SEC Crypto Regulation: How SEC Shapes the Future of Digital Assets

Unraveling the SEC's stance on cryptocurrency. Dive deep into the challenges and uncertainties faced by the crypto industry and uncover the measures, motivations, and implications of oversight.

-

Table of Contents

- Understanding the SEC’s Crypto Regulation

- What is the SEC?

- The Main Point of Dispute: Is Crypto a Commodity or Security

- Understanding the Howey Test

- The Rise of SEC's Crypto Crackdown: SEC vs. Ripple

- Crackdown on Binance and Coinbase

- Other Prominent Lawsuits Against Crypto

- Crypto Infrastructure Bill

- Crypto Regulations Around the World

- Does Crypto Have a Future in the U.S.?

Understanding the SEC’s Crypto Regulation

In recent years, the transformation of cryptocurrency from a niche investment to a recognized asset class has resulted in the intervention of regulatory bodies on a global scale. While various organizations worldwide are investigating the complexities of cryptocurrency regulation, none have been as influential as the Securities and Exchange Commission (SEC) of the United States.

The U.S. Securities and Exchange Commission (SEC), widely regarded as a leading authority in the regulation of financial markets, has garnered significant attention from investors, stakeholders, and regulators alike due to its position on cryptocurrency.

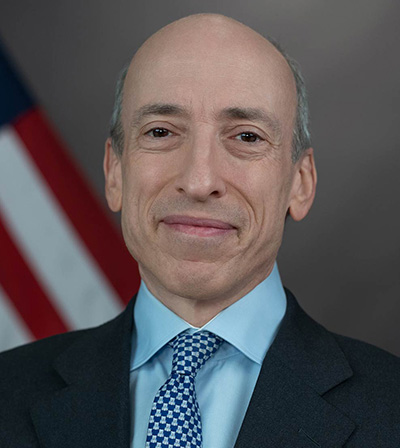

Under the leadership of Gary Gensler, who assumed the role of SEC Chair in April 2021, the commission has intensified its focus on the crypto industry.

Portrait of Gary Gensler, Chair of the Securities and Exchange Commission under President Biden.

Source and Copyright © U.S. Securities and Exchange Commission

Gensler has repeatedly emphasized the need for additional supervision resources for cryptocurrencies, comparing the sector to the "wild west". “Nothing about the crypto markets is incompatible with the securities law,” Gensler said. “Investor protection is just as relevant, regardless of underlying technologies”.

This sentiment was reinforced by his statements on September 8th, 2022, which indicated the SEC's unwavering intent to scrutinize and regulate both crypto instruments and their associated intermediaries.

Why SEC is Important?

While the SEC is fundamentally an American agency, the interconnected nature of modern financial markets means its decisions carry significant global implications, setting precedents and influencing the regulatory approach of other nations.

As international investors, exchanges, and startups often interface with the U.S. market or adopt its practices as a benchmark, the SEC's stance on crypto not only shapes the American landscape but echoes throughout the international financial community.

In this article, we’ll explore the complicated relations between the SEC and cryptocurrency in the U.S., regulatory hurdles, and cover some of the most high-impact lawsuits against crypto companies.

What is the SEC?

The U.S. Securities and Exchange Commission (SEC) is the chief authority overseeing the U.S. stock market. Its primary mission is to maintain transactional transparency and combat deceptive practices to safeguard investor trust. This involves setting and monitoring standards for securities, tracking the movement of stocks and bonds, and supervising brokers and investment entities.

Its strategies and approaches in managing disputes serve as a gold standard for regulatory bodies worldwide. Every corporation with stocks traded on American exchanges operates under the vigilant eye of the SEC. Non-compliance with securities laws or inadequate service to investors could potentially trigger an SEC inquiry, especially if firms withhold financial data from oversight agencies.

With the rise of cryptographic technologies and the associated risks, the SEC has expanded its focus to regulate and monitor the crypto market, especially concerning crypto exchanges. This also includes vigilance against illicit activities like money laundering within the crypto domain.

