How to Create Your Own Cryptocurrency

Learn the essential steps and considerations involved in creating your own cryptocurrency with our comprehensive guide. Learn how to leverage blockchain technology, market your digital asset effectively, and navigate the complexities of the crypto world. Explore the key factors to consider, including legal and regulatory aspects, cost considerations, and market viability.

-

Table of Contents

- Introduction

- Understanding the Difference Between a Coin and Token

- How Can You Start Your Own Cryptocurrency?

- How To Create Your Own Cryptocurrency Step-by-Step

- How to Create an ERC-20 Token

- Things to Consider Before You Build Your Own Cryptocurrency

- Pros and Cons of Creating Cryptocurrency

- Closing Thoughts

Introduction

As the crypto continues to develop and challenge the traditional finance, diversifying one's investment portfolio with multiple cryptocurrencies is no longer a novel concept. But have you ever considered making money by creating your own cryptocurrency?

With new cryptocurrencies continually entering the market, anyone possessing technical computer programming knowledge can potentially create one.

However, determining the optimal starting point can be a challenge as it requires more than just a passing interest. It demands a deeper understanding and a willingness to navigate the complexities. If you're considering the creation of your own cryptocurrency, our article provides a basic outline to help you begin.

Understanding the Difference Between a Coin and Token

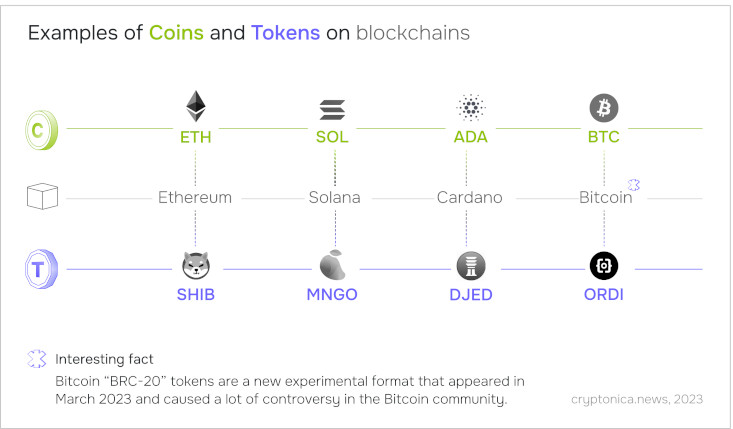

Before delving into the process of designing your cryptocurrency, it is important to understand the distinction between a crypto coin and a crypto token. Although these terms are often used interchangeably in the crypto sphere, they have some distinctions. Crypto coins are digital currencies specifically designed to function within a particular blockchain, while crypto tokens are digital assets created by decentralized applications (DApps) and platforms built upon existing blockchains.

Coins are purposefully developed from scratch to operate as currencies and are built on their own blockchain infrastructure. They typically serve specific functions within their respective networks, such as facilitating transaction fees, staking, or participating in governance. For example, ETH is the coin of its native Ethereum blockchain.

On the other hand, tokens are digital assets encoded within smart contracts and find utility within DApps and platforms existing on established blockchains. For instance, ERC-20 tokens are created on the Ethereum blockchain. Tokens come in various forms, including gaming tokens, utility tokens like stablecoins and governance tokens, as well as digital assets like non-fungible tokens (NFTs).

| Crypto Coin | Crypto Token | |

| Coins have their own separate blockchains | Tokens operate on existing blockchains | |

| Serve specific functions within their respective networks | Can serve a multitude of purposes including granting holders access to a service, representing ownership in an asset, or a unit of value for transactions. | |

| Created through the process of mining (Proof of Work) or staking (Proof of Stake). | Created through smart contracts on existing blockchains like Ethereum, Binance Smart Chain, etc. | |

|

Examples:Chainlink (LINK), Uniswap (UNI), USD Coin (USDC), etc. |

How Can You Start Your Own Cryptocurrency?

Now that we understand the difference between a coin and token, let’s explore the methods of creating your own cryptocurrency. There are three primary methods to do so:

- building your own blockchain (coin)

- modifying an existing blockchain (coin)

- and building atop an existing blockchain (token).

Each approach offers unique possibilities for bringing your digital asset to life. Creating a token is typically more straightforward than developing a coin since tokens leverage existing blockchain technology. This allows creators to take advantage of the infrastructure provided by established blockchains. Let’s take a closer look at each of the methods.

