How to Trade Cryptocurrencies?

Ready to dive into cryptocurrency trading? Our detailed guide provides valuable insights and covers everything from choosing the right exchange to explaining technical analysis, empowering you to navigate the volatile crypto market with confidence.

-

Table of Contents

- Introduction

- Choose a Cryptocurrency Exchange

- Basics of Cryptocurrency Trading

- Structure of a Crypto Trade

- Reading the Markets

- Technical Analysis

- Fundamental Analysis

- Cryptocurrency Trading Strategies

- How to Secure Your Information Trading Crypto

- Pros and Cons of Investing in Cryptocurrencies

- Cryptocurrency Trading vs Stock Trading

- Trading Crypto is Risky

Introduction

The crypto market is attracting traders and investors willing to take advantage of swinging crypto price changes. Trading cryptocurrencies is accessible for everyone and it offers benefits that traditional trading methods can lack.There is a large selection of exchanges, platforms, and tools accessible to learn how to trade digital assets, as well as thousands of different digital coins to choose from.

The world of crypto trading might seem scary for people who are just starting out since the market is highly volatile and unpredictable. But don't worry, because this guide will show you how to trade cryptocurrencies and give you the tools you need to start out.

Disclaimer. Not financial advice. Do your own research. Don't risk funds you can't afford to lose.

Choose a Cryptocurrency Exchange

First thing you need to do is to choose a cryptocurrency exchange to trade on. The good news is there are plenty of options out there, such as Coinbase, Binance, Gemini among others. Consider factors such as user interface, security measures, fees, and the selection of coins available when choosing an exchange. Pick one that suits your needs and preferences, and sign up for an account. Just like signing up for a stock brokerage, you'll need to provide some personal information including your name, address, and email to verify your identity. You may also need to provide identity verification documents to comply with Know Your Customer (KYC) requirements.

Once your account is set up, you'll need to deposit funds to start trading. You can usually fund your account using a bank transfer or credit/debit card. Though some exchanges charge fees for deposits, so make sure to check the terms and conditions before you get started.

Choose Your Crypto

There are thousands of different cryptocurrencies out there, but the most popular ones are Bitcoin and Ethereum. It is important to do your research and choose a coin that aligns with your investment goals and risk tolerance. However, if you're feeling adventurous, you can also invest in smaller altcoins or memcoins, but it's not smart and very risky.

Develop a Trading Strategy

To be a successful cryptocurrency trader, you need to have a trading strategy in place. This can involve technical analysis, fundamental analysis, or a combination of both. We’ll cover this topic in details further on. Some traders prefer to buy and hold, believing that the value of the cryptocurrency will increase over time. Others prefer to trade on short-term price movements, buying and selling quickly to take advantage of fluctuations in the market.

Start Trading

Most cryptocurrency exchanges offer trading pairs, allowing you to exchange one cryptocurrency for another. You can also use trading bots to automate your trades and maximize your profits. You can then place an order to buy or sell the chosen cryptocurrency. There are several types of orders you can place when trading cryptocurrencies. A market order is an order to buy or sell a cryptocurrency at the current market price. A limit order is an order to buy or sell a cryptocurrency at a specific price. Stop-loss orders are used to minimize losses by automatically selling a cryptocurrency when it reaches a specific price.

Secure your cryptocurrency

To keep your cryptocurrency safe, it's important to use secure wallets. There are several types of wallets, including software wallets, hardware wallets, and paper wallets. Hardware wallets are generally considered to be the most secure because they store your cryptocurrency offline and require physical access to access your funds.

Basics of Cryptocurrency Trading

Cryptocurrency trading involves buying and selling digital currencies with the aim of making a profit. These exchanges allow traders to trade cryptocurrencies for other digital assets or fiat currencies. Simply put, cryptocurrency trading works by buying at a low price and selling it at a higher price, with the difference between the two prices representing the profit. To illustrate this, let's say that you bought one Bitcoin at a price of $30,000, and then sold it when the price rose to $32,000. This would result in a profit of $2,000.

Cryptocurrency trading is similar to trading traditional assets such as stocks, commodities, and currencies, with the difference that cryptocurrencies are decentralized, operate on blockchain technology and are traded on specialized digital platforms, known as exchanges. The price of cryptocurrencies is determined by supply and demand, just like any other asset. As more people buy a particular cryptocurrency, the price will generally rise, and as more people sell, the price will fall.

Structure of a Crypto Trade

Cryptocurrency trading is a game of two sides: buyers and sellers. And just like any other trading market, there is always a winner and a loser.

When a buyer and a seller agree on a price, the trade is executed via an exchange and the market valuation for the asset is established. Typically, buyers place orders at a lower price than sellers, creating two sides of an order book. This order book represents the supply and demand of the asset at a given time.

