What Is Bitcoin ($BTC)?

Bitcoin is the first and most popular cryptocurrency in the world. It was created in 2008 as a digital currency that could function as a means of payment and a medium of exchange, independent of any third party. Instead, blockchain technology is used to facilitate peer-to-peer transactions between users on a decentralized network. A key feature of Bitcoin is its pseudonymous nature. This implies that a user's online identity may not necessarily align with their real-life identity.

Many new cryptocurrencies have emerged since the creation of Bitcoin, but Bitcoin still maintains its leading position among competitors in terms of market capitalization and trading volume.

Bitcoin has a limited supply, with only 21 million Bitcoins that will ever exist. Bitcoin can be mined by anyone with a computer and an internet connection, but it requires a significant investment in hardware and electricity. If mining Bitcoin is not a viable option, individuals can choose to buy or sell it on various cryptocurrency exchanges.

Who Are the Founders of Bitcoin?

Bitcoin was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto. The Bitcoin network was launched in January 2009, and Nakamoto is said to have been actively involved in its development and early stages.

Bitcoin was created to solve the problem of double spending in digital environments without the need for a trusted intermediary. The true identity of Satoshi Nakamoto has never been revealed, leading to much speculation and conspiracy theories about the person behind the creation of Bitcoin.

Despite the widespread use of Bitcoin and its impact on the financial world, the identity of Satoshi Nakamoto remains a mystery. Several individuals, including Elon Musk, Craig Wright, and Nick Szabo, have been speculated to be Satoshi Nakamoto over the years. However, none of these theories has been substantiated.

Key Events in the History of Bitcoin

- August 18, 2008: The domain name bitcoin.org is registered, marking the first trace of Bitcoin.

- October 31, 2008: The Bitcoin whitepaper is published by Satoshi Nakamoto, outlining the concept of a decentralized digital currency.

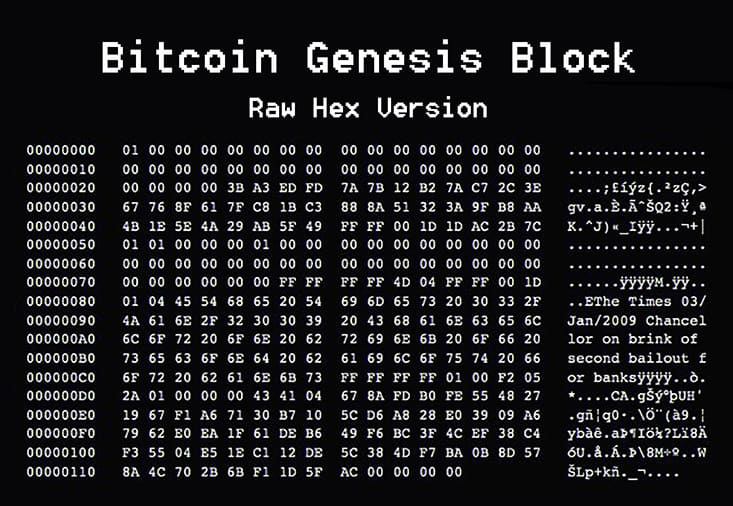

- January 3, 2009: The first Bitcoin block, known as the Genesis Block, is mined.

Satoshi Nakamoto message embedded in the coinbase of the first block

Source & Copyright © Satoshi Nakamoto, GitHub

- May 22, 2010: The first real-world transaction using Bitcoin takes place when Laszlo Hanyecz pays 10,000 BTC for two pizzas.

Source & Copyright © Laszlo Hanyecz

- 2013: The Silk Road, a darknet marketplace that accepted Bitcoin as payment, is shut down by the FBI.

- 2017: Bitcoin's price reaches an all-time high of nearly $20,000.

- 2021: The first Bitcoin ETF, ProShares Bitcoin Strategy (ticker: BITO), is approved by the Securities and Exchange Commission.

- 2022: Bitcoin experiences a significant price drop, falling from over $60,000 to under $30,000

From the mid-2010s, more businesses have started to accept Bitcoin as a form of payment, including large companies like Starbucks and McDonald's. Bitcoin adoption has grown significantly since its introduction, with more people using it in everyday life. Its growing acceptance as payment, increasing interest, and investment have all contributed to its growth.

What is Bitcoin ($BTC) Price Today?

