Algorand at Glance

Algorand is a blockchain platform that is designed to deliver decentralization, scalability, and security. It aims to solve the "blockchain trilemma," a term coined by Ethereum founder Vitalik Buterin, which refers to the challenge of achieving scalability, security, and decentralization all at once in a blockchain system.

Algorand's blockchain is designed to handle large volumes of transactions quickly and efficiently, with a focus on minimizing computational requirements and reducing the time taken to confirm transactions.

Algorand boasts the ability to process over 1000 transactions per second, while each transaction is finalized within a 4-second timeframe. To achieve this, the network uses a pure proof-of-stake (PPoS) protocol built on Byzantine consensus and a two-tiered architecture.

Algorand takes pride in its energy efficiency, positioning itself as the most environmentally friendly cryptocurrency available.

Source & Copyright @ algorand.com

Source & Copyright @ algorand.com

How Does Algorand Work?

Algorand operates on a unique consensus algorithm known as pure proof-of-stake. This algorithm functions in cycles, each of which is divided into two distinct stages. Initially, nodes propose blocks, and this is followed by a phase where a committee of nodes finalizes the selected blocks. Each stage utilizes a different security strategy. The initial phase incorporates a pure proof-of-stake model, while the subsequent phase utilizes a Byzantine Agreement protocol, where nodes cast votes on the proposed blocks.

Byzantine Agreement protocol is designed to be resilient against Sybil attacks, where an attacker creates many identities to influence the outcome of the protocol. It achieves this by using cryptographic sortition to select committee members in a way that is private and non-interactive, meaning that an attacker cannot know who the committee members are until they reveal themselves by participating in the protocol.

Algorand addresses the blockchain trilemma by incorporating randomness into its consensus algorithm. Each node that is eligible to participate in the consensus process executes a Verifiable Random Function (VRF) locally. This function determines the nodes that will form the committee in the subsequent phase. The influence of each node's vote and the probability of a specific node being selected for the committee are directly related to its stake.

Algorand's Architecture

Algorand uses a two-tiered blockchain architecture to maintain high performance. The first layer of Algorand's blockchain is designed for speed and security. It handles simple operations like token transfers and uses Algorand's Pure Proof-of-Stake consensus mechanism to validate transactions. This layer is optimized for high throughput and low latency, allowing Algorand to process a large number of transactions quickly.

The second layer of Algorand's blockchain is designed for flexibility. It supports complex operations like smart contracts and custom digital assets. This layer operates off-chain, meaning that it doesn't slow down the main blockchain. Instead, it uses the security of the first layer to validate its results.

ALGO Token

The ALGO token is the native cryptocurrency of the Algorand blockchain. The ALGO token is used in the network's consensus mechanism, where the likelihood of a user being selected to propose a block or vote on a block proposal is directly proportional to their stake of ALGO tokens.

In Algorand's protocol design, the rewards earned by validators for generating blocks are not exclusively given to the block producers. Instead, these rewards are divided and shared among all holders of the ALGO coin.

The ALGO token also serves as a means of transaction within the Algorand ecosystem. Users can transfer ALGO tokens to each other as a form of payment, and developers can use ALGO tokens to pay for the computational resources needed to run their applications on the Algorand blockchain. ALGO holders can vote on proposed changes to the network's protocol and other important decisions.

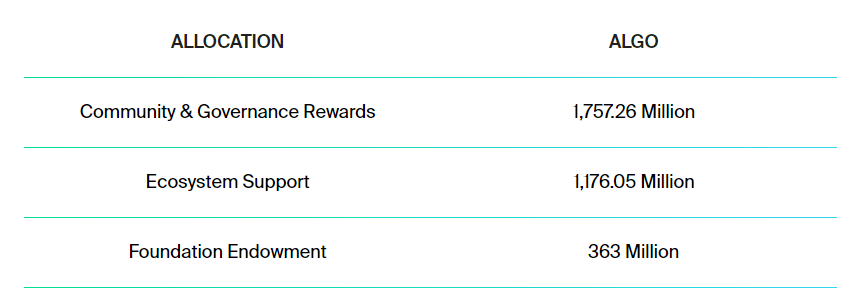

Algorand Tokenomics

In June 2019, Algorand held a Dutch Auction ICO and raised over $60 million through the sale of 25 million tokens at $2.40 each. The date of the ICO coincided with the launch of the Algorand mainnet, during which 10 billion ALGO tokens were created. Currently, the circulating supply is approximately 8 billion Algo, disseminated via various ecosystem support and community incentive mechanisms. The distribution of ALGO will end in 2030. The Foundation holds the remaining Algos with the following composition:

