TrustPad Launchpad Guide for Beginners

Learn about TrustPad, a pioneering launchpad for secure crypto projects, and explore its unique features, including the TPAD token.

-

Table of Contents

- What Is TrustPad?

- Should I Choose TrustPad Launchpad?

- How Does TrustPad Work?

- Statistics and Performance

- So, what do you need to participate in IDO on TrustPad?

- More Closely: How to Get Whitelisted on IDO: TrustPad Tiers Rules

- Joining an IDO on TrustPad Step-by-Step Guide

- The TPAD Token

- Pros and Cons of TrustPad

- Frequently Asked Questions

With the advancement of crypto technology, you might have heard of ICOs (Initial Coin offerings) and Launchpads. In this article, we are going to provide an in-depth overview of one of platforms known as TrustPad Launchpad.

It is a platform designed to support the launch, funding, and development of blockchain projects. In other words, it helps the team behind early-stage crypto projects raise funds to support platform developments.

What Is TrustPad?

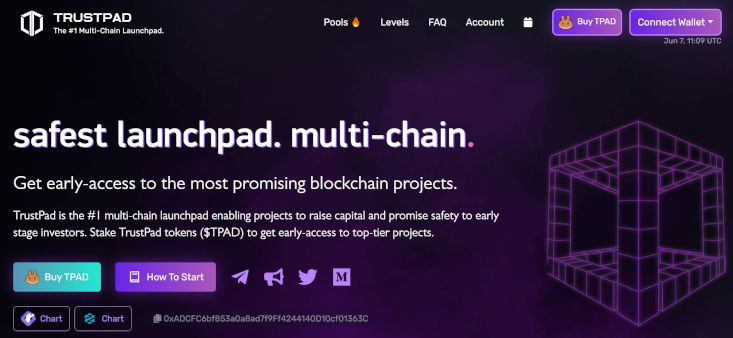

TrustPad LaunchPad is an innovative blockchain platform that facilitates the inception and growth of new crypto-oriented projects. Recognized as a permissionless and user-friendly platform, TrustPad notably enables IDO (Initial DEX Offering) capital raising, offering a secure avenue for early-stage investments in the ever-evolving crypto market.

A unique feature of TrustPad LaunchPad is its independence from centralized exchanges, which fosters a free, open market for the trading and deposit of the platform's native token. This independence sets TrustPad apart, making it a preferred platform for numerous crypto enthusiasts worldwide. Another key advantage of TrustPad is its adeptness with cross-chain technologies, permitting simultaneous project execution on diverse networks such as Solana and Binance Smart Chain.

TrustPad's commitment to the global digital community is evident through the advantages the platform offers. Users are granted early access to review and use upcoming products, catering to requests for firsthand experience and early adoption. By effectively leveraging the platform, users and investors alike can tap into the potential of cutting-edge crypto projects, contributing to and benefiting from the thriving digital economy.

Should I Choose TrustPad Launchpad?

Note that this is not a financial recommendation or advice to use this particular platform. We are simply providing you with detailed information and it is up to you to make your own choices.

TrustPad LaunchPad presents itself as a compelling option in the thriving market of crypto launchpads. There are numerous features that differentiate it from other platforms and reinforce it as a strong contender in the world of blockchain technology.

At the core of the TrustPad platform lies its commitment to create a secure environment for the trading and launch of tokens. This dedication manifests in the form of smart contracts, which include rules and regulations for initiating token sales. These contracts provide features like token lock-ups, allocation limits, and vesting schedules. These clauses are devised to foster transparency and credibility, making TrustPad a popular platform among investors in the digital world.

TrustPad also offers a unique system known as the Trustscore. This system evaluates and ranks projects based on various factors, such as the team's reputation, project viability, and the extent of community engagement. This feature ensures investors have access to top-quality projects in the IDO (Initial DEX Offering) market.

Another important feature that sets TrustPad apart is the decentralized incubator system. This is a valuable service especially for novice investors, offering mentorship, advisory support, and technical and marketing assistance during the initial stages of a project launch. This feature helps to raise funds and gain traction in the competitive blockchain ecosystem.

TrustPad has been designed with an intuitive user interface, encouraging participation from users worldwide. This user-friendly interface facilitates smooth navigation for both seasoned investors and those new to the crypto space. It's an attribute that further solidifies TrustPad's position as a good platform for token trading.

Moreover, TrustPad's native token adds to the overall appeal of the platform, with its inherent benefits and functionality in the ecosystem. Additionally, it is also known for its strict investor protection policies, such as the Know Your Customer (KYC) and Anti-money Laundering (AML) procedures. These processes ensure that only verified and credible participants can invest in the token sales process, thereby reducing the potential for fraudulent activities and boosting investor confidence.

