Proof-of-Work vs. Proof-of-Stake: The Biggest Differences

This article explores the differences between two types of consensus mechanisms - Proof-of-Work (PoW) and Proof-of-Stake (PoS). Cryptonica gives an overview of the pros and cons of each, as well as the security risks associated with each system.

The world of cryptocurrency is governed by complex systems that ensure secure and efficient transactions. Two primary mechanisms leading the way are Proof-of-Work (PoW) and Proof-of-Stake (PoS). The PoW system, initially brought to light through Bitcoin, centers on miners solving intricate mathematical problems for transaction validation and block creation. This process provides unmatched security but raises concerns due to its high energy consumption. On the other hand, PoS, a system favored by cryptocurrencies like Ethereum, select Validators based on their stake in the currency. This method is not only more energy-efficient but also encourages long-term investment. This article delves into the intricacies and significant contrasts between these two prominent systems - Proof-of-Work and Proof-of-Stake. Moreover, this article will provide insight into how the two systems are different from each other, which one is better, and many more about the two systems.

What is Proof-of-Work (PoW)?

Proof-of-Work (PoW) is a consensus mechanism used in blockchain networks to validate and secure transactions and maintain the integrity of the decentralized system. It is a fundamental concept introduced by Bitcoin, the first and most well-known cryptocurrency. PoW ensures that participants in the network agree on the order and validity of transactions without the need for a central authority.

At its core, PoW requires participants, known as miners, to solve complex mathematical puzzles to add new blocks of transactions to the blockchain. These puzzles are computationally intensive and require significant computational power to solve. The difficulty of the puzzles is adjusted regularly to maintain a consistent rate of block creation.

In the network, other participants, known as nodes, verify the solution by independently checking if the hash value meets the required criteria. If the solution is valid, the block is added to the blockchain, and the miner who found the solution is rewarded with a predetermined amount of cryptocurrency, such as Bitcoin.

At its core, blockchain transactions are added to the blockchain by miners who solve complex mathematical puzzles. These puzzles are computationally intensive and require significant computational power to solve. A constant block creation rate is maintained by adjusting the puzzle difficulty.

This system dynamically adjusts the difficulty level, ensuring that blocks are created at regular intervals and making it nearly impossible for malicious actors to overwrite the blockchain.

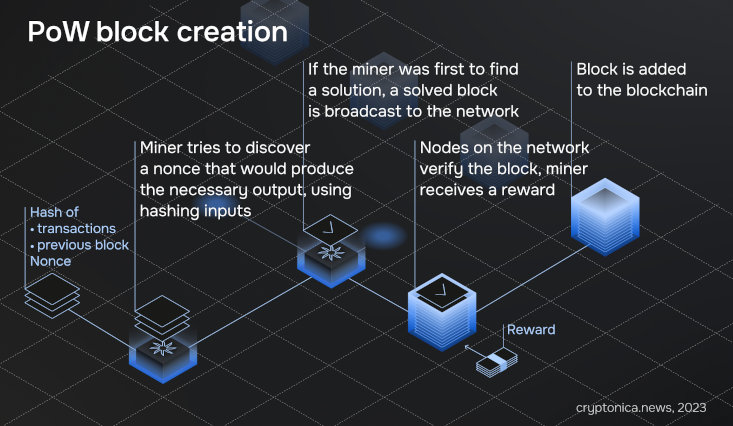

How does PoW work?

The solution of complex mathematical problems is a key principle of a PoW system. The process begins when a miner gathers a group of pending transactions into a block. The miner then appends a random value called a "nonce" to the block's data. A nonce is an arbitrary number that miners change until they find a specific output that meets certain criteria.

To find this output, miners repeatedly hash the block's data concatenated with the nonce using a cryptographic hash function such as SHA-256. The hash function generates a fixed-length output called a hash, which appears as a random sequence of alphanumeric characters. The miners' goal is to find a hash that meets certain requirements, typically by having a certain number of leading zeros.

Since the output of a cryptographic hash function is essentially random and unpredictable, miners must make numerous attempts by adjusting the nonce repeatedly. They continue this process until one of them discovers a nonce that, when hashed with the block's data, produces a hash that meets the specified criteria.

A miner broadcasts the solution (the hash) once they have found a suitable nonce. A hash of the block's data can be verified by other participants by using the nonce provided and comparing the hash with the set criteria. If the solution is correct, the block is considered valid, and the miner is rewarded with a certain amount of cryptocurrency (in the case of Bitcoin, for example, it's newly minted Bitcoins and transaction fees).

