About Aptos

Aptos is a Layer 1 blockchain that was developed by a team of former Meta employees who had previously worked on the Diem blockchain. This new blockchain aims to bring the advantages of decentralization to the mainstream, fostering widespread adoption of Web3. Aptos is built using the Move programming language, a novel smart contract language designed with a focus on safety and flexibility originally created for Diem.

Source & Copyright © Aptoslabs.com

The blockchain's unique features include a parallel execution engine, robust security measures, and low transaction costs. These features, along with its promise of enhanced scalability, reliability, and usability, have sparked significant anticipation for its mainnet and token launch.

The intrigue surrounding Aptos is largely due to its origins. The Aptos project began as part of Meta’s Diem initiative, formerly known as Facebook. Meta had been interested in creating a stablecoin, Libra, and acquired the Diem blockchain initiative to spearhead digital currencies. However, the project did not proceed as planned, and Diem was sold to Silvergate Capital at $182 million in late 2021. Following the sale, some team members decided to continue pursuing blockchain technology, leading to the establishment of Aptos Labs.

The Aptos blockchain was officially launched on October 12, 2022, with its mainnet, "Aptos Autumn," going live on October 17, 2022. Aptos have been hailed as a potential alternative to Solana, a contender to Ethereum, and a fresh layer 1 blockchain for decentralized finance (DeFi), among other things.

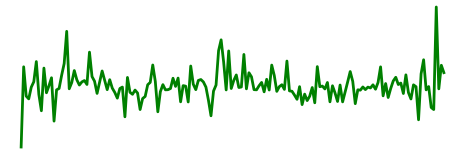

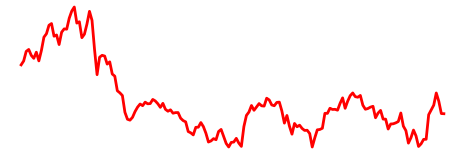

Aptos Price

Aptos has had a few rallies since its launch in 2022. The most significant rally happened in early 2023, when the price of Aptos surged by over 500% in just a few weeks. During this time, Aptos outperformed the market, and many investors made significant profits. The rally was driven by a combination of factors, including the hype around the project, solid community backing, and innovative use cases that provided the basis for rapid growth. The price of an app is influenced by the number of locked tokens. When more tokens are locked, the supply of apps decreases, which can lead to an increase in price.

Source & Copyright © TradingView

Conversely, when more tokens are unlocked, the supply of Aptos increases, which can lead to a decrease in price. Therefore, the number of tokens that are locked up is an essential factor to consider when predicting the price of Aptos. As for the future of Aptos, it is difficult to make an accurate prediction. Many crypto-assets that have risen by multiples in the past may never show this kind of growth again, whether in a bear or bull market.

Aptos is a relatively new cryptocurrency that has gained popularity in recent years. While it is difficult to make an accurate prediction, some analysts believe that Aptos has the potential to continue growing and give investors significant returns. However, it is important to note that cryptocurrency markets are highly volatile, and prices can fluctuate rapidly. Therefore, investors should always conduct their research (DYOR) before investing in cryptocurrency.

Here some of the factors to consider when deciding whether Aptos is a good investment:

Pros:

- Aptos designed to be scalable, meaning that they will not slow down when they become busier than usual, thus saving time and money for its users;

- Aptos have a limited supply of 21 million coins, making it a deflationary currency. This makes it a good store of value and hedge against inflation;

- Aptos have a fast transaction speed and low fees, which makes them an attractive option for those who want to send money quickly and cheaply;

Aptos have solid community backing and innovative use cases that provide a basis for rapid growth.

Cons:

- Cryptocurrency markets are highly volatile and prices can fluctuate rapidly;

- There is still a lack of clarity regarding what blockchain is doing to make it stand out from its competitors;

- The system features an enormous amount of dense technical jargon, which may dissuade more casual crypto investors;

- The token's launch was troubled, which may be enough to turn some investors away.

