Ethereum Launchpad for Beginners: What You Need to Know about Ethereum 2.0

Would you like to become a validator on Eth 2.0? This post explores everything you need to know about the Ethereum Launchpad, including its working, features, and current status.

Over the past few years, the Ethereum Foundation, DeepWork Studio, and Codefi Activate teams have been working on upgrading their system with some features, including a new launchpad. You may know this upgrade as Ethereum 2.0, and it seems like a great response to a lot of issues the Blockchain has faced thus far. If the upgrade works out, it will cement the Ethereum network's place on the current sustainability front in Blockchain.

If you are interested in trying out the new launchpad, then this article has you covered. We will look at the new system and how it works and answer some other questions you may have about it. But first, let us understand what the Ethereum Launchpad is.

What Is the Ethereum Launchpad?

So, first things first, what is a launchpad? You can think of it as an incubator for baby crypto projects—a decentralized, exchange-based space for new cryptocurrencies to gain initial funding and connect with interested communities.

Now, as part of the ongoing upgrade, the Ethereum Foundation has been working on its new Ethereum Launchpad. It’s a website that will enable you to create your own new crypto token on the network. However, the main bent of the launchpad is to enable you to become a validator and an even more effectual participator in the Ethereum network.

To do this, the upgrade is progressing through three main stages:

- The Beacon chain stage

- The Merge

- The Sharding

The Beacon chain stage was effected in 2020, introducing a replacement to the existing proof-of-work system. You may already be familiar with the environmental concerns associated with this more energy-intensive and less environmentally sustainable consensus mechanism. The new consensus system would now be the more sustainable proof-of-stake system, which means bye-bye to mining and hello to staking. Of course, randomness is a vital factor in staking systems, and that’s where the Beacon chain itself comes in.

The next thing to do was merge the new Beacon Chain with the existing mainnet, which still used the proof-of-work system. This process would make the unified network, now Ethereum 2.0, operate on the same proof-of-stake system and use the same coin. The merging was completed in September 2022, cementing Ethereum's push towards more sustainability. In fact, by dispensing with the mining mechanism, the network is estimated to see as much as a 90% drop in energy requirement.

However, aside from making Ethereum more sustainable, the merge has also set up the Blockchain for further upgrades, such as the upcoming sharding stage. While the merge was for energy efficiency, the sharding will make the network more storage-efficient by distributing storage.

Source and Copyright © Ethereum

Should I Choose the Ethereum Launchpad?

Naturally, with all the hype surrounding the new Ethereum launchpad, the question arises: should you even bother with it? Well, the answer to that is a Yes for a number of reasons, one or two of which we’ve already mentioned previously. When we discuss the pros and cons of the Ethereum launchpad, we will talk about some of its downsides you should consider. However, it bears pointing out that none of the disadvantages appear to trump the system's advantages, especially regarding sustainability. As such, Ethereum 2.0 and its launch pad make for a great choice.

Disclaimer. Not financial advice. Do your own research. Following these steps doesn't guarantee you an airdrop. Don't risk funds you can't afford to lose.

How Does Ethereum Launchpad Works and How to Use it?

Previously, we said the Ethereum launchpad and other upgrades would change the way the network operates in some significant ways. Of course, the third phase of the upgrade isn’t scheduled to complete until 2024. However, the stages that have already been completed introduce some new workings. So, how does the Ethereum blockchain work now, given all the completed improvements?

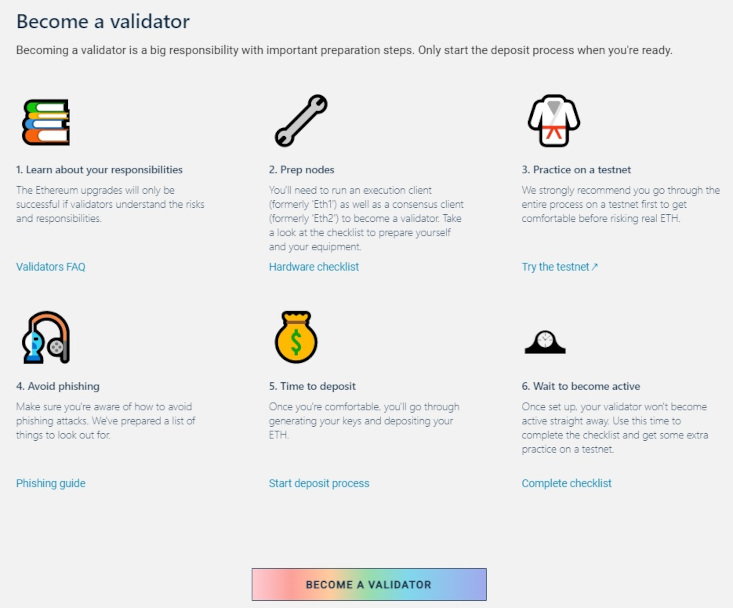

For starters, we have already met the Launchpad website and some of what it does. It will afford you access to a set of new and existing crypto projects, complete with their current performance and/or development status. From there, you can monitor and engage with them in various ways, including providing funding or buying them when sales begin. However, the main changes to the Ethereum Blockchain’s operation are in the security and proof-of-work systems.

