Crypto Markets See Massive Liquidations

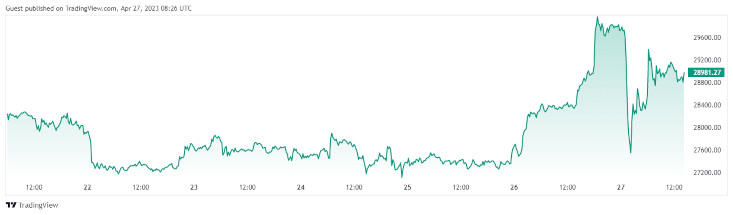

The crypto market has been volatile over the past 12 hours, with Bitcoin (BTC) surging to $30,000 before taking a sudden dive to around $27.5K.

Bitcoin climbed to over $30,000 on Wednesday evening on hopes of favorable monetary policies in the U.S., but sudden sales drove prices down to the $27 000 level the following few hours. Overall, the future crypto market remains unstable. As of the time of this writing Bitcoin is trading at $28 981

Source and Copyright: © TradingView

Other leading assets such as Ethereum (ETH), Binance Coin (BNB), XRP, and Dogecoin (DOGE) have also fluctuated over the same period of time.

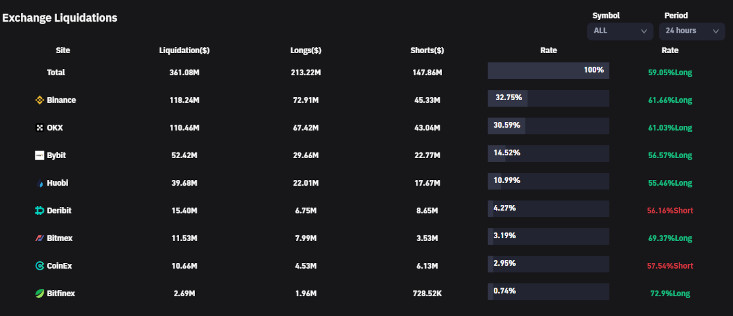

According to Coinglass, the crypto market saw $361.82 million liquidated in the past 24 hours, with more than 80,000 traders being liquidated, with short traders losing around $150 million in the last 24 hours. Around 73% of that occurred over the past 12 hours as panic selling ensued. The analytics platform reported that it was the largest period of long liquidations for the past month.

The largest single liquidation order happened on Bitmex - XBTUSD value $5.05M. Crypto exchange Binance had over $118 million liquidated on its platform over 24 hours, followed by counterparts OKX and Bybit at $110 million and $52 million, respectively.

Source and Copyright: © Coinglass

Bitcoin saw liquidations of more than $54 million in the past 12 hours, while Ethereum saw $22 million. Other assets such as Dogecoin, Arbitrum, Chainlink, XRP, Litecoin, and Solana experienced about 500k-1m liquidations.

Rumors of bitcoin sales from the U.S. government and crypto exchange Mt.Gox may have further impacted prices, as prices fell to as low as $27,200. Blockchain analytics firm Arkham said wallets linked to no longer existing crypto exchange Mt. Gox and the U.S. government had moved large amounts of Bitcoin.

However, such data alerts were later confirmed to be misclassified by Arkham. The firm stated that Jump Trading, a prominent market maker, deposited $26.6M worth of BTC to various exchange deposit addresses in the past hour.

Most of these funds were sent to Binance, with Jump Trading transferring $23.7M to their BTC deposit address. Arkham said it did not believe its alerts caused the market panic as they were sent to a “small subset” of users much after bitcoin’s move.