About Sui

the Sui Network is a layer-1 blockchain and smart contract platform that aims to increase Web3 adoption through high throughput and scalability.

Unlike traditional blockchains such as Bitcoin or Ethereum, which rely on proof-of-work or proof-of-stake, Sui harnesses the power of delegated proof-of-stake. This means that users of the Sui network have the ability to elect and vote for delegates who will validate the next block, ensuring fast and secure transactions.

Unlike traditional blockchains such as Bitcoin or Ethereum, which rely on proof-of-work or proof-of-stake, Sui makes use of the delegated proof-of-stake consensus. This means that users of the Sui network have the ability to elect and vote for delegates who will validate the next block, ensuring fast and secure transactions.

The developers behind Sui have positioned it as a general-purpose network with a focus on high throughput, instant settlement, and an easy-to-use Web3 interface. By offering fast and affordable transactions, Sui aims to facilitate the widespread adoption of decentralized applications and provide a seamless user experience.

One of the standout features of Sui is its dedication to reducing latency and increasing speed in executing smart contracts. As the blockchain ecosystem evolves, it is crucial to address the challenges associated with executing complex smart contracts efficiently. Sui tackles this issue head-on with its native programming language called Move, which is based on the Rust crypto programming language. Move is designed to enhance security and performance while simplifying the coding process, making it easier for developers to create and deploy smart contracts.

Move was specifically developed to address issues found in Solidity, the language used in Ethereum. Move focuses on representing digital assets and performing secure operations on them.

The design of Sui eliminates a critical bottleneck that plagues existing blockchains. Traditional blockchains often suffer from the sequential processing of transactions, leading to wasteful computational power. Sui's innovation lies in organizing data into independent objects, allowing transactions to be executed in parallel. This breakthrough not only enhances efficiency but also paves the way for greater scalability and throughput.

Moreover, Sui achieves horizontal scalability by enabling parallel agreement on causally independent transactions. By utilizing Byzantine consistent broadcast, the network eliminates the overhead associated with global consensus, without compromising safety and liveness guarantees. This approach ensures that the Sui network can handle a high volume of transactions while maintaining the integrity and security of the blockchain.

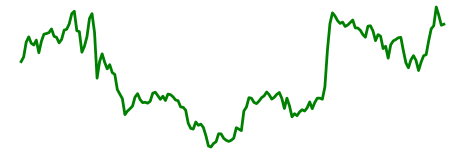

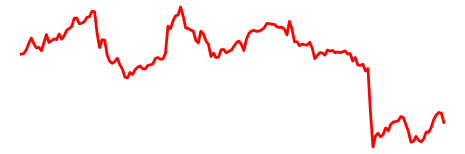

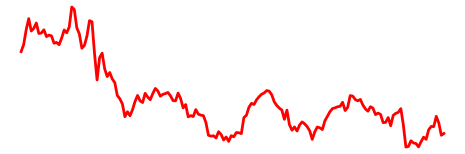

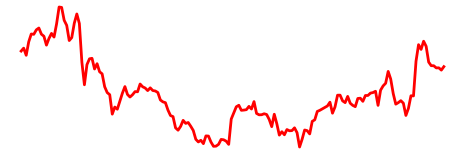

Sui Price

The current Sui price is $1,14 USD with a 24-hour trading volume of $186 267 612 USD. Sui market cap is $603 769 917 USD, with a circulating supply of 528 273 718 SUI and a max. supply of 10 000 000 000 SUI coins.

Sui is currently traded on such exchanges as Binance, OKX, CoinW, BTCEX, and Bybit.

How Does Sui Work?

When it comes to fast and cost-effective instant settlements, the Sui blockchain has a winning formula that combines three core elements: Move language, parallel transaction execution, and the Sui Consensus Engine.

At the heart of Sui is the Move language, a variation of the language initially developed by Facebook for the Diem blockchain. Designed with security and efficiency in mind, Move is built on the robust Rust programming language. Unlike other programming languages, such as Solidity, Move was purposefully created to address the imperfections and vulnerabilities that can compromise asset representation and security on blockchain platforms.

