About Binance USD

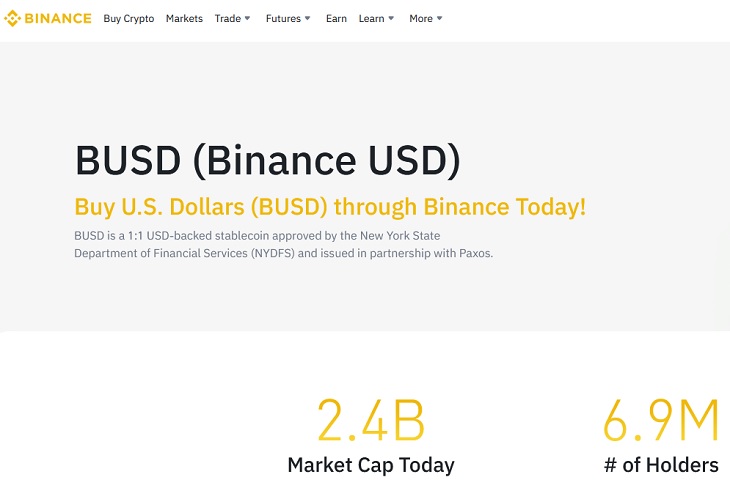

Binance USD (BUSD) is a stablecoin backed by the US dollar and issued by Binance and Paxos. Each BUSD token is backed 1:1 with US dollars held in reserve, which aims to provide a more stable cryptocurrency alternative for traders and investors looking to avoid the volatility of the digital asset market.

BUSD is an ERC-20 token built on the Ethereum blockchain, but it also supports BEP-2, a technical standard that defines how new digital assets can be created and transferred to the Binance Chain.

Source & Copyright © Binance

Binance Chain is a blockchain platform developed by Binance that offers interoperability between its native chain and the most popular smart contract platform, providing users with a wide range of options for digital assets. BUSD is widely accepted by many wallets and lending platforms, supporting its broad adoption.

Unlike other cryptocurrencies, BUSD is backed by US dollars held in reserve, which ensures its stability and offers a safe investment option for traders and investors looking to avoid the volatility of the digital asset market. BUSD is one of the few regulated crypto tokens available on the market and has received approval from the New York Department of Financial Services, a notoriously strict regulatory body.

Binance USD is an incredibly useful monetary asset that can be used anywhere outside Binance due to its exponential adoption. Its global acceptance has created one of the largest cryptocurrency networks in the industry.

BUSD is not only used for derivatives trading, but also for stabilizing funds. In the crypto industry, BUSD has formed new partnerships with companies like BitPay, Simplex, Moonpay, Alchemy, and more.

Management

The management team of BUSD comprises Binance's co-founders Changpeng Zhao (CZ) and Yi He. CZ, known as the "CZ" of Binance, is a renowned personality trait in the cryptocurrency industry.

He was a Chinese-Canadian entrepreneur who established Binance in 2017 and scaled it to become one of the largest cryptocurrency exchanges globally. CZ's entrepreneurial flair and adeptness to create flourishing ventures are recognized worldwide. Since 2013, he has actively participated in the cryptocurrency industry and has promoted the adoption of blockchain technology.

Along with his philanthropic efforts, including the Binance Charity Foundation, which utilizes blockchain technology to improve the lives of people in need globally, Zhao has gained recognition. Furthermore, the BUSD management team comprises skilled professionals from the financial and cryptocurrency industries, in addition to CZ and Yi He.

The team is accountable for crucial decisions regarding BUSD's development and management of BUSD, ensuring compliance with regulatory standards and interoperability with diverse platforms.

CZ is a prominent figure in the cryptocurrency industry, well known for his entrepreneurial acumen and philanthropic endeavors. The team's primary duties include making vital decisions concerning the development and administration of the BUSD. This entails ensuring that the currency remains compliant with regulatory standards and is interoperable across multiple platforms.

Paxos has a team of experts on its board of directors, including Sheila Bair, former Chairperson of the Federal Deposit Insurance Corporation (FDIC), Bill Bradley, a former senator and Chairman of the Senate Finance Committee, and Patricia Kemp of Oak Investment Partners.

