What Is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin. Pegged 1:1 to the main cryptocurrency, WBTC is an ERC-20 standard token and is designed for DeFi protocols.

The protocol aims to solve the Bitcoin and Ethereum incompatibility problem by moving the main cryptocurrency to another network by creating a tokenized version of it. WBTCs were originally created to increase the functionality of Bitcoin, with the rise of DeFi, the range of purpose has expanded.

Wrapped Bitcoin is a great solution for those who want to bypass the disadvantages of Bitcoin, such as slow transactions, and use the token on DEX, make loans there, participate in farming and staking. The Wrapped Bitcoin protocol fully integrates Bitcoin into the DeFi space, but it's worth noting that WBTC is not the original Bitcoin. WBTC can be used on the Ethereum network, but not on Bitcoin.

Who Are the Founders and Investors of Wrapped Bitcoin?

WBTC was a joint solution between Kyber Network, BitGO and Ren. The protocol was launched in 2019. Now, the token issuance is handled by WBTC DAO, which consists of 17 parties involved. Each of them owns a multi-signature wallet key that secures the system. They can vote to add or remove members and make changes to the underlying smart contracts. Wrapped Bitcoin is also supported by about 40 market participants, including Kyber, BitGO, Ren, UniSwap, AAVE, and others.

Source & Copyright © WBTC

Wrapped BTC partners include BitGo, Kyber Network, Ren, Airswap, CoinList, 0x, AAVE and Maker. WBTC has raised over $442 million in funding through 59 funding rounds with 230 investors.

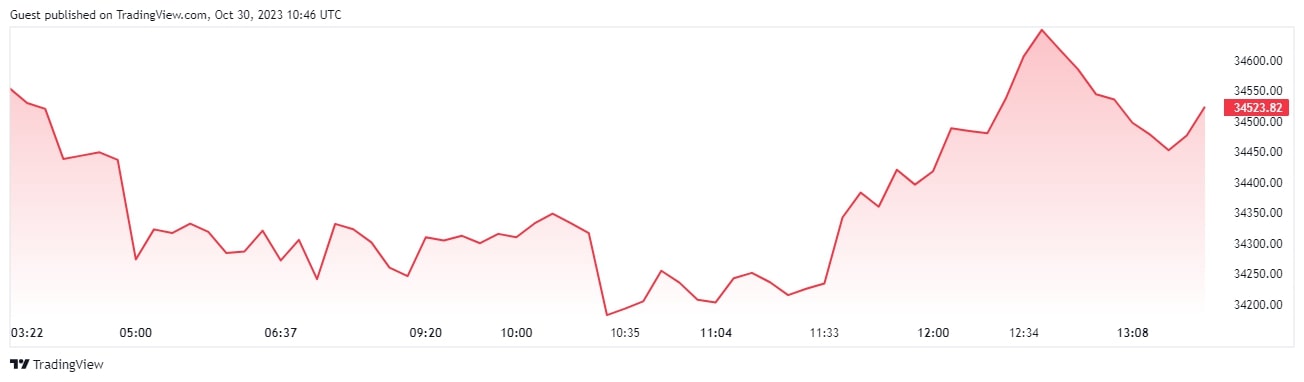

What Is Wrapped Bitcoin Price Today?

Today, the price of WBTC is $107,796.0 and the trading volume for the last 24 hours is $269,928,723. WBTC is backed by Bitcoin, the token fully follows the price trajectory of BTC.

Source & Copyright © TradingView

What Is the All-time High for Wrapped Bitcoin (WBTC)?

The all-time high for WBTC was recorded on November 10, 2021 at $70,643.40. This is due to the events that pushed Bitcoin to grow.

What Is the All-time Low for Wrapped Bitcoin (WBTC)?

The all-time low for WBTC was set on April 2, 2019 at $3,139.17.

What Is the Market Cap of Wrapped Bitcoin (WBTC)?

The market capitalization of WBTC is $13,965,643,878. It is calculated by multiplying the current price by the amount of coins in circulation. There are currently 128,814 coins in circulation. Market capitalization can change. It is important to follow the price dynamics in order to make reasonable investment decisions.

How and Where to Buy Wrapped Bitcoin Coin?

There are two ways to buy WBTC, one of which involves token minting. We will talk about it a little later. Here we will tell you about the second way: buying WBTC on the exchange. To do this, you need to:

- Choose any exchange on which WBTC is listed, create an account and pass KYC verification.

- Fund your account through available methods (e.g. bank card, wire transfer or other type of transfer supported by the exchange).

- Go to the WBTC trading page and select the number of coins you want to buy.

- Check the transaction details and confirm the purchase.

- Your WBTC coins will appear on the exchange's wallet.

In general, the process of buying WBTC is the same on any exchange, but there may be minor differences.

