What's Next for Bitcoin and Ethereum? A Comprehensive Look at Future Targets and Projections

In the midst of a challenging banking crisis, the value of Bitcoin (BTC) and Ethereum (ETH) continues to soar in 2023, reaching new heights and defying market expectations. Read price predictions based on analytics

In May 2022, Bitcoin dropped to $30,000. After almost a year, the cryptocurrency has once again hit that impressive milestone.

Source and Copyright: © TradingView

Meanwhile, Ethereum has also returned to its May 2022 price point, reaching $2,100.

Source and Copyright: © TradingView

As these cryptocurrencies experience recent surges in value, investors are keenly observing their future price targets, wondering whether these upward trends are sustainable.

In this analysis, we will delve into the potential future price targets of BTC and ETH, considering recent market developments and expert opinions.

BTC Expert Opinions

After reaching $30k, Bitcoin has been trading within a narrow range due to resistance. The longer it lasts, the more intense the breakout will be, up or down. Therefore let's examine popular analysts' predictions on BTC price action.

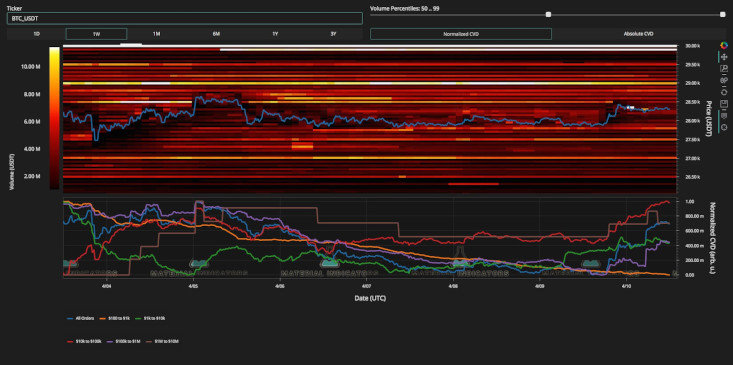

Material Indicators

Material Indicators has recently released order book data warning that increased volatility is on the horizon for Bitcoin. This data shows that liquidity is being removed from the near spot price to lower and higher levels, making room for erratic moves within its range. However, the question remains whether BTC will "pop or drop" due to this potential trend break.

Source and Copyright: © Material Indicators

Source and Copyright: © Material Indicators

Credible Crypto

Credible Crypto, a famous trader, sees similarities in Bitcoin's current price behavior to its past bull runs. According to his analysis, BTC appears to be repeating a positive preparatory pattern similar to the one it exhibited before surpassing its previous all-time high of $20,000 in late 2020.

A perfect scenario would be for BTC/USD to consolidate the $27,500 range as support before a bullish surge higher.

Source and Copyright: © Credible Crypto

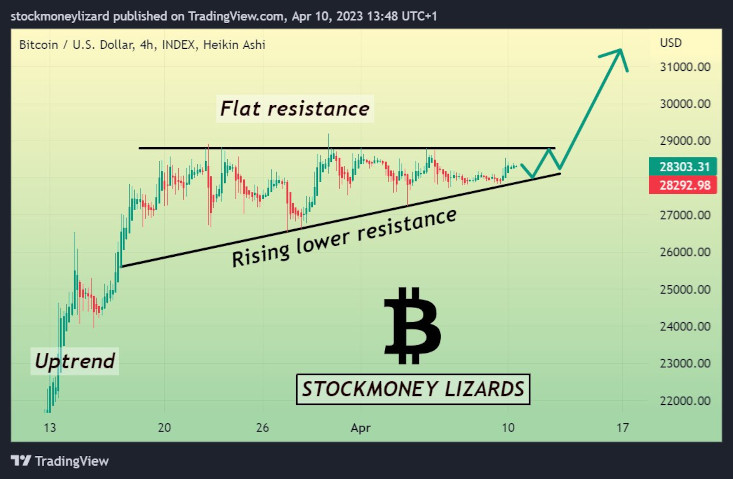

Stockmoney Lizards

Stockmoney Lizards, on the other hand, predicts that the overwhelmingly likely outcome of the current range-bound period is "up."