On the launchpad, you have to generate a pair of validator keys, both public and private. These will allow you to launch your validator client, with the public one giving you access to your activity and stats, while the private one will be used for proposing and voting on new blocks. When the sharding phase completes, these two keys will also help generate your withdrawal keys and withdraw your Ethereum deposits and rewards. And as one of its sustainability measures, the system will generate these key pairs and phrases in a way that can be done in an offline and secure environment.

Then, there is the proof-of-stake consensus mechanism, where validators will stake part of their holdings. The validators can then go about their functions and be rewarded with new coins or penalized by losing their staked ones.

Source and Copyright © Ethereum

Statistics and Performance

So, how has the Ethereum blockchain been doing lately, what with the launchpad and other updates?

One of the most glaring developments is just how many people have been staking on the network since. The numbers have grown from 2.1 million in 2020 to 8.8 in 2021, 15.9 in 2022, and an all-time high of 19.2 in 2023. This represents a steady growth rate since staking was introduced in 2020, with a 13.3% month-on-month growth rate since November of that year. Additionally, while there is now an ‘unstaking’ process for withdrawals, staking is still outpacing withdrawals. Currently, the demand for staking is so high that, as of May 2023, up to 50,000+ queue up to access their network.

Another major development concerns the blockchain’s energy usage after the implementation of proof-of-stake. According to the most reliable estimates, the energy consumption across the entire global Ethereum network is 0.0026 TWh. This is several orders of magnitude above the 78 TWh from the Proof-of-work days.

Ethereum Launchpad Pros and Cons

We’ve talked about whether you should try the Ethereum 2.0 Launchpad before now. Here, we want to look at not just the reasons you should try it but also some considerations you should take into account.

Pros

On the bright side, here are the advantages of the new system.

- More energy-efficient solutions are important now, especially with the conflict in Ukraine and the aftermath of COVID-19 disturbing the global energy supply. One of the many benefits of the proof-of-stake system is that it does not require energy-guzzling mining rigs as proof-of-work does. It rewards staking and not mining power, requiring way less of the latter to work.

- The sharding stage will see the implementation of a system where all 5 quintillion gigabytes of the entire blockchain don’t have to be stored in each node. Instead, storage be more distributed without killing data availability.

- It’s inadvisable to step into your role as a validator on the network without being familiar with things like the deposit contract, community rules, rewards, penalties, staking types, or the general nature of the system. Fortunately, the system serves not just as a launchpad for validators but also as an educational space with enough resources to inform you.

- The boost to trust within the community is another great advantage the Ethereum Launchpad has. Since every node in the system is an individual with a stake in the whole thing, users have more incentive to be honest actors. After all, they stand to lose part or all of their stake if the other nodes sniff out any dishonest dealing.

Cons

These are the problems of the launchpad as it exists now.

- At any point in time, the launchpad has thousands of validators in the queue to be signed in, so you may have to wait a long time.

- Not all of your earnings will necessarily return to you, as you would have to pay some staking fees to participate.

- Staking is more fruitful long term, so you may have to hold on for a while.

FAQs

Is staking the same as a validator?

All validators on a blockchain are stakers, but not all stakers are validators. Solo stakers generally have to put in a considerable stake and participate in the network, while pool stakers can stake smaller amounts and need not be validators. Pool stakers also have to pay some fees to keep their validator clients operational.

What Is the Reward of an Ethereum Validator?

Currently, the network rewards validators with interest on their staked holdings. This reward is in Ether and is based on their active engagement in the network. This is also referred to as the ‘staking yield,’ with the annual percentage staking yield currently being 5%.

Can I make money as a validator?

If you participate as a validator on the Ethereum 2.0 blockchain, you will be able to make money in the form of Ether-denominated interests. This interest is generally higher the more you stake, and the relevant percentages, rules governing rewards, and penalties (in Ether deduction) for dishonest practice will be available on the Launchpad website.

How Much Does an Ethereum Validator Make in 1 Year?

Current staking yields for validators on Ethereum 2.0 stand at about 5% annually. Although, past history gives sufficient reason to suppose this yield will increase in the future.

Do Validators Get Gas Fees?

Validators are who the gas fee system exists for in the first place, as this fee is another incentive to sustain their participation. As a validator on the Ethereum blockchain, you will also be rewarded in this manner, and the fee can be high or low, depending on the specifics of any given validation.