PeakDeFi Launchpad Guide

Here’s how to participate in IDOs of high-quality blockchain projects via PeakDeFi Launchpad. Find out all you need to know about the protocol and how to get started.

As the cryptocurrency market gets flooded with new projects every day, PeakDeFi Launchpad has risen to the occasion to help investors make the right decisions as regards the most viable projects to participate in. Individual investors are always on the lookout for more transparent, fairer, and diverse projects for investment.

Source and Copyright © PEAKDEFI Launchpad (here and later in this article)

In response to investors’ need for a reliable platform that on-boards and supports young and promising cryptocurrency projects with high ROI potential, PeakDeFi created its launchpad in 2020 to bridge the gap between high-quality DeFi projects and potential investors. The protocol provides promising projects with the resources to thrive, assimilate a dedicated audience, and gain widespread adoption in the market.

Read on if you’re looking to invest in a DeFi fund comprising some of the most promising projects in the crypto space.

What is PeakDeFi Launchpad?

PeakDefi is a multi-chain platform to connect fresh fundraising projects with investors looking for high-quality new projects with impressive ROI potential. It is a self-funded project providing DeFI for its community through different web3 products and the various utilities of its native token, PEAK.

Its ecosystem has a global fund with automatic redistribution capacity among its best performers via smart contracts. A multi-chain DeFi wallet for iOS and Android provides direct access to promising NFT (Non-Fungible Token) collections, a fast dApp browser, and staking functionalities all in one mobile app.

The thousands of IDOs (Initial DEX Offerings) and IGOs (Initial Game Offerings) that pass through the crypto ecosystem increase the difficulty of filtering promising projects with high ROI generation potential. But PEAKDEFI thoroughly analyzes its potential projects’ teams, tokenomics, use cases, finances, long-term potential, and developmental processes and strategies.

The company has a highly experienced team whose members have helped develop and launch thriving crypto and DeFi startups. So, they know how to deploy all the necessary tools and processes for all fundraising projects, thereby facilitating seamless project execution with reliable long-term growth and development potential.

How does PeakDeFi Launchpad Work?

You can participate in PeakDeFi by buying PEAK, staking it, and joining IDOs of promising crypto projects. If you’ve not got PEAK tokens, you can simply get them via any of these exchanges: Bibox, NEXC Global, PancakeSwap, Hitbtc, Uniswap, etc. Always remember that your PEAK token must be on the Binance Smart Chain since the launchpad is compatible with the Binance Smart Chain.

The PEAKDEFI Launchpad team democratizes access to high-quality projects via a tiered system. To ensure fair project launches of early-stage crypto projects, the PeakDeFi team created a tier system to enable everyone to get their deserved portion of the pools’ allocations. The launchpad has six levels in its tier system, and they are as follows:

|

Tier |

No. of staked PEAK tokens |

Pool Weight |

|

Tier 0 |

1,000 |

12 |

|

Tier 1 |

10,000 |

22 |

|

Tier 2 |

50,000 |

24 |

|

Tier 3 |

100,000 |

26 |

|

Tier 4 |

250,000 |

28 |

|

Tier 5 |

1,000,000 |

30 |

Of the six tiers, there are five normal tiers where users have guaranteed allocations for every sale. Then there’s the tier 0 level, which is lottery based. That means tier 0 follows an allocation lottery system, where a participant must win the lottery to get an allocation for a particular sale. Any user wanting to participate in the Tier 0 lottery Ned’s just 1,000 PEAK tokens and the integrated Chainlink VRF (Variable Random Function) will select the winners on-chain.

After opening a Sale pool, it remains open until all the tickets are sold out or the pool’s time limit elapses. In a case where the allocation is not sold out, the rest of the tokens are then split between all other tiers based on their pool weights.

How to use the PeakDeFi Launchpad

Here’s a step-by-step guide on how to participate in the PeakDeFi Launchpad:

Step 1. Buy Peak Tokens

The first step to begin participating in the launchpad is buying PEAK. You can buy it via any of the exchanges linked to in the above section. After buying it, you can proceed to the next step below.

