What is Parcl (PRCL)?

Explore Parcl, the first decentralized real estate derivatives protocol on Solana. Learn how it enables investment in real estate indices across global cities without owning physical properties.

Parcl is a decentralized real estate trading platform built on the Solana blockchain, with a focus on perpetual futures contracts tied to synthetic real estate assets. It represents the first initiative to develop a decentralized real estate derivatives protocol on the Solana network, aiming to create a market where users can effectively invest in real estate by the square foot through a price index. This system utilizes smart contracts to reflect the price changes of real-world real estate indexes without the actual need to own the properties themselves.

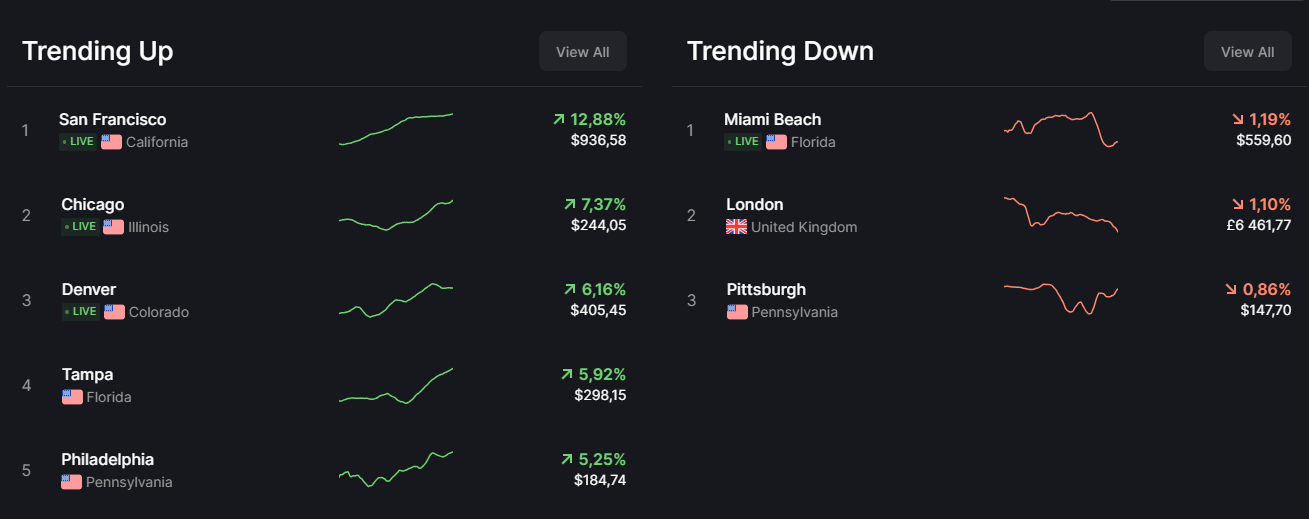

Currently, Parcl is operational in 10 cities across the U.S., including major urban areas like New York, San Francisco, and Chicago. There are plans in place to introduce real estate index products for cities beyond the U.S., such as Hong Kong, London, and Jakarta, in the near future.

Source and Copyright: Parcl App

Parcl have been supported with an $11 million investment from several entities, including Archetype, Dragonfly Capital, Solana Ventures, and Coinbase Ventures, among others.

How Does Parcl Work?

Parcl provides a platform where traders can engage in speculation on the value of real estate via city indexes instead of investing in individual properties directly. These city indexes represent the collective value of real estate within a particular city. On Parcl, you aim to forecast if the real estate values in a location will rise or fall, enabling you to trade real estate values across different cities around the globe.

The Parcl ecosystem includes the following actors:

Traders on Parcl are individuals looking to capitalize on fluctuations in the real estate market, whether these values go up or down. They have the opportunity to speculate on the future prices of real estate in 10 US markets, such as New York, Chicago, and Los Angeles. The process mirrors that of trading traditional futures contracts, with users able to take long or short positions on any market with up to 10x leverage.

Liquidity Providers (LPs) play a crucial role in facilitating trades on Parcl. They contribute USDC to the protocol to ensure there are always counterparts for traders' long and short bets. As a reward for their services, LPs receive 70% of the trading fees generated on the protocol. In this setup, LPs essentially perform functions similar to a bank, and there's a risk of financial loss if traders consistently make profitable moves.

To maintain market balance between long and short positions, traders are required to pay a funding fee to LPs, protecting LPs from being disproportionately affected by market swings. This fee can reach up to 35% per day, though the current highest funding rate on Parcl is only 0.07%.

The pricing for city indexes on Parcl is determined by price feeds created by Parcl Labs, which then utilizes Pyth, a decentralized blockchain oracle, to place these prices on-chain.

Parcl Tokenomics and Airdrop

In March, Parcl announced the upcoming launch of its project token, PRCL, set for April with a total supply of 1 billion tokens. Between 7% to 8% of these tokens, equating to 70 million to 80 million tokens, will be distributed to the community through an airdrop.

At the start of the year, Parcl initiated its second airdrop campaign, which rewards users with points that will be convertible into future airdrops.

The primary ways to earn points in Parcl include staking, trading, providing liquidity for projects, and executing real estate contract orders on the blockchain. PRCL token holders will gain the right to vote on governance issues within the Parcl Protocol, along with access to enhanced data and trading incentives within the ecosystem.

In addition to governance, the token will unlock access to premium real estate data and drive incentive programs within the protocol, with further details to be revealed later.

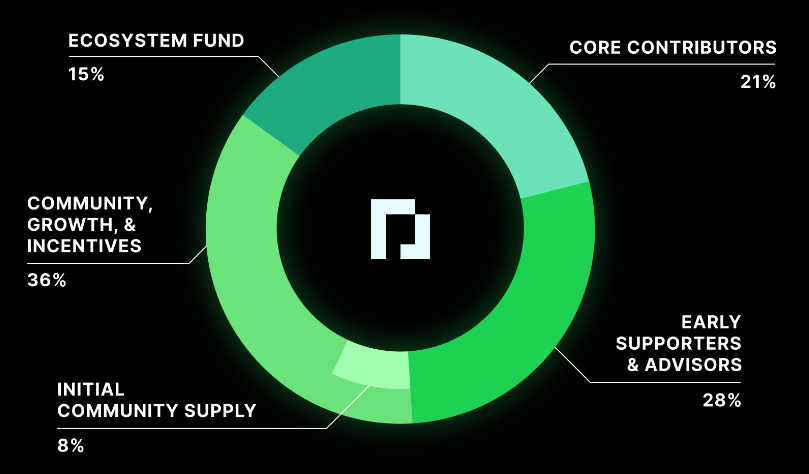

The total issuance of PRCL tokens is allocated as follows:

- 36% for Community, Growth, & Incentives

- 28% for Early Supporters & Advisors

- 21% for Core Contributors

- 15% for the Ecosystem Fund

- 8% for the Initial Community Supply

At the Token Generation Event (TGE), 8% of the community tokens will be unlocked: 7.5% for Parcl points and 0.5% for Parcl and MadLabs NFT collections.

Source & Copyright: Parcl Blog

Where to Buy PRCL Token?

The PRCL token is already available for trading on the Aevo pre-market, a decentralized exchange, where it is priced at $1.8 per PRCL token.