What is STON.fi?

STON.fi is first decentralized exchange (DEX) on TON blockchain. More specifically it is an Automated Market Maker (AMM). In this article we'll explore its features, tokenomics, how it works and much more.

What is STON.fi?

STON.fi is the largest protocol within the TON Ecosystem and the first decentralized exchange (DEX) on the Ton blockchain. With a total value locked (TVL) exceeding $130 million, STONfi claims to offer a combination of near-zero transaction fees, minimal slippage, a user-friendly interface, and seamless integration with TON wallets.

STON.fi's mission is to create an accessible and easy-to-use crypto exchange aimed at widespread adoption, particularly leveraging its connection to the extensive Telegram user base.

Source & Copyright: Ston.fi

The development of the platform is progressing rapidly. Notably, TON recently initiated The Open League company, which allocates $3 million in assets for tasks designed to encourage users to explore and utilize TON’s features. Participants need to acquire assets and exchange them via STONfi to complete these tasks.

How Does STON.fi Work?

STON.fi is a decentralized exchange (DEX) on TON blockchain. More specifically it is an Automated Market Maker (AMM). AMMs are a crucial part of the decentralized finance (DeFi) ecosystem. They enable the automatic and permissionless trading of digital assets using liquidity pools, unlike traditional markets that rely on direct interactions between buyers and sellers.

In this system, users contribute cryptocurrencies to pools that provide liquidity. These pools use algorithms to set the prices of tokens based on the ratios of assets they hold. When users wish to trade, they swap one token for another directly via the AMM, with prices determined by the pool's algorithm. This method allows AMMs to consistently offer liquidity for a broad range of assets.

STON.fi Services

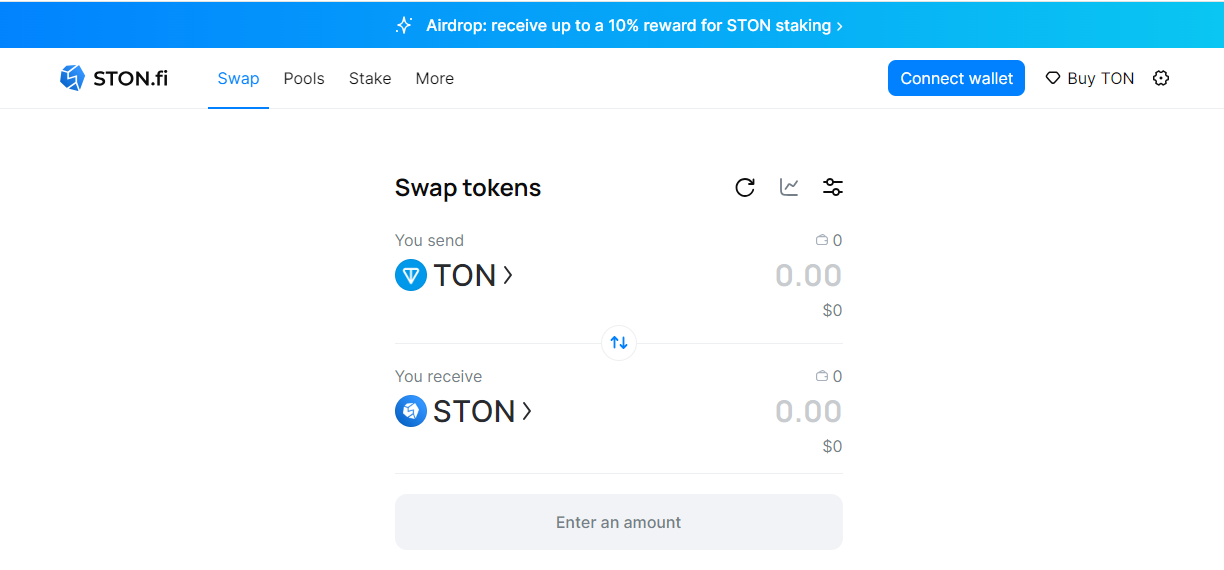

The primary service offered by STON.fi is the token swap, enabling users to exchange any token of their choice. A fee of 0.3% is applied to each swap on STON.fi, distributed as follows:

0.2% is allocated to liquidity providers as a reward, which helps to increase the pool’s size.

0.1% is directed to the StonFi protocol itself.