Step 2. Stake PEAK Tokens

To stake your PEAK tokens, you need a MetaMask wallet installed in your browser for holding the tokens. You can download it as an app on Android or iOS, or you can download MetaMask’s Google Chrome extension on your PC. Alternatively, you can connect a wallet through the Walet Connect software.

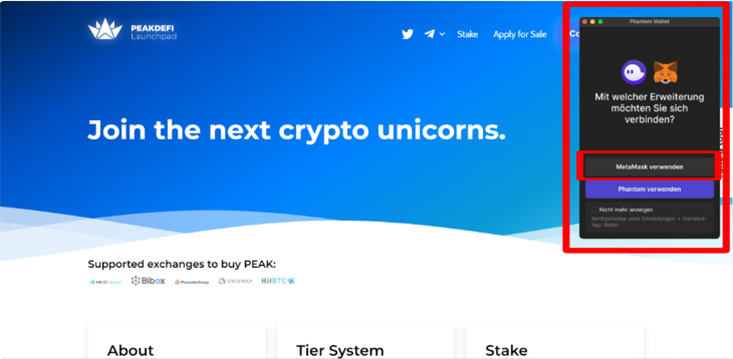

Now, you can visit https://launchpad.peakdefi.com (make sure it’s this URL). You need to open the website from the browser where you installed your wallet if you’re using your PC. Then connect your wallet to the launchpad by clicking "Connect Wallet" on the upper right corner of your screen. You’ll see a popup with MetaMask and Phantom wallets, but always choose MetaMask.

Remember to set the network as Binance Smart Chain to be able to interact with their ecosystem. Also, ensure to have some BNB in your wallet to cover transaction fees on the launchpad. At least $30 worth of BNB is suitable for a start. Now you’re ready for staking and can stake your PEAK tokens and earn up to 20% APY. You can also get IDO allocations for upcoming projects - the size of your allocation based on your tier level or how many PEAK tokens you’ve staked.

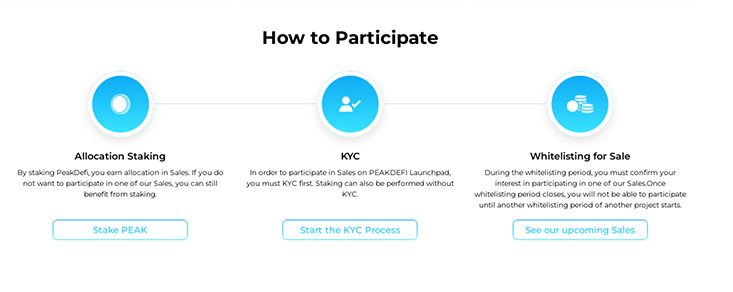

To participate in Sales on the PeakDeFi launchpad, you must complete your KYC; however, staking can also be done without KYC. Here’s how to stake PEAK step by step:

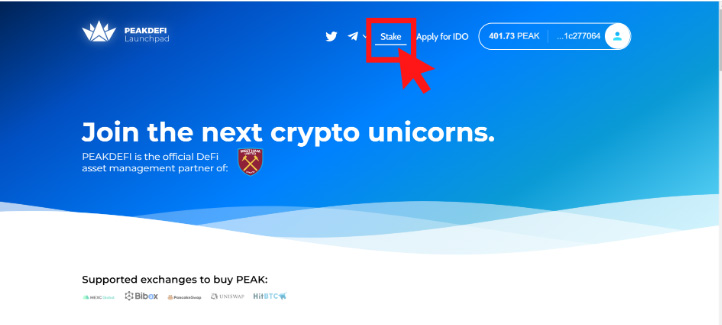

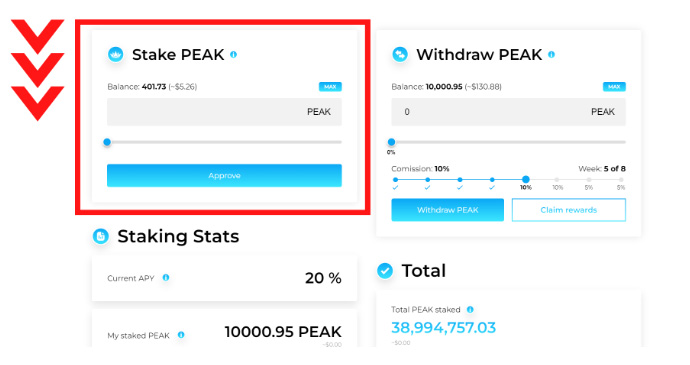

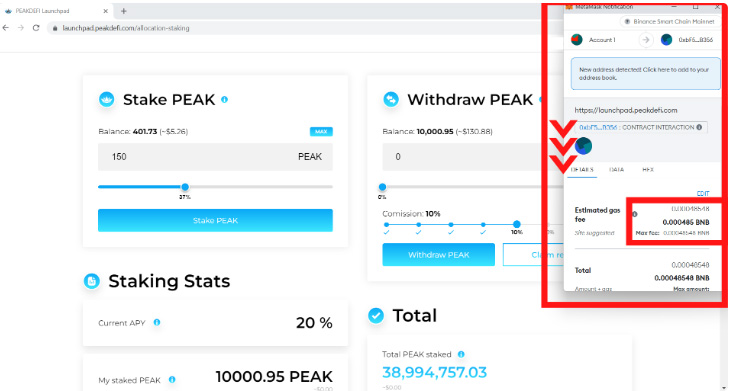

Step I: Visit the homepage of the launchpad and click on "Stake" at the top of the page to enter the staking area.

Step II: Scroll down a little in the staking area until you find the "Stake PEAK" box.

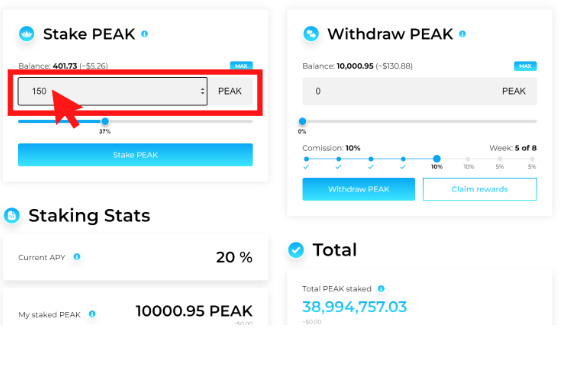

Step III: Fill in the amount of peak you want to stake on the gray area. Then click on the "Stake PEAK" button to confirm the amount.

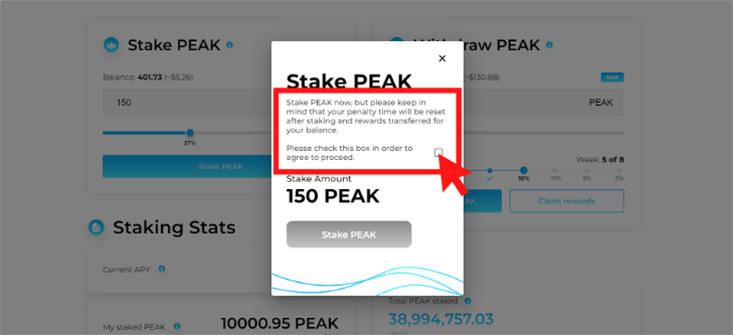

Step IV: A popup window will appear, asking you to confirm that you’re aware your cooldown period will start over if you had already staked PEAK tokens on the platform and are now staking new ones. (A new cooldown period of 8 weeks starts counting each time you deposit, pay out, or claim PEAK rewards).