Create your Own Blockchain and Native Coin

This option is the hardest one. However,  if you're looking to create a cryptocurrency that is truly unique and innovative, building your own blockchain may be just what you need.

if you're looking to create a cryptocurrency that is truly unique and innovative, building your own blockchain may be just what you need.

While this job requires technical expertise and a solid understanding of blockchain technology, it offers unparalleled design freedom. As a blockchain developer, you have the freedom to code your coin as you wish, without any limitations. However, keep in mind that developing an entire blockchain and promoting your coin requires a significant investment of time and money.

Modify the Code of an Existing Blockchain

If you're interested in creating your own token but don't want to start from scratch with a brand new blockchain, another option is to utilize the source code of an existing blockchain. This process is commonly known as forking. Many blockchain codes are open source, meaning they are accessible for viewing and downloading by anyone. Platforms like GitHub provide a vast repository of various blockchain source codes for you to explore. Major blockchains like Ethereum or EOS have their source codes readily available on GitHub, making it easier for developers to access and modify them. Once you've identified the suitable source code, you can customize it to make your token unique. This option does require a certain level of technical expertise.

If you're interested in creating your own token but don't want to start from scratch with a brand new blockchain, another option is to utilize the source code of an existing blockchain. This process is commonly known as forking. Many blockchain codes are open source, meaning they are accessible for viewing and downloading by anyone. Platforms like GitHub provide a vast repository of various blockchain source codes for you to explore. Major blockchains like Ethereum or EOS have their source codes readily available on GitHub, making it easier for developers to access and modify them. Once you've identified the suitable source code, you can customize it to make your token unique. This option does require a certain level of technical expertise.

Notable examples of cryptocurrencies that were created through forking include Litecoin and Bitcoin Cash, both of which originated from Bitcoin.

Once you have downloaded and made the necessary modifications to the source code, it's important to collaborate with a blockchain auditor to review and validate your changes.

Build a New Cryptocurrency on the Back of an Existing Blockchain

There is also a solution for those who are not confident with their coding skills or working with limited resources. Anyone can develop a token on a pre-existing blockchain, such as Solana, Ethereum or its EVM-compatible counterparts Binance Smart Chain, Optimism, Arbitrum, and Polygon. Ethereum, in particular, uses the ERC-20 standard, which is user-friendly and doesn't demand extensive programming knowledge. You could also consider sidechains that utilize the security of a larger chain like Polkadot, but offer customization.

with their coding skills or working with limited resources. Anyone can develop a token on a pre-existing blockchain, such as Solana, Ethereum or its EVM-compatible counterparts Binance Smart Chain, Optimism, Arbitrum, and Polygon. Ethereum, in particular, uses the ERC-20 standard, which is user-friendly and doesn't demand extensive programming knowledge. You could also consider sidechains that utilize the security of a larger chain like Polkadot, but offer customization.

If you choose this option, your cryptocurrency's capabilities will be tied to the underlying blockchain you choose. Creating a token on an existing blockchain may still require some technical expertise, however, even those with moderate computer knowledge can likely create their own token with relative ease.

While tokens generally offer less customization compared to coins, they represent a cost-effective and efficient way to create a cryptocurrency. By leveraging the security and features provided by established blockchain platforms, your token gains credibility and value within the market.

How To Create Your Own Cryptocurrency Step-by-Step

Once you’ve made up your mind regarding the methods of creating your cryptocurrency, here are the general steps you need to undertake:

Define Your Objectives

The first step is to carefully consider the objectives you want your cryptocurrency to achieve. Think about the specific problem your cryptocurrency will solve, what benefits does it offer to potential users? Is there an existing blockchain addressing this issue? It's essential to have a unique use case that differentiates your cryptocurrency from others and offers something innovative. This distinction will catch the attention of potential investors. For instance, Bitcoin emerged as a decentralized alternative to traditional fiat currencies, while Ethereum was designed as a platform for decentralized application development.

Creating a new crypto asset is like launching a startup, requiring careful planning and marketing analysis. Therefore, you should conduct thorough research to enhance your chances of achieving genuine product/market fit. Pay close attention to the marketing aspect and identify a responsive target audience. This will enable you to craft a highly targeted marketing plan for the post-launch phase.