The most recent chart forecast indicated that BTC/USD is maintaining a consistent level of resistance around $30,000 while also creating a sequence of increased lows. As Bitcoin approaches a "decision point," it is believed that the bulls will come out on top.

Source and Copyright: © Stockmoney Lizards

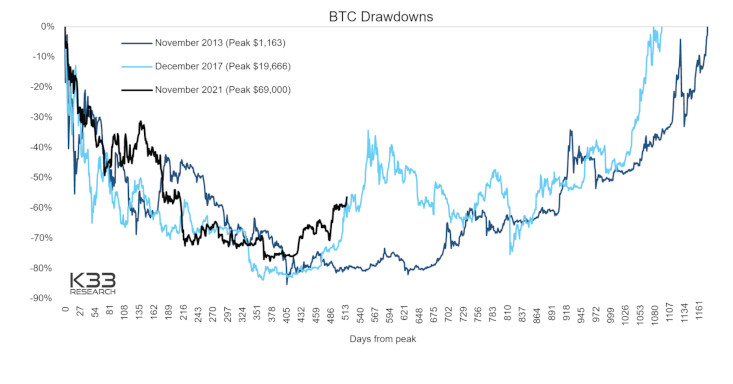

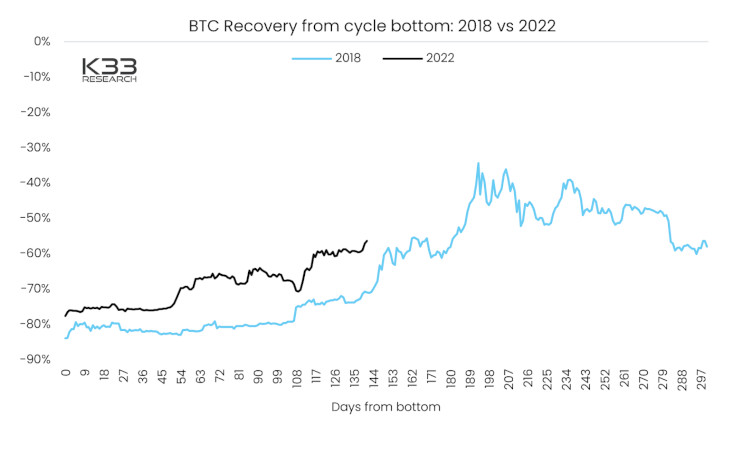

K33 Research

Bitcoin could hit $45,000 by May 20, according to a report by K33 Research. The report draws similarities between Bitcoin's current drawdown and recovery cycle and the one seen during the 2018 bear market. Both lasted around 370 days at the bottom and experienced a peak-to-trough drawdown of approximately 60% after 510 days.

Source and Copyright: © K33 Research

The report notes that committed long-term holders are driving the current accumulation phase of BTC, which could help sustain the rally longer.

Source and Copyright: © K33 Research

Crypto Potato

Crypto Potato has also shared an in-depth view of the technical side of the issue.

On the daily chart, Bitcoin's price has broken out of its tight consolidation range around the $28K mark and is now testing the $30K resistance. A bullish breakout could continue to the significant resistance zone around $38K.

In comparison, a rejection could result in a drop toward the 50-day moving average at $26K or even the $25K support area. Nevertheless, the bulls can remain optimistic if the price remains above the 200-day moving average.

Source and Copyright: © Crypto Potato

Meanwhile, on the 4-hour chart, the price is struggling to break past the $30K resistance level, and the RSI indicator signals a potential consolidation or correction in the short term. In case of a deeper correction, the $28K level and the $25K area could provide support.

Source and Copyright: © Crypto Potato

Looking at on-chain analysis, the Long-Term Holders Spent Output Profit Ratio (SOPR) shows that investors who bought Bitcoin at prices lower than $30K are now realizing profits aggressively.

While profit-taking is natural in a bull market, it could lead to a bearish reversal or a continuation toward lower prices if supply is not met with sufficient demand. Therefore, monitoring the SOPR metric constantly is crucial to determine the market's direction.

Source and Copyright: © Glassnode

Ali B.

According to this expert, from a technical analysis standpoint, the BTC/USD pair shows an upward trend, nearing the $30,250 level. If this is breached, resistance may occur at $30,600 before advancing to $31,000 or even $32,250.

