What is Bitcoin ETF in Trading: Comprehensive Guide

Learn more about Bitcoin ETF: how it works, where to buy, why everyone is talking about it, and whether it is useful for private investors.

Many traders and private investors still fear the high volatility of the crypto market, the absence of a legal framework, difficulties in storing digital assets, hacking of commercial sites, etc. Such financial instruments as ETFs may solve these fears of potential institutional investors and in perspective, other traders and investors. Throughout the summer of 2023, the cryptocurrency community was buzzing with excitement over the prospect of a Bitcoin ETF being introduced in the United States.

In this article, we'll delve into what exactly a Bitcoin ETF is, why investors are eagerly awaiting its launch, how to invest in it, and the challenges companies may face when implementing it.

What is ETF

Exchange Traded Funds (ETFs) are investment funds, whose shares are traded on exchanges. Those companies allow investors to earn on exchange rate changes. To achieve this, ETFs purchase one or more assets and offer shares in the fund for members to purchase. As the value of assets in the portfolio changes, the price of ETFs also changes. An ETF is designed to accurately track the portfolio's performance. ETFs are created by specialized investing companies, like, for example, the world’s largest operators: BlackRock, Vanguard, State Street, Invesco, iShares, Charles Schwab, etc.

One key difference between ETFs and stocks is that while shares in stocks always represent ownership in a single company, ETFs can be made up of a variety of assets. Investing in an ETF allows you to avoid direct investment in a particular asset and instead invest in the ETF itself.

Nowadays ETF can be called one of the major investment instruments among different types of traders, because any investor may purchase a “basket” full of assets with a democratic amount of money and feel a bit less risk.

You require a brokerage account in order to purchase an ETF share. Different countries may have different opening conditions. Typically, presenting an identity paper to the broker is sufficient. You will then simply need to select the share you wish to purchase and locate the ticker (short investment tool designation) in the list.

Bitcoin ETF: Long Story Short

After getting acquainted with the common ETF instrument, it is necessary to find out what Bitcoin ETF is. Logically, is it a fund that owns bitcoins and allows investors to own bitcoins as well...or is it not? To dig deeper we need to understand the formation of the Bitcoin ETF.

SEC role in the BTC ETFs launch

A Cryptocurrency ETF, or exchange-traded fund, is an investment vehicle that tracks the price of various cryptocurrencies. With the rise of digital currencies, many investors have shown an interest in this type of investment. For larger investors, a Cryptocurrency ETF can be a useful tool as it allows them to gain exposure to the crypto market without needing to hold the individual coins themselves.

Given that the USA is the financial capital of the world, it is fitting to launch a Cryptocurrency ETF in this country. Many American companies have been attempting to create a Cryptocurrency ETF for the past few years. However, obtaining approval from the US Securities and Exchange Commission (SEC) has been a hurdle. The SEC's role is to ensure that investment products are safe for investors and that they comply with regulations. Therefore, the approval process for a Cryptocurrency ETF can be quite lengthy and complicated.

Source and Copyright © SEC Official website

Source and Copyright © SEC Official website

The SEC was managed by Commissioner Jay Clayton from 2017 to 2020 during the first wave of attempts by companies to launch cryptocurrency ETFs, but no company was approved. Gary Gensler became the head of the SEC in April 2021. Market participants hoped about his appointment as he was known for his interest in cryptocurrency and had given lectures on the subject at MIT. There was speculation that Gensler's appointment would lead to the introduction of a cryptocurrency ETF in the market.

Following the change of leadership at the SEC, applications for the creation of cryptocurrency ETFs resumed. The majority of businesses desired to create a Bitcoin-based fund. However, Gary Gensler followed in the footsteps of his predecessor and began to deny applications. Gensler commented on the situation in September 2021, saying that developing such a tool based on Bitcoin could be problematic because the instrument's status in the financial industry is not clearly defined. Hensler suggested Bitcoin-ETF futures as an alternative.

Futures and spots Bitcoin ETFs

A futures contract is a contract in which the seller agrees to deliver a specified asset to the buyer at a specified price and within a specified time frame. Since December 2017, Bitcoin futures have been traded on the Chicago Commodity Exchange. Hensler stated that futures, as opposed to "pure" spot bitcoin, are totally legal and must be registered with the government.

Market participants heeded Gensler's advice, and in October 2021, Bitcoin-ETF futures the BITO from ProShares debuted. Others followed suit: The SEC authorized an application for such a tool from the Teucrium stock exchange fund provider in April 2022.

Source and Copyright © BITO Official website

It turns out that cryptocurrency ETFs come in two varieties:

- Spot, an investment is the purchase of a share of a cryptocurrency-based fund. A spot Bitcoin ETF is an exchange-traded fund that would offer exposure to Bitcoin without having to own it.

- Derivative, an investment is the purchase of a share of a fund comprised of Bitcoin derivatives, based on other resources. It may be a BTC futures contract, with the market player investing in a contract with specified terms. It includes completion dates as well as a price.

What happens now?

Bitcoin futures are still more distant from Bitcoin than spot ETFs. As a result, market players continued to seek SEC approval.