Source & Copyright: STON.fi App

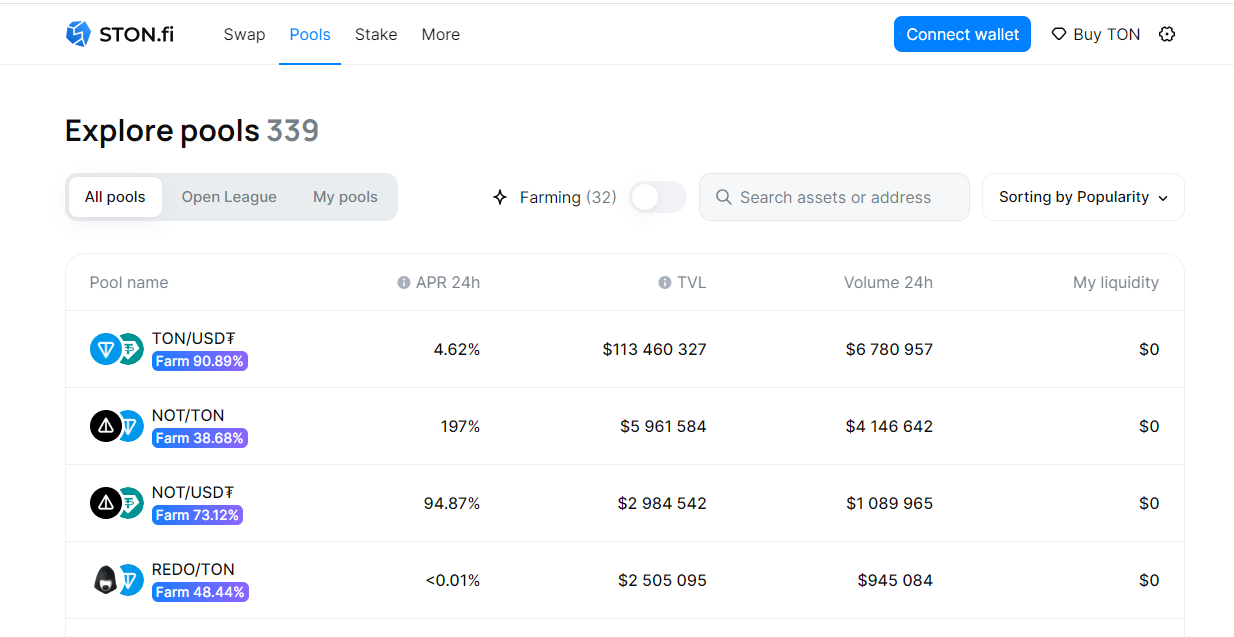

Additionally, users have the option to provide liquidity to STON.fi's pools and begin earning a portion of the transaction fees for each trade in that specific pair immediately. By supplying liquidity, users are issued LP tokens, which can be used to participate in farming. This involves staking LP tokens to earn further rewards. Notably, Ston.fi was the first protocol in introducing the farming feature within the TON ecosystem.

Source & Copyright: STON.fi App

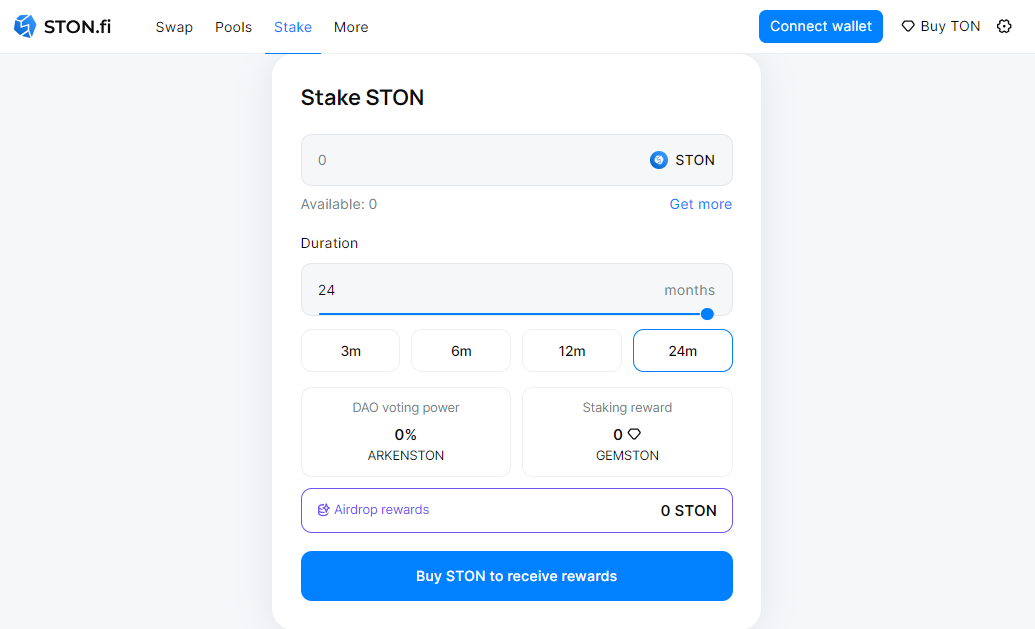

Furthermore, users can engage in staking on STONfi. Currently, there is an airdrop for those who stake STON, with rewards up to 10% of the staked amount. This limited-time offer is set to conclude on May 31. Additionally, participants who stake STON will have the chance to participate in protocol governance once the STON DAO is launched.

