FTX 2.0: The Exchange's New Beginning?

FTX, the international cryptocurrency exchange, is set to relaunch after filing for bankruptcy in November 2022. In this article, we explain what this means for investors in crypto.

The reboot initiative came after the alleged misuse of $9 billion in customer assets prior to the company's collapse. The company’s new leadership has been working to recover assets and pay back creditors, and it is now in the process of soliciting interested parties to reboot the exchange.

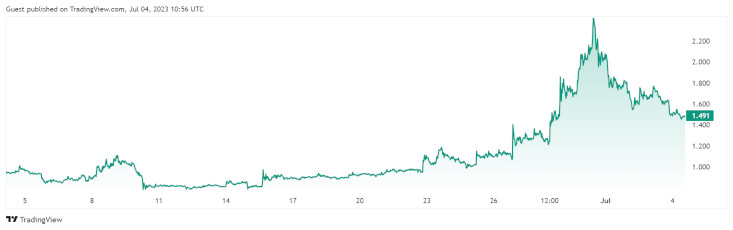

Following talks of this reboot, the exchange's native token, FTT, surged by 15%. This is seen as a significant step in reviving the collapsed exchange under the new CEO John Ray, who is set to rebrand the platform.

Source and Copyright © TradingView

What Happened to FTX?

FTX was founded in 2019 by Sam Bankman-Fried. The exchange quickly became one of the most popular platforms in the world, with over 2 million users. However, in November 2022, FTX filed for bankruptcy.

The bankruptcy filing was caused by a number of factors, including the collapse of the Terra ecosystem, liquidity problems of the platform, and fraud.

Here’s the simplified timeline of the events:

- November 2022: FTX files for bankruptcy after facing a liquidity crisis; Sam Bankman-Fried is accused of fraud by the U.S. Department of Justice and the Securities and Exchange Commission (SEC).

- December 2022: SBF is arrested in the Bahamas and extradited to the United States.

- January 2023: SBF appears in court and pleads not guilty to the charges against him.

- February 2023: SBF is released on bail.

- March 2023: FTX is reorganized under new ownership.

- April 2023: FTX begins talks to relaunch the exchange.

Ray's team conducted a detailed audit of FTX's assets, which stood at $2 billion, against $11 billion in outstanding customer accounts. This investigation uncovered a deficit of nearly $9 billion owed to clients on the company's exchange.

How is FTX Paying Back Creditors?

The company "has begun the process of soliciting interested parties to the reboot of the FTX.com exchange," Ray said, according to the Wall Street Journal's report.

According to the report, FTX has recovered over $7 billion in assets since filing for bankruptcy in November 2022. The company is now looking to raise additional capital to fund the relaunch. Ray said that FTX is also considering rebranding the platform.

FTX is embarking on a comprehensive repayment plan to compensate creditors after its financial setback.

One of the primary strategies is selling off assets. The company holds a diverse portfolio of assets, and by liquidating these, FTX hopes to convert them into significant cash flow that can be used to reimburse creditors.

Another method involves raising fresh capital from investors. FTX is in active talks with potential investors who might be interested in backing the platform. The new investments will not only help settle the debt, but they also promise to provide the essential resources needed to bolster the platform's revival and ensure it is operationally sound going forward.

Blockchain technology company Figure has shown interest in supporting the FTX reboot. This comes after the firm lost its bid to revive Celsius Network, another collapsed crypto company, to a group backed by Fortress Investment Group. Interested parties have a deadline of this week to submit their early signals of interest.

Lastly, FTX is aiming to utilize the revenue generated from the relaunched platform itself. The new exchange, FTX 2.0, is expected to be profitable, and the income earned from this business activity will be directed toward debt repayment. This ensures a self-sustaining model where the exchange itself contributes to clearing its debts while operating efficiently.

These combined efforts represent a determined approach from FTX to fulfill its obligations to its creditors, restore trust among its user base, and build a solid foundation for future operations.

What to Expect from FTX 2.0?

So far, reviving the collapsed FTX exchange has been a challenge, with assets sold and attempts to recoup investments to close the deficit. Some assets, like U.S. derivatives exchange LedgerX and trading platform Embed, are worth much less now than when purchased.

FTX is still in the early stages of planning the relaunch. However, the company is expected to improve the platform in a number of ways. These include:

- A more robust internal security infrastructure

- Improving customer support

- Adding new features and products

- Making the platform more user-friendly

The company is also considering rebranding the platform. However, no final decisions or detailed plans have been made yet.

The revival of FTX could be beneficial for creditors, particularly due to the potential value of the FTT tokens, FTX's proprietary token. If the exchange isn't revived, these tokens become worthless. Disputes with Bahamian liquidators over the ownership of almost 195 million FTT tokens have complicated matters.

FTX's reorganization efforts are expensive, incurring around $200 million in professional costs that need to be paid before a Chapter 11 exit. FTX plans to release a formal reorganization plan in July outlining initial creditor payments. In the meantime, the U.S. Bankruptcy Court urges cooperation to prevent further customer asset deterioration.

Given the extreme volatility and uncertain future of FTX's FTT, we advise you to be cautious with your investments in this token.

Conclusion

The relaunch of FTX is a major and slightly controversial event in the cryptocurrency industry. The exchange has the potential to become a major player in the market again. However, when the trust is lost, it could be quite a challenge to regain it back. Be careful when dealing with this exchange.