Will Crypto Recover?

Will crypto make a comeback? This article examines the variables that could influence a market recovery and what to watch for in the near future.

Introduction

The year 2022 was particularly harsh for cryptocurrencies, characterized by a series of high-profile scandals and bankruptcies that impacted several key players in the space. Amid a volatile inflationary landscape and aggressive monetary tightening, high-risk assets, ranging from growth stocks to overvalued real estate, suffered significant devaluation. Cryptocurrencies were no exception, experiencing sharp declines.

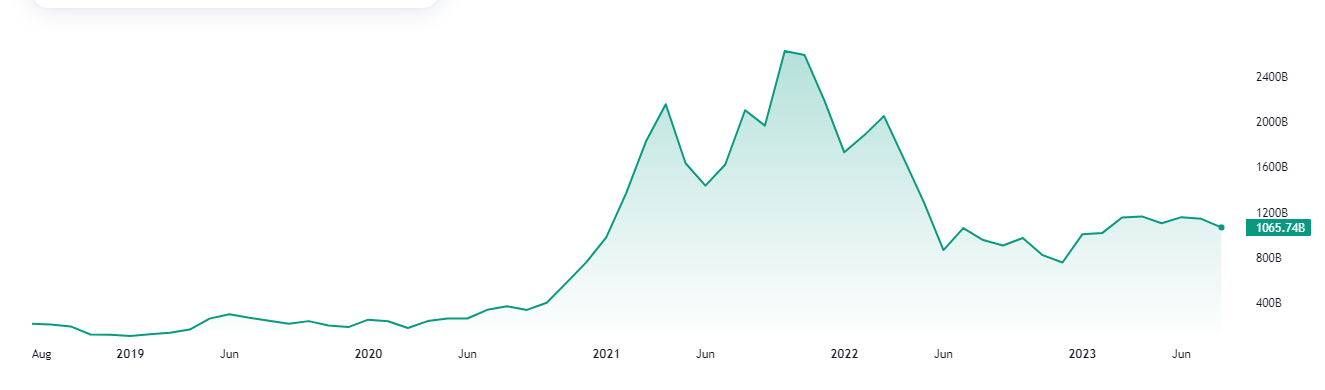

So far 2023 offers mixed feelings. Despite some positive indicators and green shoots of recovery, the cryptocurrency market cap now stands at a more modest $1.13 trillion compared to market capitalization of $3 trillion in November 2021.

Source and Copyright: © TradingView

Source and Copyright: © TradingView

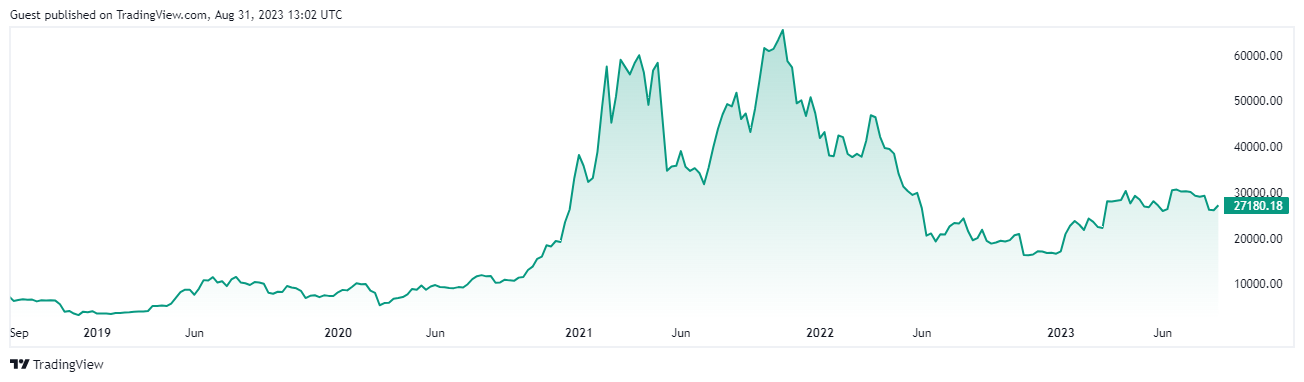

The crypto market as a whole continues to experience significant volatility. The fall of FTX in 2022 severely undermined faith in digital currencies, causing a bearish sentiment that persisted without showing any signs of recovery. The majority of currencies are still significantly below their all-time highs. Similarly, Ethereum, which is currently trading at around $1,700, reached its all-time high of $4,000 in 2021. Bitcoin is still more than 50 percent below its all-time high of $69,000, which it reached in November 2021.

