What is Cryptocurrency: All You Need To Know

Cryptocurrency is a revolutionary form of digital currency that has been gaining traction in recent years. Read a detailed explanation of what it is and how it works.

-

Table of Contents

- Understanding Cryptocurrencies

- How Does Cryptocurrency Work?

- Types of Cryptocurrency

- What is a blockchain in cryptocurrency?

- Proof of Work vs. Proof of Stake

- How Can You Mine Cryptocurrency?

- How Can You Use Cryptocurrency?

- How to Invest in Cryptocurrency?

- How to Store Cryptocurrency?

- Pros and Cons of Cryptocurrency

- Bottom Line

- Frequently Asked Questions

- What Is the Point of Cryptocurrency?

- What Are the Most Popular Cryptocurrencies?

- Are Cryptocurrencies Safe Investments?

- Are cryptocurrencies financial securities, like stocks?

- Why are there so many kinds of cryptocurrency?

- Are cryptocurrencies legal?

- What is the future of cryptocurrency?

- Should You Invest in Cryptocurrency?

It uses cryptography to secure transactions, and it exists on the Blockchain, a distributed ledger system where each transaction is recorded and stored across multiple computers. Cryptocurrency can be used as a store of value, medium of exchange, or unit of account, much like traditional currencies such as US Dollars or Euros. The major difference between cryptocurrency and other forms of money is that it is decentralized--meaning no government or bank controls its supply or value.

In this article, we will discuss what is cryptocurrency, how it works, what blockchain technology has to do with cryptocurrency, how you can mine cryptocurrency, how to use it safely and securely online, and even how to invest in cryptocurrencies for long-term gains. So, let's dive in!

Understanding Cryptocurrencies

Cryptocurrencies are digital assets that exist on the Blockchain and are secured using cryptography. Cryptocurrencies are different from traditional fiat currencies in the sense that they have no physical form and can only be exchanged digitally. They use a decentralized system to verify transactions, meaning that each transaction is stored and distributed on multiple computers across the world. Cryptocurrencies are digital money, but they can also be used as a store of value or unit of account, similar to traditional currencies like US Dollars and Euros. In addition, cryptocurrencies are not backed by any government or bank; therefore, the market completely determines the supply and value of these digital currencies.

How Does Cryptocurrency Work?

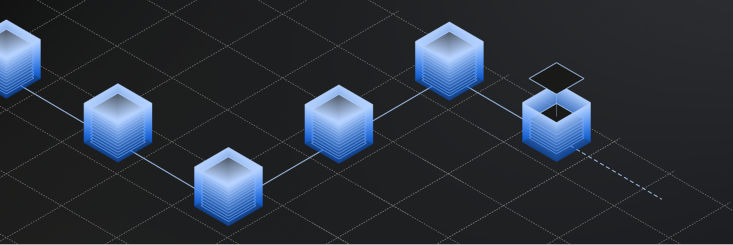

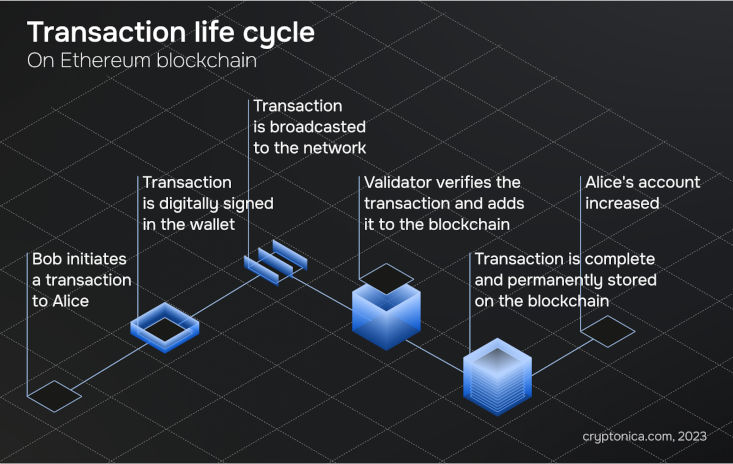

Cryptocurrencies are powered by a technology called Blockchain. Blockchain is a distributed ledger system that stores every transaction and distributes it across multiple computers worldwide. An immutable data chain is formed by storing every transaction in a "block" and linking it to other blocks. This makes cryptocurrency transactions secure, transparent, and highly reliable.