The Main Point of Dispute: Is Crypto a Commodity or Security

At the heart of the regulatory conversation lies a pressing question: should cryptocurrencies be categorized as securities, commodities, currencies, or an entirely different class? Depending on this classification, different U.S. regulatory bodies would have jurisdiction.

If treated as commodities—akin to crude oil or coffee—cryptocurrencies would fall under the Commodity Futures Trading Commission (CFTC), which already oversees currency trading. However, if seen as securities comparable to stocks or bonds, jurisdiction shifts to the U.S. Securities and Exchange Commission (SEC).

SEC Chair Gary Gensler holds a firm stance, suggesting that the majority of cryptocurrencies align with the definition of securities, according to the Howey Test—a framework rooted in a 1946 Supreme Court decision (SEC v. W.J. Howey Co.). Yet, Gensler has earmarked Bitcoin as an exception, viewing it as a commodity.

Understanding the Howey Test

Understanding the Howey Test is important because the majority of all lawsuits against cryptocurrency companies in the U.S. stem from this concept.

The Howey Test is a test established by the U.S. Supreme Court to determine whether a certain transaction qualifies as an "investment contract" and thus would be considered a security under the Securities Act of 1933 and the Securities Exchange Act of 1934.

The test comes from the case SEC v. W.J. Howey Co., decided in 1946. In that case, the Supreme Court sought to establish a definition for an "investment contract" as a type of security.

Under the Howey Test, a transaction is considered an investment contract (and thus a security) if it meets all of the following criteria:

Investment of Money: There is an investment of money or some valuable consideration.

Common Enterprise: The investment is in a common enterprise. There has been some debate over the years about what constitutes a "common enterprise," but generally, it's thought to mean that the fortunes of the investor are tied to the fortunes of the enterprise.

Expectations of Profits: There is an expectation of profits from the investment. This doesn't necessarily mean that profit is guaranteed; just that the investor has a reason to believe profits could be realized.

Profits Arise from the Efforts of a Promoter or Third Party: The profit comes primarily from the efforts of someone other than the investor. This generally means that the investor is passive, relying on others to generate a return on their investment.

In the context of cryptocurrencies and Initial Coin Offerings (ICOs), the U.S. Securities and Exchange Commission (SEC) has often applied the Howey Test to determine whether a particular token sale might be categorized as a security offering. If a token or coin is deemed a security, then it must be registered with the SEC, and the sale must comply with federal securities laws.

Reflecting on this, Gensler remarked that many crypto tokens are promoted and purchased with the anticipation of gains, primarily due to the endeavors of others, implying that these should be registered and monitored. Given Gensler's classification of many digital tokens as securities, crypto intermediaries engaged in these transactions should align with SEC regulations.

The Rise of SEC's Crypto Crackdown: SEC vs. Ripple

The crypto sector has seen intensified scrutiny from regulators, notably after the collapse of the crypto exchange FTX in November 2022. However, the pivotal moment that ignited many legal actions was the SEC vs. Ripple lawsuit. This landmark case emerged as a touchstone, generating significant concern within an industry accustomed to minimal regulation.

In December 2020, the SEC accused Ripple Labs and its top executives of raising funds by selling XRP tokens, deemed unregistered securities. The core issue is whether XRP should be classified as a security. Ripple Labs, between 2013 and 2020, raised USD 1.3 billion through XRP sales.

XRP's market capitalization soared into the billions, especially in 2017. However, the SEC's legal action in December 2020 negatively impacted the token's sentiment. Major exchanges, like Coinbase, suspended XRP trading, and its price struggled during the peak cryptocurrency bull market of 2021.

The lawsuit alleges that Ripple's co-founder, Chris Larsen, and its current CEO, Brad Garlinghouse, conducted personal unregistered XRP sales worth around $600 million. They are also accused of manipulating XRP sales to support the company's business operations. Additionally, Ripple offered billions of XRP in exchange for non-cash services like market-making and labor.