So, what does it mean for the investment viability of cryptocurrencies? Past trends suggest that cryptocurrencies have a tendency to bounce back after significant market downturns. Therefore, though the future is far from certain, it's not entirely bleak either. So, it might be too early to write off cryptocurrencies as a bad investment.

Looking Back

Both 2020 and 2021 experienced crypto bull markets, fueled by market innovations and growing public interest in trading. During this period, Bitcoin's market cap crossed the $1 trillion milestone and various coins achieved all-time highs. But this bullish trend wasn't sustainable indefinitely.

Concerns about inflation intensified towards the end of 2021, sparking fears of rising borrowing costs and prompting a retreat from cryptocurrencies. Bitcoin's value fell from a peak of about $69,044 in November 2021 to $46,696 by mid-December, extending its decline into January 2022 to reach $35,180. As of the time of this writing BTC is trading at around 27,000

Source and Copyright: © TradingView

Source and Copyright: © TradingView

However, the situation began to heat in 2022. A sequence of unfavorable circumstances initiated a domino effect of financial losses, ultimately resulting in a deterioration in investor trust and belief in the viability of cryptocurrencies.

2022: Domino Effect

It all started from Terra. TerraUSD (UST), an algorithmic stablecoin, lost its peg to the dollar in May 2022. The ensuing collapse of its sister token, LUNA, set off a wave of market panic, leading to a loss of over $40 billion. By the 16th of May, the Terra stablecoin and Luna token were essentially dead, with some media agencies labeling it a Ponzi scheme and others a rug-pull scam.

Bankruptcy Cases

In June 2022 Celsius Network temporarily suspended withdrawals due to market instability. After rapid expansion, Celsius Network was forced to lay off roughly 23% of its workforce and begin bankruptcy proceedings. Bankruptcy proceedings also began in July for major players like Three Arrows Capital and Voyager Digital. These collapses were attributed to risky investment strategies, loan defaults, and evaporating liquidity.

Cherry on the Pie

However, the most stunning event that rattled the crypto industry was the dramatic collapse of FTX, one of the sector's flagship exchanges. On November 17, 2022, FTX officially filed for Chapter 11 bankruptcy, along with its 101 debtors, marking a catastrophic end to what was once a cornerstone of the digital asset marketplace. The fallout was all the more sensational because its founder, Sam Bankman-Fried, found himself facing numerous felony charges, potentially setting the stage for a lifetime behind bars. While FTX's demise was undoubtedly a crushing blow, it represented just one facet of a multifaceted crisis that has engulfed the cryptocurrency world.

Rising interest rates, and increased regulatory scrutiny at the federal level courtesy of Federal Reserve policy shifts aimed at containing inflation, further drained investment from the crypto market.

What Could Trigger the Next Crypto Bull Run?

The narrative that cryptocurrencies are on the verge of collapse has been circulated multiple times. A key reason for optimism about the future of cryptocurrencies lies in their proven ability to bounce back. Since its inception, the crypto space has gone through various phases of booms, busts, and eventual recoveries. Each period of downturn has invariably been followed by a rebound that pushed the market to new peaks.

Take, for instance, the notable market crash of 2017-2018, when cryptocurrency valuations plummeted. Despite this, the market made a robust recovery, with Bitcoin setting record highs in both 2020 and 2021, showcasing its resilience and capacity for revival.

Various factors may underpin the fluctuations in the crypto market, and there isn't a single, quick fix for the crisis experienced in 2022. To pave the way for a sustainable recovery, several key elements may influence the future of crypto.

Crypto adoption

Firstly, the role of cryptocurrencies must evolve beyond just speculative instruments. The initial crypto boom of 2020 was, to some extent, fueled by its growing acceptance as a legitimate currency across numerous nations. Pioneering projects in decentralized finance (DeFi), NFT, and popular play-to-earn applications indicate that broader utility could drive future growth.