If there are more buyers than sellers, the price of the asset usually goes up due to high demand. Conversely, if there are more sellers than buyers, the price of the asset usually goes down. Most exchange interfaces display buys and sells in different colors to give traders an instant overview of the market status.

You might have heard the phrase “buy low, sell high” in trading. However, determining high and low prices can be a relative concept. The underlying idea is that when buying something, you want to spend the least amount possible, and when selling something, you want to make as much profit as possible.

But there's also a crucial factor: longing or shorting an asset. Longing refers to buying an asset and profiting from its upward price movement, while shorting involves selling an asset with the intention of buying it back at a lower price to earn a profit. However, shorting is more complicated and involves selling borrowed assets that are paid back later.

Reading the Markets

Understanding the markets is the key to trading cryptocurrencies successfully. It may seem intimidating at first, but the basics are straightforward. The market represents the collective activity of buyers and sellers, and traders seek to identify patterns or trends in order to make profitable trades. These trends fall into two categories: bullish and bearish.

A bullish market is characterized by upward price movement, or "pumps." This occurs when buyers outnumber sellers, causing prices to increase. Conversely, a bearish market is characterized by downward price movement, or "dumps." This happens when sellers outnumber buyers, resulting in lower prices.

It's important to note that bullish and bearish trends can exist within larger, opposing trends. For example, a small bearish trend may occur within a long-term bullish trend. When analyzing trends, traders look for higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend.

Consolidation is another market state where prices trade sideways or within a range. This occurs when an asset is cooling off after a sharp trend or when trading volumes are low. Consolidation phases can be easier to spot on higher time frames, such as daily or weekly charts. They can also signal an upcoming trend reversal.

Technical Analysis

Technical analysis is a method of analyzing financial markets by studying the price and volume data on a chart. It is based on the idea that market trends, patterns, and behaviors can be identified and used to make predictions about future price movements.

In cryptocurrency trading, technical analysis can be used to study the price charts of cryptocurrencies and identify patterns and trends that can help traders make informed decisions about buying and selling. Here are some common tools and techniques used in technical analysis for crypto trading:

Candlestick Charts

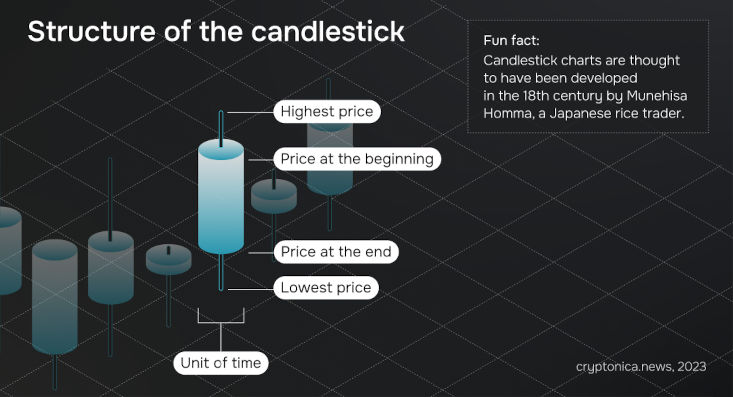

Candlestick charts are a popular tool used by traders to analyze price movements in cryptocurrency trading. They are a type of financial chart used to represent the price movement of an asset over a specific time period, such as an hour, day, week or month.

Each candlestick represents a unit of time (e.g. one hour) and shows the open, high, low, and close prices for that time period. The body of the candlestick represents the price range between the open and close prices, while the "shadows" (also called "wicks" or "tails") show the price range between the high and low prices.

For example, a long green candlestick with a small shadow indicates that the price of the cryptocurrency opened low, rose significantly during the time period, and closed near its high. This could indicate a bullish trend and suggest that the price is likely to continue to rise.

On the other hand, a long red candlestick with a small shadow would indicate that the price of the cryptocurrency opened high, fell significantly during the time period, and closed near its low. This could indicate a bearish trend and suggest that the price is likely to continue to fall.

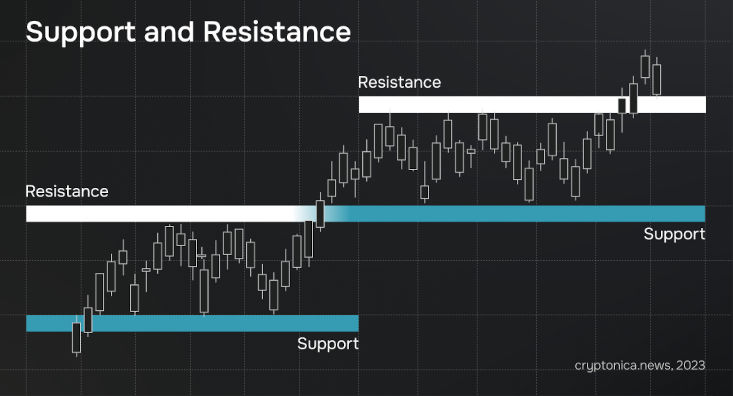

Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis that traders use to identify potential price levels at which buying or selling pressure may emerge. These levels are based on the idea that price movements tend to repeat themselves over time, and that historical price patterns can provide clues about future price movements.