. In conclusion, aptos is a promising cryptocurrency that offers a range of benefits to investors. However, it is important to note that cryptocurrency markets are highly volatile, and prices can fluctuate rapidly. Therefore, investors should always do their research (DYOR) before investing in any cryptocurrency.

Aptos Blockchain

Aptos is a new Tier 1 blockchain intended to facilitate the widespread adoption of Web 3.0, and empower a decentralized application ecosystem. The key selling point of this platform is its "Parallel Execution" technology, which enhances the blockchain's throughput and accelerates transactions.

The primary architects behind Aptos were Mo Shaik and Avery Ching, who had previously worked on the Diem wallet for Mark Zuckerberg's social networks. The team also includes engineers, researchers, designers, and programmers from various parts of the world. Over 350 people have been working on this project over the past three years. The Aptos Foundation supported and developed this project.

The Aptos blockchain uses the Move programming language for quick and secure transaction executions. A smart contract verifier written in this language enables application developers to better safeguard their programs against malicious objects as per the project's technical documentation.

Aptos also provides hybrid key storage and management options. Along with pre-transaction transparency and practical client protocols, it results in a safer and more secure user experience, according to developers.

The Aptos blockchain could potentially surpass Solana and other similar projects, including Bitcoin. Blockchain's employment of the Move programming language and parallel execution technology allows it to process roughly 160,000 transactions per second (TPS). For comparison, the Solana blockchain boasts a speed of 50,000 TPS, whereas the VISA international payment system has a speed of 24,000 TPS. By contrast, the Bitcoin network only conducts an average of five to seven transactions per second

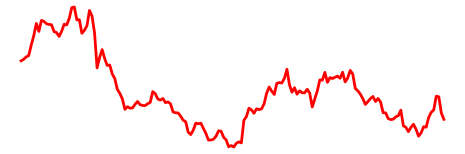

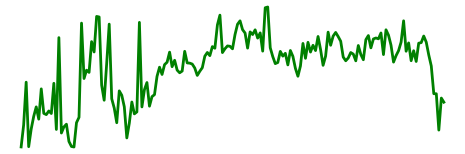

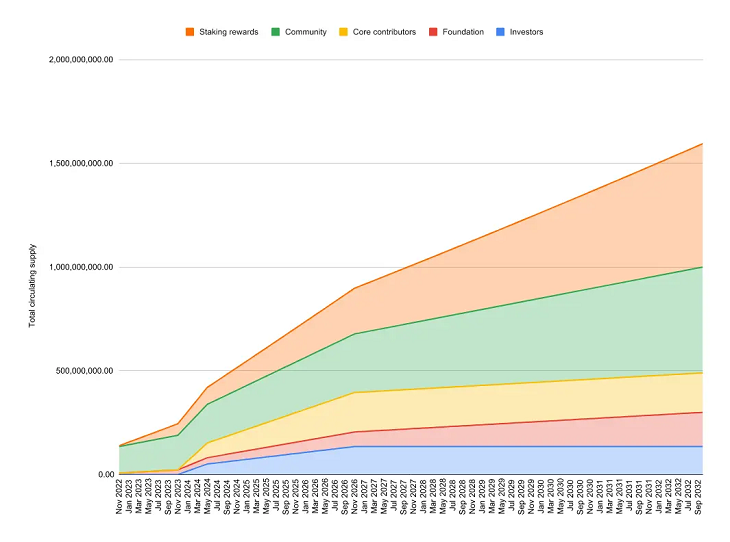

APT Token Unlock Calendar

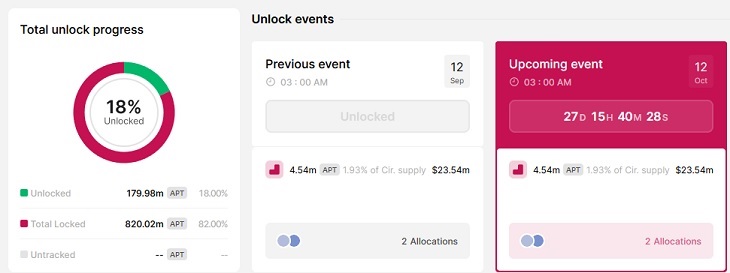

As of September 14th, 2023, only 18% of all APTs have been unlocked and are currently in circulation. The total supply of APT token is 1,042,713,962, but only 235,028,554 are in circulation.