Source & Copyright: STON.fi App

STON.fi Supported Tokens

Currently, STON.fi supports mainly TON-based tokens and USDT. Supported TON tokens include NOT, TON, ARBUZ, PEPE, CATS, KONG, PUNK, BARO, and many others. However keep in mind that there is quite a lot of scams, as well as in the whole tone ecosystem, so be careful and DYOR.

STON.fi Tokenomics

STON is the the protocol’s utility token on the TON Blockchain, which is integrated into the protocol's main operations. Holders of the STON token are enabled to engage in governance through voting, facilitated by long-term staking. The STON token operates on a deflationary model with the supply capped at initial minting. The STON minter smart contract ensures no additional tokens will be minted in the future. The total supply of STON tokens will decrease over time as tokens are gradually burned. Moreover, the token holders might receive benefits such as reduced fees, which are determined through the DAO governance process.

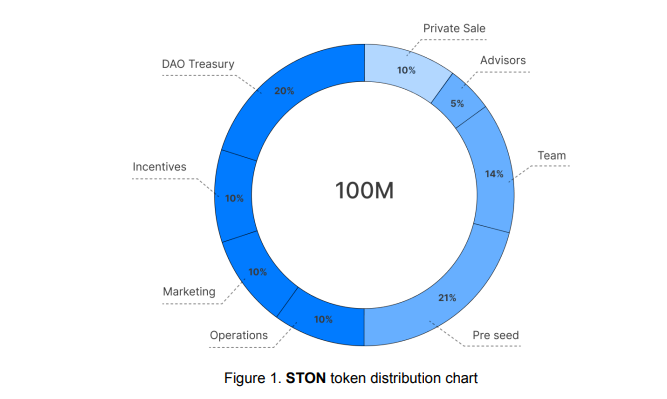

Initially, 100 million STON tokens have been issued. They are distributed as follows:

Source & Copyright: STON.fi Whitepaper

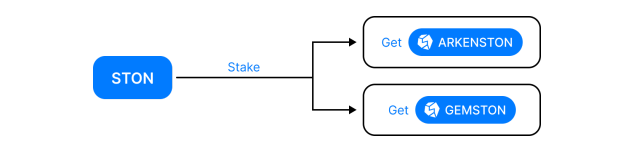

In addition, the protocol has introduced two specific types of tokens:

ARKENSTON: This is a soul-bound non-fungible governance token. When you stake STON, you receive an equivalent amount of ARKENSTON tokens, which are non-transferable and remain in your wallet. These tokens allow you to participate in the DAO governance, enabling you to propose, discuss, and vote on changes within the protocol. After the staking period of your STON tokens ends, you can burn the ARKENSTON tokens to fully retrieve your staked STON.

GEMSTON: This token is received similarly to ARKENSTON when you stake STON, but it differs in that GEMSTON is fungible and offers more flexibility. It allows you to sell, swap, or transfer the tokens to other users. The future trajectory of GEMSTON, including its development and circulation, will be determined by the DAO, providing holders the freedom to manage these tokens as they prefer.

Source & Copyright: STON.fi Whitepaper

STON.fi Roadmap

STON.fi is set to expand into a cross-chain protocol. The platform plans to integrate additional blockchains, including Polygon and other EVM-compatible chains, enhancing the STON.fi DEX framework and facilitating cross-chain interactions.

Other key plans include:

- Synthetic Asset Swapping: The platform will enable users to swap synthetic assets using an optimal path and stableswap invariant, tailored for high-volume trades. This method aims to reduce fees and eliminate liquidity constraints.

- DAO Governance: A DAO governance protocol will be introduced, allowing token holders to actively participate in decision-making processes.

- Limit Order Book: STON.fiwill be enhanced with limit order trading capabilities, permitting users to execute transactions at predetermined prices.

- Margin Trading: The platform will offer margin trading, allowing users to trade assets using borrowed funds from an AMM as collateral.

- Gasless Swaps: STON.fi plans to support transactions where fees can be paid with any token, thus removing the necessity for native tokens in transaction fees.

Investors and Partners

At present, details regarding the project team have not been disclosed. Similarly, specific information about the investors remains unavailable. However, notable partners collaborating with the project include 1inch, Tonkeeper, and Tonstarter.