How to Sell Wrapped Bitcoin Coin?

In order to sell WBTC, you need to:

- Choose any exchange where WBTC is listed, create an account and pass KYC verification.

- Transfer your coins from your wallet to the exchange if they are not already there.

- Go to the WBTC trading page and select the number of coins you want to sell.

- Verify the transaction details and confirm the sale.

- Withdraw the funds to your bank account/e-wallet.

In general, the process of selling WBTC is the same on any exchange, but there may be minor differences.

Is Wrapped Bitcoin Coin Legit?

Wrapped Bitcoin is a secure and legitimate protocol. However, as with any cryptocurrency, there are risks with investing, such as market volatility. The legality of using WBTC, depending on the country, is a matter of research on its own.

Be aware and research the legislation in your region.

What Makes Wrapped Bitcoin Unique?

WBTC is a sort of handshake of the Bitcoin and Ethereum networks, as this decision has reduced the tension between the communities. Bitcoin owners can earn interest on their assets without liquidating them. The WBTC token has been well received in the DeFi community for its properties and the opportunities it provides:

- Decentralized Finance (DeFi): Through WBTC, Bitcoin holders can participate in lending, staking, farming, marginal trading, etc. WBTC allows BTC holders to participate in the Ethereum ecosystem of decentralized exchanges, cryptocurrency lending services, prediction markets, and other ERC-20-enabled DeFi applications.

- Provision for crypto borrowers: WBTC can be used to borrow digital assets on platforms such as MakerDAO, Compound, Kyber Network, AAVE and Uniswap. Lenders can earn interest from the WBTC they offer to borrowers through money markets and liquidity pools.

- Decentralized trading: DeFi traders can use WBTC for margin trading on decentralized derivatives exchanges. Traders can also provide liquidity by injecting liquidity into the Ethereum ecosystem from Bitcoin holders, benefiting the entire decentralized trading ecosystem on the Ethereum network.

- Farming: WBTC can be used as collateral on protocols such as Compound, MakerDAO, and AAVE, allowing users to earn revenue for placing their assets in decentralized liquidity pools.

In general, WBTC is used to provide liquidity for Bitcoins on the Ethereum network and create new scenarios for their use on Ethereum. Thanks to WBTC, holders of the main cryptocurrency can participate in the Ethereum ecosystem by lending, borrowing, trading and more.

How to Mine Wrapped Bitcoin Coin?

Here's how the WBTC creation process works:

- A user seeking WBTC transfers their Bitcoin reserves to a qualified custodian for safekeeping. They are responsible for securely storing the bitcoin and managing the reserve. Examples of WBTC custodians include BitGo, Coinbase Custody, and Anchorage.

- Upon receiving Bitcoins from the user, the custodian starts minting WBTC on the Ethereum blockchain in an equivalent amount. The custodian also ensures that the amount of WBTC is backed by an equal amount of BTC held in reserve. With the proof-of-reserve mechanism, the user can ensure that the amount of WBTC issued matches the amount of Bitcoins stored in it.

- The newly created WBTCs are sent to the user who entrusted the custodian with their Bitcoins.

To get their Bitcoins back, the user can take a few necessary steps at any time. User initiates the process of redeeming the Bitcoins from the custodian. The WBTC tokens are burned and the corresponding amount of BTC is sent to the address specified by the user.

How to Keep Your Wrapped Bitcoin Safe?

To safely store WBTC for a long period of time, it is better to use cold wallets such as Ledger or Trezor. You can also use hot wallets that support ERC-20 based tokens, but some risks accompany their use.

Pros and Cons of Wrapped Bitcoin

| Pros of WBTC | Cons of WBTC |

| Access to DeFi capabilities. Users can utilize their Bitcoins by participating in lending and borrowing platforms, staking, farming, etc. | Lack of decentralization. Use of the protocol requires passing KYC and AML. And issuance is concentrated in the hands of a narrow circle of market participants. |

| Extra liquidity. WBTC brings additional liquidity to the Ethereum DeFi market. | The need for trust in the custodian. The custodial model creates counterparty risk because users rely on the ability of custodians to securely store and manage Bitcoin reserves. |

| WBTC activity is transparent and verifiable. The amount of WBTC in circulation is always backed by the equivalent amount of BTC held in reserve, ensuring transparency. | Regulatory issue. WBTC custodians may face the challenge of complying with the regulatory requirements of the jurisdictions where they operate. |

| WBTC allows seamless Bitcoin trading on DEXs operating on the Ethereum network. |

Summary

WBTC bridges the gap between Bitcoin and Ethereum by combining the advantages of both networks. The token provides increased interoperability, liquidity, and programmability in the DeFi ecosystem. WBTC is a way to transfer Bitcoin to another blockchain without losing its value.