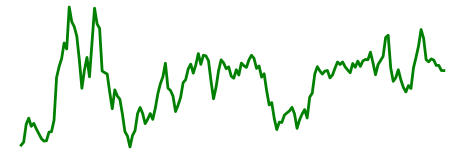

The current price of Bitcoin is $107,890.0 with a 24-hour trading volume of $23,083,449,933. Bitcoin's price has been known to fluctuate dramatically over the years, with periods of rapid growth followed by sharp decline. These fluctuations have a significant impact on the prices of other cryptocurrencies, as Bitcoin is often seen as a bellwether in the entire cryptocurrency market. When Bitcoin's price rises, other cryptocurrencies tend to follow suit; when it falls, they tend to fall as well. One reason for this is that Bitcoin is the most well-known and widely used cryptocurrency, with its market capitalization far exceeding that of any other.

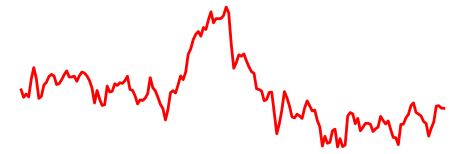

For example, in 2017, Bitcoin's price increased from approximately $1,000 at the beginning of the year to nearly $20,000 by the end of the year. This rapid growth was fueled by a combination of factors including increased mainstream adoption, media attention, and speculation.

Bitcoin Price Fluctuations. Source & Copyright © TradingView

However, this growth did not occur without skepticism. Many experts warned that the rapid rise in Bitcoin's price was unsustainable and that a crash was inevitable. In late 2017 and early 2018, these predictions proved to be correct as Bitcoin's price fell sharply, losing more than 80% of its value in just over a year. The reasons for this decline varied, but they included increased regulatory scrutiny, a lack of mainstream adoption, and a general cooling off of the cryptocurrency market.

Bitcoin's price predictions vary widely, with some experts predicting that it could reach even $1,000,000 soon, while others predict a more modest value of $45,000 in 2025. However, It is important to note that Bitcoin price predictions are speculative and can vary widely depending on the expert and the methodology used, and there is no guarantee that Bitcoin will increase over any timeframe.

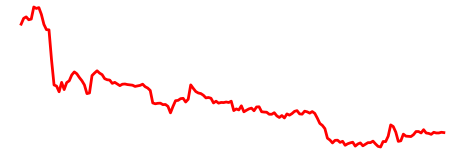

What Is the All-time High for Bitcoin?

The all-time high of Bitcoin is $68,789.63, which was reached on November 10, 2021.

Bitcoin All Time High. Source & Copyright © TradingView

What Is the All-time Low for Bitcoin?

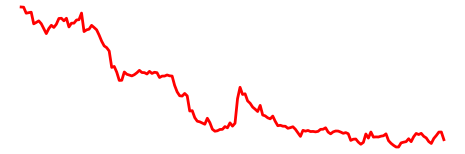

It is hard to decide which moment is exactly ATL for Bitcoin, but some of the moments in its history could be considered "lows":

- Mid-November 2011: After hitting a high of $29.60 in June 2011, bitcoin hit a low of $2.05 in mid-November of that year.

- 2014: Bitcoin's price slumped throughout 2014, hitting $315.21 in early 2015.2018: After reaching an all-time high of nearly $20,000 in December 2017, bitcoin's price fell sharply in 2018, hitting a low of $3,191.30.

- 2022: Bitcoin begins to lose steam in January 2022, and has been plagued by periods of steep declines.

But historically Bitcoin has always bounced back and regained its previous highs, proving its resilience and gaining new supporters along the way.

What Is the Market Cap of Bitcoin?

Market cap is used as an indicator of the dominance and popularity of cryptocurrencies, and it is often regarded as the single most important indicator for ranking cryptocurrencies. At the moment, Bitcoin is #1 cryptocurrency by market cap. You can readily access current Bitcoin market capitalization on our website.

What Factors Influence Bitcoin Price?

The value of Bitcoin is determined by several factors, such as supply and demand, regulations, competition, investor sentiment, and media attention. The following are the principal elements that impact the value of Bitcoin.

- Supply and demand. The fundamental economic concept of supply and demand is essential for determining the price of Bitcoin. The rarity of Bitcoin, which has a maximum supply of 21 million, and its growing demand and complexity of mining after halving events are the factors that can affect its value.

- Institutional adoption. The adoption of Bitcoin by more institutions and companies can increase its value. The participation of major corporations such as Tesla and MicroStrategy has already had a constructive effect on the value of Bitcoin.