How Does TrustPad Work?

TrustPad functions in a methodical and transparent manner to facilitate the launch and growth of blockchain projects. Here's a step-by-step guide on how TrustPad works:

1. Create an Account

The first step is to register an account on the Platform. This step involves providing necessary details and going through the sign-up process. This ensures that users have their unique account to manage their activities.

Source and Copyright © Trustpad

2. KYC Process

After account creation, TrustPad mandates a Know Your Customer (KYC) process. This process verifies the identity of the user, aligning with global regulations to prevent fraudulent activities. It is an essential step to ensure secure and transparent transactions.

3. Explore Projects

Once the account setup and KYC process are complete, users can explore the various projects and startups listed on the platform. This phase often involves thorough research, as it's vital for users to understand the project details, the team's expertise, and potential returns before participating.

Source and Copyright © Trustpad

4. Choose a Project

After exploring, you can choose a project which interest you the most. TrustPad offers a diverse range of projects, from blockchain tools to decentralized games. Selecting a project is based on the user's interest and investment strategy.

5. Participate in Token Sales

After selecting a project, users can participate in token sales or IDOs (Initial Dex Offerings). Participation involves committing a certain amount of money to buy tokens related to the chosen project. Here are detailed instructions on the official website.

Source and Copyright © Trustpad

6. Transaction Confirmation

Once users have completed their participation, they'll receive a transaction confirmation. This serves as proof of their involvement in the token sale.

7. Track Progress

Finally, users can track the progress of the project and their investments through their TrustPad account. TrustPad's transparent protocols ensure that every transaction detail and project progress is clearly visible to the investor.

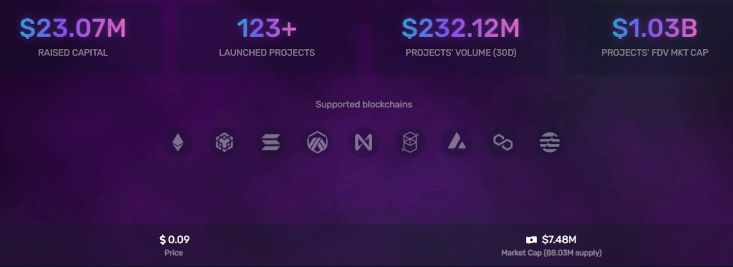

Statistics and Performance

According to the statistics from cryptorank.io, TPAD ranked 10th on the list of crypto platforms. So far, TrustPad has raised $13.88 million in investments with an average ROI of 18.75x. The performance of TrustPad so far has been quite good.

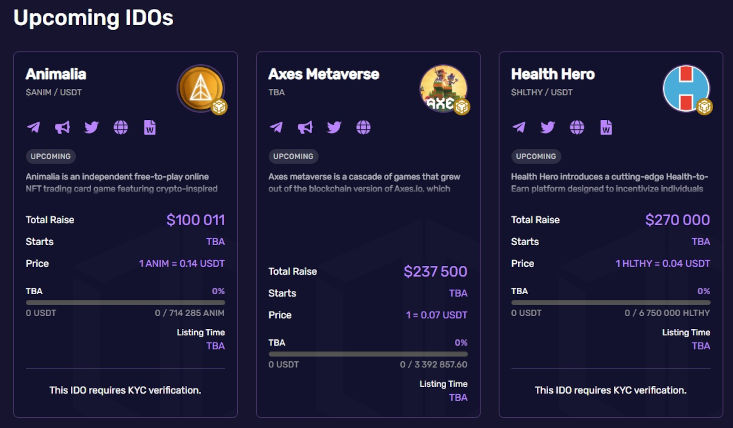

As per the website of TPAD, 10 NFTs and 126 Crypto IDOs have been done since its inception in 2021. Here are a few of the recent successful IDOs on TrustPad Launchpad.

- Mizar (Total raised: $ 280,000, ATH ROI 2.35x), Listed on March 09, 2023

- Honeyland (Total raised: $ 142, 502, ATH ROI 3.45x), Listed on March 16, 2023

- PlayZap (Total raised: $ 270,001, ATH ROI 1.22x), Listed on April 19, 2023

- Finblox (Total raised: $ 189, 962, ATH ROI 4.09x), Listed on May 18, 2023

- FitBurn AI (Total raised: $ 100,001, ATH ROI 2.02x), Listed on May 15, 2023

So, what do you need to participate in IDO on TrustPad?