Pros and cons of PoW

Here are the main pros and cons of using a PoW consensus mechanism:

Pros

- Secure: PoW is considered a secure mechanism for verifying transactions and creating new blocks, as it requires significant computing power to successfully attack the network.

- Diverse: As miners do not need to hold any currency in order to mine, PoW allows miners from all over the world to join the network without any form of discrimination.

- Decentralized: Unlike centralized systems, there is no single authority that makes decisions for the system.

- Cost-Effective: The system is cost-effective as miners are rewarded for their work with cryptocurrency and transaction fees.

Cons

- Energy Intensive: PoW requires significant energy to operate, raising concerns over its environmental impact.

- Lack of Scalability: PoW systems are not as scalable as other consensus mechanisms, and the amount of time needed to confirm transactions is relatively long.

- Potential for Centralization: PoW systems can be prone to centralization if miners with powerful hardware gain an advantage over smaller miners.

What is Proof-of-Stake (PoS)?

The PoS consensus mechanism was developed with the goal of addressing some of the issues associated with PoW. In a PoS system, participants (known as validators) must stake their own cryptocurrency in order to be eligible to validate transactions and create new blocks. The amount of currency they must stake varies from network to network, but it is typically proportional to their wealth.

In a PoS system, participants are chosen to create blocks and validate transactions based on the number of tokens they hold and "stake" in the network. The higher the stake, the higher the chance of being selected as a validator. This design aims to ensure that those with a greater economic interest in the network are more likely to be selected to validate transactions. Additionally, it further incentivizes holding the currency long-term. Finally, the system also eliminates the need for miners to invest in expensive hardware, as they simply need to acquire and hold tokens in order to participate in block creation.

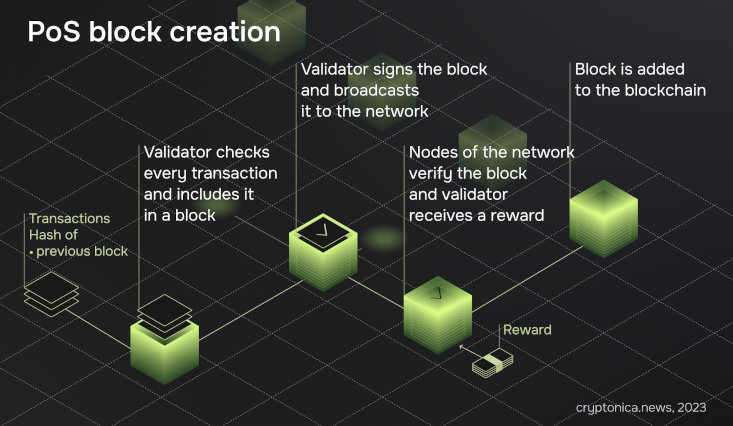

How does PoS work?

In a PoS system, Token holders are selected as Validators based on their token holdings and stakeability. When a participant stakes their tokens, they become eligible to create new blocks by validating the transaction. The process begins with Validators placing bids on the next block; the highest bidder is then randomly selected from a pool of bidders as the winner.

The validator who wins the bid is then responsible for validating the transactions in the upcoming block. If they successfully validate all of the transactions, they are rewarded with a predetermined amount of cryptocurrency. This reward is typically proportional to their stake and the number of tokens staked by other Validators.

The key idea behind PoS is that individuals who have a larger stake in the network (i.e., hold more coins) are more likely to act in its best interest to maintain the security and stability of the blockchain. This is because Validators who attempt to compromise the system risk losing their staked coins as a form of punishment, known as slashing.

Pros and cons of PoS

Here are the main pros and cons associated with a PoS system:

Pros

- Energy Efficient: PoS is much more energy efficient than PoW, as it does not require miners to use expensive hardware or expend large amounts of electricity.

- Cost Effective: There is no need for miners to invest in expensive equipment, as all they have to do is purchase and stake the currency in order to participate in the consensus process.

- Scalable: PoS systems are much more scalable than PoW, as they can handle far more transactions per second.

- Incentivizes Holding: By requiring participants to stake their own funds, the system incentivizes coin holders to hold their coins for longer periods of time.

Cons

- Prone to Centralization: As PoS systems reward those with larger stakes, there is a risk of centralization if the wealth becomes too concentrated in fewer hands.

- Higher Stake Requirement: Participating in a PoS system typically requires participants to stake more coins than would be needed for PoW mining.

- High Barriers to Entry: As the stakes are higher, it can be more difficult for smaller players to enter a PoS system.

