What's Next with Bitcoin's Price and Can We Call the Market Bullish Right Now?

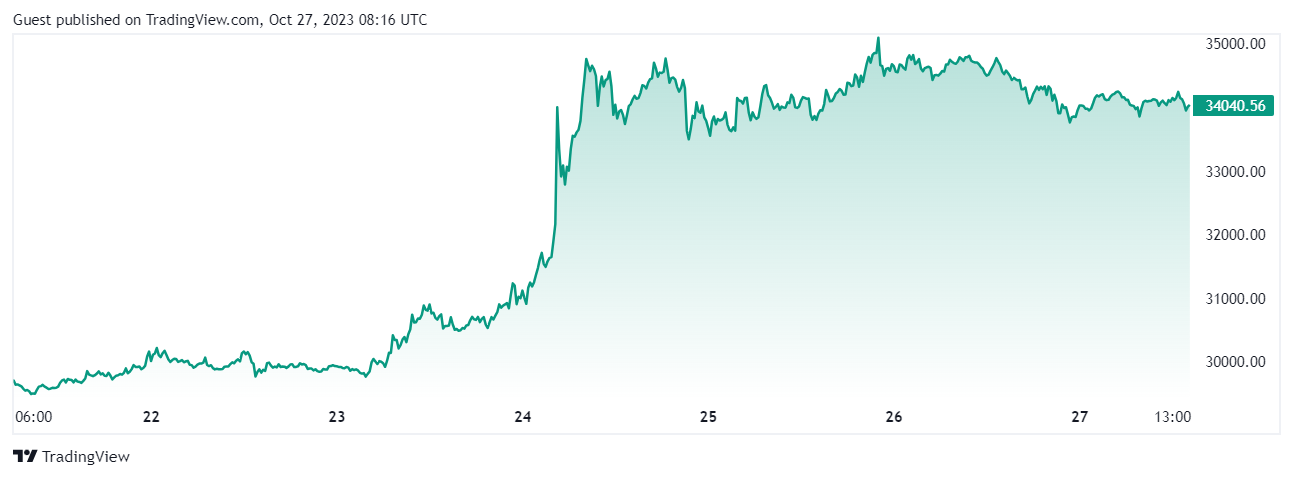

Bitcoin is on the rise once more, drawing in investors seeking rapid returns. Although it has slightly rebounded after almost touching the significant $35 per Bitcoin mark, the leading cryptocurrency has made notable gains. Since mid-October, its price has climbed from the $26–27 range to between $33–34, marking an all-time high within the past eighteen months. Together with market experts, Cryptonica is delving into the potential future movements of Bitcoin's price, aiming to determine if the much-anticipated bull market is near.

Why Is the Price of Bitcoin Rising Now?

Bitcoin's value soared to $35,000 on October 24, a peak not seen since May 2022, fueled by optimism that BlackRock, the world's largest asset manager, is on the verge of receiving a green light from the U.S. Securities and Exchange Commission (SEC) for its Bitcoin ETF application.

Source & Copyright: © TradingView

This excitement was due to the fact that the BlackRock Bitcoin exchange-traded fund made its appearance on a list managed by the Depository Trust and Clearing Corp. (DTCC), a Nasdaq-operated clearing house for stocks and ETFs. DTCC provides Nasdaq with post-trade clearance, settlement, custody, and information services. This move has been interpreted by many as a positive sign, hinting that SEC approval might be drawing nearer.

BlackRock, which applied for a Bitcoin spot ETF in June, is still awaiting approval. Being the world’s top ETF provider, managing trillions in assets, a Bitcoin ETF from BlackRock would lend significant legitimacy to the cryptocurrency.

Prior to the Bitcoin price surge, the court had also mandated that the SEC reevaluate Grayscale’s application to create a spot bitcoin exchange-traded fund (ETF), a goal Grayscale has been pursuing since 2021. This came after Grayscale initially took legal action against the regulatory body, challenging its previous refusals to consider their application. Currently, Grayscale's trust holds assets exceeding $19 billion.

The Crypto Fear and Greed Index has simultaneously escalated, reaching levels last witnessed in November 2021 when Bitcoin peaked at over $69,000. According to Coinglass, the Fear and Greed Index currently stands at 70, signaling a prevailing greed sentiment among market participants.

Source & Copyright: © Coinglass

What Will Happen to the Price of Bitcoin: Experts’ and Crypto Market Influencers’ Opinions

The opinions of crypto market experts and influencers regarding the future price of Bitcoin vary. Still, most of them believe that the price of Bitcoin will rise, especially after the 2024 halving and the approval by the US Securities and Exchange Commission (SEC) of a spot Bitcoin exchange-traded fund (ETF). Experts also believe the long-awaited bull market has arrived and the race has begun. Let's find out what the powerful of the cryptocurrency world are saying in the media and their social networks.