To participate in an Initial Dex Offering (IDO) on TrustPad, there are several key factors and requirements you need to consider. The first essential requirement is having a compatible crypto wallet. This wallet is your digital bank account, where you'll store, manage, and transact the tokens involved in the IDO. TrustPad provides a list of recommended wallets that can seamlessly integrate with their platform, making the process smoother for you.

TrustPad, being a platform dedicated to transparency and credibility, often mandates whitelisting for some IDOs. The whitelisting process involves providing comprehensive details, such as your wallet address, full name, residential information, and more. After KYC requirments are met and approved, you can gain access to participate in IDOs of your interest.

Token allocation on the TrustPad platform is another aspect to comprehend. Some projects might impose a cap or limit on the minimum and maximum contribution allocation, so you'll need to align your investment strategy accordingly to purchase in the IDO at the specified price.

Before the IDO, you might need to swap your base currency, whether Ethereum or Binance Coin, to acquire your chosen tokens. This swapping usually happens at a decentralized exchange (DEX) or through any other swapping mechanism recommended by TrustPad.

Lastly, timing is a crucial factor when participating in TrustPad IDOs. Each IDO has a specific start and end time, and you need to carry out your activities within this specified timeframe. Failure to act within the set window could result in a lapse, and you would have to wait for the next IDO to participate. So, being timely and prepared is vital in the fast-paced world of IDOs on TrustPad.

More Closely: How to Get Whitelisted on IDO: TrustPad Tiers Rules

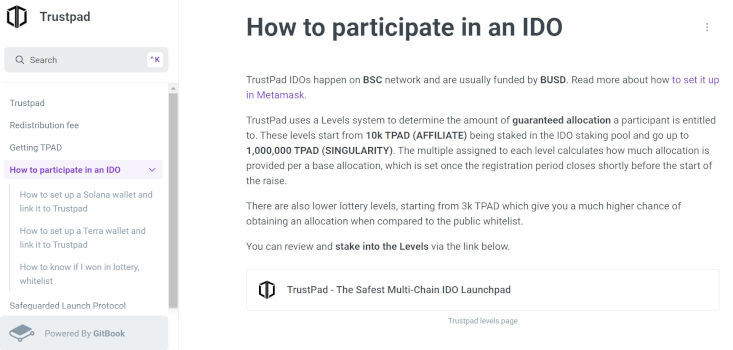

At TrustPad, users can enjoy the luxury of getting whitelisted on IDO. There are certain rules and levels allocated in the shape of various tiers. The users are divided into as many as 11 tiers, depending on the number of TPAD tokens they have in their wallets. To be eligible for each assigned level, the user must have to stake their tokens according to the set benchmark.

Two subcategories are allocated in the Lottery section. 3000 TPAD tokens are required for the Chance Tier. It has a 20% chance of winning. Similarly, 6000 Tpad tokens are required for Prospect Tier. It has 30% of winning.

Guaranteed levels are allocated to three subcategories. 10,000 Tpad tokens are required for the Affiliate tier. It has a 2x chance of winning. Similarly, 15,000 TPAD tokens are needed for the Member tier. It has a 4x chance of winning. 25,000 TPAD tokens are required for the Club tier which has a 7x chance of winning.

"All-Access Guaranteed" (AAG) levels give guaranteed allocations also in the strategic, private, and seed sales. There are six subcategories in the AAG. i.e, Associate, manager, executive, chief, partner, and orbit with a requirement of 45,000 TPAD, 65,000 TPAD, 90,000 TPAD, 120,000 TPAD, 150,000 TPAD, and 185,000 TPAD respectively, in the wallet.

The last category is Super All Access Guaranteed. They have some special benefits for the future. There are six sub-categories of Black, Jet Black, Obsidian, Thermosphere, Outer Space, and singularity with requirements of 250,000 TPAD, 375,000 TPAD, 500,000 TPAD, 625,000 TPAD, 750,000 TPAD, 1000000 TPAD. To get one of the SAAG levels, the user must have staked at least 60 days to be eligible.