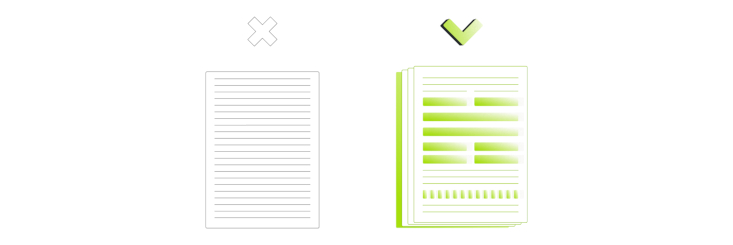

Creating a White Paper

Outlining the purpose and defining the characteristics of a cryptocurrency are essential tasks that should be documented in a whitepaper. It should articulate the problem your project aims to solve and explain why a new solution is necessary. Make sure that your whitepaper is clear, concise, and not too technical. If potential investors struggle to comprehend the objectives and value proposition of your project, they are unlikely to invest in it.

Take, for example, the renowned whitepaper created by the enigmatic Satoshi Nakamoto for the pioneering cryptocurrency Bitcoin (BTC). Translated into over 40 languages this whitepaper sets a standard for clarity and accessibility.

Investors heavily rely on whitepapers to form their initial impressions and evaluate projects. If your whitepaper fails to convey the value behind your idea, it may lead potential investors to turn away.

To ensure the effectiveness of your whitepaper, it should articulate the problem your project aims to solve and explain why a new solution is necessary, outline your company's intended use of the raised funds from the Initial Coin Offering (ICO), provide transparency regarding how these funds will be utilized, specify the timeline for the release of tokens, including the quantity and the exchanges on which they will be listed, and present a comprehensive roadmap that outlines the key milestones and development stages of your project.

Choose a Consensus Mechanism

The consensus mechanism determines how participants confirm and validate transactions on the network. The two most common consensus mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). While PoW is considered more secure, it can be expensive to maintain and less environmentally friendly. On the other hand, PoS has lower hardware requirements and offers various variations.

You can also consider other consensus mechanisms that are available in the blockchain sector. Some of theme include delegated proof of stake (DPoS), nominated proof of stake (NPoS), proof of history (PoH), proof of authority (PoA) and many more.

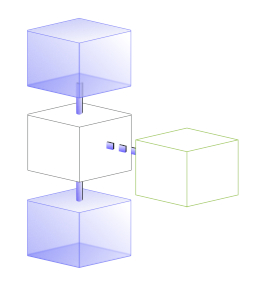

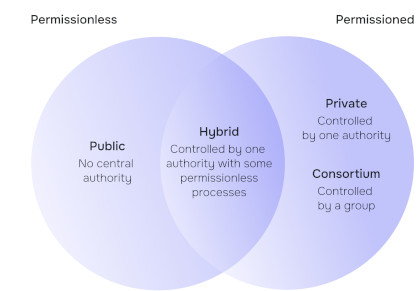

Select a Blockchain Format

Regardless of the method you choose for creating a cryptocurrency, you must have a blockchain. There are four fundamental blockchain types: public, private, hybrid and consortium. You need to choose the model that aligns with your goals. Additionally, you'll need to define essential details such as the blockchain address, data access, key formats, asset creation rules, block size, transaction limitations, rewards, and node identification.

for creating a cryptocurrency, you must have a blockchain. There are four fundamental blockchain types: public, private, hybrid and consortium. You need to choose the model that aligns with your goals. Additionally, you'll need to define essential details such as the blockchain address, data access, key formats, asset creation rules, block size, transaction limitations, rewards, and node identification.

Prepare the Nodes

After selecting the format for your cryptocurrency, the subsequent step involves downloading the required software and configuring nodes. Nodes are computers connected to the blockchain network. They play a crucial role in validating and relaying transactions, as well as storing the transaction history on the blockchain. Setting up nodes involves considerations such as node accessibility (public or private), hosting options (cloud network or local nodes), preferred operating systems, and hardware specifications (GPUs, processors, RAM, hard drives, etc.).

Keep in mind that creating a node from scratch requires advanced technical skills. Most blockchains already have an existing node structure in place that can be utilized for transaction validation.

Design the API and User Interface (UI)

Once you've reached this stage, it's time to integrate the application programming interfaces (APIs) into your cryptocurrency. APIs serve as channels of communication between blockchain and its participants, making software more user-friendly and comprehensible. Depending on the complexity of your blockchain, you may need web, mail, and FTP servers, external databases, and proficiency in front-end programming languages like HTML5, CSS, PHP, C++, Java, JavaScript, or Python.

The integration of APIs plays an important role in ensuring security, privacy, and collaboration within your cryptocurrency's blockchain, especially during transactional activities. When selecting an API, it's essential to ensure that your chosen blockchain platform supports its functionality. For instance, if you're utilizing a proof-of-work (PoW) blockchain, integrating the Bitcoin API would be necessary.