In June 2023, a new high-speed wave centered on Bitcoin ETF occurred. BlackRock's largest asset manager, in collaboration with Nasdaq, has entered the race to debut the product. BlackRock's goal is to manage clients' diverse assets in such a way that they generate a profit, for as through investing in assets or renting out real estate.

Source and Copyright © BlacRock Official website

Source and Copyright © BlacRock Official website

Grayscale, Fidelity, Invesco, Wisdom Tree, and Valkyrie filed applications after BlackRock, but the SEC rejected them as "inadequate." The cryptocurrency sector has begun to react.

The Coinbase application has been upgraded by Nasdaq and BlackRock. Coinbase Exchange is the first cryptocurrency company in the United States to go public through a direct listing of shares (akin to an IPO). The stock of the corporation is traded on the Nasdaq. Coinbase will take custody of the tool and notify Nasdaq of its results. In other words, the crypto exchange will serve as yet additional guarantee of the instrument's transparency.

During the lengthy debate, Grayscale lawyers pointed out the SEC's inconsistent approach to crypto investment products and asked the agency to "promptly" approve the spot Bitcoin-ETF.

Source and Copyright © Grayscale Official Website

Source and Copyright © Grayscale Official Website

Grayscale applied to the SEC in October 2021 to convert the product. After the SEC refused to convert GBTC, the Bitcoin Investment Trust ticket by Grayscale, to ETF, the organization launched a lawsuit against the regulator in June 2022. Grayscale's lawsuit contesting the regulator's refusal to allow its proposal to operate a Bitcoin-ETF was upheld in court on August 29. The Commission's ruling was ordered to be reconsidered by the appeal court.

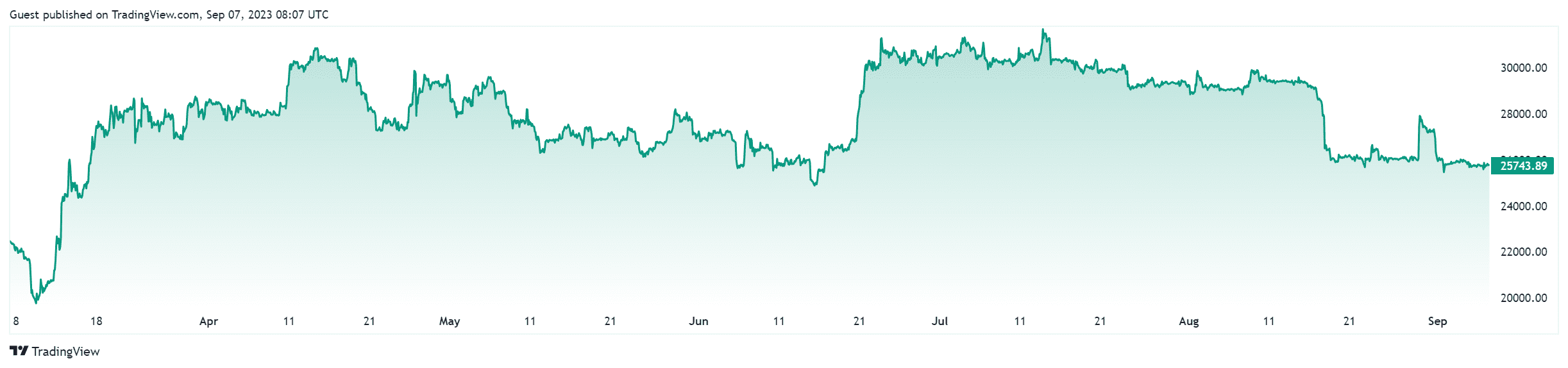

Cryptocurrencies reacted strongly to the news, with Bitcoin breaking the $27,000 barrier and Ethereum rising to $17,000.

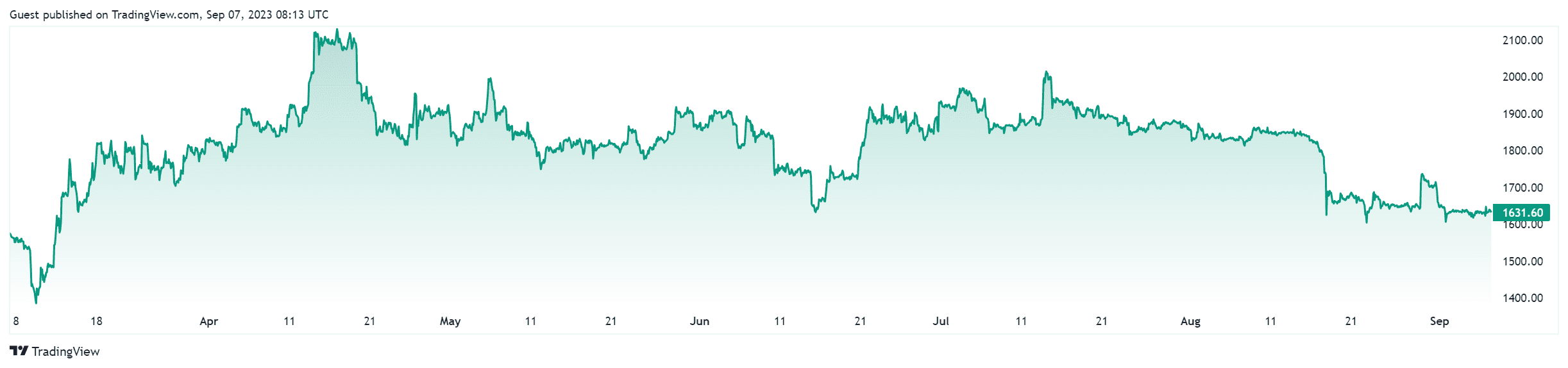

Below we have put the charts for BTC and ETH for the last 6 months; pay attention to the period from June. The cryptocurrency has risen exactly after the news about Grayscale's win over SEC in the court.