The SEC maintained that Ripple failed to provide adequate information to investors and emphasized that while XRP ballooned in market capitalization, it lacked the necessary securities registration.

The SEC's classification of XRP as a security leaned on the Howey test. By this measure, XRP met the security requirements since Ripple's management benefited from its sales, and the token funded Ripple's operational platform.

Rather than settle, Ripple chose a confrontational stance, asserting that the SEC hadn't given prior warnings about XRP's potential classification as a security. Ripple's defense also insinuated potential bias, highlighting that while the SEC spared Ethereum, classifying it as decentralized, the same leniency wasn't extended to XRP.

On July 13, both the SEC and Ripple experienced a mixed verdict. Judge Analisa Torres of the United States District Court for the Southern District of New York partially ruled in favor of both parties. She agreed with the SEC that the XRP sales to institutional investors were unregistered securities sales, but also highlighted Ripple's efforts in marketing and developing its blockchain infrastructure.

Yet, the SEC remained unsatisfied with the decision. On August 18, Judge Torres approved the SEC's request to file an appeal in the Ripple Labs case.

The legal case is ongoing, with potential appeals, new arguments, or even a possible settlement between Ripple and the SEC. This lawsuit's outcome could significantly impact the regulatory approach to cryptocurrencies and digital assets in the future.

Crackdown on Binance and Coinbase

In June 2023, the SEC intensified its regulatory grip on the cryptocurrency sector by suing both Coinbase and Binance, the two largest crypto exchanges by market cap.

SEC vs. Binance

Binance, based in the Cayman Islands, Binance U.S., and its founder and CEO, Changpeng “CZ” Zhao, were targeted by the SEC over allegations of violating federal securities laws. The charges include the offering of unregistered securities like the BNB token and Binance-linked BUSD stablecoin. Moreover, Binance's staking service was alleged to infringe upon securities law. The SEC asserts that Binance had enabled U.S. residents to trade on its platform, contrary to its stated policies, and that Zhao covertly controlled Binance US. The regulatory body also cited the improper commingling of user funds and accused an entity owned by Zhao of artificially boosting Binance.US’s trading volume.

In response, Binance has expressed its readiness "to work closely with regulators and policymakers, both in the U.S. and internationally". The company further commented, "The SEC's reluctance to engage constructively with us highlights the Commission's persistent unwillingness to offer clear guidance for the digital asset sector." Binance is expected to address the US SEC's lawsuit by September 21.

SEC vs Coinbase

The SEC’s case against Coinbase revolves around the firm operating its crypto platform without the necessary registrations. The SEC remarked on how Coinbase combined the roles of brokers, exchanges, and clearing agencies, yet never obtained the necessary registrations, thereby sidestepping the mandated disclosure processes. This included soliciting customers, processing orders, and playing intermediary roles.

Additionally, SEC’s suit alleges that since at least 2019 Coinbase has earned billions by allowing for the unlicensed buying and selling of “crypto asset securities”, particularly through its staking-as-a-service program, which the SEC charges Coinbase chose deliberately not to register, putting investors at risk.

In August, Coinbase requested a judge to drop the case lodged by the Securities and Exchange Commission. Coinbase argued that the SEC is overreaching its authority by targeting the cryptocurrency platform. In a recent submission, Coinbase emphasized that the SEC hasn't identified any involvement of investment contracts in their claims. The SEC has been given a deadline of October 3 to reply to Coinbase's motion, while any supportive briefs for Coinbase can be submitted by August 11.

While both Binance and Coinbase have previously been on the SEC's radar, these recent charges are markedly severe, especially considering the allegations of operating without the proper registrations.

The two lawsuits do exhibit key differences. The SEC's contention with Coinbase primarily concerns the classification of cryptocurrencies as securities. In contrast, the lawsuit against Binance encompasses a plethora of allegations against the company and Zhao, with potentially severe repercussions for the implicated parties.

