Homepage:

https://makerdao.com/

| https://blog.makerdao.com/

Twitter: SkyEcosystem

Reddit: maker

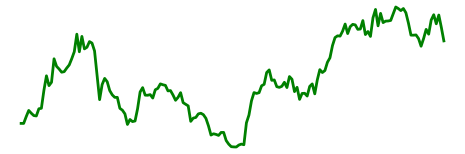

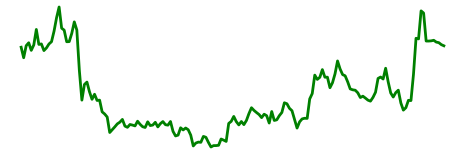

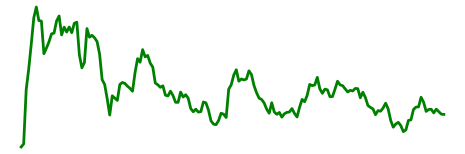

Maker (MKR) Price

MKR

$1,721.83

Market cap

982,928,358.0

Total volume

65,743,725

Circulating supply

570,835

Total supply

595,760

The MakerDAO team brought Maker Dai to life on December 18th, 2017. Dai stands as a stablecoin designed for a myriad of financial activities including payments, savings, and use as collateral, thereby offering traders a broader spectrum of strategic options for managing their positions. Dai's operations are fully conducted on the blockchain, ensuring its stability is not influenced by legal systems or third parties, thus supporting trading activities purely within the cryptocurrency ecosystem. The principle behind a stablecoin, like Dai, is relatively simple – it is a digital token whose value is pegged to a specified fiat currency, maintaining steadiness in value contrary to the inherent volatility observed in tokens like Bitcoin and Ethereum.

MKR, functioning as an ERC-20 token within the Ethereum blockchain, defies the typical mining process. It is dynamically generated or annihilated in reaction to Dai’s valuation shifts to maintain its target value around $1 USD. MKR serves a dual purpose within the Maker ecosystem: facilitating payment of transaction fees and securing the system through collateralization. Ownership of MKR bestows voting rights through Maker’s continuous approval voting mechanism, emphasizing the vital role of sound governance. Poor management practices risk the devaluation of MKR tokens, thus motivating holders to engage in voting that aligns with the system’s overarching welfare. This represents a key utilization of blockchain’s decentralized, democratic capabilities.

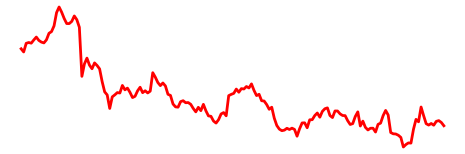

Comparatively examining value volatility, it is evident that this concept is not exclusive to cryptocurrencies but extends to fiat currencies as well. For instance, the US dollar's value against the yen has experienced notable fluctuations over the years, reflecting significant shifts in exchange rates. Variability in inflation rates across different periods further complicates the internal value comparisons within a single currency. The concept of $1 has undergone substantial transformation from its worth in 1913 to its value today. Unlike traditional fluctuating currencies, stablecoins like Tether and Dai are pegged to the U.S. dollar, aiming to mitigate price instabilities and offer a semblance of financial steadiness.

Converters MKR

amount

EURO

JPY

USD

Explore more

Popular

Top 10 Artificial Intelligence (AI) Cryptocurrencies

AI cryptocurrencies are on the rise again. Early 2023 brought a breakthrough in the artificial intelligence segment, which resulted in the emergence and rapid popularity of AI cryptocurrencies. The artificial intelligence and cryptocurrency sector slowed down mid-year, but the fourth quarter of 2023 surprised the crypto community once again. What are AI cryptocurrencies, and which are the best ones to invest in right now?

News

HowTo

Last news

08/14/2024

08/12/2024

07/11/2024

06/21/2024

06/19/2024