A support level is a price level at which a cryptocurrency has historically found buyers and bounced back up. When the price of a cryptocurrency approaches a support level, traders may expect buying pressure to emerge, as investors who missed out on buying the asset at lower prices seek to enter the market.

A resistance level, on the other hand, is a price level at which a cryptocurrency has historically found sellers and been pushed back down. When the price of a cryptocurrency approaches a resistance level, traders may expect selling pressure to emerge, as investors who bought the asset at higher prices seek to exit the market.

One way to identify support and resistance levels is to look for areas on the chart where the price of a cryptocurrency has repeatedly bounced back up (in the case of support levels) or been pushed back down (in the case of resistance levels). These areas may be identified by drawing trendlines, horizontal lines, or using technical indicators.

For example, a trader may draw a horizontal line across the price chart at a level where the price of a cryptocurrency has historically bounced back up several times, creating a support level. When the price of the cryptocurrency approaches this level again in the future, the trader may expect buying pressure to emerge and look for potential entry points.

Another way to identify support and resistance levels is to use technical indicators, such as moving averages, which can help identify potential levels of support and resistance based on past price data.

Moving Averages

A moving average is calculated by taking the average price of a cryptocurrency over a specified number of periods and plotting that value on a chart. For example, if you want to calculate a 20-day moving average for Bitcoin, you would take the average price of Bitcoin over the last 20 days, and then plot that value on a chart. This process is then repeated for each subsequent day, using the most recent 20 days of data.

Traders often use moving averages to help identify trends in a security's price. If the current price is above the moving average, it could indicate an uptrend, while if the current price is below the moving average, it could indicate a downtrend.

Moving averages can be calculated using different time periods, such as 10-day, 50-day, or 200-day moving averages. The longer the time period used in the calculation, the smoother the resulting line will be.

Of course, these are just a few of the basics, if you want to use technical analysis, get special training. The same goes for fundamental analysis, of which we will now give a general introduction.

Fundamental Analysis

Fundamental analysis involves looking at the "fundamentals" of an asset; this strategy focuses more on the larger picture than technical analysis does.

It is a method of analyzing cryptocurrencies based on the underlying economic, financial, and industry factors that may influence their price. It involves studying the cryptocurrency's market capitalization, adoption rate, use cases, competition, regulatory environment, and other relevant factors to determine its intrinsic value and potential for growth. Fundamental analysis can be useful for long-term investors who are interested in holding cryptocurrencies for a prolonged period of time, as it focuses on factors that may impact the cryptocurrency's underlying value over time. Here are some of the key factors that fundamental analysts consider when evaluating a cryptocurrency:

- It is essential to read the white paper of a token/coin. The white paper gives a detailed overview of the project, including the team's vision, goals, technology behind the cryptocurrency, distribution, upgrades, and new features.

- The technology behind a cryptocurrency is another important factor to consider, as it can affect its ability to scale, process transactions, and handle security. Analysts may evaluate factors such as the cryptocurrency's consensus mechanism, smart contract capabilities, and development team.

- It is also important to identify competing projects and examine existing projects that the new project might replace if successful.

- The team behind the project should have the right skills and experience to make their project work.

- Investors should also consider on-chain metrics, such as transaction count, transaction value, active addresses, fees paid, hash rate, and staking, as well as the tokenomics.

- Finally, investors should consider the community behind the project, which can significantly impact a crypto asset's price action, particularly through social media.

Cryptocurrency Trading Strategies

There are plenty of cryptocurrency trading strategies used by traders, here are some of the most common ones with a brief overview:

HODL

This is a long-term investment strategy where traders hold their cryptocurrency for a long period of time, regardless of price fluctuations, with the belief that it will increase in value over time.

Swing Trading

This strategy involves buying a cryptocurrency at a low price and selling it when its price goes up in a short period of time, usually a few days or weeks.

Day Trading

The goal of this strategy is to profit from short-term price fluctuations. This involves buying and selling a cryptocurrency within the same day.

Scalping

Under this strategy traders make many small trades in a short period of time to profit from small price movements.

Arbitrage

Arbitrage means buying a cryptocurrency on one exchange where its price is lower and selling it on another exchange where its price is higher, to pocket the price difference.

