What Is Alloy USDT (aUSDT) and Is It a Scam? Reviews, Opinions, and DYOR

Tether is undoubtedly a leader in the stablecoin sector. Recently Tether introduced a new category of digital assets known as tethered assets. The first token in the Alloy by Tether lineup is aUSDT. What this new stablecoin is all about, what makes it different from traditional USDT, and is this new coin a scam? Read our review to find out.

Alloy by Tether (aUSDT) Overview

Tether, a leading stablecoin provider in the cryptocurrency market has recently launched a new stablecoin backed by gold, named Alloy by Tether (aUSDT), which is pegged to the U.S. dollar. The company described the launch of aUSDT as the initial phase of its broader strategy to tokenize real-world assets. Alloy by Tether, the first product in this series, aims to mirror the U.S. dollar's value using Tether Gold as collateral.

Alloy by Tether brings a new class of digital assets termed "tethered assets," which aim to replicate the values of diverse assets such as major currencies, commodities like gold, oil, and wheat, or financial instruments including stocks and bonds. Tethered assets maintain their peg to the underlying asset through mechanisms that often combine overcollateralization with robust liquidity pools in secondary markets.

Unlike USDT, which is backed by a basket of assets including fiat currencies and securities, Alloy will be overcollateralized by Tether Gold (XAUT) — a token representing ownership of physical gold — but pegged to the U.S. dollar. Overcollateralization is a key characteristic of aUSDT, ensuring that the tokens are supported by a value of Tether Gold that exceeds their face value. Essentially, the new token serves as a synthetic dollar, intended to mimic the U.S. dollar’s value and functionality without being directly backed by it. The physical gold stored in Switzerland supports aUSDT, combining the stability of the U.S. dollar with the inherent value of gold.

Tether's CEO, Paolo Ardoino, referred to AUSD₮ in a X post as a synthetic dollar, heavily collateralized by Tether Gold.

aUSDT tokens are minted using Ethereum Virtual Machine (EVM)-compatible smart contracts, enabling smooth interoperability and integration within the broader Ethereum ecosystem and its various compatible blockchains, including Ethereum Mainnet, Polygon, Optimism, Arbitrum, BNB Chain, and more.

The Alloy platform enables users to create new aUSDT tokens by depositing Tether Gold via smart contracts and price oracles, requiring a collateral deposit exceeding the value of the aUSDTthey wish to mint. This excess XAUT serves as a buffer to maintain aUSDT stability amidst potential gold price volatility.

Alloy by Tether (aUSDT) Reviews and Opinions: X and Reddit

Since its launch less than two weeks ago, aUSDT has garnered mixed reviews on Reddit and X. The primary feedback indicates users are struggling to comprehend the coin's functionality and financial mechanisms.

Reddit Feedback

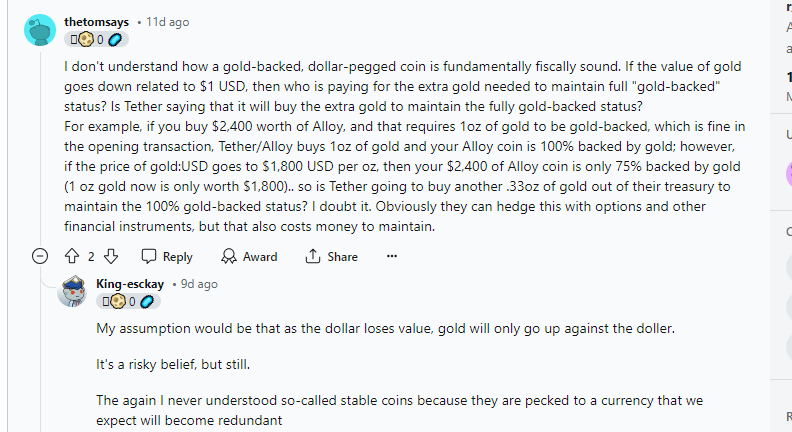

On Reddit, discussions around aUSDT are sparse, with a thread highlighting confusion over the coin's fiscal stability. One user expressed skepticism about the gold-backed, dollar-pegged concept, questioning how Tether would manage fluctuations in gold prices:

Source & Copyright: Reddit

X Reactions

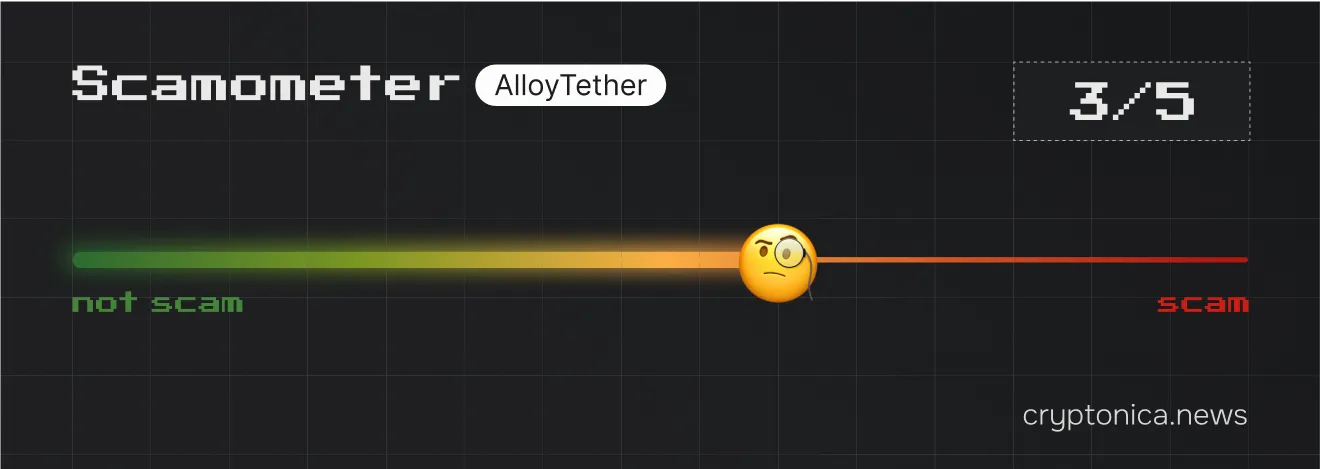

On X, opinions are diverse. Many users are puzzled by the need for aUSDT when USDT already exists, while others appreciate the innovation but question its practical advantages.

Skepticism about Tether's intentions

Unclear advantage over USDT

-Perceived as a DAI imitation

Confusion over holding a derivative vs. underlying asset:

Questioning the necessity of aUSDT:

Dismissive criticism:

Positive Feedback:

Endorsement from industry analysts:

Bitcoin on-chain analyst Willy Woo believes that Alloy (aUSDT) is a 'genius idea'. He said that instead of issuing USDT and earning the T-Bills yield, the company can now issue aUSDT earning the gain on gold. Woo believes that over the long term, gold gets 8%, compared to T-Bills at 0-5%.

