Bitcoin Dominance: What is It and What Does It Mean for You?

Bitcoin dominance is a percentage value for how much of the total crypto market cap is held by Bitcoin, its market cap divided by all cryptocurrencies’ market cap.

-

Table of Contents

- Bitcoin Dominance Explained

- What is Bitcoin Dominance for?

- How Crypto Traders Use Bitcoin Dominance

- How to Use Bitcoin Dominance

- Bitcoin's Dominance Over Time: in 2017, in 2019-2020, in 2021

- The Lure of Altcoin Season

- Why?

- Bitcoin Versus Altcoin Movements

- Bitcoin Dominance: What to Make of It?

- Summary

Bitcoin Dominance Explained

Tracking this metric over time can provide insight into the relative strength of Bitcoin compared to other cryptocurrencies.

Bitcoin dominance is a measure of the total market capitalization of the leading cryptocurrency, Bitcoin, against the total market capitalization of all other crypto assets. This ratio is an important data point for traders to understand the performance of Bitcoin relative to other cryptocurrencies, because it can give them a better perspective on the current phase of the crypto market and help inform their future trading decisions.

You shouldn’t use this metric alone, just like you wouldn’t use only the RSI, or, God forbid, your hunches. Remember: the only way to make money at a casino is by buying it, and the same goes for trading. Take into account a wide array of factors!

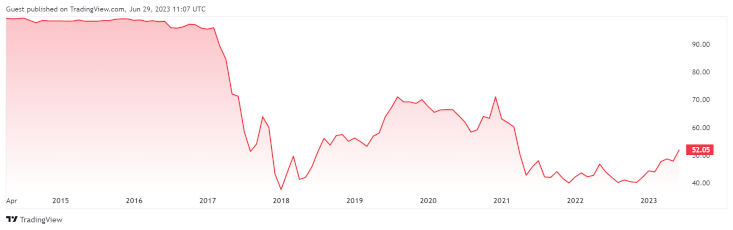

Source and Copyright © TradingView

What is Bitcoin Dominance for?

This metric is a trading indicator, but it’s also useful if you want to make long-term conclusions about the crypto market’s future. You could, for example, calculate Bitcoin’s dominance in relation to all money on the planet, and make your own conclusion about Bitcoin’s strength of character and where it will probably be 5 years from now.

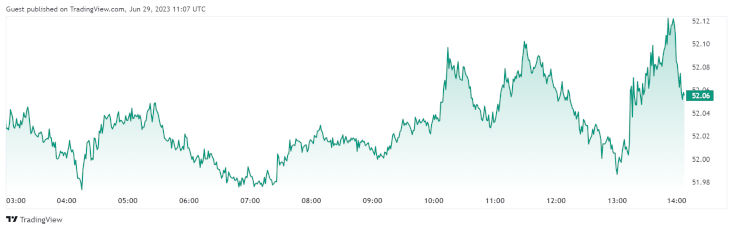

A high rate of bitcoin dominance, which is currently near 52%, suggests that Bitcoin has maintained its value even as altcoins have declined significantly in market value.

However, when bitcoin dominance drops, it typically indicates that alternative coins are becoming more attractive to traders and that money is flowing into the crypto space away from the leading cryptocurrency.

Source and Copyright © TradingView

How Crypto Traders Use Bitcoin Dominance

The charting platform Tradingview provides real-time data on bitcoin dominance spikes, which can be tracked to determine the current level of dominance over the total crypto market.

This data can be used to evaluate the current state of the market, and can also provide insight into how heavily the crypto markets will react to news or events that could affect the total market capitalization.

Remember that Bitcoin dominance isn’t as simple as a percentage because there are other factors at play, such as influxes and exoduses of new and old coins, and domination of one type of asset doesn’t mean it’s the best. What’s valuable today isn’t tomorrow in the crypto world, as we learned from the likes of FTX, so be advised that this indication shouldn’t be your only and best metric.

In addition, some experts consider that besides Bitcoin dominance, there’s a better metric, which actually takes into account Bitcoin’s real competitors (only those who use POW instead of everyone ever). We’re not sure this applies, but you may find it interesting.

How to Use Bitcoin Dominance

The charting platform reveals that Bitcoin dominance has been steadily declining since 2017, when it held a peak market share. Since then, Bitcoin's market share has steadily declined and is currently hovering around 70%. This suggests that while Bitcoin remains the largest asset in the crypto space, there is an increasing amount of interest in alternative coins and that they are gaining market share.

The so-called lure of altcoin season can cause some traders to flock to alternative coins in search of potential profits, but savvy investors should always keep an eye on Bitcoin dominance as an indicator of overall market liquidity and future performance.

Let’s take a look at that in a little more context.

Bitcoin's Dominance Over Time: in 2017, in 2019-2020, in 2021

In 2017 Bitcoin hovered at an average of 90+% of the market, because the industry was just developing and there weren’t many projects around with much uptime or infrastructure. Good times! We recall 2010, when it was at an absolute 100%, and you could mint dozens of Bitcoins a day on your laptop while having dinner with your family.

It went on that way up until 2015, when Bitcoin gave up 1 or 2% of its territory, but real turbulence began in 2017 when Bitcoin’s dominance took a sharp dive to almost 50%. This was more good news than bad, as now new projects were coming around (the more, the merrier), but was Bitcoin in good company?

You can take a look at the crypto market in 2017 and decide for yourself what led to the drop and who caused it, and whether these new infrastructures (cough! Ethereum! cough) added value to the market or made it more vulnerable overall. Less dominance isn’t always bad! Like the great Andreas Antonopoulos said: “when the tide goes down, we will all see who on the beach wasn’t wearing swimming trunks”. And the tide always goes down.

