Solana's Advances Failed to Ease the SOL Correction

Solana Mobile saw record pre-sales of its new smartphone, and Solana became a popular network for stablecoins, noting $300 billion in sales. The positive sentiment in the ecosystem failed to impact SOL's growth. How will the asset perform in the near term? Does it have a chance to overcome the $100 mark.

What happened in the Solana ecosystem?

Solana Mobile confirmed that pre-orders for the new version of its crypto smartphone surpassed the 30,000 mark in 48 hours, a record for the company. The company's first smartphone, the Solana Saga, struggled with low sales for a long time and essentially became the ecosystem's most failed product until its owners discovered Solana-based tokens stored on the device were worth more than the smartphone itself. This not only caused a surge in demand for the smartphone, but also made the developers think about creating a new version of the product. The second version of Solana Saga is designed to eliminate the mistakes of its predecessor. The smartphone will retain the distinctive features of Saga, integrate a cryptocurrency wallet and a decentralized app store. This strong reaction to the new product from Solana indicates a positive market sentiment. However, the real impact on SOL pricing can only be seen in the long term.

30,000 preorders in the first 30 hours.

— Solana Mobile 2️⃣ (@solanamobile) January 18, 2024

It's small step towards realizing our goal of making web3 universally accessible.

Your faith in our vision means the world to us. We're just getting started 🔥

Preorder now 👉 https://t.co/nYR9apGGIT https://t.co/HUYKYd1aHF

With Solana gaining attention with its recent increased activity, the network boasts a record-breaking volume of stablecoin transactions. In January, Solana became a popular network for stablecoins, reaching an all-time high of $300 billion. This led to Solana's market share growing to 32%. By this metric, the network caught up with Ethereum, whose share is 33%. This impressive growth in stablecoin transactions can be attributed to the addition of the new stablecoin, USDP. In addition, the network's TVL reached $1.36 billion, which is the highest since September 2022, as reported by DeFiLama.

🚨 BREAKING BIG: Solana surpasses $300 billion in monthly stablecoin transfer volume - an all time high. pic.twitter.com/HJpp7xMql2

— SolanaFloor | Powered by Step Finance (@SolanaFloor) January 21, 2024

SOL price and its outlook

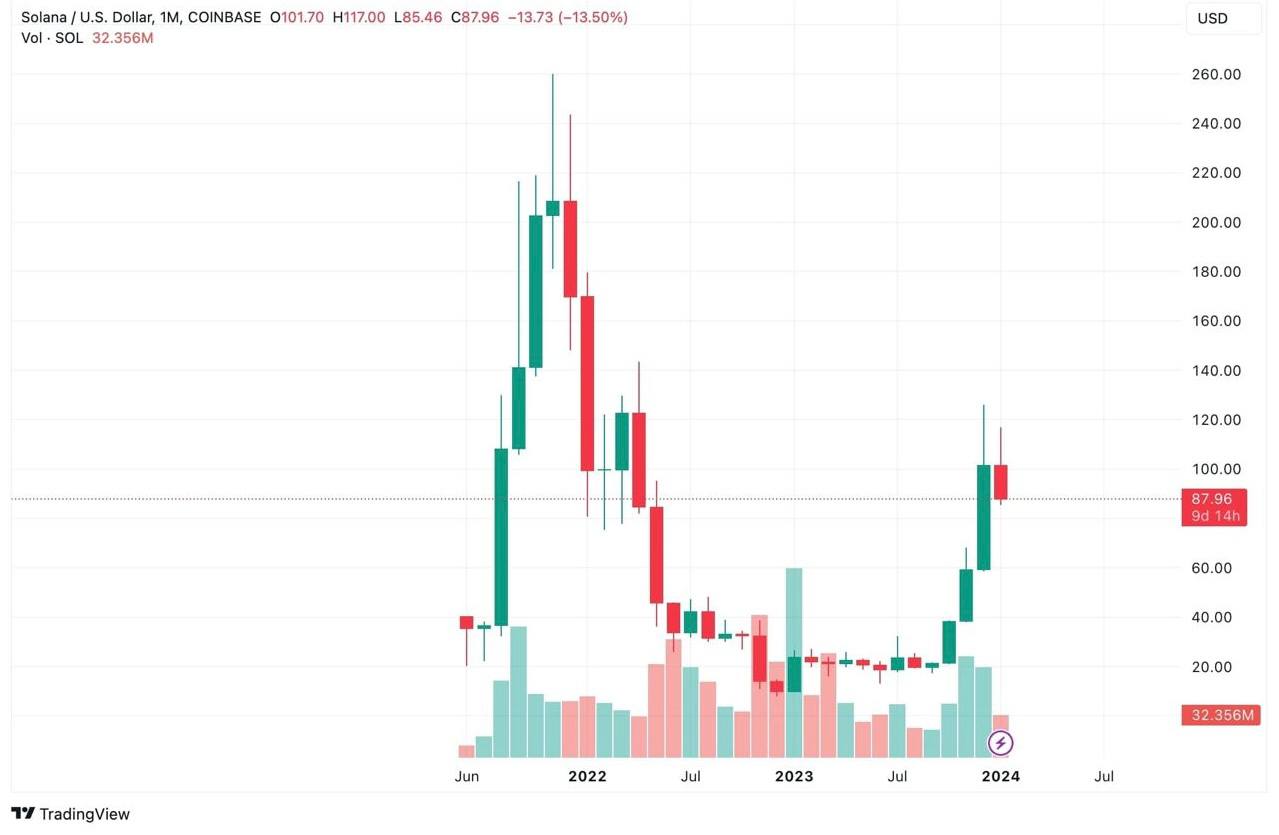

Yet, despite such solid advances in the ecosystem, it hasn't helped the SOL price to grow. After the asset's stunning bullish rally in December 2023, the SOL price continues to decline. The December rally is mainly due to FOMO over the Solana-based SPL token launches. This influenced the sharp rise of other tokens in the ecosystem. However, with the start of the new year, there was a noticeable pullback, which was mainly due to over-optimism in anticipation of the airdrop of new tokens and the launch of dApps. The effect of new apps emergence turned out to be short-lived.

As a result, after a long struggle, SOL failed to overcome the resistance level of $100, and now continues its decline.

At the time of writing, SOL was trading at $87.96, having lost 5.45% of its value over the day. Market participants attribute this fall to the bankrupt crypto exchange FTX, which liquidated part of its SOL assets worth $4.2 billion.

Source and Copyright © TradingView

Volatility and uncertainty on the market indicate bearish dynamics of Solana. Potentially, the asset may fall to $80, and if selling pressure continues, to $60.

Everything may change if the buyers gain significant momentum and break through the resistance level of $110. If this happens, SOL will be able to retest $121.

From a technical point of view, most indicators are currently in neutral, indicating market uncertainty.

Still, some experts are more optimistic about SOL. Taking into account the position of indicators on the price chart, the hype around Solana ETF and possible easing of the Fed policy, they predict the growth of the asset up to $200 by March.

For fun, here's a look at the SOL price prediction given by artificial intelligence. Grok, an AI developed by Elon Musk's company xAI, has given a forecast for SOL by the end of 2024. In a best-case scenario, Grok expects SOL to rise to $125-$150. In a negative one, it will fall to $60-$80.

This is not a 100 percent statement. The cryptocurrency market is very volatile and unpredictable. Therefore, investors should do their own research and remain cautious.