To achieve successful crypto adoption, the user interface should also be visually appealing and easy to navigate.

Audit and Verify

Implementing robust security measures and conducting thorough audits are essential to protect the cryptocurrency and its users. To ensure the security and reliability of your blockchain, many cryptocurrency developers choose to hire specialized auditors who review the blockchain's code and identify any vulnerabilities.

Mint Your Cryptocurrency

Finally, you're ready to mint your new cryptocurrency. You have the flexibility to decide how many coins you want to issue initially. You can either mint the complete coin supply in a single batch or gradually increase the supply over time as new blocks are added to the blockchain.

How to Create an ERC-20 Token

ERC-20 is a standard interface for tokens on the Ethereum blockchain. It defines a set of rules and functions that a token contract must implement to be considered ERC-20 compliant. To create your own ERC-20 token you can follow these steps:

- Start by defining the specifications of your token. This includes determining unique features that will set your token apart from others.

- To create an ERC-20 token, you need to write code in a programming language that the Ethereum protocol understands. However, you don't necessarily need in-depth technical knowledge, as there are other programs available that can assist you. These programs allow you to replace the specific features in the code with the ones you provided in the token specifications.

- The next step involves testing your token. By using a testnet, you can identify and rectify any potential defects in your token. To perform the testing, you'll need a reliable wallet. Popular software wallets like MyEtherWallet and MetaMask can be used for this purpose.

- Testing allows you to simulate the creation of your token without any actual monetary transactions. Although you may be prompted to make a payment during this process, it is part of the simulation and doesn't involve real money. Once this step is complete, you can review the source code.

- Verification of the token's source code is the final step. This phase is crucial as it ensures transparency in your project. You can achieve this by utilizing the "match and disclosure" option in the contract code. Double-check that all the data is accurate to facilitate the verification of the contract source code. Afterward, you can upload your token to the mainnet and make it available to other cryptocurrency enthusiasts.

Things to Consider Before You Build Your Own Cryptocurrency

Launching your own crypto project involves careful consideration of various factors. Here are some key factors you should take into account:

Legality

Cryptocurrencies initially emerged as a tool free from government intervention, they have increasingly garnered regulatory attention. The legality and regulations surrounding cryptocurrencies vary depending on the jurisdiction.

If you find yourself in a country that isn't crypto-friendly, it's advisable not to mint your own crypto coin. Engaging a legal advisor can provide you with accurate and up-to-date information. Furthermore, it is essential to include the legal aspects of your project in the white paper of your coin.

Different countries have their own unique laws and regulations concerning cryptocurrencies, and some jurisdictions may even prohibit their use entirely. To ensure the legality of your cryptocurrency, there are established rules for legalizing coin creation. This typically involves establishing a company and obtaining a government license. It is important to carefully consider your legal obligations and potential compliance issues.

Cost of Creating Your Own Cryptocurrency

The cost of creating a cryptocurrency can vary significantly based on the level of customization you desire for your coin or token. Developing highly customized coins on native blockchains tends to be a more expensive option, whereas launching a standardized token on the Ethereum platform can be done for free using specific platforms.

If you decide to create a coin and its accompanying blockchain, you'll likely need to allocate funds for a dedicated team that will work over several months. Also, such a method tends to incur higher costs due to significant initial development expenses and ongoing maintenance requirements.

Additionally, conducting a code audit by a reputable will also require money. Taking all these factors into account, to develop a cryptocurrency with a reasonable chance of success, you can expect to spend thousands of dollars on its creation, marketing, and community building.

Funding and Sustainability

Determining the funding strategy for your project will define whether your project will be successful in the long run. Assess whether you will conduct an initial coin offering (ICO), seek venture capital funding, or explore alternative fundraising methods. Consider the long-term sustainability of the project and how it will generate revenue or support ongoing development.

Also building a community around your cryptocurrency project is another thing to keep in mind. Focus on creating awareness, engaging with potential users, and fostering adoption. Develop a marketing and communication strategy to promote your project and highlight its unique features. Identify potential partnerships and collaborations that can enhance the credibility and reach of your cryptocurrency project. This could include collaborating with other projects, businesses, or influential individuals in the crypto space.