Source & Copyright © Paxos

Paxos’s regulatory status sets it apart from many other blockchain infrastructure platforms, providing a level of trust and security for its users. The platform offers a range of products and services designed to facilitate and streamline blockchain-based transactions, including stablecoins, digital asset custody solutions, and settlement systems.

Binance USD Price

The Binance USD (BUSD) is a stablecoin pegged to the US dollar and issued by Paxos. It is one of the most regulated and safest stablecoins, with a 1:1 ratio against the US dollar. BUSD is available for purchase and redemption at a rate of 1 to 1. BUSD is compliant with the strict regulatory standards of NYDFS. BUSD is green-listed by the NYDFS, making it pre-approved for custody and trading by any NYDFS virtual currency licensees.

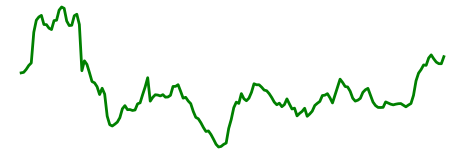

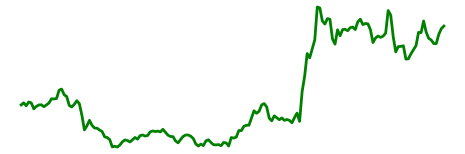

Since its launch in 2019, Binance USD (BUSD) has become one of the most successful stablecoins in the cryptocurrency market. At the beginning of 2021, BUSD had a market capitalization of approximately $1 billion.

The BUSD ecosystem has witnessed tremendous growth throughout the 2021 year, and by the end of it, its market capitalization surged to over $14 billion. BUSD's market capitalization now stands at roughly $6 billion, making it one of the top stablecoins in the market. The current BUSD 24-hour trading volume is approximately $3.22 billion. BUSD's circulating supply amounts to 6.66 billion coins, with the maximum supply remaining undisclosed.

BUSD is widely accepted by trading platforms and exchanges, making it a practical choice for investors looking to diversify their wallets. Transactions made with BUSD are fast and cheap, making them a popular choice for digital finance users. BUSD can also be used for transactions on decentralized platforms such as DeFi protocols.

How does Binance USD work?

As mentioned earlier, BUSD is a stablecoin backed by fiat currency, specifically the US dollar. Binance and Paxos, along with major banks, have created a reserve of US to back every BUSD in circulation, ensuring that the supply and reserves are always at a 1:1 ratio. Paxos holds US dollar reserves to back BUSD tokens, and it acts as a custodian for BUSD.

Each BUSD token can be exchanged for one US dollar from the reserves, which means that the BUSD is fully redeemable for US dollars. If the price of BUSD starts to fall below $1, arbitrage traders will purchase large amounts of BUSD to make a profit, which will increase demand and raise the token price back up to $1.

BUSD is an ERC-20 token, which means it can be stored in popular Ethereum wallets, such as MetaMask and Exodus. This allows users to transact in decentralized marketplaces on Ethereum without converting US dollars into ETH.

Binance is responsible for managing the BUSD token, which includes listing it on exchanges and providing customer support. They also used smart contracts to mint and burn BUSD tokens, as needed. Binance uses a deflationary mechanism to maintain BUSD's 1:1 peg to the US dollar. When BUSD is bought, an equivalent amount is added to the Paxos treasury; when BUSD is sold, the equivalent amount is taken from the treasury, and the BUSD is burned.

Additionally, the BUSD token is compatible with both Ethereum's ERC-20 standard and Binance's BEP-2 standard, which allows users to move their BUSD seamlessly between the two blockchains using Binance's convert function.

New York State regulators have imposed several regulatory measures that BUSD must comply with. They require that BUSD be fully collateralized and that its creation and burning be strictly controlled by Paxos. To prevent illegal activities, Paxos also has the authority to freeze accounts and remove funds. All these regulations follow the Trust Charter and New York banking laws that apply to BUSD. The smart contracts used for BUSD contain a new function called SetLawEnforcementRole, which enables Paxos to implement the aforementioned regulations to uphold the NYDFS standards.