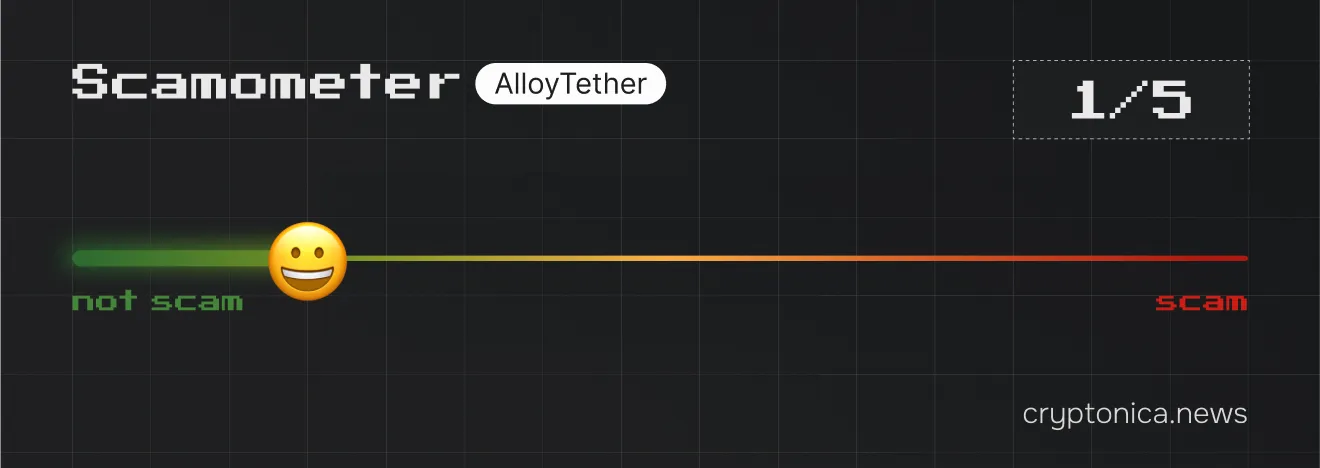

Community, Website, and Social Media Accounts

The aUSDT X account was recently established and has garnered approximately 2,400 followers with just 12 posts. The comment sections show moderate activity.

The aUSDT website is straightforward, featuring a link to the app for minting aUSDT, a comprehensive documentation section, and a statistics page. Although there is a link to a Telegram page, aUSDT does not have its own dedicated channel; instead, it directs users to the official Tether channel.

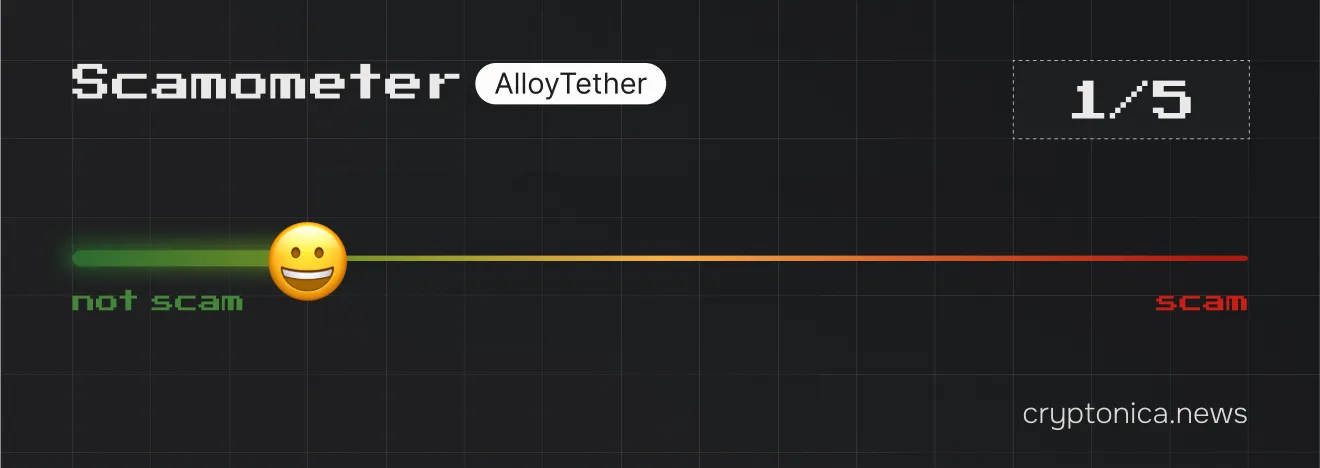

Founders and Investors of aUSDT

aUSDT is a product of the stablecoin giant Tether, led by CEO Paolo Ardoino. Tether holds a dominant position in the stablecoin market and is recognized as one of the most profitable companies in the crypto industry. In the first quarter of 2024, Tether reported a profit of $4.5 billion and a net capital of $11.4 billion.