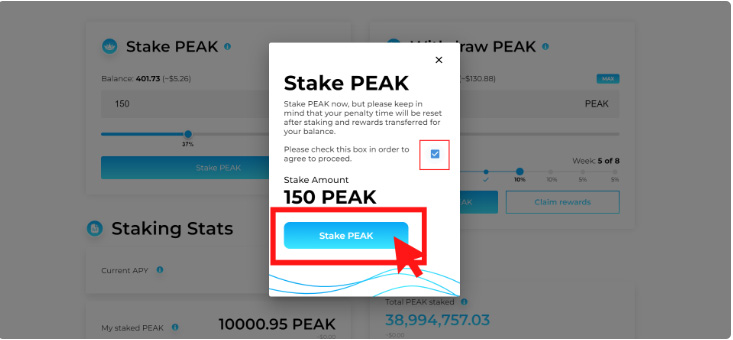

Step V: If you agree, click on the checkbox. Immediately, the "Stake PEAK" button changes from gray to blue, and you can confirm everything.

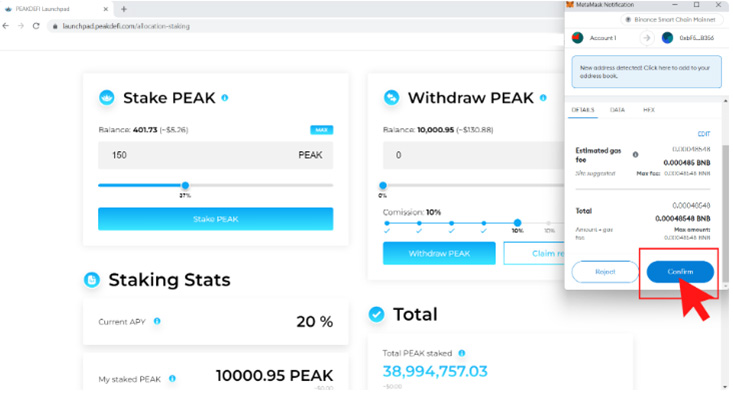

Step VI: Your wallet’s pop-up window will open, providing an overview of your transaction. You will see how much the expected BNB transaction fee will be, then scroll down to see all the details.

Step VII: Click the "Confirm" button at the bottom of the pop-up window if you agree.

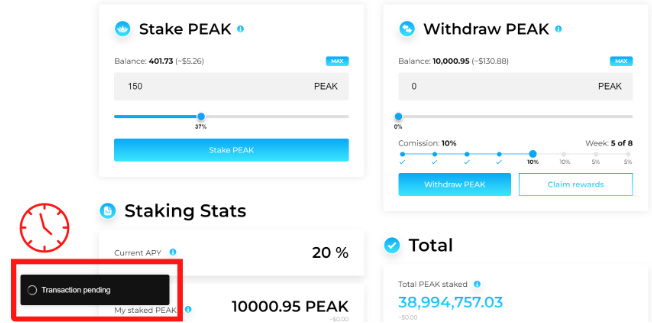

Step VIII: If everything goes smoothly, you will get a small info text at the bottom left of the page telling you your transaction is pending.

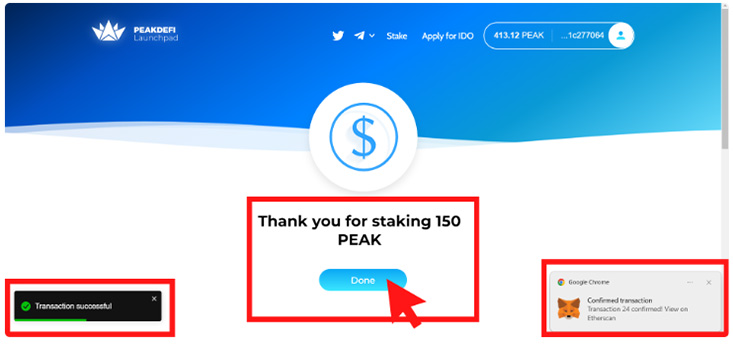

Step IX: If the transaction goes smoothly, you will get two pop-up windows - one from your wallet and the other from the launchpad, confirming your transaction. Click on "Done," and you’ve successfully staked PEAK.

Step 3. Participate in PeakDeFi IDOs

Participating in IDOs on the platform can be done in the following three successive phases:

- Phase 1 - IDO whitelisting

- Phase 2 - Deposit tokens

- Phase 3 - Claim your allocation

Visit here to see all the steps on how to complete these phases and participate in your favorite project IDOs.