- Regulatory changes. Any alterations in government policies or regulations that affect the use or legality of Bitcoin can affect its price.

- Accessibility and liquidity. If more people use Bitcoin, it may become more valuable. When potential use cases of Bitcoin are revealed, its price typically increases. Certain players in the market, including exchanges, have either developed or are in the process of developing investment tools centered around Bitcoin, such as futures and mutual funds.

- Rival cryptocurrencies can bear the Bitcoin's value. If another cryptocurrency gains significant traction, it may entice investors to divert their attention from Bitcoin, leading to a decrease in its price.

- Media coverage can significantly influence the value of Bitcoin. Favorable news can positively impact demand and prices, whereas negative news can cause a decline.

The value of Bitcoin may increase to reflect this expense. The cost of mining Bitcoin can also affect its prices. In summary, market forces, emotional reactions, and external events contribute to Bitcoin's price fluctuations. Although forecasting the forthcoming price of Bitcoin is challenging, comprehending its determining elements can help investors make better-informed decisions while trading or investing in cryptocurrencies.

How and Where to Buy and Sell Bitcoin?

There are several ways to buy or sell Bitcoin.

- Online cryptocurrency exchanges, such as Binance or eToro, where Bitcoin can be bought or sold using various payment methods such as bank cards, bank transfers, and e-wallets. On these exchanges, one can create an account, go through verification, and start trading.

- Local cryptocurrency exchanges where you can buy or sell Bitcoin locally by meeting the seller in person. Some of these exchanges include HodlHodl.

- Cryptocurrency ATMs, where Bitcoin can be bought using cash or bank cards.

- Peer-to-peer networks can buy or sell Bitcoin directly from other users using a variety of payment methods.

It is important to remember that cryptocurrencies are volatile assets. Therefore, before buying or selling Bitcoin, it is crucial to thoroughly research the market and make well-informed decisions. Before buying or selling cryptocurrencies, it is important to study the legislation in your country, as they may be prohibited by law in some states.

What Makes Bitcoin Unique?

Bitcoin is a distinct type of asset class that distinguishes itself from conventional asset classes like real estate, stocks, and even gold. Some unique features of Bitcoin are decentralization, anonymity, and security.

- Decentralization:The decentralized bitcoin network is a core feature that makes Bitcoin unique. Unlike traditional currencies, bitcoin is not controlled by a central authority or government. Instead, it is powered by a peer-to-peer protocol that allows users to transact directly with each other without the need for intermediaries such as banks or payment processors.

- Immutability: Bitcoin transactions are recorded on a public ledger called the blockchain, which is immutable and tamper-proof. This makes the network reliable and trustworthy, setting it apart from all other asset classes where a lack of transparency, counterfeiting or corruption could pose a risk to investors.

- Limited and deflationary supply: Bitcoin has a limited supply of 21 million coins, making it a deflationary currency. The creation of new Bitcoins is mathematically defined and strictly enforced by the Bitcoin network, unlike fiat currencies, which can experience supply changes due to government decisions.

- Global Accessibility: Bitcoin is accessible to anyone with an Internet connection, making it a borderless currency that can be used for fast and easy international transactions.

- Security: Bitcoin uses the latest cryptographic techniques to secure transactions and prevent any type of fraud. Transactions on the Bitcoin network are verified by sophisticated mathematical algorithms that require enormous computing power to solve.

- Store of value: Bitcoin is considered a legitimate store of value and is used by many people, giving it more liquidity and acceptance than most other traditional assets.

These are key features that make Bitcoin unique. Its technology has revolutionized the way we think about money, exchange and transactions.Its unique characteristics make it useful for both individuals and businesses, and it represents an exciting paradigm shift in both finance and technology, paving the way for a new era of financial innovation.

What is Bitcoin Halving?

Bitcoin halving is an event that happens every four years, reducing the reward for miners by 50%. This results in a slower circulation rate of new Bitcoin. Consequently, the cryptocurrency's supply and demand dynamics are directly impacted. Halving cuts down the available supply by decreasing the rate at which new BTC gets introduced to the market. As the supply goes down, and demand stays the same or grows, basic economic principles say Bitcoin's price goes up. Some people think that a cut in inflation will make Bitcoin's price go up a lot, while others argue that people already expected halving so it won't change anything.

How to Mine Bitcoin?

Steps to mine Bitcoin:

- Get a Bitcoin Wallet: Before mining Bitcoin, you will need to obtain a Bitcoin wallet to store your earnings. There are several types of wallets, including hardware wallets, software wallets, and online wallets.