It is important to note that these regulations apply only to the Paxos-issued BUSD on Ethereum. BUSD issued by Binance on the BNB Chain (previously known as Binance Chain and BNB Smart Chain) is not regulated by the NYDFS or issued by Paxos.

What is Binance USD used for?

Binance USD (BUSD) is a stablecoin that is used for various purposes in the cryptocurrency industry. It is a fiat-backed stablecoin approved by the New York State Department of Financial Services (NYDFS) and complies with strict regulatory standards. BUSD primarily serves as a trading pair on the Binance Exchange.

The BUSD serves as a base cryptocurrency for trading other digital assets, enabling traders to evade the volatile nature of the digital asset market. It also serves as a payment method for numerous platforms that accept it and can be used to purchase goods and services. In addition, BUSD serves as a stable store of value, much like fiat currencies, such as US dollars.

As a stablecoin, each BUSD unit is secured 1:1 with US dollars held in reserve, ensuring that the BUSD retains a value equivalent to one US dollar. BUSD is a popular option for people seeking to stabilize their funds and avoid fluctuations in other cryptocurrencies. Additionally, BUSD has applications in decentralized finance (DeFi), serving as collateral for loans that allow users to borrow other cryptocurrencies or fiat currencies while using BUSD as a backing.

The BUSD can also be utilized in liquidity pools to aid trading in decentralized exchanges. BUSD is a versatile stablecoin used for remittances, the process of sending money internationally, and a variety of purposes in the cryptocurrency industry. It is an attractive option because it can be sent anywhere in the world instantly and at low cost.

BUSD is used as a trading pair, means of payment, store of value, collateral for loans, and liquidity pools. BUSD is a commonly chosen option for those seeking stability in their finances through cryptocurrencies. This is because it adheres to regulatory standards and compatibility with multiple platforms, establishing it as a dependable and versatile monetary asset.

Summary

Binance USD (BUSD) is a stablecoin that has gained significant traction in the cryptocurrency market since its 2019 launch. Many wallets and lending platforms accept BUSD, facilitating its widespread adoption.

BUSD primarily functions as a trading pair on the Binance exchange, a means of payment, a store of value, collateral for loans, and a liquidity pool. It can be entirely redeemed in US dollars and is supported by fiat currency, specifically the US dollar. State regulators in New York implemented various regulations to which BUSD must adhere. It is a reliable and adaptable monetary asset, with significant potential.

Key Features

- BUSD is a fiat-backed stablecoin approved by the New York State Department of Financial Services (NYDFS) and complies with strict regulatory standards.

- BUSD serves primarily as a trading pair on the Binance exchange, a means of payment, a store of value, collateral for loans, and a liquidity pool.

- BUSD is fully redeemable for US dollars and is backed by a fiat currency, specifically the US dollar.

- BUSD is an ERC-20 token, which means it can be stored in popular Ethereum wallets such as MetaMask and Exodus.

- New York State regulators have imposed several regulatory measures that BUSD must comply with.

FAQ

How is BUSD backed?

Each BUSD token is backed 1:1 with US dollars held in reserve, which ensures its stability and offers a safe investment option for traders and investors looking to avoid the volatility of the digital asset market.

What is the difference between BUSD and Binance-Peg BUSD?

BUSD is issued natively on Ethereum, thus limiting its usage outside the Ethereum ecosystem. To extend BUSD’s utility to other blockchains, Binance offers a wrapped version of the stablecoin, Binance-Peg BUSD, which is designed to track the value of the original, ERC-20 BUSD at a 1:1 ratio.

Is BUSD regulated?

Yes, BUSD is approved and regulated by the New York State Department of Financial Services, ensuring utmost consumer protection. BUSD is 100% backed by reserves held in either or both fiat cash in dedicated omnibus accounts at insured U.S. banks and/or the U.S. Treasury bills (including repurchase agreements and/or money-market funds invested in the U.S.) Treasury bills).