What does the PeakDeFi Launchpad offer?

The launchpad offers several qualities that make it stand out and worth investors’ time and resources. It provides:

The highest quality standards

High-potential crypto projects undergo five stages of scrutiny before they are listed on PeakDeFi to ensure that only the most promising projects in the crypto market are launched on the platform.

Fairness

PeakDeFi has created guaranteed transparent allocation tiers for all its potential investors to ensure that every participating investor has a sense of belonging by holding an allocation spot.

Efficiency

The decentralization and automation on PeakDeFi ensure the highest efficiency throughout all the stages, from the onboarding to the development and final launch of brand new fundraising projects.

Tokenomics

PEAK is the native Token behind PEAKDEFI, and it powers the platform. It’s an ERC-20 Token built on the Ethereum network, just like PEAKDEFI itself. There’s a total PEAK supply of 2,000,000,000 PEAK. Here’s how the token is distributed:

- Staking on ETH Chain - 50%

- Staking on Binance Smart Chain - 15%

- MarketPeak Community on ETH Chain - 10%

- MarketPeak Community on Binance Smart Chain - 10.5%

- Yield Farming for Liquidity on ETH Chain - 4.4%

- Founders and Team - 10%

- Initial PEAK Liquidity on ETH Chain - 0.1%

- Initial peak Liquidity on Binance Smart Chain - 0.05%

Basically, the PEAK token is used for:

- managing assets as a trader

- rewarding liquidity providers

- incentivizing community growth through rewards

- stimulating the fund via protection staking

- compensating platform development

Project Team

CEO

Sergej Heck

Lead Tech

Benjamin Bendig

Lead Social Media

Jonas Mehmood

Solidity Engineer

Ararat Tonoyan

iOS Developer

Oksana Pylypenko

Android Developer

Denys Roman R.

PeakDeFi Roadmap

To continuously develop its ecosystem, provide a smoother user experience, and impact lives beyond its community, the PEAKDEFI team has split its significant goals for 2023 and beyond as follows;

- May 2023. 4th-anniversary celebration plus the next Airdrop project projected to reach 150,000 members.

- September 2023. New User Interface and Design of MarketPeak

- December 2023. Road to 500,000 members. The goal is to reach 500,000 members with more projects and adequate education.

- End of 2024. Road to 1 Million members

Upcoming Projects

Upcoming projects are kept confidential till about a few weeks to a month of launch. The latest project awaiting launch on the platform is Octovia Token.

OctoviaToken

Octovia is a web-3 AI crypto assistant powered by its native token VIA (with a total supply of 100,000,000). As the first on-chain AI assistant, Octovia has access to the internet and blockchain and can research and retrieve information about crypto wallets, tokens, contracts, etc.

It can carry out actions on-chain, such as buying and selling tokens, buying into presales, and scheduling orders. Also, it has a real memory that enables it to learn about you and your preferences and serve you better.

The token is scheduled to launch on PeakDeFi on the 10th of August 2023, while the TGE (Token Generation Event) will be held around the 26th of September.

Frequently Asked Questions

Is PeakDeFi Safe?

Yes, PeakDeFi follows industry best practices to ensure the safety of your crypto investments. Its decentralization has also revolutionized governance and helps protect users from scams. However, in the case of the cryptocurrency market, you should always do your own research and keep in mind the high risks inherent in this field.

What makes PeakDeFi unique?

PeakDeFi is different from other platforms because it has a diversified business model that allows them to impact users without charging them exorbitant fees. For instance, the protocol makes only a 0.1% developer fee from the AUM (Assets Under Management) in the DeFi Fund every 60 days.

What technologies has PeakDeFi Launchpad created and used?

The PeakDeFi ecosystem comprises the Launchpad, a Mobile DeFi Wallet on the Ethereum network, and the DeFi Fund. These together make it a formidable interoperable ecosystem with multiple utilities and earning opportunities for investors and project owners.