- Lack of Anonymity: In some cases, participants must reveal their identity in order to participate in the consensus process. This can reduce privacy and increase the risk of malicious actors targeting Validators.

By combining both PoW and PoS consensus mechanisms, some projects have developed hybrid solutions like Decred that offer the best of both worlds. Hybrid systems are designed to leverage the security benefits of PoW while also reducing energy consumption and improving scalability by utilizing PoS. Such systems could provide a more sustainable model for blockchain networks in the future.

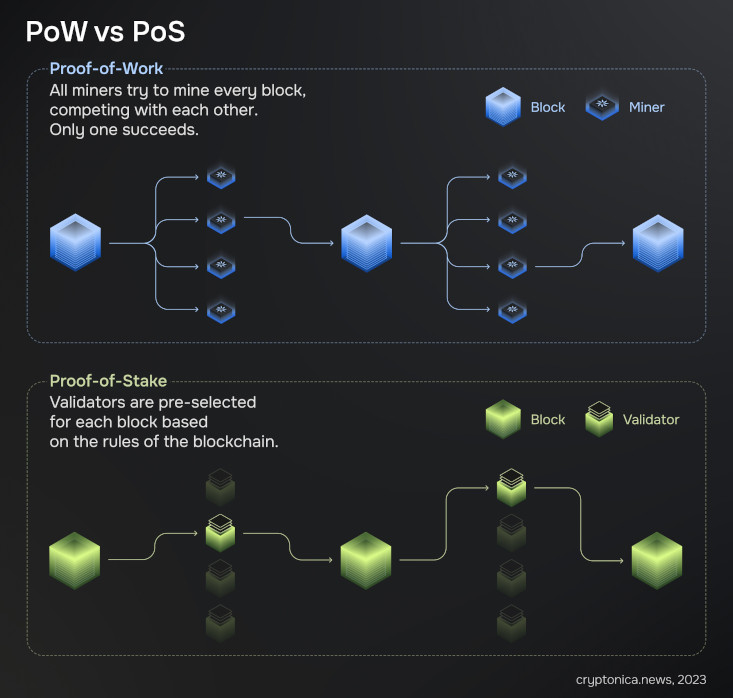

How is Proof-of-Stake Different From Proof-of-Work?

The biggest difference between PoW and PoS is the way in which validators are selected to validate transactions and create new blocks. In a PoW system, miners compete against each other to solve complex mathematical puzzles in order to be rewarded with cryptocurrency. On the other hand, in a PoS system, participants need only stake their funds in order to become eligible for selection as a validator.

Another key difference is that in a PoS system, Validators who attempt to manipulate the system can have their stake slashed as punishment, which incentivizes good behavior and discourages malicious actors from attempting to compromise the network. Finally, PoS systems are generally much more energy-efficient than PoW systems due to the lack of expensive hardware requirements.

The third one is that PoS systems are much more scalable than PoW. This is because they can process more transactions per second, as miners do not need to solve complex mathematical puzzles.

Finally, PoS incentivizes coin holders to hold onto their coins for a longer period of time. As Validators must stake their own funds to participate in the consensus process, they are more likely to act in the network's best interest and maintain its stability. This also helps to prevent extreme volatility in coin prices.

Overall, PoS systems offer a much more energy-efficient solution than PoW while still providing a secure and decentralized consensus process.

Which is better: Proof-of-Stake or Proof-of-Work?

The answer to this question largely depends on the specific requirements of a given network. Generally speaking, PoS systems are much more energy-efficient than PoW systems and offer faster transaction processing times. This makes them ideal for networks requiring speed and scalability while maintaining a secure consensus process.

On the other hand, PoW systems provide greater security due to their complex mathematical puzzles, making them a better choice for networks prioritizing security over speed and scalability.

In terms of environmental impact, PoS systems are much more friendly to the environment than PoW systems due to their lack of energy-intensive hardware requirements. This makes them a better choice for networks that prioritize sustainability.

Ultimately, both PoW and PoS systems have their own advantages and disadvantages, and it is important to consider the specific requirements of a given network when deciding which consensus mechanism is best. For many projects, using a hybrid system like Decred can be a great way to leverage the benefits of both PoW and PoS. So, it depends on the individual's needs and which system will be better for him.

When should PoW or PoS be used?

The choice of whether to use a Proof-of-Work system or a Proof-of-Stake system comes down to the goals and objectives of the blockchain network in question.