Source & Copyright @ algorand.com

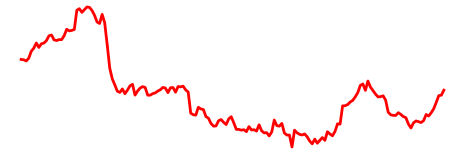

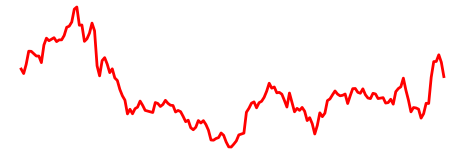

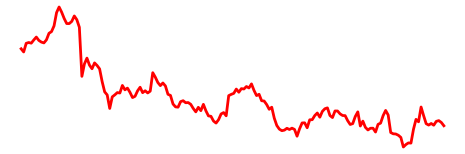

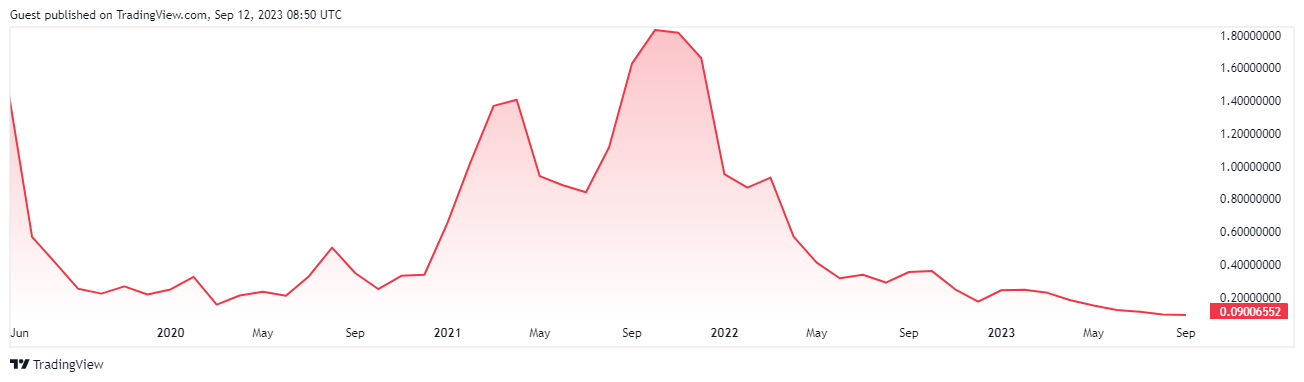

Algorand Price Movement

The price of Algorand continually fluctuates, being influenced by various determinants that can sway its market valuation. This encompasses conventional elements like updates and progress within the project, the overall mood of the market, cryptocurrency movements on trading platforms, and broader economic conditions.

In June 2019, ALGO was introduced to the cryptocurrency scene, starting at an impressive price point of around $2.74. However, its value decreased rapidly during its initial price settlement phase. Over the subsequent three months, a largely negative price trajectory was observed until ALGO's value plateaued between $0.20 and $0.30. The start of 2020 saw a surge in ALGO's value, pushing it up to $0.50. However, as with many other digital currencies, ALGO faced a significant drop in price in March 2020, due to the economic disruptions caused by the COVID pandemic, settling around $0.10. Post this downturn, Algorand experienced a favorable phase, with its value peaking at $2.52 in September 2021 during the climax of that cryptocurrency bull phase.

Ever since ALGO has been consistently trending downwards. As of the time of writing, the current price of Algorand (ALGO) is approximately $ 0,090047 and the market cap is $ 704 929 619, the circulating supply of ALGO tokens is over 7 billion, out of a maximum supply of 10 billion.

