First Republic Bank's Decline Triggers Bitcoin Rally

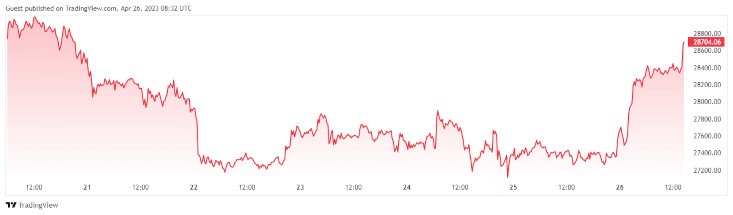

Bitcoin's price has risen above $28,000 after experiencing a 10% dip earlier this week. The increase in price comes as First Republic Bank's stock, FRC, has plummeted by almost 50%, causing concerns of another banking crisis.

The rise in Bitcoin prices happened concurrently with issues at First Republic Bank, which saw its shares drop by over 50% on 25 April. Currently, Bitcoin is trading at 28, 765 marking a 5% growth over 24 hours. Other major cryptocurrencies are also trading in green.

Source and Copyright: © TradingView

The bank could potentially be seized by the US government if it exhausts all private sector solutions, such as asset sales or finding a buyer, as stated by Fox reporter Charles Gasparino.

The crash in FRC's stock price was mainly due to the bank facing a $100 billion deposit exodus, with its deposits shrinking by 40% in the first quarter of this year. This decline has caused investors to worry about the possibility of another banking crisis, with market participants already gauging the possibility of the next Fed rate hike scheduled for the upcoming week.

Crypto analytics firm Santiment suggested that Bitcoin's correlation with the S&P 500 index may be diminishing as the narrative that Bitcoin is a safe haven during banking crises regained momentum.

CEO Mike Roffler announced in a press release that the bank would be “pursuing strategic options” and “taking steps to meaningfully reduce our expenses to align with our focus on reducing the size of the balance sheet.” The bank plans to downsize its balance sheet, cut expenses, and lay off an expected 20% to 25% of its employees in Q2 to strengthen its financial standing.

First Republic Bank's issues have been ongoing since early March, with 11 major US banking institutions, including J.P. Morgan and Bank of America Corp., depositing $30 billion to assist the troubled bank, according to Bloomberg.