The aftermath of these lawsuits was immediate and substantial. Coinbase users withdrew approximately $1.18 billion following the announcement, with the parent company, Coinbase Global Inc., experiencing a significant drop in its shares, closing down 12.1% on the day the charges were made public. Similarly, Binance saw a withdrawal of about $ 1.44 million, and Binance.US halted the trading of certain cryptocurrencies.

Other Prominent Lawsuits Against Crypto

In March 2023, the CFTC took legal action by filing a lawsuit against Binance. The lawsuit accused Binance of permitting U.S. customers to engage in trading activities involving unregistered securities.

Earlier that same month, the SEC issued Coinbase a Wells notice, alerting the exchange to potential violations of U.S. securities laws. This notice followed a similar warning previously issued to stablecoin issuer Paxos.

In February, the SEC issued an order to Kraken, instructing the crypto exchange to cease its crypto-staking operations within the United States. Subsequently, Kraken paid $30 million in disgorgement and civil penalties.

In January 2023, the SEC charged crypto lender Genesis and cryptocurrency exchange Gemini for the sale of unregistered securities. Shortly thereafter, Genesis filed for bankruptcy protection.

When FTX faced a major crisis in November 2022, the SEC brought forth various allegations against FTX founder Sam Bankman-Fried and other high-ranking FTX executives. These allegations centered on their purported involvement in defrauding investors.

In July 2022, former executives of Coinbase were charged by the SEC for their alleged involvement in an insider trading ring that amounted to $1.1 million.

In February 2022, crypto lender BlockFi agreed to a settlement of $100 million in penalties with the SEC. This settlement was related to BlockFi's failure to register sales of its retail crypto lending product. BlockFi later filed for bankruptcy protection in November 2022, following the FTX bankruptcy.

In September 2021, BitConnect executives faced charges filed by the SEC, which accused them of running a Ponzi scheme and defrauding investors of $2 billion.

Crypto Infrastructure Bill

Just when you thought things couldn't get any tougher for the crypto industry, U.S. regulators have unveiled another curveball.

In August, the U.S. Department of the Treasury and the IRS released long-awaited rules for tax reporting related to cryptocurrency, non-fungible tokens, and other digital assets. These regulations aim to ensure increased tax reporting of crypto transactions.

If adopted, brokers will report 2025's transactions in January 2026 using Form 1099-DA, paralleling how financial institutions report other investments. This proposal, originating from the 2021 federal infrastructure bill, aims to bridge the "tax gap" and tackle cryptocurrency tax evasion. The proposal encompasses both centralized exchanges and some decentralized entities, including certain crypto payment processors and online wallets.

New regulations, anticipated to be released by year's end, mandate companies with cryptocurrency assets to disclose their holdings at fair value. This ensures that the most current value, including any price recoveries, is captured. While the reporting rule was originally set for 2024, the IRS postponed it in late December 2022, but stressed that current crypto activities should still be reported, tax form notwithstanding.

Since 2019, tax return forms have included a query about crypto, and the IRS has procured customer records by issuing court orders to multiple exchanges. The proposed regulations provide exceptions for cryptocurrency miners, stakers, and certain decentralized exchanges.

On November 15, 2021, President Biden ratified HR 3684, the "Infrastructure Investment and Jobs Act", which, despite its focus on infrastructure, incorporated new reporting mandates for crypto transactions. While the Act spans 1039 pages, only three are dedicated to these new requirements, yet they carry significant implications for U.S. businesses and consumers involved in crypto.

Upon the release of the crypto taxation proposal, immediate criticism emerged, especially from those linked to decentralized entities categorized as "brokers." Many on the X platform, once known as Twitter, voiced concerns about the broad reach of the tax-reporting mandates. Critics believe these regulations might alienate the crypto sector from the U.S.