For cryptocurrencies to function properly, participants need to have wallets installed on their computers to send and receive cryptocurrency. A wallet is a digital storage solution that stores the private and public keys necessary to access your cryptocurrencies. When you send or receive cryptocurrency, the data is stored on the Blockchain and updated across all computers to verify and complete the transaction. Additionally, miners are for verifying transactions and creating new blocks on the Blockchain.

Types of Cryptocurrency

Many different types of cryptocurrency are available in the market today. Each cryptocurrency has its own unique characteristics, but they all share the same basic features—they are digital assets that exist on the Blockchain and use cryptography to secure transactions.

Popular Types of Cryptocurrencies

Some of the most popular types of cryptocurrencies or Coins are:

- Utility Tokens: Utility tokens are used to access specific services or products on a blockchain platform. They can be used as digital currencies, but their primary purpose is to give users access to a platform's utility.

- Security Tokens: Security tokens have various legal definitions according to jurisdiction, but in the crypto world, they typically refer to tokens that represent an investment in the underlying asset.

- Stablecoins: A stablecoin is a digital token of value that is pegged to a traditional fiat currency such as the US dollar or the euro.

- Exchange Tokens: Exchange tokens are digital assets that facilitate trading other digital assets on cryptocurrency exchanges.

- Governance Tokens: Governance tokens are digital assets that provide users with the right to participate in governance decisions and protocols on a blockchain platform.

- Asset-Backed Tokens: Asset-backed tokens are digital assets that are backed by a physical asset, such as gold or real estate.

Examples of Cryptocurrencies

There are numerous cryptocurrencies available in the crypto market today, such as:

- Bitcoin: In Crypto Industry, Bitcoin (BTC) is the most popular and oldest cryptocurrency. Satoshi Nakamoto, an anonymous individual or group, created BTC in 2009.

- Ethereum: Decentralized applications (dApps) can be developed on Ethereum's platform, facilitating smart contract development.

- Litecoin: Peer-to-peer cryptocurrency Litecoin (LTC) provides faster transaction times and greater efficiency than Bitcoin.

- Ripple: Ripple (XRP) is a real-time payment system that facilitates global money transfers with low transaction fees.

These are just some of the most popular cryptocurrencies, but hundreds of different coins are available in the crypto market today.

What is a blockchain in cryptocurrency?

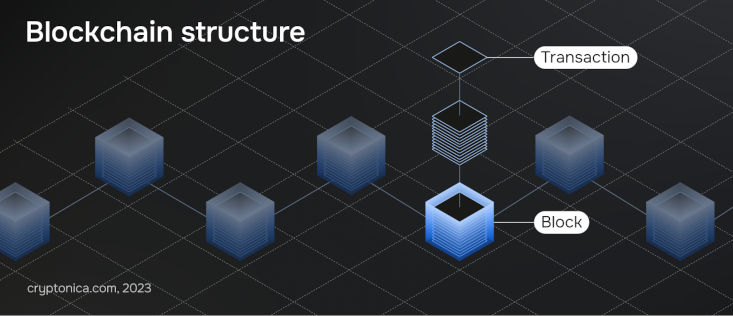

In the crypto world, Blockchain is a decentralized and distributed digital ledger that records the transactions of cryptocurrencies. It consists of blocks, which are data clusters chronologically linked together using cryptography. Each block contains details such as the time, date, sender, and recipient information and is secured by complex mathematical algorithms.

The Blockchain is constantly updated as new transactions take place, and all transactions are validated by a network of computers (nodes) before being added to the chain. This makes it virtually impossible for anyone to tamper with or alter the data stored within the Blockchain, ensuring that all transactions remain secure and transparent. The Blockchain is one of the key components of cryptocurrency and is responsible for its decentralization and security. Moreover, the Blockchain uses consensus mechanisms such as proof of work and proof of stake to prevent fraudulent activity.

Proof of Work vs. Proof of Stake

Two of the most common consensus mechanisms in blockchain networks are proof-of-work (PoW) and proof-of-stake (PoS). Let's look at the main differences between these two protocols.

Proof of Work?

Adding new blocks to the Blockchain by solving complex mathematical puzzles is accomplished through a consensus mechanism called proof-of-work (PoW). This process is known as mining and serves two main purposes: first, miners are rewarded for their efforts in the form of cryptocurrency; second, it secures the network by making it difficult for malicious actors to make changes or add new data. PoW requires a significant amount of computing power, which further helps to secure the network.

