transactions: USDC transactions are faster and cheaper than traditional currency transactions, making it a cost- and time-efficient option for sending and receiving money. | Mix of Reserve Assets Not Fully Disclosed: The mix of reserve assets that back USDC is not fully disclosed, which could be a concern for some investors. |

| Passive Income: USDC can be lent to other crypto users to earn interest, providing a passive income stream. |

It's important to note that the advantages and disadvantages of USDC are subject to change over time and may vary depending on individual circumstances. Investors should do their own research and consult with a financial advisor before making any investment decisions.

Summary

USD Coin (USDC) is a digital stablecoin that is fully backed by U.S. dollar assets held in reserve by the issuer. USDC is a tokenized U.S. dollar, with the value of one USDC coin pegged as close to the value of one U.S. dollar as possible. USDC is issued by regulated financial institutions, such as Circle and Coinbase, and is managed by a consortium called Centre. USDC is known for its transparency, security, compatibility, accessibility, regulation, and widespread adoption. USDC can be used for a variety of purposes, including remittances, cross-border payments, and integration with different blockchains. USDC is primarily available as an Ethereum ERC-20 token, and on blockchains including Hedera Hashgraph, Algorand, Avalanche, Solana, Stellar, Polygon, and TRON.

USDC is designed to maintain a stable value of $1 USD, which makes it a reliable store of value and a useful medium of exchange. However, as with any investment and financial instrument, holding USDC comes with certain risks and fluctuations. For example in March 2023, USDC holders suspected potential consequences from the Silicon Valley Bank (SVB) crash and quickly redeemed over $1 billion of USDC for U.S. dollars, causing the USDC market capitalization to drop to the lowest point over the past year.

Thus, investors should be aware of the risks that may follow with the keeping of this asset:

- Regulatory Risks: The regulatory landscape surrounding digital currencies and stablecoins is constantly evolving, and there is a risk that government regulations could have a negative impact on USDC.

- Centralization: USDC is managed by a consortium, which some critics argue makes it more centralized than other cryptocurrencies.

- Mix of Reserve Assets Not Fully Disclosed: The mix of reserve assets that back USDC is not fully disclosed, which could be a concern for some investors.

- No Potential for Price Appreciation: USDC is designed to maintain a stable value and does not offer the potential for price appreciation.

- Counterparty Risk: USDC is issued by a private entity, and there is a risk that the issuer could default on its obligations.

- Inflation Risk: USDC is pegged to the US dollar, which is subject to inflation risk. If the value of the US dollar decreases, the value of USDC could also decrease.

It's important to note that the risks associated with holding USDC are subject to change over time and may vary depending on individual circumstances. Investors should do their own research and consult with a financial advisor before making any investment decisions.

FAQs

What is USDC?

USDC is a stablecoin that is pegged to the US dollar and is fully backed by U.S. dollars or dollar-denominated assets.

How does the USDC maintain its 1:1 peg with the US dollar?

USDC maintains its 1:1 peg with the US dollar by depositing and storing fiat currency as one U.S. dollar for every USDC minted. When USDC is sold in exchange for fiat currency, the USDC is burned, and the fiat money is transferred back to the user's bank account.

How can USDC be used?

USDC can be used for hedging against volatility, gaining U.S. dollar exposure, trading on cryptocurrency exchanges, using in decentralized finance (DeFi) protocols, purchasing goods and services, and international remittances.