Token unlocking calendar:

Aptos tokens unlock calendar. Source & Copyright © Aptos Foundation

If the tokens are unlocked, there could be a potential for lower prices. However, the dynamics of supply and demand in the market and the sentiment in the cryptocurrency market could push prices to recover.

The impact of investor and team placement, as well as project strategies, will also influence how token prices will react. Typically, spot prices decrease following token issuance due to a rise in supply. The ultimate increase in prices depends on token liquidity and market demand.

Next APT Unlock for Sep 14 2023. Source & Copyright © Token Unlocks

APT unlocking will continue in a linear manner until 2032, with the next scheduled unlocking in November 2023.

How Does Aptos Work?

At its core, Aptos leverages a Byzantine fault-tolerant (BFT) proof-of-stake (PoS) consensus mechanism. This system allows the network to operate effectively, even in the face of component failure or trustlessness, by utilizing a network of validators to authenticate and process the transactions.

To maintain the network, validators are required to stake a certain number of Aptos tokens to be eligible for transaction validation. Validators have autonomy to determine the distribution of rewards between themselves and their stakers. Conversely, stakers have the flexibility to choose any number of validators to stake their tokens with and negotiate a mutually agreed reward distribution. The rewards were disbursed at the conclusion of each epoch through the corresponding on-chain move module.

One of the standout features of Aptos is its emphasis on horizontal scaling, which is achieved through the use of sharded-ledger states. This design principle aims to mitigate network stress as the platform expands, ensuring efficient operation, even as the user base grows. Parallel execution, a concept that first emerged during the Diem era, is the cornerstone of Aptos's design. It distinguishes Aptos from most blockchains that employ a sequential or serial execution method, where transactions are added individually to a single, ever-growing ledger.

The sequential method, although reliable, is often slow owing to the need for each transaction to be verified before the next transaction can be processed. However, Aptos avoids this bottleneck by processing all transactions simultaneously and validating them post-execution. This means that a single failed transaction does not stall the entire chain. Instead, failed transactions are identified, aborted, and re-executed using software transactional memory (STM) libraries, which are adept at detecting and managing conflict.

As mentioned earlier, Aptos uses the Move programming language, which is designed with a focus on resource scarcity, preservation, and access control. The Aptos team has further enhanced Move to support a wider range of web3 use cases. For example, it allows Decentralized Autonomous Organizations (DAOs) to share accounts collaboratively and facilitates the minting of Non-Fungible Token (NFT) collections within a single account.

Move is an executable bytecode language that provides a secure and flexible environment for Aptos developers. This allows users to define custom resources that are immune to copying or discarding, thereby fortifying the Aptos blockchain against potential threats. Aptos’ use of Move offers several advantages over other platforms such as Ethereum. For instance, it enables the easy verification of blockchain commands and allows users to modify their private keys. Moreover, Aptos’ modular design allows network upgrades without the need for a complete system shutdown.

Aptos’ state machine is called a Move Virtual Machine (MVM), which is very similar to Ethereum EVM (Ethereum Virtual Machine (EVM). The MVM converts the move modules into bytecodes for execution using the Aptos blockchain.

What is Aptos Used For?

Aptos can be used to build various DeFi applications, NFT marketplaces, launchpads, wallets, Oracles, DAOs, gaming apps and much more.

- $APT is Aptos’ governance token. Many of the initial APT supplies have gone towards community initiatives, such as grants and other incentives. The token is used to pay network and transaction fees, staking, and voting for network decisions.