Proof of Stake?

PoS (Proof-of -stake) is an alternative consensus mechanism to PoW. In PoS, there are no miners; network participants stake their coins to validate new blocks. The more coins staked, the higher the chance of being chosen as a validator and receiving rewards for validating new blocks. PoS is more energy-efficient than PoW as it does not require the same amount of computing power. Furthermore, PoS also has the potential to reduce centralization in a blockchain network since it does not require expensive mining hardware.

Which one is better for cryptocurrency?

The choice of consensus mechanism depends on the type of cryptocurrency and its use case. Generally speaking, PoW is better suited for high-security applications such as Bitcoin, while PoS is more suitable for faster transaction processing and energy efficiency. Ultimately, it comes down to the specific use case and the goals of the cryptocurrency. Finally, it is worth noting that many blockchains combine both PoS and PoW protocols to maximize security and energy efficiency, like Decred.

How Can You Mine Cryptocurrency?

As part of cryptocurrency mining, transactions are verified and added to a public ledger known as the Blockchain. This is done by powerful computers that solve complex mathematical equations. When a computer solves one of these equations, it is rewarded with a unit of the cryptocurrency in question. This reward system encourages miners to participate in the network and helps keep it secure.

Anyone can mine cryptocurrency, but it is not an easy task. As the number of miners increases, the difficulty of solving a block also increases. Therefore, mining requires powerful computers and specialized software to succeed. In addition, miners must pay for electricity and other costs related to running their hardware.

Cryptocurrency mining can be done as part of a larger pool or as an individual. When mining in a pool, miners combine their computing power to increase the probability of solving a block and receiving a reward. Mining solo is riskier but can be more profitable, as the miner keeps all rewards.

Process of Mining Cryptocurrency

To mine cryptocurrency, miners must first set up their mining hardware. This includes computers with powerful graphic cards and specialized software to run the hardware. Next, miners must select a cryptocurrency to mine, join a mining pool, or start mining solo.

Once these steps are completed, miners connect to the blockchain network and verify transactions. When a miner solves a block, they receive rewards in the form of cryptocurrency. These rewards are then transferred to their wallet, which can be used for payments or other purposes.

Mining cryptocurrency can be a lucrative endeavor, but it is important to understand its risks and costs. By doing so, miners can maximize their profits and minimize their losses.

Disclaimer: The government has imposed strict regulations on cryptocurrency mining in some countries, such as China and Saudi Arabia. Therefore, it is important to research the legal implications of your country before engaging in mining activities.

How Can You Use Cryptocurrency?

Cryptocurrency can be used for a variety of purposes, including payments, investments, and trading.

- Payments: Cryptocurrency can be used to pay for goods and services online or in person. Many businesses now accept cryptocurrency as payment, making it a convenient option for customers.

- Investments: Cryptocurrencies are also popular among investors due to their volatile nature and potential for high returns. Investors can buy and sell cryptocurrencies on exchanges or use them as a long-term store of value.

- Trading: Cryptocurrency is also used for trading purposes on exchanges and peer-to-peer platforms. Trading cryptocurrency allows users to speculate on price movements and capitalize on market fluctuations.

- Crowdfunding: Cryptocurrency can also be used to facilitate crowdfunding campaigns. Many startups and projects have launched their own tokens to raise funds from the public. This is a popular option for entrepreneurs who want to launch their own projects without relying on traditional sources of funding.

- Remittances: Cryptocurrency can be used to send money internationally with lower fees than traditional remittance services. This makes it convenient for those who want to send money overseas without paying high fees.

- Governance: Cryptocurrency can also be used to facilitate more efficient, secure, and transparent forms of governance. Blockchain-based voting systems have been developed to allow citizens to vote in elections or on other matters.

Cryptocurrency is not only a digital currency but also an asset with various uses. By understanding how cryptocurrency works and the different ways it can be used, users can make informed decisions when engaging with the technology.

How to Invest in Cryptocurrency?

Cryptocurrency investment involves buying, holding, and trading digital assets. To get started, you'll need to decide which cryptocurrency or crypto assets you want to buy. You can buy Bitcoin, Ether, and other major cryptocurrencies directly from online exchanges like Coinbase or Binance. Alternatively, you may choose to invest in a Security Token Offering (STO) or Initial Coin Offering (ICO).