The development of aUSDT was undertaken by Tether subsidiaries Moon Gold and Moon Gold El Salvador. Both companies are registered in El Salvador and are authorized stablecoin issuers by the National Commission of Digital Assets (CNAD) in El Salvador.

aUSDT Current Price

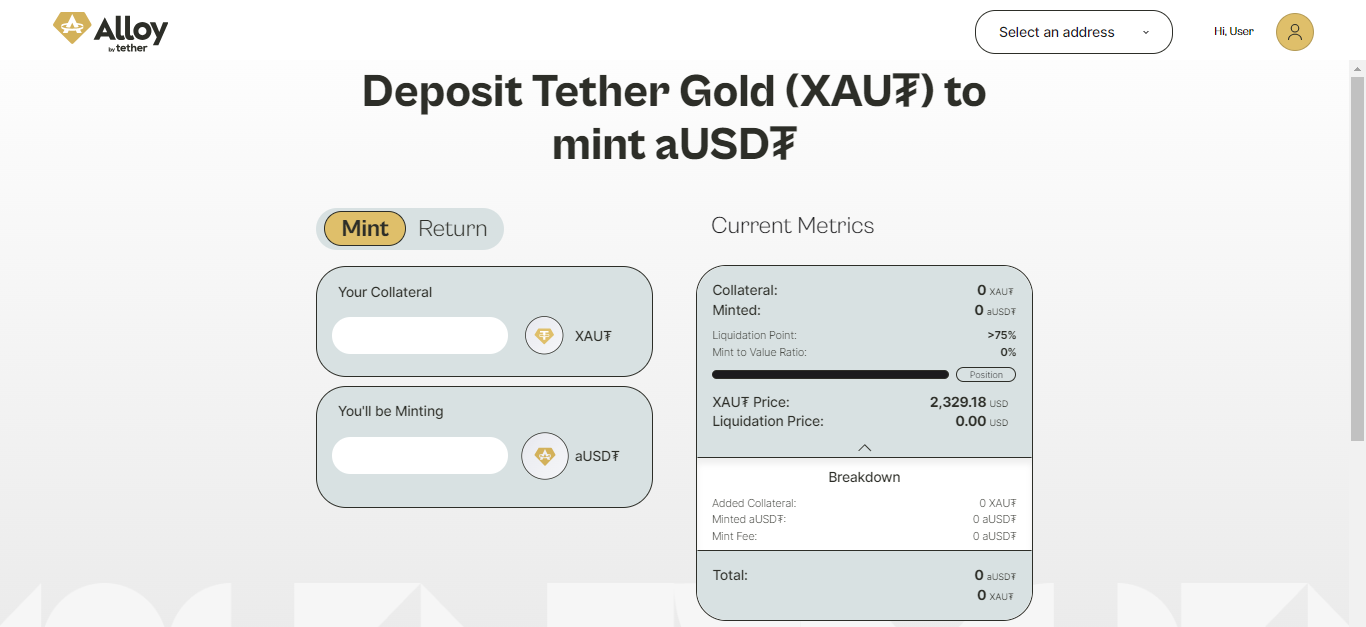

aUSDT is a stablecoin backed by gold and consistently pegged to the value of the U.S. dollar. Users can acquire aUSDT by depositing XAUT as collateral directly through the Alloy USDT app, receiving aUSDT in return. It is important to note that users must provide a collateral deposit exceeding the value of the aUSDT they wish to mint.

Source & Copyright: aUSDT app

Alternatively, aUSDT can be traded on the secondary market through centralized exchanges such as Bitfinex, as well as decentralized exchanges.