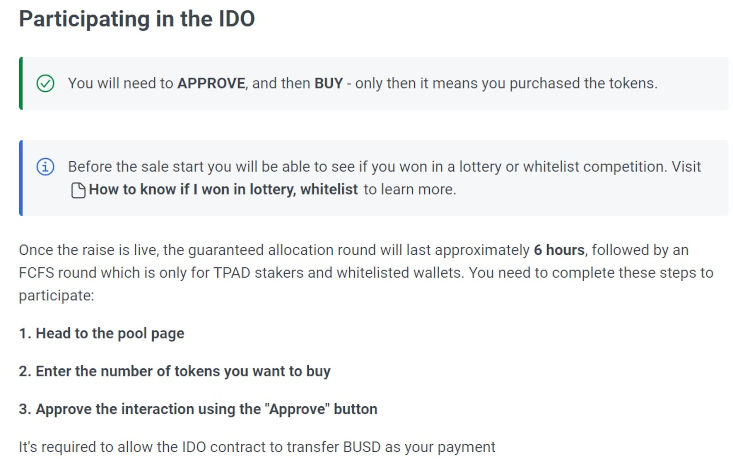

Joining an IDO on TrustPad Step-by-Step Guide

Joining an Initial Dex Offering (IDO) on TrustPad is a process that involves four crucial steps. Let's delve into each one of them.

Source and Copyright © Trustpad

Step 1: Set Up Your Wallet

The first step towards participating in an IDO on TrustPad involves setting up a compatible crypto wallet. This wallet acts as your digital vault for storing, managing, and transacting the tokens. TrustPad recommends a list of wallets that can easily integrate with their platform, offering a seamless user experience. Choose a wallet from this list, create an account, and ensure it's ready to accept and manage the tokens you plan to buy in the IDO.

Step 2: Whitelisting

As explained previously whitelisting is an important step where you need to provide detailed personal information to TrustPad. This process ensures transparency and credibility in your transactions and is required for some IDOs on TrustPad. After submitting details like your wallet address, name, residential information, and more, TrustPad verifies the information, and once approved, you gain permission to participate in the IDO.

Step 3: Understand Token Allocation and Prepare for Swapping

Once whitelisted, you need to comprehend the token allocation rules for the particular IDO. Some projects might enforce a cap on the minimum and maximum contribution, which you need to adhere to while purchasing tokens in the IDO. Additionally, prepare for swapping your base cryptocurrency (like Ethereum or Binance Coin) to acquire the tokens of the project you're interested in. The swapping usually takes place at a decentralized exchange (DEX) or through any other mechanism recommended by TrustPad.

Step 4: Participate within the Specified Timeframe

Lastly, remember that each IDO on TrustPad comes with a specific start and end time. Ensure you conduct all your activities within this timeframe. Any delay could result in a lapse, making you wait for the next IDO to participate. Staying timely and prepared is of utmost importance when joining an IDO on TrustPad.

The TPAD Token

The Tpad token holds a central role within the TrustPad ecosystem. As the native token of TrustPad, it's a crucial asset used to fuel various transactions and operations on the platform. It serves as the primary currency in Initial Dex Offerings (IDO's) hosted by TrustPad, where users require Tpad tokens to participate and purchase the newly introduced tokens. This means the token isn't merely a passive asset but a key component that facilitates active involvement within the TrustPad platform.

In addition to driving token sales, Tpad tokens also unlock other services and features in the ecosystem. For instance, users can use them to provide liquidity to the decentralized exchange (DEX) supported by TrustPad, thereby bolstering the robustness and efficiency of the overall platform.

Moreover, owners of Tpad tokens have the privilege to participate in platform governance, wielding their voting rights to shape the trajectory of the platform's development. This could include influencing decisions on new features, project listings, and overall platform direction. Thus, the Tpad token empowers its holders with both economic and political influence within the TrustPad ecosystem.

Pros and Cons of TrustPad

Pros:

- The website is user-friendly, and Easy to navigate for both professional and novice investors.

- Support Multi-chains including Binance Smart Chain, Ethereum, Cardano, Polygon, and Solana.

- TrustPad is reliable and has credibility in the crypto platforms.

- Multiple tiers, Tpad Tokens, and the transparent ranking system is winning the confidence of the investors participating in the crypto market.

Cons:

- The initial investment is heavy due to the cap of a minimum 3000 TPAD Token requirement.

- The investment procedure can be time-consuming due to the different steps to initiate before participating in IDOs

- Privacy-oriented users might be reluctant to go through the verification process.

Frequently Asked Questions

Is TrustPad Safe?

Yes, TrustPad is considered safe, implementing robust blockchain security, stringent vetting for projects, and thorough KYC procedures to protect investors.

What is FCFS?

FCFS stands for "First Come, First Served." In the context of crypto or tech, it often refers to a system where services or products are provided to users in the order that they request or apply for them.

Can a user unstake after each IDO?

After a user stake, the tokens are locked for a specific period. This timeframe varies from 7 to 1095 days, depending on your pool. The tokens are unlocked every time the user registers for a sale. For every early unstake, a 40% fee will be charged.