Bitcoin slowly picked up momentum in the following years, and by 2021 it was back to around 70%. These new coins were getting into trouble with the authorities, mainly due to the compromises they were making on integrity for the sake of profits, and it was getting easier for Bitcoin to breathe.

By now, most new projects have learned their lessons, plus there’s far more regulatory clarity than before, so altcoins are rearing their ugly heads again, with Bitcoin at nearly 50%. Which is probably a good thing.

The Lure of Altcoin Season

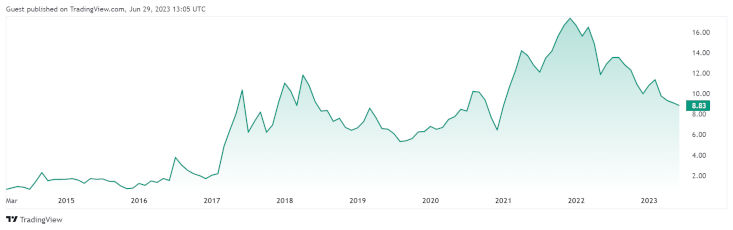

In the crypto space, Bitcoin has been viewed as the leading cryptocurrency, with an estimated 70-80% of the total market capitalization. However, in recent years, the trend has been changing. As new coins and tokens enter the space, the market share of Bitcoin is slowly declining and its dominance rate is dropping.

This has led to what is known as an "altcoin season" where alternative coins move toward center stage.

During this period, traders are interested in buying and selling coins other than Bitcoin as they offer potentially higher returns compared to the leading cryptocurrency.

Source and Copyright © TradingView

Why?

This could be attributed to a number of reasons such as increased trading activity, improved liquidity in the markets or new technologies such as smart contracts being added to the existing coins.

It is worth noting that when Bitcoin dominance spikes, it sometimes signals a bear market. This means that Bitcoin's market value's share in the total crypto market increases while other crypto assets suffer heavily and react negatively.

It is worth noting that Bitcoin's dominance of the market cap does not reflect its real value, nor does it mean a sudden influx of money to the market.

Bitcoin Versus Altcoin Movements

While traders are still interested in Bitcoin, they are also looking to invest in other coins, which is why it is important to keep an eye on the total market cap and the overall market price of different coins.

By looking at data on a charting platform like TradingView, traders can gain a better perspective on how Bitcoin's dominance rate is changing over time. This can help them determine when the current phase may be shifting from Bitcoin to alternative coins, but only in combination with other metrics.

It is also important to remember that when it comes to cryptocurrencies, past performance does not guarantee future performance!

Bitcoin Dominance: What to Make of It?

When this ratio rises, it means that bitcoin's value as a percentage of the overall market capitalization is increasing.

By looking at the charting platform TradingView, you can easily see how bitcoin’s dominance has moved over time and how heavily it reacts to changes in the overall crypto market. When the market experiences bearish trends, traders tend to turn towards bitcoin as a safe haven asset, which results in an increase in its dominance rate. Conversely, when the total market capitalization rises due to bullish trends in the crypto space, alternative coins usually outperform Bitcoin and its dominance rate drops as a result.

Don’t jump to conclusions based on Bitcoin dominance alone! Remember about taking a holistic approach.

Summary

Ultimately, understanding Bitcoin's dominance is key for having a better perspective of how it relates to the entire crypto space and the real value it holds compared to other coins.

Additionally, while it is impossible to predict what will happen with BTC dominance in the future, it is clear that it is an important metric to pay attention to when trading or investing in cryptocurrencies.

Whoa there! While it’s an important metric, don’t forget about a holistic approach: do fundamental analysis, give diversified portfolios a thought, and think about perhaps getting into cash, gold and NFTs too. Promising new stealth (privacy) coins aren’t such a bad idea either. After all, sneakiness is what keeps crypto alive.

FAQ

Will BTC Dominance drop?

It is worth noting that bitcoin dominance is often used as an indicator for the start of altcoin season; when bitcoin dominance falls significantly it indicates that traders are shifting their focus away and towards alternative coins, which leads to a significant amount of buying pressure on altcoins and a surge in their prices.

This is inevitable, but not threatening! If you’re a trader, your strategy should be to view all events not in terms of good or bad, but of what you can gain from them.

What will happen if BTC dominance goes down?

Even when there is an altcoin season and alternative coins gain popularity, this does not necessarily mean that their prices will rise significantly or that their circulating supply will remain steady. As with any investment, crypto traders should conduct their own due diligence before investing in any asset.

In other words, don’t panic, but any dramatic movement in the sector is a sign for you to flex, and you’re definitely far better off reacting sooner rather than later. Don’t forget to explore a range of other tools, dig through the news, and try to get an idea where Bitcoin’s direction is and why.

How long does BTC dominance last?

It is worth noting that bitcoin’s dominance rate has been steadily declining since its nine-month high of 68% in April 2019.

For crypto traders, understanding how the bitcoin dominance rate behaves and what it means for the future performance of crypto markets is often essential for making informed decisions about trading and investing in cryptocurrencies.

Why is BTC dominance important?

You can use this indicator to predict Bitcoin’s movements with some degree of certainty, as well as altcoins (or that’s what we’d like to believe), but there’s more to it than that.

Ultimately, you can think of Bitcoin as the foundational crypto that started it all, the only one that hasn’t been classified as a security, the one that hasn’t been hacked, and so on. If Bitcoin dominance drops too low, it may signal the end of Bitcoin, which will most likely be followed by the rest of cryptos.

Now, no-one can say for sure what the future holds, especially in the crypto markets, but you know our policy: it’s better to know where the wind is blowing in advance, and to be prepared for all outcomes. Be careful when you purchase unexplored asset classes!