Once you've decided on what to invest in, you'll need to set up a digital wallet and purchase the cryptocurrency. Cryptocurrency wallets allow users to store their digital currency securely and send and receive payments. Once your wallet is set up, you can purchase cryptocurrency using traditional methods like a credit card or bank transfer.

Tips for Investing in Cryptocurrency

Before investing in cryptocurrency, it is important to understand the risks associated with digital assets. Here are a few tips for investing in cryptocurrency:

- Do your research: Before investing in any asset, be sure to do your research and familiarize yourself with the technology.

- Start small: Investing a large amount of money can lead to high losses if the market moves against you. It is best to start small and gradually build up your portfolio as you gain experience.

- Set a budget: Set a limit on how much you are willing to invest in cryptocurrency so that you don't put too much of your money at risk.

- Understand the risks: Cryptocurrency is highly volatile, so it's essential to understand the risks before investing.

Investing in cryptocurrency can be lucrative but carries a certain degree of risk. By following the tips above and doing your research, you can safely navigate the world of cryptocurrency investing.

How to Store Cryptocurrency?

Cryptocurrency is stored in digital wallets, secure online accounts allowing users to store and manage their digital currency. Choosing a secure wallet that can protect your funds from hackers is important. Hot and cold wallets are the main types of wallets.

Hot Wallets: These types of wallets are online wallets that store private keys on an internet-connected device. They are more convenient to use than cold storage but less secure due to the possibility of hacking or malware attacks.

Cold Wallets: Cold wallets, also known as hardware wallets, store private keys offline on a physical device. This makes them more secure than hot wallets, but they require the user to access the device to access their funds.

Which one is better?

Both hot and cold wallets have their advantages and disadvantages. Cold wallets are more secure but require the user to access the physical device to use it. Hot wallets are more convenient to use but less secure due to the possibility of hacking or malware attacks. Ultimately, it is up to the individual user to decide which type of wallet best suits their needs.

No matter which type of wallet you choose, it is important to keep your private keys secure. Private keys should never be shared with others as this could result in loss of funds. Using two-factor authentication and a strong password is also advisable to further protect your wallet.

Pros and Cons of Cryptocurrency

Cryptocurrency can offer many advantages, but there are also some drawbacks that should be taken into consideration. Here is a brief overview of the pros and cons of cryptocurrency.

Pros:

- Low Transaction Fees: Transactions with cryptocurrency are generally low cost as there is no need to pay traditional banking fees.

- Secure: Cryptocurrency is secured by cryptography and users' private keys, making it difficult for hackers to steal funds.

- Fast Transactions: Payments made with cryptocurrency are generally processed more quickly than those made with traditional banking methods.

- Decentralization: Cryptocurrency is not controlled by any central authority, giving users more power over their finances.

- Borderless: Cryptocurrency can be used to send and receive money from anywhere in the world.

- Efficiency: Cryptocurrency can reduce the time and resources required for traditional financial transactions.

- Privacy: Cryptocurrency transactions are generally anonymous, allowing users to protect their privacy.

Cons:

- Volatility: The value of cryptocurrencies can be highly volatile, making them a risky investment.

- Lack of Regulation: Cryptocurrency is not regulated by governments or central banks, which could make it difficult to recover funds if something goes wrong.

- Scams: Fraudulent activities are common in cryptocurrency, so users should always do their due diligence before investing.

- Taxes: The tax implications of cryptocurrency can be complicated and might require users to pay taxes on their gains.

- Lack of Liquidity: Cryptocurrencies are not as liquid as traditional currencies, so it might be difficult to convert them into cash.

Overall, cryptocurrencies have the potential to revolutionize the way financial transactions are conducted, but users must be aware of the risks and regulations before investing. By understanding what cryptocurrency is, how it works, and its advantages and disadvantages, users can make informed decisions about whether it is the right fit for them.

Bottom Line

In Conclusion, cryptocurrency is a digital asset that can be used as a unit of account, medium of exchange, or store of value. Cryptocurrency is secured by cryptography and stored on a blockchain, making it secure and borderless. Cryptocurrency has many advantages, such as low transaction fees, security, fast transactions, and privacy but also some drawbacks, such as volatility and lack of regulation. Ultimately, it is up to the individual user to decide if cryptocurrency is the right fit for them. With proper research and understanding of cryptocurrency, users can make informed decisions about their financial transactions.

Be safe and enjoy trading!