In contrast to traditional blockchains that rely on "accounts" for smart contracts, Sui embraces the concept of programmable "objects" that are unique to its ecosystem. This object-oriented approach empowers developers to customize the behavior of these objects, including their ability to change and how they can be transferred. This flexibility proves particularly advantageous when dealing with non-fungible tokens (NFTs) and gaming assets, making asset programming more streamlined and accessible.

Another remarkable feature of Sui is its parallel transaction execution capability. Unlike other platforms that process smart contracts sequentially, Sui leverages parallel execution, allowing multiple transactions to be processed simultaneously. This approach significantly reduces transaction processing time and enables near-instant finality.

Sui Consensus Engine consists c of two components: Narwhal and Bullshark. Narwhal serves as a spacious and high-capacity mempool, acting as a "waiting room" for unconfirmed transactions. Its vital role revolves around guaranteeing the synchronization and availability of data submitted to validators for confirmation. Bullshark introduces an innovative consensus protocol that harnesses the power of Directed Acyclic Graph (DAG) and Byzantine Fault Tolerance (BFT) technologies. This cutting-edge feature enables consensus to be achieved without requiring validators to exchange information.

Furthermore, the Sui blockchain's horizontal scalability allows the network to support millions of transactions per second without the need for dedicated nodes, eliminating the requirement for specialized hardware. This scalability paves the way for widespread adoption and mass usage without compromising on performance or accessibility.

Operating on a delegated proof-of-stake (DPoS) system, Sui provides SUI token holders with the power to select validators within each epoch, a 24-hour period. By staking their SUI tokens, holders delegate the processing of transactions to a chosen set of validators. During the epoch, the staked tokens remain locked within the system, but token holders retain the flexibility to withdraw their tokens or change their delegated validators when the epoch transitions.

What is Sui Used For?

SUI, the native cryptocurrency of the Sui blockchain, offers a range of uses and benefits within the ecosystem. Users can stake SUI tokens to actively participate in the platform's proof-of-stake mechanism, contributing to the network's security and consensus.

SUI serves as the primary asset for paying gas fees, which are required to execute and store transactions, as well as perform various operations on the Sui platform. Beyond its utility as a means of transactional value, SUI functions as a versatile asset on the platform, embodying the essential qualities of traditional money. It acts as a unit of account, facilitating the measurement and valuation of assets and services. Additionally, it serves as a medium of exchange, enabling seamless transactions between participants. Moreover, SUI can unlock more advanced functionalities through the implementation of smart contracts across the Sui platform, expanding its potential use cases.

SUI token holders hold a significant role in the governance of the Sui ecosystem. They possess the right to participate in on-chain governance voting, actively shaping the future of the platform by influencing decisions on protocol upgrades and other relevant matters.

By holding SUI tokens, users can engage in a wide range of DeFi applications and explore new financial opportunities.

With a total supply of 10 billion SUI tokens, Mysten Labs, the driving force behind Sui, has strategically allocated the distribution. 20% of the tokens will go to early contributors, 14% to investors, 10% to its treasury, 6% to a Community Access Program and Sui app evaluators, and 50% to a Sui Foundation-managed community reserve. The community reserve will fund delegation programs, grant programs, research and development, as well as validator subsidies.

Management

Sui blockchain was developed by Mysten Labs, a California-based company founded in September 2021. The team behind Mysten Labs comprises a group of former executives and developers from Novi Research, a division of Meta Corporation, known for their work on the Diem blockchain and Move programming language.

Evan Cheng is the co-founder and CEO of Mysten Labs, who previously served as the director of research and development at Novi Research.

The public announcement of the Sui project took place on March 22, 2022. To support the development and growth of the platform, Mysten Labs successfully raised funds through two funding rounds. The renowned Andreessen Horowitz fund led the Series A round, securing $36 million in early 2022. Building on this momentum, the Series B round generated an impressive $300 million, resulting in a valuation of $2 billion for Mysten Labs.