Homepage:

https://bitcoingold.org/

Twitter: bitcoingold

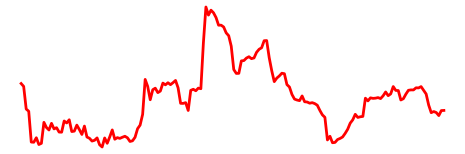

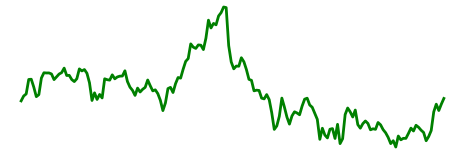

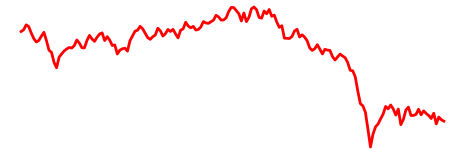

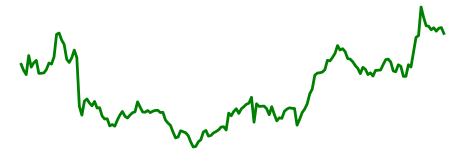

Bitcoin Gold (BTG) Price

BTG

$0.685332

Market cap

12,002,846.0

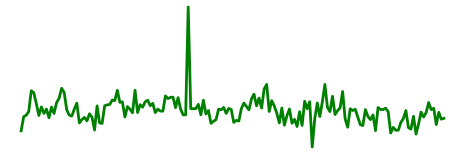

Total volume

2,632

Circulating supply

17,513,924

Total supply

17,513,924

The ambition of Bitcoin Gold is to foster a network that enables anyone to engage in mining activities using standard hardware. This approach aims to decentralize Bitcoin Gold mining across a broad spectrum of participants, rather than concentrating it within a handful of large entities. Among its standout features is its commitment to decentralization. Bitcoin Gold achieves this through the adoption of a proof-of-work (PoW) algorithm, Equihash-BTG, which is incompatible with the specialized equipment designed for Bitcoin mining (ASIC miners). This adjustment provides everyday users with the opportunity to mine using conventional GPUs. In addition, the project emphasizes equitable distribution. By hard forking the Bitcoin blockchain, Bitcoin Gold ensures the prompt and fair distribution of 16.5 million BTG to crypto enthusiasts worldwide.

Alternative methods, such as the creation of coins from a new genesis block, tend to centralize ownership within a narrow group. Furthermore, Bitcoin Gold has implemented robust replay protection and unique wallet addresses. These critical safeguards protect users and their assets from a range of risks and malevolent activities. The move towards ASIC-resistant hashing algorithms is becoming increasingly common among new mineable cryptocurrencies, striving to uphold decentralization. In this vein, Bitcoin Gold presents numerous promising facets, chiefly its commitment to making Bitcoin mining more distributed.

Yet, despite the concerns addressed, there appears to be limited evidence suggesting that the current Bitcoin mining framework is flawed. There have been minor grievances, and the high degree of centralization within the network is far from ideal. However, miners invested in Bitcoin have much at stake and are unlikely to exercise their influence recklessly. Furthermore, the Bitcoin mining landscape is witnessing the arrival of new players, further dispersing control from the dominant ASIC farms. The prevailing view among Bitcoin aficionados is that Bitcoin Gold doesn't introduce enough novelties to justify a standalone investment. While holding onto the complimentary BTG received from the fork (provided you owned Bitcoin before Oct 24) is harmless, it may be prudent to observe how the situation unfolds before committing to additional acquisitions.

Explore more

Popular

News

AI Tokens Dominate the Market

03/07/2024

HowTo

Last news

10/14/2024

09/24/2024

09/24/2024

09/24/2024

09/23/2024