Source and Copyright © Bitcoin chart for the last 6 months on TradingView

Source and Copyright © Ethereum chart for the last 6 months on TradingView

How to invest in BTC ETF?

As of September 2023, there is no pure-play spot Bitcoin ETF available for investors. A spot Bitcoin ETF tracks the price of Bitcoin by holding physical Bitcoins in its portfolio, but there are no spot Bitcoin ETFs currently available.

However, there are several Bitcoin ETFs available that invest in Bitcoin through derivatives or Bitcoin ownership. These ETFs provide exposure to Bitcoin but do not hold physical Bitcoins in their portfolio. The Proshares Bitcoin Strategy ETF, Valkyrie Bitcoin Strategy ETF, VanEck Bitcoin Strategy ETF, and Global X Blockchain & Bitcoin Strategy ETF are some of the Bitcoin ETFs that trade on exchanges such as the New York Stock Exchange ARCA and Nasdaq.

Summary

A Bitcoin ETF in the United States is intended to raise Bitcoin investing to a new level of mainstream dependability and acceptance. In 2020 and 2021, large publicly traded firms such as Square and Tesla purchased Bitcoin as an investment for their balance sheets, spurring fresh acceptance, although the cryptocurrency is still viewed even as a novelty by many conservative investors.

The SEC's approval of a Bitcoin ETF would allow institutional investors to more readily speculate on the price of Bitcoin. It would effectively bring Bitcoin to Wall Street, with the Bitcoin ETF trading in the same venues as Tesla stock, bonds, gold, oil, or any other traditional asset. And it would likely be a huge boost to the price of Bitcoin.

Even with the boost of crypto and its acceptance in the conservative fields, investing in a spot Bitcoin ETF comes with some risks, including:

- Price volatility

Bitcoin is known for its price volatility, and a spot Bitcoin ETF may amplify volatility in prices, creating risks for investors if the fund is a large share of the market.

- Regulatory risk

The SEC has yet to approve any applications for a spot in Bitcoin ETF and has so far rejected all applications. The regulatory environment for cryptocurrencies is still evolving, and changes in regulations could affect the value of a spot Bitcoin ETF.

- Fraud and mismanagement risks

Investors must trust the ETF provider to buy and safely store Bitcoin, posing fraud and mismanagement risks.

High-risk assets

- Bitcoin is considered a high-risk asset, and investors should limit their exposure to high-risk assets in their portfolios.

If the US Securities and Exchange Commission approves Bitcoin-ETF, the first cryptocurrency will be able to reach $150,000 and approach $180,000. Tom Lee, co-founder of Fundstrat, mentioned this. Although digital gold exchange funds have shown to be successful on a global scale, the expert believes that US assistance will be critical for the local crypto economy.

Eric Balchunas forecasts in a recent podcast «Unchained Crypto» that traditional cryptocurrency purchases would be replaced by buying Bitcoin-ETF in stock markets within a few years. This trend may have a particularly negative impact on exchanges that are unable to adjust their commissions in order to remain competitive.

Recent events, including BlackRock's anticipated entry into the Bitcoin-ETF market, have improved market confidence and the likelihood of widespread adoption among institutional investors.

Before making any investment decisions, investors should carefully analyze the benefits and dangers of investing in a spot Bitcoin ETF. It is critical to DYOR on the ETF and the underlying assets and to speak with a financial counselor if necessary.

Frequently Asked Questions

What is the spot BTC ETF?

A spot Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin. A spot Bitcoin ETF is backed by physical Bitcoins that underpin the value of the ETF, meaning that when an investor buys shares of a spot Bitcoin ETF, they are holding Bitcoin within the fund, similar to buying a stock

Can I buy a spot Bitcoin ETF now in the USA?

Many major financial companies, including Grayscale, BlackRock, etc. are waiting for the SEC’s approval of their spot BTC ETFs. It remains a topic of interest in the crypto community, but for now, investors cannot buy a spot Bitcoin ETF in the US at this time. However, it is available in Canada, Brazil, Dubai, Australia, etc.

How do spot Bitcoin ETFs differ from buying Bitcoin directly?

A spot Bitcoin ETF provides a more accessible and streamlined way for investors to gain exposure to Bitcoin, while buying Bitcoin directly requires more technical knowledge and effort. However, a spot Bitcoin ETF does not provide direct ownership of the physical asset and is not as straightforward as buying Bitcoin directly.

Gary Gensler Coinbase Exchange