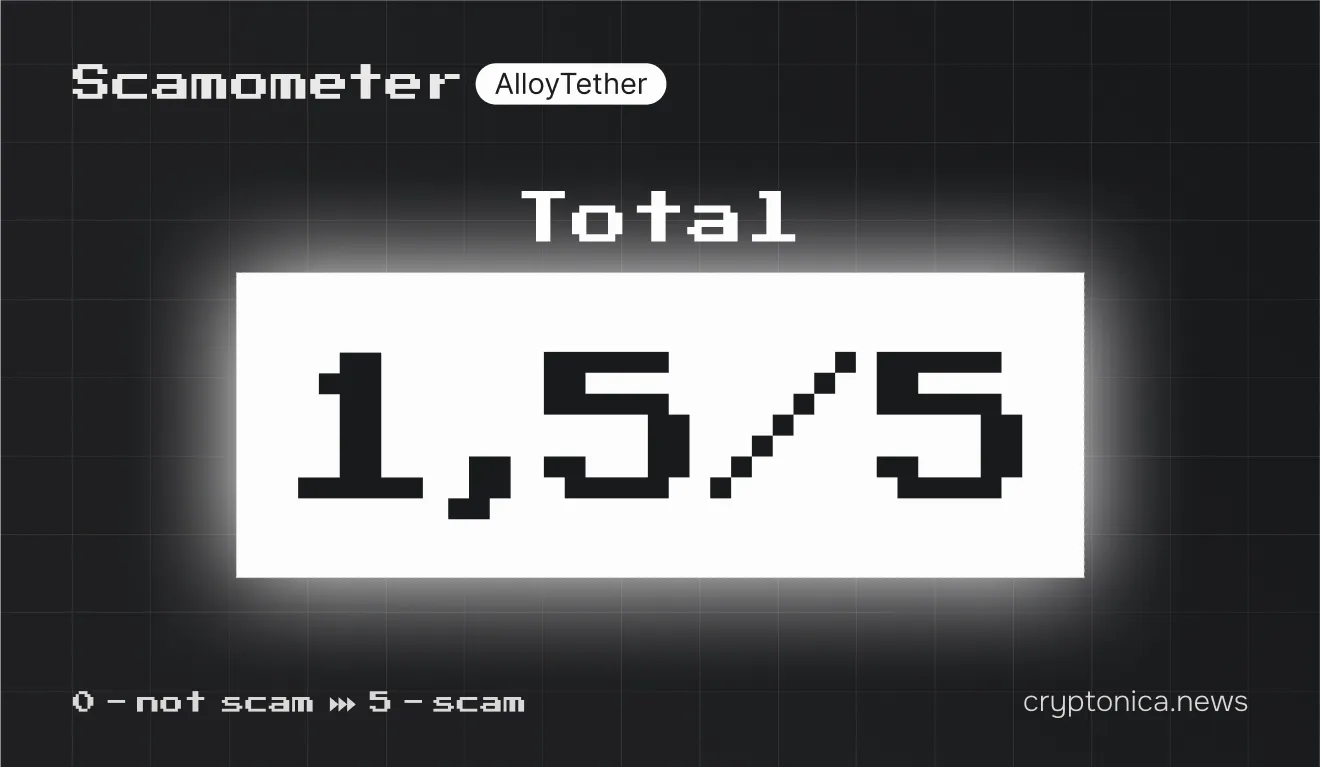

Bottom Line: Is aUSDT a Scam or Not?

What advantages does aUSDT offer over traditional USDT? While Tether (USDT) is tailored for everyday financial transactions, XAU₮ caters to investors looking to invest in gold. aUSDT, however, merges the stability of the dollar with the security provided by gold, and it introduces the possibility of generating yields through its distinctive overcollateralization process.

aUSDT emerges from Tether, a leading entity in the stablecoin market. Despite its widespread use, Tether has encountered regulatory scrutiny and challenges, particularly during incidents where its peg to the dollar was compromised. In response to these regulatory concerns, Tether consistently undergoes independent attestations to affirm the adequacy of its reserves. Notably, in April 2024, Tether successfully completed a System and Organization Controls 2 (SOC) audit, achieving the highest level of security compliance. Furthermore, Tether enhances transparency by publishing quarterly reports that detail its reserves and the composition of its assets.

Given Tether’s track record and reputations on the market, we regard this stablecoin as posing a relatively low risk. But as always we strongly advise our users to DYOR and exercise caution when it come to investments in crypto assets.