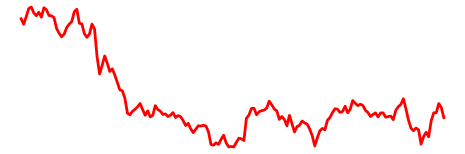

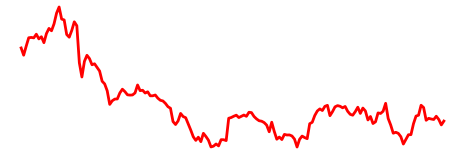

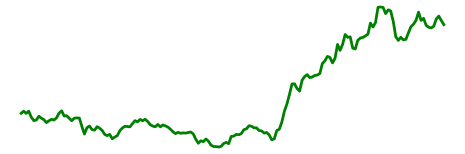

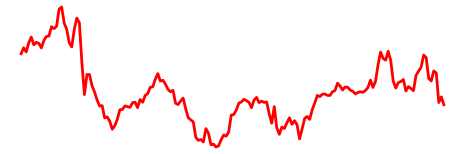

Current Lido LDO price data

The current Lido price is $3.04.

What is Lido?

Lido DAO is a liquid staking platform for Ethereum, allowing users to generate rewards without locking their digital assets. More specifically, Lido DAO allows its users to deposit their crypto holdings in ETH and other ERC-20 tokens into the platform in return for a tokenized version stETH. Such tokens can be used to earn yield rewards in other DeFi protocols as well as represent the user’s deposit which includes a generated reward.

Staked ether and stETH tokens differ in their limitations regarding liquidity and transferability. Compared to self-staking, Lido DAO offers a more flexible solution by eliminating the need for maintaining a validator node and the risk of frozen assets.

Lido DAO was launched in late 2020 and has quickly gained popularity in the Ethereum community. It is backed by a number of blue-chip investors and has received support from prominent figures in the blockchain space, including Vitalik Buterin and Balaji Srinivasan.

Lido runs as a decentralized autonomous organization and its members are responsible for governing the platform, with a focus on maintaining its efficiency and safety. As part of this responsibility, the DAO is tasked with promoting the platform to attract new users, node operators, and validators as well as oversees the technical development of the platform, ensuring that it remains up-to-date and relevant to the needs of its users.

How does it work?

As mentioned before at its core, Lido DAO is a liquid staking platform, which allows users to stake their tokens on Ethereum and receive a liquid representation of their deposited assets in return. Users can then use these liquid assets to trade, invest, or use it in other DeFi protocols, while still earning rewards on their staked assets.

The process of staking on the Ethereum is typically quite complex and requires a significant scope of technical background. For that end, users need to know how to run a node and maintain the relevant infrastructure, and they also need to ensure that their node is always online and functioning properly. Lido simplifies this process.

As a first step, users need to convert their ETH or other ERC-20 tokens into stETH. Or in other words deposit their assets into the Lido smart contract in exchange for stETH. Users can exchange their stETH for the underlying assets at any time, as the value of stETH is tied to that of the underlying assets.

When a user deposits their assets into the Lido smart contract, the assets are automatically included in the staking pool. The staking pool is made up of a group of validators who are responsible for safeguarding the Ethereum network and handling its transactions. By pooling their assets with others, Lido users can contribute to decentralizing the network and enhancing the security of the Ethereum ecosystem.

Lido's staking pool is highly decentralized, with over 150 nodes currently participating in the network and responsible for validation. This ensures that the platform is highly resilient to attacks and that no single entity has control over the network. On top of that, validators in the network are subject to ongoing performance monitoring and review to ensure that they are meeting the high standards required to secure the network.

In addition to rewards from staking, Lido also distributes governance tokens to its users. These tokens give users a say in the direction of the platform and allow them to vote on key decisions such as upgrades, changes to fees, and the addition of new assets to the platform.

Overall, Lido is a highly innovative project that simplifies the process of staking on the Ethereum network and helps to decentralize the network by allowing more validator nodes to participate. Its liquid staking protocol is highly efficient and allows users to earn rewards on their staked assets while maintaining the flexibility to use those assets in other DeFi protocols. With a strong team, a growing user base, and the backing of high-profile investors, Lido is well-positioned to play an important role in the future of the Ethereum ecosystem.

Lido has two tokens: LDO, which is utilized for governance, and stETH, which is a tokenized form of staked ETH.

Where to buy and how to store LDO?

LDO token can be purchased on centralized exchanges like Gemini and Digifinex and

decentralized exchanges like SushiSwap, Uniswap v2, and Balancer. It can be stored on hot and cold wallets, as well as on centralized and decentralized exchanges.