How to Secure Your Information Trading Crypto

Here are some common tips to help you keep your information secure when trading crypto:

- Choose a strong, unique password that is at least 12 characters long and contains a mix of letters, numbers, and symbols. Avoid using common words or phrases, and never reuse passwords across multiple accounts.

- Consider using a hardware wallet to store your cryptocurrency rather than keeping it on an exchange or software wallet.

- Keep your operating system, antivirus software, and other software up-to-date with the latest security patches and updates. This can help to protect your computer from vulnerabilities that hackers can exploit.

- Avoid trading crypto or accessing your accounts while using public Wi-Fi networks as they can be easily hacked. If you do, use a virtual private network (VPN) to encrypt your connection.

- Be aware of phishing attacks. Phishing is a common tactic used by scammers to trick you into revealing your login credentials or other sensitive information. Always be cautious of emails or messages that ask for your login information or direct you to a suspicious website.

Pros and Cons of Investing in Cryptocurrencies

| Pros | Cons |

| Potential for high returns in a relatively short period of time. | Can be highly volatile, with prices fluctuating rapidly and dramatically. This can result in significant losses. |

| Not controlled by any central authority. This can offer greater privacy and freedom | Regulatory risks, such as government restrictions or bans, which can impact their value and adoption. |

| Adding cryptocurrencies to a portfolio can offer diversification benefits, as cryptocurrencies have low correlation with traditional assets | Cryptocurrency exchanges and wallets can be vulnerable to hacks and cyber attacks. |

| Cryptocurrencies operate on public, decentralized ledgers that offer transparency and immutability | The adoption and use of cryptocurrencies is still relatively low, and there is no guarantee that they will become widely adopted in the future. |

| Cryptocurrencies offer innovative technology, such as blockchain | Cryptocurrencies and their underlying technology can be complex and difficult to understand for many traders |

Cryptocurrency Trading vs Stock Trading

Stocks and cryptocurrencies belong to fundamentally distinct categories of investment vehicles and should be handled as independent components of a portfolio.

Stocks represent ownership stakes in a publicly traded corporation, with each share purchased representing a proportionate percentage of ownership in the company. Capital gains can be earned from selling stocks to other investors, with the profit being the difference between the purchase price and sale price. Additionally, the value of stocks can increase through dividends and voting power, both of which are dependent on the performance of the underlying company.

On the other hand, cryptocurrencies are digital assets that exist solely online, lacking any physical component. Ownership of these assets is tracked in a digital ledger, which records transactions and token ownership. This is in contrast to traditional currencies like the US dollar, which have both physical and digital components. Each unit of a cryptocurrency is referred to as a token, similar to a shares with tickers in stocks.

Trading Crypto is Risky

Trading cryptocurrency is a risky venture that requires careful consideration and risk management. While the potential for high returns can be tempting, it's important to recognize that the market is highly volatile and subject to dramatic price swings.

One of the key factors in managing risk when trading crypto is determining your risk tolerance and establishing appropriate risk management strategies. This may involve setting limits on the amount of money you are willing to lose on a single trade, or limiting the total amount of capital you are willing to invest in the market.

Another important aspect of risk management when trading crypto is staying informed about market trends and news. This may involve monitoring social media and news outlets, as well as analyzing technical indicators and chart patterns to identify potential entry and exit points.

In addition to risk management strategies, it's crucial for traders to educate themselves about the market and develop their own trading strategies. This may involve experimenting with different indicators and trading styles to find the approach that works best for your individual needs and preferences.

Ultimately, trading crypto requires significant responsibility and discipline. Traders must be willing to accept the risks associated with the market and take appropriate measures to protect their capital and manage their risk. By staying informed, developing effective risk management strategies, and maintaining discipline and focus, it is possible to profit from the cryptocurrency market while minimizing potential losses.

FAQ

How much money do I need to start trading cryptocurrency?

The amount of money you need to start trading cryptocurrency depends on the exchange you use and the cryptocurrency you want to trade. Many exchanges have minimum deposit requirements, which can range from a few dollars to thousands of dollars.

What moves the cryptocurrency markets?

The cryptocurrency markets are influenced by a variety of factors, including supply and demand, news and announcements, and the overall sentiment of traders and investors.

Can crypto trading be profitable?

Crypto trading can be profitable, but it also carries significant risks. It's important to do your own research, understand the risks involved, and develop a trading strategy that works for you.

Can I day trade cryptos?

Yes, you can day trade cryptocurrencies. However, day trading involves making multiple trades in a single day, which can lead to significant losses if not done properly. It's important to have a solid understanding of technical analysis and risk management before attempting to day trade cryptocurrencies.