A PoW system is best suited for projects that require secure transactions, such as Bitcoin, whose focus is on trustless censorship resistance. The energy requirements associated with PoW are also considered a security measure, making the process more expensive and difficult to attack.

On the other hand, Proof-of-Stake systems are better for projects with a focus on scalability. This is because PoS-based blockchains require less energy for validation and can handle more transactions per second.

Moreover, PoS is used in countries with highly restricted electricity supply and provides a way to validate transactions without using up large amounts of energy.

It's important to note that the two systems don't necessarily have to be mutually exclusive, as some projects may choose to implement both systems in order to benefit from the best of both worlds. Ultimately, the best system for any given project will depend on its specific needs and objectives.

Centralization Risk

Centralization risk is a significant concern in both Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus mechanisms. In PoW, centralization risk arises from the concentration of computational power in the hands of a few mining entities. As mining becomes increasingly resource-intensive, smaller participants struggle to compete, leading to a few dominant players controlling the network.

On the other hand, PoS introduce its own centralization risk. In PoS, Validators are selected based on the number of coins they hold or have staked. This creates a situation where those with a significant stake have more influence and are more likely to be chosen as Validators, potentially consolidating power in the hands of a few wealthy individuals or entities.

Both PoW and PoS centralization risks can undermine the decentralized nature of blockchain networks. Centralized control can lead to a loss of trust, increased vulnerability to attacks, and decreased system resilience. Efforts are being made to address these concerns through mining pool regulations, hardware diversity, and hybrid consensus mechanisms combining PoW and PoS elements.

Overall, mitigating centralization risk in PoW and PoS is crucial to maintaining blockchain technology's core principles, including decentralization, security, and fairness.

Security Risks

Security is one of the most important aspects of any blockchain network, as it helps ensure data integrity and protect users from malicious actors or hacks. Both Proof-of-Work (PoW) and Proof-of-Stake (PoS) systems present unique security risks that must be considered when designing a blockchain network.

In PoW systems, the most significant security risk arises from the concentration of mining power in the hands of a few entities. Suppose one entity is able to control more than 51% of the network's computing power. In that case, it has the potential to disrupt or even reverse transactions, double-spend coins, and generally undermine the network's security.

In Proof-of-Stake networks, the security risk is less related to computing power and more focused on wealth. PoS systems incentivize coin holders to stake their coins in order to become Validators, meaning those with large holdings of coins have a greater chance of becoming Validators and potentially controlling the network. This can lead to centralization of power and create an unequal playing field for smaller users.

Bottom Line

In short, both Proof of Work (PoW) and Proof of Stake (PoS) consensus mechanisms have their own unique advantages and disadvantages. PoW systems provide greater security due to their energy-intensive nature, while PoS networks are more scalable and energy-efficient. Centralization is a risk with both types of systems but can be mitigated through certain techniques. Ultimately, the best system for a given project will depend on its specific needs and objectives. Ultimately, whichever system you choose should be able to provide your network with a secure and fair consensus process.

Frequently Asked Questions

Is proof of work still used?

Yes, Proof-of-Work (PoW) is still used in many blockchain networks, such as Bitcoin. It is a secure consensus mechanism that requires miners to solve complex mathematical problems in order to validate transactions and create new blocks.

Why is Proof-of-Work better?

Proof-of-Work (PoW) is better for projects that require secure transactions, such as Bitcoin. The energy requirements associated with PoW make it more expensive and difficult to attack, providing an extra layer of security. Additionally, the fact that miners are rewarded for their work is seen as a key incentive to keep the network secure.

Can Bitcoin be converted to Proof-of-Stake?

It is possible but highly unlikely that Bitcoin could be converted to a Proof-of-Stake (PoS) system. This is because the transition would require making fundamental changes to the existing network, which may not be feasible given its current size and complexity. Additionally, it is uncertain if PoS can provide the same level of security as PoW in this case. Finally, there are issues related to governance that would need to be addressed, such as how new Validators are chosen and how rewards are distributed. As a result, it is unlikely that Bitcoin will transition to PoS in the near future.

How Do You Earn Proof-of-Stake?

In Proof-of-Stake (PoS) consensus mechanisms, Validators must stake a certain amount of coins in order to become eligible for block rewards. The amount of coins that must be staked varies depending on the project, but typically it is around 1% or more of the total circulating supply. Once you have staked enough coins, you will be eligible to become a validator and start earning rewards. However, keep in mind that staked coins are locked up for a certain time, so it is important to ensure you can afford to commit the coins before staking them. Additionally, it is important to research the project thoroughly before investing, as there may be risks associated with staking your coins.