For example, JPMorgan, a large American financial conglomerate, expects that due to the future halving, the price of Bitcoin will reach $45,000 by 2024. Financial corporation Standard Chartered has given a forecast according to which the price of Bitcoin could reach $50,000 by the end of 2023 and $120,000 by the end of 2023. by the end of 2024. Hedge fund Pantera Capital predicts that the price of Bitcoin before the halving will be $35,000, and after it – $148,000.

Fundstrat Global Advisors co-founder Tom Lee believes Bitcoin will reach $180,000 by the end of 2024, especially after the approval of the Bitcoin ETF. Former BitMEX CEO Arthur Hayes predicts that the price of Bitcoin will reach $70,000 by the end of 2024. The head of ARK Invest, Cathie Wood, predicts that Bitcoin will reach $1.5 million by 2030 due to the importance of the transition to digital currencies in the not-very-stable world of traditional ones.

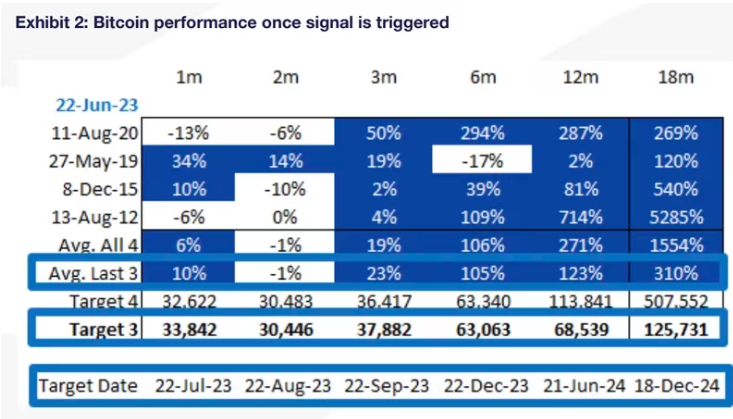

The head of the research department of the crypto-financial service Matrixport, Markus Thielen, predicted that by the end of next year, Bitcoin will cost $125,000. The forecast is based on average data from previous halvings. These calculations show that Bitcoin will rise to $125,731 by December 18, 2024.

Source & Copyright: © Matrixport Technologies

As for influencers, their forecasts are also quite positive. Crypto blogger Crypto Rover is confident that in 2025 Bitcoin will cost $110,420. With this prediction, he responded to a post by another famous crypto-influencer, The Bitcoin Therapist, about the price of Bitcoin. Educator and podcaster Stefan Livera estimates Bitcoin at $500,000–$600,000 by the end of 2025, according to the same “Bitcoin Therapist.”

In his X, Trader Michael van de Poppe predicts that the price of Bitcoin will reach $50,000-$55,000 in 2024 ahead of the halving. He also congratulates his readers for surviving the bear market and now heading into the bull cycle.

In August, the famous cryptocurrency blogger PlanB surveyed subscribers about the future of Bitcoin; 19,088 subscribers responded. The majority of those participating in the survey (59.6%) believe that after the halving the bull market will return. Only 17.3% of people do not believe this, and the remaining 22.9% answered that they do not know for sure.

Predicting the price of Bitcoin can be difficult, and opinions on the matter may vary. Therefore, if you are considering investing in cryptocurrency, it is crucial to remember that certain risks in this industry exist. Thus, you should consider the speculative nature of the assets, as well as any regulatory issues, including legality in your country.

When Will Crypto Winter End?

Cryptowinter describes a prolonged period of decline in the value of cryptocurrencies. The first cryptowinter occurred at the end of 2017, when Bitcoin reached its all-time high of $20,000. However, the value of Bitcoin rose again, reaching its highest point of $64,000 in April 2021. Throughout 2018, the value of Bitcoin continued to fall and many people lost faith in cryptocurrencies. The sudden crash of the cryptocurrency market occurred due to the decline of the FTX exchange, ending its explosive growth.

Source & Copyright: © TradingView

Cryptowinters often have a prolonged growth period. Prices then fall, causing losses to investors. Some experts anticipate that cryptowinters will soon come to an end and a new bull cycle will begin, possibly through the approval of Bitcoin ETFs by key investment firms in the US.

Bitcoin's recent sharp increase does not guarantee the end of the cryptowinter, as the bearish pattern may persist for a while. As the number of cryptocurrency users increases, the cryptocurrency market is likely to become less volatile. This is because a larger user base results in a more stable demand for cryptocurrencies. This, in turn, could result in shorter and less frequent instances of cryptowinters and substantial price surges. However, it is important to note that cryptocurrencies are still high-risk investments and trying to predict their future is very challenging.