Source & Copyright @ TradingView

What is Algorand Used For?

Algorand provides a platform where assets can be tokenized, transferred, and subjected to specific conditions. It enables the creation of cryptocurrencies and Non-Fungible Tokens (NFTs) in a straightforward manner, without the need for expertise in smart contract coding. Algorand also supports the functionalities of smart contracts, making it a popular choice for hosting decentralized applications (dApps). It offers four Software Development Kits (SDKs) that utilize Python, JavaScript, Golang, and Java. Moreover, the code of the Algorand network is open-source. In addition, Algorand's low transaction fees and high throughput make it an excellent platform for stablecoins. Several stablecoins, including USDT (Tether) and USDC (USD Coin), have already launched on the Algorand blockchain.

Algorand Team & Investments

Algorand was founded by Silvio Micali, a professor of computer science at the Massachusetts Institute of Technology (MIT) and a recipient of the prestigious Turing Award. According to the project’s website the Algorand team consists of internationally recognized researchers, mathematicians, cryptographers, and economists along with proven business leaders from global technology companies.

Algorand Foundation is a non-profit organization that oversees the development of the network. It is also responsible for many incentives and educational programs that inspire developers to build on Algorand.

Algorand has raised a total of $132 million over ten funding phases from a variety of Venture Capital funds. These range from crypto-specific funds to investors with a broader focus on technology.

Source & Copyright @ algorand.com

Algorand has also invested in its Algocapital venture capital fund. This fund has amassed $100 million and will support Algorand protocol-based initiatives. Later in 2021, Algorand Foundation launched the Viridis fund with an additional $300 million to support DeFi innovation.

Algorand on Reddit

Reddit, often considered the frontline of Internet communities, has witnessed a variety of reviews and opinions on Algorand. These reviews, reflective of the diverse user base of the platform, offer a multifaceted perspective on this particular cryptocurrency.

Some investors seem to have suffered from a devalued investment, with one user saying, “I'm down so far from when I bought in that going to zero is hardly different from selling, so I might as well HODL”.

The technical strength of Algorand has emerged as a focal point of several discussions. Users mention, “A major project is in the process of migrating from ETH to Algo,” indicating Algorand’s potential to attract other projects due to its technological advantages.

An optimistic view shared was, “Algorand isn't going anywhere..the Fud is usually the people that don't hold any to start... It's the fastest with instant finality... Cheap to move around. Yeah...it's here to stay”.

Of course, not all sentiments lean positive. Some users compare the unpredictable nature of altcoins with lottery tickets, suggesting the inherent risks. Others express concerns over Algorand's future, given market trends and competition, suggesting, “It might revive later, if the world turns bullish, but I would not dare to bet on it”.

Recognizing the cyclic nature of cryptocurrencies, one user highlighted that “this is the first crypto winter of Algorand and will not be the last. Only well-managed projects and legit one will survive”.

A more analytical approach was taken by a user emphasizing the reasons behind Algorand’s price drop since hitting $2.40. They identified that “immense amounts of supply were released into circulating supply during 2021 and 2022”.

FAQ

Will Algorand reach $100?

The total number of ALGO tokens capped is at 10 billion. Should ALGO attain a price of $100 with its entire supply in circulation, Algorand's market value would stand at $1 trillion. ALGO's present standing appears uncertain, trading nearly 98% below its peak value. Given this, it's uncertain if ALGO can return to its all-time high, much less touch the $100 mark.

What will ALGO be worth in 2025?

Predicting the exact value of any cryptocurrency, including Algorand, several years into the future is inherently speculative. Many factors, including technological developments, market adoption, regulatory decisions, and broader economic trends, can influence its price.

What is so special about Algorand?

Algorand was developed to enhance transaction speeds and boost efficiency, addressing the sluggish transaction durations observed in Bitcoin and similar blockchains. Unlike Bitcoin's energy-consuming mining process, Algorand employs a permissionless pure proof-of-stake (PoS) blockchain protocol, leading to reduced transaction costs.