Homepage:

https://www.curve.fi/

| https://curve.eth.link/

Twitter: curvefinance

Telegram: curvefi

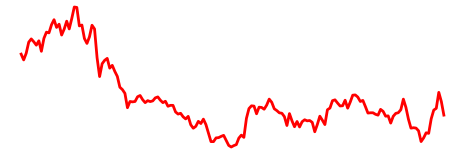

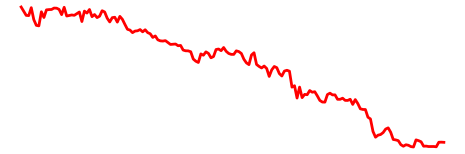

Curve DAO (CRV) Price

CRV

$0.579829

Market cap

790,457,128.0

Total volume

103,557,884

Circulating supply

1,363,250,528

Total supply

2,273,757,283

Take the 3CRV pool as an illustrative case. This stablecoin collective pools together DAI, USDT, and USDC. The distribution of these coins within the pool is determined by market supply and demand dynamics. Contributing a coin that is underrepresented in the pool's ratio can grant an investor a larger share of the pool. This imbalance often presents lucrative opportunities for arbitrage.

Additionally, Curve Finance extends its support to tokens that generate yield. A notable collaboration with Yearn Finance led to the creation of yUSD pools, incorporating yield-bearing variants like yDAI, yUSDT, yUSDC, and yTUSD. Engaging in these pools not only provides returns from the tokens' inherent yield but also from the transaction fees collected by the Curve pool. Further augmenting the incentive to provide liquidity, participants can also earn farming rewards through CRV tokens, thus offering a tri-fold revenue stream.

Last news

09/24/2024

09/24/2024

09/24/2024

09/23/2024

09/23/2024