How the Fed's Interest Rate Hike Impacted Crypto

On Wednesday, the Federal Reserve raised its benchmark interest rate by 25 basis points to 5-5.25% a move aimed at addressing the persistently high inflation and a series of notable bank failures in the United States.

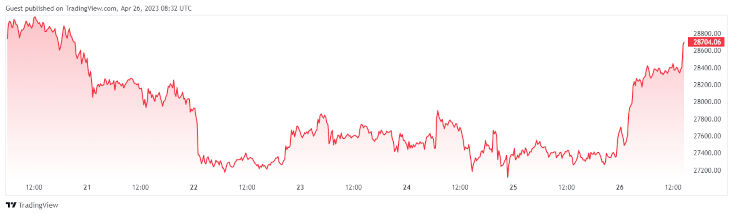

Following this announcement, Bitcoin experienced a gradual recovery. Initially, it dropped by 1% in response to the rate hike, but it subsequently rebounded by 1.4% to reach $29,058. In a similar fashion, Ether saw an increase of 1.8%, reaching $1,900.

Source and Copyright: © TradingView

Since March 2022, the U.S. Federal Reserve has implemented a consistent series of 10 consecutive interest rate increases in an effort to stabilize the economy and manage skyrocketing prices. This outcome was widely anticipated due to the fact that Chairman of the Federal Reserve Jerome Powell has stated on multiple occasions that "ongoing increases" were required in order to bring inflation back down to the goal level of 2% set by the Fed. The annual rate of inflation reached 9.1% in June 2022, marking a new high not seen since 1981.

"In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments," the Fed's statement says.

In addition, the Fed is now faced with a potential debt ceiling crisis as the U.S. risks defaulting on its debt for the first time in history. Treasury Secretary Janet Yellen warned that this could happen as early as June 1 if Congress fails to reach an agreement.

The prices of major crypto assets increased during the day, with Ethereum rising by 1.8% to $1,900. The Ripple (XRP) rose 0.7%, Cardano (ADA) increased by 2%, Solana (SOL) rose 1.5% and Avalanche (AVAX) gained 2,1%.

Over 37,000 trader positions were liquidated on cryptocurrency exchanges in the past 24 hours, totaling $100.86 million, according to Coinglass.