- Build or buy a mining rig: A mining rig is a computer designed specifically for cryptocurrency mining. It typically consists of multiple GPUs capable of performing complex mathematical calculations at high speeds. You can either build your own mining rig or buy one from a manufacturer.

- Install Bitcoin Mining Software: Once you have a mining rig, you will need to install Bitcoin mining software. There are several mining software options available, including CGMiner, BFGMiner, and EasyMiner.

- Join a mining pool: You can start mining Bitcoin at home by joining a group of other miners to pool your resources and increase your chances of earning new BTC. However, the mining pool will divide the rewards among the members according to their contributed mining power.

- Configure your mining software: You will need to configure your mining software with your Bitcoins wallet address and the address of the mining pool you joined. You will also need to set the number of threads and the intensity of mining.

- Start mining: Once you have configured your mining software, you are ready to start mining BTC. The mining software will use the processing power of your mining rig to solve complex mathematical problems and validate Bitcoin transactions.

However, mining Bitcoin at home requires a substantial investment in specialized equipment and a high level of technical expertise. There are multiple ways to do so, including using a computer with a powerful graphics card, joining a mining pool, or participating in cloud mining.

How to Keep Your Bitcoin Safe?

To safeguard your Bitcoins, follow these practices:

- Use cold storage: it is one of the most secure ways to hold your Bitcoin since offline wallets are not connected to the internet. For the most secure storage, consider using a non-custodial hardware wallet for all your long-term Bitcoin and cryptocurrency storage needs.

- Use a hardware wallet: a hardware wallet is also recommended. A hardware wallet is a physical device that securely stores your private keys offline, making it the safest way to store your Bitcoin. These wallets can store cryptocurrency and can connect to other devices via USB, Bluetooth, or an app.

- Back up your wallet: regular backups can help you recover your currency in case of a computer failure. Include all wallet data files and store the backup at multiple secure locations, such as on a USB, CD, or other removable device. Also, make sure to use a strong password and encrypt the backup.

- Use strong passwords to prevent unauthorized access to your Bitcoin.

- Use multisignature security: Multisignature security helps maintain control of your Bitcoin by requiring multiple signatures to authorize a transaction.

- Use a hot wallet for small amounts: Only keep what you plan to use in your hot wallet. Once you're done with your transaction, move your Bitcoin back to cold storage.

- Be cautious of online services: Be cautious of any online service, as any device connected to the internet is vulnerable. Use reputable exchanges and wallets, and never share your seed phrase or private keys with anyone.

It is crucial to bear in mind that no storage method provides 100% secure storage and taking necessary precautions is necessary to safeguard your Bitcoin from theft, computer malfunctions, loss of access keys, and other potential risks.

Pros and Cons of Bitcoin

| Pros | Cons |

|---|---|

| Decentralized: Bitcoin is decentralized, meaning that it is not controlled by any government or financial institution. This makes it immune to government interference and manipulation. | Volatility: Bitcoin's value is highly volatile, meaning that its price can fluctuate rapidly and unpredictably. This makes it a risky investment. |

| Anonymity: Bitcoin transactions are anonymous and do not require personal information to be disclosed. This makes it attractive to those who value privacy. | Security concerns: Bitcoin is vulnerable to hacking and theft, as it is stored in digital wallets that can be accessed by hackers if not properly secured. |

| Accessibility: Bitcoin can be used by anyone with an internet connection, regardless of their location or financial status. | Limited acceptance: Bitcoin is not widely accepted as a form of payment, which limits its usefulness in everyday transactions. |

| Lower transaction fees: Bitcoin transactions typically have lower fees compared to traditional banking transactions. | Environmental impact: Bitcoin mining requires a significant amount of energy, which has a negative impact on the environment. |

| Transparency: All Bitcoin transactions are recorded on a public ledger, which makes them transparent and traceable. |

Lack of regulation: Bitcoin is not regulated by any government or financial institution, which can lead to illegal activities such as money laundering and tax evasion. |

Summary

Bitcoin is a first cryptocurrency based on cryptography and blockchain technology — it means that digital signatures and cryptographic algorithms are used to verify and record transactions on the blockchain, where all transactions are recorded. Bitcoin's market capitalization — exceeds that of any other cryptocurrency — as does the amount of information noise and speculation surrounding it. Therefore, bitcoin price predictions should be taken very carefully.