Source and Copyright: © Ali B.

On the other hand, Bitcoin's support at the $29,600 mark remains steady, and a drop below this level could prolong the downtrend to the $28,900 level.

ETH Expert Opinions

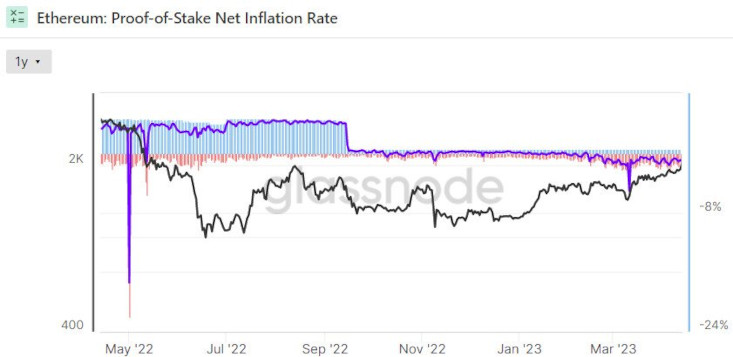

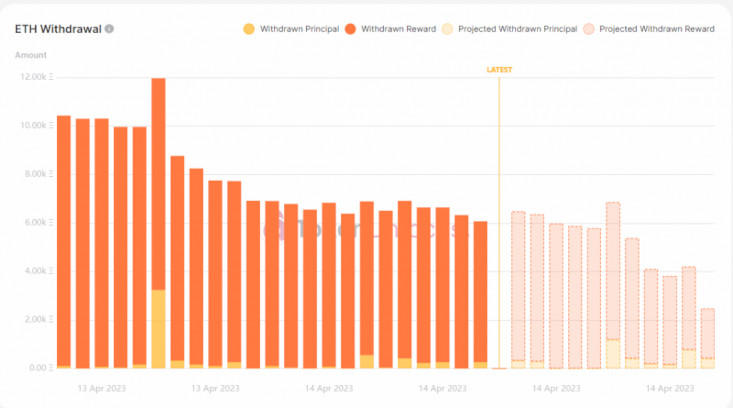

Ethereum has surged above $2,100 following the Shapella upgrade and bullish supply dynamics. With the cryptocurrency market gaining momentum, it's worth exploring where the ETH price might be headed next.

Joel Frank

Despite high transaction costs, more users are turning to Ethereum layer-2 scaling solutions such as Polygon and Arbitrum. However, Joel Frank is sure that deflationary ETH supply tailwinds and the progress Ethereum is making to address its scalability issues should support the price in the future.

Source and Copyright: © Glassnode

Short-term technicals are also positive, with all of ETH's major moving averages moving higher in consecutive order. In the coming weeks, a melt-up towards the psychologically important $3,000 area is possible.

Source and Copyright: © Joel Frank

NASDAQ Experts

Based on the article, the NASDAQ team's future price target for Ethereum is $2,500.

The post-Shapella Upgrade ETH staking statistics have been bullish (less than 5% of ETH withdrawals were original stakes), which is expected to support the move to $2,500.

Source and Copyright: © Token Unlocks

However, updates from the ongoing SEC v Ripple case and Binance and Coinbase-related news will also influence the price.

The specialists suggest that investors should monitor the crypto news wires for regulatory activity, as the SEC targeted staking services and labeled ETH a security in Q1.

The technical indicators also support a continued run towards $2,300 if ETH holds above the First Major Support Level (S1) at $1,935 and the 50-day EMA ($1,903).

Source and Copyright: © NASDAQ

Conclusion

Despite all the FUD and the collapse of three US banks, Bitcoin and Ethereum have gained momentum over the past month. This has revived the narrative among Bitcoin bulls that the coin offers an attractive alternative to traditional finance.

A drop in liquidity to a 10-month low could also explain the rebound, as lower trading volume can result in more dramatic price swings for both cryptos.

Finally, Strahinja Savic, head of data and analytics at FRNT Financial, notes, "Under these circumstances, we may see price action that is difficult to pin to any one reason." These factors make Bitcoin and Ethereum potential targets for investors seeking alternative investment opportunities.