Chris Perkins, CoinFund's president, expressed concerns about other nations outpacing the U.S. in crypto innovations due to these stringent regulations. Instead of strict measures, he advocates for clear and concise rules to foster safe innovation. Likewise, Brad Garlinghouse, Ripple's CEO, mentioned the crypto sector's pivot away from the U.S. towards nations with more advanced crypto regulations.

Another commentator highlighted the potential challenges for entities like Metamask and Uniswap, suggesting they might need to establish new customer verification protocols due to these reporting stipulations.

By the way what happens in other countries in terms of regulating digital assets?

Crypto Regulations Around the World

China 🇨🇳

Cryptocurrencies are viewed as property for inheritance matters. China banned crypto exchanges, Bitcoin mining in May 2021, and cryptocurrencies in September 2021. However, they've advanced the development of their digital yuan (e-CNY), with another testing phase launched in August 2022.

Canada 🇨🇦

Crypto is not a legal tender in Canada, but it has progressive regulations. Canada approved the first Bitcoin ETF. Crypto platforms must register with provincial regulators, and crypto investment firms are classified as money service businesses. Crypto is taxed similarly to other commodities.

United Kingdom 🇬🇧

The U.K. views cryptocurrency as property. Crypto exchanges register with the Financial Conduct Authority (FCA). The country has specific crypto-related KYC, AML, and CFT requirements. In October 2022, the British Parliament expanded regulatory oversight to include stablecoins.

Japan 🇯🇵

Japan recognizes crypto as legal property. Exchanges register with the Financial Services Agency and adhere to AML/CFT norms. Trading gains from cryptocurrency are taxed as miscellaneous income. To curb money laundering through crypto, the government announced remittance rules for 2023.

Australia 🇦🇺

Cryptos are legal property in Australia and are subject to capital gains tax. Exchanges must register with the Australian Transaction Reports and Analysis Centre. In 2019, the Australian Securities and Investments Commission set rules for ICOs and banned privacy coins. In 2021, there were plans for a crypto licensing framework and the launch of central bank digital currency.

Singapore 🇸🇬

Singapore views crypto as property. The Monetary Authority of Singapore regulates exchanges under the Payment Services Act. Long-term capital gains aren't taxed, but businesses transacting in crypto are taxed on their gains.

South Korea 🇰🇷

Exchanges register with the Korea Financial Intelligence Unit. The country banned privacy coins in 2021. A proposed 20% crypto tax was postponed to 2025. A "Digital Asset Basic Act" intended to regulate crypto is under development.

India 🇮🇳

India has a neutral stance on crypto, with a bill against private cryptocurrencies pending. Cryptos are taxed at 30%, with a 1% tax deduction at source on trades. A tokenized rupee pilot began in 2022.

Brazil 🇧🇷

Cryptos aren't legal tender but were legalized as payment methods in November 2022. Digital currencies will be treated similarly to air mileage programs, with oversight yet to be determined. Securities tokens are under the Brazilian Securities and Exchange Commission.

European Union 🇪🇺

Crypto legality varies within the EU. Taxation ranges from 0% to 50%. The EU has enforced AML directives and proposed the MiCA in 2020 for consumer protection and industry regulation. In April 2023, the Parliament authorized measures permitting legislation mandating certain crypto service providers to obtain an operating license.

Does Crypto Have a Future in the U.S.?

The overarching issue at hand for the future of crypto in the U.S. largely centers on the classification of digital assets, especially whether or not they're viewed as securities. The Securities and Exchange Commission (SEC) has taken an increasingly assertive stance towards the crypto industry but paradoxically hasn't offered any clear guidelines regarding the categorization of these digital assets.

Currently, the trajectory of crypto in the U.S. is veiled in uncertainty due to the absence of definitive regulations and heightened scrutiny from federal entities. However, there's an undercurrent of optimism that the forthcoming U.S. presidential elections might usher in a more transparent and favorable regulatory climate for the crypto industry.

Brad Garlinghouse Changpeng Zhao Chris Larsen Gary Gensler Sam Bankman-Fried Binance Binance.US Kraken MetaMask