- Aptos blockchain built to support a range of decentralized applications (dApps) and nonfungible tokens (NFTs), while ensuring a safe and dependable system for users. Some of the main uses of Aptos are as follows.

- P2P lending and borrowing constitute significant use cases for platforms. The platform offers a secure and transparent method for users to lend and borrow money without intermediaries.

- Store of Value: Aptos’ limited coin supply of 21 million makes it a deflationary currency. This makes it a reliable store of value and hedge against inflation. In addition, Aptos boasts fast transaction speeds and low fees, making it an attractive option for those looking to send money quickly and affordably.

- Regarding governance, apps enable users to vote on proposals affecting the future of the blockchain, making it a governance coin. This means that users can participate in the network by mining or staking their coins, making it an inclusive currency that is accessible to a wider range of users.

Management

The Aptos was founded by Mo Shaikh (CEO) and Avery Ching (CTO). Both Shaikh and Ching are former employees of Meta, boasting years of experience as a senior developer and engineer in the blockchain sector.

Their professional paths crossed during their work at Meta, where they collaborated on the Diem Blockchain project. Shaikh brings to the table his expertise in product scaling and his background in private equity and venture capital markets.

Ching, on the other hand, has served as a principal software engineer at Meta, leading to numerous groundbreaking development projects. Following Meta's decision to abandon the Diem project, Shaikh and Ching teamed up to establish Aptos Labs.

The Aptos team is composed of a seasoned mix of PhDs, researchers, engineers, designers, and strategists, who were the original creators, designers, and builders of Diem.

The blockchain project has successfully garnered $400 million in funding from prominent crypto funds such as FTX Ventures, Jump Crypto, a16z, Multicoin Capital, Dragonfly, and Binance.

Summary

Overall, Aptos is a promising cryptocurrency that offers a range of benefits to users. It is designed to be scalable, secure, and reliable, making it an attractive option for those who want to invest in cryptocurrency with a solid use case. However, it is important to note that cryptocurrency markets are highly volatile, and prices can fluctuate rapidly. Therefore, investors should always do their research (DYOR) before investing in any cryptocurrency.

- Aptos is a decentralized cryptocurrency that operates on its own blockchain network, meaning that it is not controlled by any central authority or government. This makes it a secure and transparent way to transfer funds without intermediaries.

- Aptos has a limited supply of 21 million coins, which makes it a deflationary currency. This makes it a good store of value and a hedge against inflation.

- Aptos has a fast transaction speed and low fees, which makes it an attractive option for those who want to send money quickly and cheaply.

Frequently Asked Questions:

What is Aptos?

Aptos is a decentralized currency that operates on a its own blockchain network, meaning that it is not controlled by any central authority or government. Aptos has a limited supply of 21 million coins, which makes it a deflationary currency. It also has fast transaction speed and low fees, which makes it an attractive option for those who want to send money quickly and cheaply.

Should I invest in Aptos?

investing in Aptos, it is important to consider your investment goals and risk tolerance. Aptos is a relatively new cryptocurrency that has been gaining popularity in recent years. According to some analysts, Aptos have the potential to continue growing and give investors significant returns. However, cryptocurrency markets are highly volatile and prices can fluctuate rapidly. Therefore, investors should always do their research (DYOR) before investing in any cryptocurrency.

If you are considering investing in Aptos, it is recommended that you invest moderately and diversify your portfolio. Some experts suggest investing 50% in BTC, 35% in a basket of big-cap coins, and the rest in small projects with huge upsides. It is also important to note that Aptos is designed to run a variety of decentralized applications (dApps) and non-fungible tokens (NFTs), which makes it an attractive option for those who want to invest in a cryptocurrency with a solid use case

What is the technology behind Aptos?

Aptos use a module-based, step-by-step transaction process that efficiently uses all resources. It also uses the ‘Move’ language, which is recognized for secure transactions. Aptos is designed to be scalable, secure, and reliable, making them an attractive option for those who want to invest in cryptocurrencies with a solid use case.