The Fall of the NFT Industry: How Does Yuga Labs Overcome Challenges?

Back a couple of years ago, the NFT industry was a trendy movement. Now it is in dire straits. In recent months, major projects have continued to keep the digital collectibles industry from collapsing completely. However, the problems of the NFT market have finally hit them too.

Challenges of the NFT industry

As recently as last month, dappGambl cited shocking numbers in their research: 95% of the entire NFT market has no value. This confirmed market participants' fears that the NFT space is dead. And data from cryptoslam.io shows that NFT sales volumes are down for the seventh week in a row. But enthusiasm for digital collectibles disappeared much earlier. Has the once thriving industry become just another fast-moving fashion trend?

In order to understand this, we should first answer the question: why did people buy NFT? Despite the fact that the concept of NFT appeared many years ago, digital collectibles gained their popularity in 2021. Back then, everyone from traditional and respectable collection houses such as Sotheby's to Hollywood stars wanted a tidbit of the new Web3 world trend. NFTs became the next product of speculation. People saw these tokens as a way to make huge profits. And very quickly, digital collectibles lost their fundamental importance, becoming an empty shell for enrichment. Sales were built on FOMO, so the demand for tokens held for a while. The interest in NFT was also supported by the attention of celebrities: many people wanted to buy NFT just because their idol bought or created their own collection.

The fall of the NFT industry as it presented itself to us in 2021-2022 was only a matter of time. The crypto winter caused by the collapse of FTX and Terra in 2022 spilled over into the NFT space almost immediately. Macroeconomic indicators made NFTs an increasingly risky investment, and the value of once-record expensive collections crashed to the price of electricity bills. Gradually, prominent figures began to exit, abandoning their NFT plans.

Yuga Labs takes extreme action

Yuga Labs, one of the whales that has kept the NFT industry going, has hinted clearly at its problems. Last Friday, the company announced a necessary restructuring and employee layoffs. Daniel Alegre, CEO of Yuga Labs, said the company had taken on too much, and now it was time to change its focus without losing the support of its partners. The layoffs only affected the U.S. branch, the evaluation of international teams is still ongoing.

In his statement, Alegre touched on the company's current projects. He noted that this year the launches of some projects were successful, but projects in the field of games failed. Notably, Alegre prioritized the development of the Otherside metaverse despite the overall decline in the sector. Yuga Labs announced several strategic agreements related to the development of Otherside. The company is smoothly shifting its focus from NFT to the development of its metaverse. Alegre confirmed the company's plans to focus on launching digital content only around Otherside.

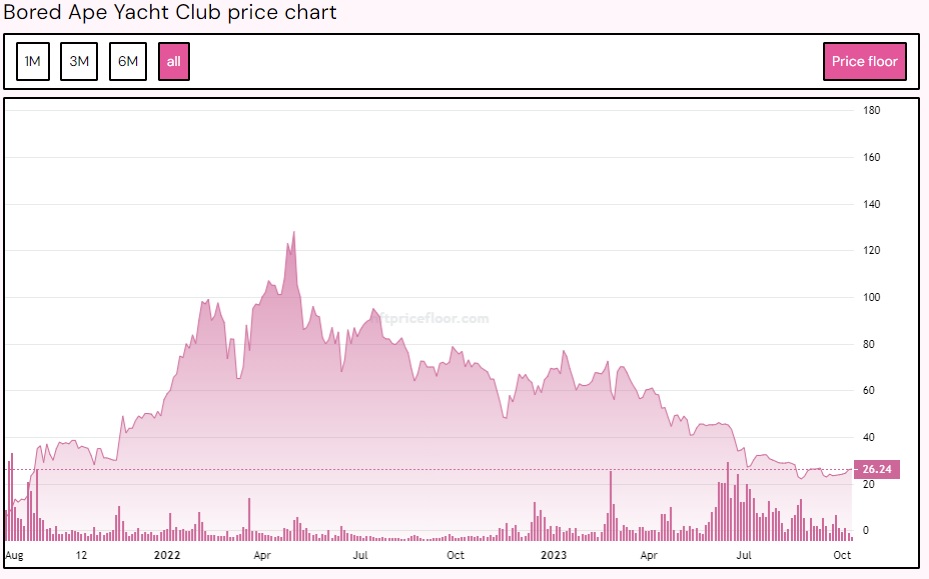

Meanwhile, another major Yuga Labs project, the Bored Ape Yacht Club NFT collection, has seen a rapid decrease following the company's other NFT collections. The bored apes have indeed become boring, and no one wants them.

Source & Copyright NFTPriceFloor

A glimmer of hope

Is there a chance for an industry revival? Despite the dismal figures, many experts express their hope for a recovery of the NFT trend. For example, Krypto Kaleo analyst is sure that the industry is approaching the bottom, which means that already in 2024-2025 the NFT space will see a revival. And it seems he's not the only one who thinks so. Some institutional investors are making a bold entry into the NFT sector. For example, PayPal this week joined SONY, Formula One, Fidelity Investments and others in filing trademark applications in the NFT sector. And OpenSea intends to attract more creators to its platform by launching OpenSea Studio.

But in order to fully revitalize the industry, we need to move away from the vision that enthusiasts have placed upon NFT in 2021-2022. The stability and prosperity of NFT depends on the real value of the token, not just in its high price. And for as long as market participants don't realize this, the NFT industry will remain dead.