Is Crypto Bear Market Getting to an End? - latest news about the crypto industry at Cryptonica

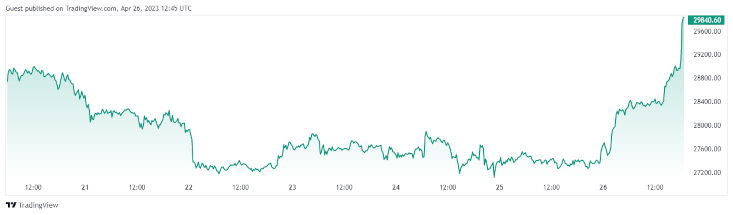

According to an analysis by a crypto expert called Trader Tardigrade on April 26, Bitcoin has finally broken out of its bearish trend after holding steady support above the $27,000 level following days of bearish price action.

The cryptocurrency has been consolidating above its upper trendline for a while now, which has allowed it to build up momentum to overcome the remaining selling pressure. As a result, an expanding triangle pattern has emerged, which Trader Tardigrade sees as a clear signal of a bullish trend reversal. This suggests that the Bitcoin bear market has come to an end and that BTC will soon soar.

The current Bitcoin price is $29, 795, and the 24-hour trading volume is about $21 billion. Bitcoin has increased by over 9% in the previous 24 hours.

Source and Copyright: © TradingView

Source and Copyright: © TradingView

In April, Bitcoin surpassed $30,000 for the first time in 10 months, continuing its upward trend this year. After a significant downturn in 2022 due to central bank interest rate hikes and high-profile crypto business implosions, the crypto sector has begun to make a partial recovery. Other prominent figures in the crypto community have also expressed bullish sentiments toward Bitcoin’s future prospects.

Geoff Kendrick, the head of digital assets research at Standard Chartered, has stated that the bear market for cryptocurrency is over and Bitcoin could reach $100,000 by the end of 2024, according to a report.

Kendrick’s report cites several factors that could drive the cryptocurrency to new highs, including instability in the banking sector, the end of the US Federal Reserve’s rate-hiking cycle, and the improved profitability of crypto mining.

Robert Kiyosaki, renowned for his personal finance book Rich Dad, Poor Dad, also shares optimism for Bitcoin. Kiyosaki predicts that the cryptocurrency will surpass $100,000 and recently purchased a significant amount due to its decentralized, non-fiat nature. In a tweet on April 21, he explained that Bitcoin has gained support from people, not government or federal entities, and did not require a bailout like those institutions.

Crypto community also believes that the upcoming “Bitcoin halving,” which cuts the rewards given to Bitcoin miners by 50%, could trigger another significant surge in the coin’s value.