Disclaimer: This information is only for educational purposes and is not investment advice. Cryptonica is not responsible for any loss or profit from using the information. Please consult a licensed professional before making investment decisions.

Frequently Asked Questions

What Is the Point of Cryptocurrency?

Cryptocurrency is a digital currency that operates on a decentralized, secure, and private platform. It provides an alternative to the traditional financial system by offering more efficient and cost-effective solutions and enabling new possibilities for innovation and financial inclusion. In addition, cryptocurrency can be used to transfer value and make payments without the need for a third-party intermediary.

What Are the Most Popular Cryptocurrencies?

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are three of the most popular cryptocurrencies. Bitcoin is the leading digital currency, and Ethereum is a blockchain platform that enables developers to build decentralized applications. Ripple's XRP token is used for cross-border payments. There are also popular coins such as Litecoin (LTC) and Bitcoin Cash (BCH).

Are Cryptocurrencies Safe Investments?

The answer to this question is a resounding "It depends." Cryptocurrencies represent a relatively new asset class and have the potential for both significant gains and losses.

On the one hand, cryptocurrencies can be incredibly safe investments if you know what you're doing. Many investors are attracted to the fast-paced and decentralized nature of cryptocurrency trading, which makes it easier for them to take advantage of short-term market movements and generate profits quickly. Moreover, blockchain technology ensures that all transactions are verified in real-time by many different computers located across the world - making cryptocurrencies more secure than ever before.

On the other hand, there's no guarantee that your investment will pay off; while they offer exciting potential opportunities, they also come with considerable risk. The digital nature of these currencies makes them vulnerable to cyberattacks or hacks. Additionally, volatile markets make it harder to forecast their value over long periods, so timing your trades correctly becomes essential for success when investing in cryptocurrency assets.

So, if you're looking to invest in cryptocurrency, it is important to do your own research and take the necessary steps to protect your funds. Additionally, it is important to only invest what you can afford to lose and understand that the potential for both gains and losses is real.

Are cryptocurrencies financial securities, like stocks?

No. Cryptocurrencies are not considered financial securities like stocks, as they do not represent ownership in a company or give holders any claim to assets or profits. Instead, they are a form of digital currency that operates independently of traditional financial systems. However, some cryptocurrencies may be classified as securities by regulatory bodies, depending on their specific characteristics and how they are offered to investors.

Why are there so many kinds of cryptocurrency?

There are many kinds of cryptocurrency because the technology behind them, called Blockchain, allows for the creation of unique digital assets with different characteristics and use cases. As a result, developers and entrepreneurs have been able to create a wide range of cryptocurrencies with different features, such as privacy, security, speed, or utility, that cater to specific needs and preferences. Additionally, the open-source nature of blockchain technology has made it possible for anyone to create their own cryptocurrency with a unique set of rules and properties.

Are cryptocurrencies legal?

The legality of cryptocurrencies varies from country to country. In some countries, cryptocurrencies are completely banned, while in others, they are accepted as legal tender. It is important to research the laws and regulations in your country before buying or using any cryptocurrency. Additionally, it is important to note that regulatory bodies around the world have taken steps to ensure that investors are protected when dealing with cryptocurrencies and have established guidelines for exchanges and wallet providers. This makes it easier for users to trust and use cryptocurrencies in a safe and reliable manner.

What is the future of cryptocurrency?

The future of cryptocurrency is uncertain, but it is clear that digital currencies are here to stay. While the market remains volatile and unpredictable, more and more people are beginning to recognize its potential as an investment opportunity and a viable payment solution. As blockchain technology continues to evolve and become more widely adopted by governments and businesses around the world, cryptocurrency will become more accessible and easier to use. With the right mix of investment and adoption, cryptocurrencies could revolutionize the way we think about money in the future. However, only time will tell the true impact of digital currencies on our lives.

Should You Invest in Cryptocurrency?

The answer to this question depends on each individual's risk tolerance and financial goals. While there are potential rewards for investing in cryptocurrencies, the volatile nature of the market means that there are also significant risks involved. Before making any decisions, it is important to do your own research and make sure that you understand the implications of investing in cryptocurrency. It is also important to ensure that you have the proper security measures to protect your funds. This includes understanding how to store and trade cryptocurrencies securely and taking steps to protect yourself from scams and fraud. Ultimately, it is up to each individual investor to determine whether or not investing in cryptocurrency is right for them.