Interest Rates

Secondly, the issue of rising interest rates needs attention. High rates not only breed market uncertainty but also make it challenging for investors to secure capital. As a result, many are divesting from volatile markets like crypto in favor of safer investments. A decline in interest rates could reinvigorate capital inflow into the crypto ecosystem.

Regulating Crypto

Thirdly, the cloud of regulatory uncertainty must be lifted. While regulation can be beneficial in weeding out unscrupulous players, inconsistent or arbitrary rules create uncertainty that depresses prices. A stable and transparent regulatory framework is crucial for re-establishing investor trust. For instance, the latest court win of Greyscale in a legal battle against the U.S. Securities and Exchange has sparked a surge in crypto market, pushing up with prices of major coins.

BTC Halving and Inflation

The next Bitcoin halving is approximately a year away, and historically, such events have often preceded bull markets. Moreover, the recent inflation crisis has exposed the shortcomings of traditional financial systems, making the case for blockchain-based solutions more compelling. Adding to this turbulent climate, prominent institutions like Silicon Valley Bank, Silvergate Bank, and Signature Bank, all of which had considerable exposure to cryptocurrencies, have collapsed amid market volatility.

U.S. Presidential Election

Some even argue that the upcoming US presidential election could shape the next cryptocurrency bull market, with candidates' crypto stances being a key factor. In contrast to Ron DeSantis, Vivek Ramaswamy, and Robert F. Kennedy Jr., who support Bitcoin and the broader crypto market, Joe Biden, the incumbent president, maintains a skeptical stance on cryptocurrencies. Due to the global prominence of the United States, a pro-Bitcoin president could persuade other nations to adopt cryptocurrencies, resulting in a significant industry boost.

Even, Donald Trump, despite previous statements expressing skepticism about Bitcoin, continues to support the crypto market as a whole, particularly Non-Fungible Tokens (NFTs). The Trump-branded NFT trading cards have garnered attention in the cryptocurrency community, and numerous polls indicate that he remains the most popular Republican nominee. Moreover, Trump holds up to 500 million worth of Ethereum in a cryptocurrency wallet according to the recent financial disclosure.

In the end, the future of crypto isn't just tied to market cycles or changes in government regulations. It is up to creators and users to make it useful enough for a large number of people to use. Even though the time and size of the next uptrend are still unknown, it is clear that the sector is ready for another rise.

So When Will the Crypto Recover?

Forecasting the crypto market's path is tricky due to its history of volatility and rebounds. In 2023, major cryptocurrencies like Bitcoin and Ethereum are showing signs of resilience, making gains of 33.2% and 8 % in August respectively. The market's future depends on various factors, including banking trends, government policies, and investor sentiment. Analysts are keeping an eye on Bitcoin and Federal Reserve actions for clues on market direction.

Bitcoin, currently with a market cap of $528.5 billion, still has growth potential, but its correlation with stock markets and the influence of rising interest rates add layers of complexity. Investing in crypto can yield high returns or significant losses, as exemplified by Bitcoin's rise from 2010 to 2021 or its 80% drop in value in 2018.

Risks in crypto investing are not limited to market volatility. Issues like the recent FTX collapse or uncertainties in banking institutions like Silvergate Capital underline the need for due diligence, portfolio diversification, and risk assessment.

To succeed in the fluctuating crypto market, investors need a well-researched approach, clear financial goals, and an understanding of their risk tolerance. Despite challenges, a well-strategized investment can unlock the market's potential.

FAQ

Is crypto ever going to recover?

The question of whether cryptocurrencies will recover from any given downturn is complex and influenced by a number of factors, such as regulatory changes, technological advancements, and market sentiment. Historically, the cryptocurrency market has shown a capacity to recover from declines, but past performance is not indicative of future results. Market dynamics are highly unpredictable, and investment in cryptocurrencies remains speculative and risky.

Does crypto still have a future?

The future of cryptocurrencies is a subject of ongoing debate among experts, regulators, and investors. The technology behind cryptocurrencies, blockchain, has found multiple applications across industries, which suggests a level of staying power. Additionally, cryptocurrencies offer unique features that could make them increasingly integral in future financial systems and beyond. However, there are also challenges to overcome, including regulatory hurdles, technological limitations, and market volatility. The outlook is therefore uncertain, but there is potential for continued relevance and growth.

Michael Saylor Sam Bankman-Fried