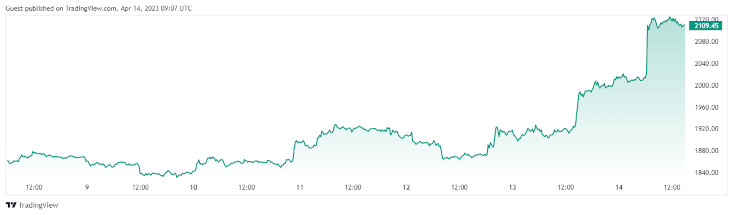

Ethereum's Shapella Upgrade Boosts Ether to New 2023 Highs

Ether climbs above $2,000 following its Shanghai upgrade surge, bringing its year-to-date gain to over 75%

The price of Ether (ETH) surged above $2,000 on Thursday, reaching its highest level since May 2022. The second-largest cryptocurrency by market value is currently trading at $2,112, gaining nearly 10 % over the past 24 hours. Bitcoin gained about 3% and cracked $30,000, the highest level since June.

Source and Copyright: © TradingView

The Shapella upgrade, also known as the Ethereum Shanghai hard fork, continued the September Merge upgrade's transformation of the Ethereum network from a proof-of-work (PoW) consensus mechanism to a more energy-efficient proof-of-stake (PoS) consensus mechanism.

Another push for Ether and Bitcoin prices might be the publication of the March producer price index, which indicates that inflation is declining. It was the second report of the week, following the consumer price index on Wednesday.

Noelle Acheson, an economist, and author of the “Crypto is Macro Now” newsletter, said she's skeptical the sudden move higher in Ether isn't entirely Shanghai-driven. “It seems to be a bet on the overall liquidity outlook, but relief that Shapella did not produce a sharp drop is driving ETH's outperformance this morning," she told CNBC.

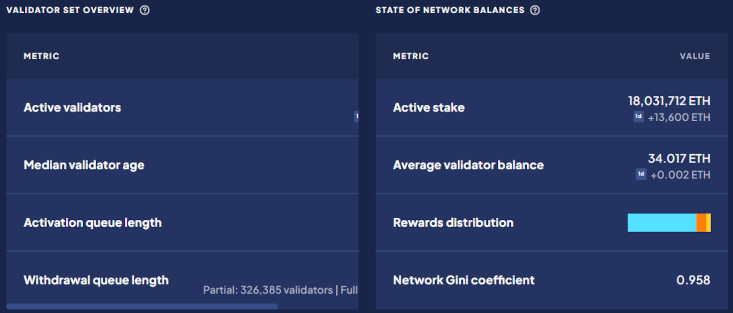

According to Rated Network's explorer, ETH unstaking requests start to pile up following the Wednesday upgrade. Validators looking to fully exit the chain could be looking at a wait of up to 14 days to get their crypto back. In the hours following the Shanghai upgrade, the number of validators waiting for redemptions has grown to about 18,000 for full withdrawals and 326,000 for partial withdrawals.

Source and Copyright: © rated.network

The most-notable unstaker of ether is the centralized exchange Kraken, which make up about 96% of that queue.

That move comes at no surprise as Kraken agreed to shut down its staking service in the U.S. in a settlement with the Securities and Exchange Commission in February.

The total number of validators is about 567,000, according to Nansen, so the ones waiting for full withdrawals represent just 4%. A full withdrawal is when validators request back their entire original deposit of 32 ETH (about $64,000 worth), the amount that's required to participate in the proof-of-stake network.