Planning Tokenomic

Tokenomics refers to the planned supply of tokens, including their distribution among creators, team members, affiliated parties, and investors. Tokenomics is a crucial aspect of any cryptocurrency It involves strategic decisions regarding the release schedule, methods to control the token supply, the approach for initial distribution, and the potential for token creation post-launch. Tokenomics represents the utmost importance for investors. They examine factors such as the total number of coins or tokens to be created, their gradual release, the allocation held by creators and early investors, as well as mechanisms like burning or buybacks to regulate emissions. If you don't handle tokenomics the right way, it could prevent your project from growth in the long run.

Pros and Cons of Creating Cryptocurrency

|

|

| As the creator, you have full ownership and control over the cryptocurrency and its underlying technology. | The cryptocurrency market is highly competitive, making it challenging to gain traction and stand out among numerous existing cryptocurrencies. |

| You can design the cryptocurrency according to your specific requirements and tailor it to suit your project's needs. | Developing a cryptocurrency requires significant technical expertise in blockchain technology, cryptography, and security. This can be a steep learning curve for new developers. |

| If your cryptocurrency gains popularity, you have the potential to earn substantial financial returns through initial coin offerings (ICOs), token sales, or token appreciation. | Cryptocurrencies operate in a regulatory gray area in many jurisdictions, and navigating the legal landscape can be complex and time-consuming. Compliance with evolving regulations can pose challenges. |

| Cryptocurrencies are often designed to be decentralized, allowing for peer-to-peer transactions without relying on intermediaries or central authorities. This can enhance transparency, security, and censorship resistance. | The cryptocurrency market is known for its high volatility, which can lead to significant price fluctuations. This volatility can impact the value and stability of your cryptocurrency. |

| Creating a cryptocurrency provides an opportunity to gain hands-on experience with blockchain technology, which is a valuable skill in the rapidly growing field of distributed ledger technology. | Building user trust and driving the adoption of a new cryptocurrency can be a significant challenge. Convincing users to adopt and utilize your cryptocurrency requires marketing efforts and a compelling value proposition. |

| Developing your own cryptocurrency allows you to explore and experiment with new ideas, features, and use cases. | Cryptocurrencies are vulnerable to security breaches, hacking attempts, and other malicious activities. |

Closing Thoughts

If you're considering creating your own cryptocurrency, it's important to recognize that the information provided here should serve as a preliminary guide. The subject of cryptocurrency is complex and requires a substantial amount of time to grasp comprehensively. In addition to the initial creation of the token or coin, it's crucial to plan for its success after the launch.

A valuable approach is to study and analyze other cryptocurrency projects and their respective launches. By examining what worked effectively and what didn't, you can gain valuable insights to inform the creation of your own cryptocurrency. This research will contribute to a deeper understanding of the strategies and practices that can lead to a successful launch and subsequent growth of your project. Remember, learning from the experiences of others is a valuable tool in the world of cryptocurrency.

| Phase | Expenses | Time |

| Development of the concept | Depending on the project but typically varies between $1,000 and $200,00 | From 15 minutes to 6 months |

| Security audit | Approximately $3,000-$12,000 | 1 month |

| Crafting white paper and documentation | $5,000 to $8,000 | 2-8 weeks of full-time work |

| Marketing | Approximately $10,000 per week | 1 week - 30 days |

| Coin/token placement | 1-2 weeks | $ 5000 - 10,000 |

FAQ

What is the future of the cryptocurrency market?

The future of the cryptocurrency market is uncertain and subject to various factors such as regulatory developments, technological advancements, market demand, and investor sentiment. It is important to conduct thorough research and analysis to form your own perspective on the potential future trends of the market.

How much does it cost to make a cryptocurrency?

The cost of creating a cryptocurrency can vary significantly depending on factors such as the complexity of the project, customization requirements, development resources needed, and market conditions. It is advisable to consult with experts or development teams to get accurate cost estimates based on your specific project requirements.

How long does it take to create a cryptocurrency?

The duration to create a cryptocurrency can vary depending on the scope and complexity of the project, as well as the availability of development resources. Simple token creation on existing platforms may take a shorter time while building a customized blockchain and implementing advanced features can take several months or even longer. Developers should establish realistic timelines based on the project's requirements and the capabilities of the development team.

How to choose a developer to create a cryptocurrency?

When choosing a developer to create a cryptocurrency, it is essential to consider their expertise, experience in blockchain development, previous projects, and technical skills. Conducting thorough research, reviewing portfolios, and seeking recommendations can help in evaluating potential developers. It is also advisable to have detailed discussions, understand their approach, and assess their ability to meet your specific project requirements before making a decision.