Ethereum's Shanghai Upgrade: Should Investors Expect the Unstaked ETH Flood

The Ethereum community is gearing up for the highly anticipated Shanghai upgrade, set to take place on Wednesday at 22:27 coordinated universal time (6:27 p.m. ET). The Shanghai upgrade will enable validators to withdraw staked ether (ETH) that have been locked up

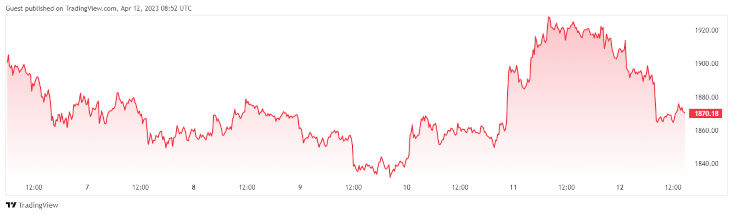

As the upgrade approaches, the price of Ethereum has experienced a 2,5 % loss, falling below $1,900 on April 11, meanwhile, Bitcoin is slightly down losing 0.3% over the last 24 hours after a sharp rise on Monday. SOL remained in the green, while BNB, ADA, DOGE and XRP lost ground from Monday night. So-called Liquid Staking Tokens also decreased in value. Lido's LDO declined as much as 10%, while Rocket Pool's RPL dropped 9%.

Source and Copyright: © TradingView

Despite the potential for staked ETH to enter circulation after upgrade, it is unclear whether most of that amount will be unstaked in the long term, and whether a large amount will be unstaked immediately. Currently, 18 million ETH is staked, according to the Ethereum Foundation. That amount is worth about $34 billion and is a significant portion of Ethereum’s $227 billion market cap. If a significant amount of ETH enters circulation, the upgrade could naturally affect prices.

Despite the opinion that the upgrade to have a significant impact on the cryptocurrency market, on-chain analytics firm Glassnode predicts that the Shanghai upgrade will have minimal impact on the price of ETH. Glassnode estimates that only 170,000 Ether, or less than 1% of all ETH staked on the Beacon Chain, will be unlocked in the first days after the hard fork.

Even if all the rewards and stake are withdrawn and sold, the sell-side volume would still be within the range of the average weekly exchange inflow volume. Glassnode also expects a large amount of ETH to be withdrawn from the crypto exchange Kraken and lending platform Celsius but says it is unlikely to happen immediately after the Shanghai upgrade.

Global financial firm Fidelity Investments is also of the view that the Shanghai upgrade won't have too much of an impact on ETH's price action. It said in an April 5 report that "selling pressure will be muted due to the likelihood of partial withdrawals being re-staked as well as the length of time the withdrawals will take."