The Most Common Crypto Scam Methods 2023. How to Recognize & Avoid Them

Unmasking the tactics of crypto fraudsters. Dive deep into the most widespread scam schemes to ensure your digital assets remain secure.

Crypto Scammers Are on the Rise

As cryptocurrencies gain traction, there's a parallel rise in scams associated with this arena. Wherever there's money, there are opportunists looking to exploit. The allure of crypto for fraudsters lies in the newness of the technology and the average person's unfamiliarity with blockchain. Scammers often present themselves as seasoned experts or leaders in the field to earn trust.

Many users are unfamiliar with how digital currencies operate and how to secure their assets. Given that cryptocurrency transactions lack legal protections or government guarantees, they become prime targets for cybercriminals. Furthermore, there's no centralized authority like banks to monitor suspicious crypto activities and once a crypto transfer is made, it's irreversible. These factors make the industry a hotspot for fraudulent activities.

Scammers use inventive tactics to fool victims, often resorting to impersonation and meticulously constructed deceptions. These deceits are frequently adapted to the individual they're trying to dupe.

A 2022 report by CertiK, titled "Web3 Security Report", noted that the past year was the worst in terms of financial losses from Web3 protocols. The damage from crypto-related hacks, manipulations, and scams amounted to a $3.7 billion in 2022, marking a 189% rise from 2021’s $1.3 billion.

This article delves into prevalent cryptocurrency scams and offers guidance on how to avoid them. By familiarizing yourself with these deceptive practices and taking preventive measures, you can protect your crypto assets against potential threats.

What Is a Crypto Scam?

Cryptocurrency scams are deceptive schemes executed by fraudsters to steal your digital assets. Their sophistication can vary from simple emails to meticulously crafted fake websites and celebrity impersonators that are indistinguishable from the real ones.

Some scams might not confront you directly. Instead, they aim to snatch critical data, like your seed phrase or private keys. By doing so, they can gain access to your crypto wallet. Such deceptive practices might be challenging to spot but can lead to severe losses.

In essence, the mechanics of crypto scams mirror traditional financial crimes. The only difference between crypto scams and conventional financial scams is that the scammers seek your crypto assets rather than your cash.

The underlying objective for these scammers remains consistent: manipulate the unsuspecting into either revealing personal information or redirecting precious digital assets, like NFTs, into the scammer's control.

Now let’s cover the most common cryptoscam schemes you are likely to encounter while engaging in crypto investments.

SIM-Swap Scams

SIM-swap scams are some of the fresh entrants in the crypto scam playbook. This scam is based on the illicit acquisition of a person's SIM card data, which grants the perpetrators complete access to the victim's mobile data, opening the way for illegal fund withdrawals.

One might wonder why hackers are especially drawn to this method in the context of cryptocurrency. The rationale is simple: digital wallets, often holding significant sums, are sometimes secured with nothing more than a mobile phone number they frequently fabricate fake emergencies in order to quickly deplete user assets.

To orchestrate the SIM-swap, fraudsters first hop on a data-gathering mission, amassing as much personal information about their target as possible. Armed with this information, they employ social engineering to deceive mobile carriers.

Typically, the fraudster impersonates the victim and contacts the carrier to report a lost or damaged SIM card. Their goal is to persuade the carrier to activate a new SIM card—one that's in the scammer's possession. Upon compliance from the carrier, the victim's phone number is redirected to the scammer's device, redirecting all incoming calls and messages.

How to Avoid SIM-Swap Scam

Avoid relying solely on phone numbers for Two-Factor Authentication (2FA). Such methods, especially SMS-based verifications, are vulnerable to SIM-swap hacks. Opt for authenticator apps as a secure alternative for 2FA. If you're storing substantial amounts of cryptocurrency, think about investing in a hardware wallet.

Implement Multifactor Authentication (MFA). Wherever possible, activate multifactor authentication. By requiring multiple pieces of evidence before granting access, you dramatically reduce the chances of unauthorized entry.

Never underestimate the power of a strong PIN or password, especially for your SIM card and mobile account. Make them complex, change them periodically, and avoid using easily guessable information like birthdays.

Impersonation Scams

Imagine scrolling through X (former) Twitter and stumbling upon a tweet from Elon Musk or Vitalik Buterin promising generous Bitcoin or Ethereum giveaways. If this scenario sounds familiar, you've likely encountered one of the most pervasive yet seemingly simplistic crypto scams: impersonation.

It's shocking to realize that despite its transparent nature, countless individuals have fallen victim to this fraudulent scheme. The Federal Trade Commission (FTC) notes a loss of $417 million USD solely to such social media-driven frauds.

The modus operandi of impersonation scams spans a broad spectrum:

Pretending to be an Investment Managers

A common ploy involves scammers representing themselves as investment experts, enticing you with promises of guaranteed returns if you entrust them with your crypto holdings.

Impersonating Trusted Entities

Fraudsters might present themselves as reputable businesses or established organizations, reaching out via varied mediums such as emails, calls, social media, or even unexpected computer pop-up alerts. Their narratives usually revolve around alleged fraud on your account, threats to your financial security, or other issues. Their proposed solution invariably involves you purchasing crypto and transferring it to their addresses, or sharing personal details on fake websites.

Government & Utility Impersonations

Some impostors take the audacity a notch higher by feigning affiliations with government bodies, law enforcement, or utility firms. They spin tales of legal complications or outstanding dues, manipulating victims into procuring cryptocurrency and dispatching it to specified wallet addresses.

Fake Job Listings

The job market isn't spared either. Scammers post fabricated crypto-related job opportunities on employment platforms. Unsuspecting applicants are attracted with prospects of roles centered on investor recruitment, crypto sales, or mining Once they get a job, they are required to pay a charge in cryptocurrency to begin their employment.

How to Avoid Impersonation Scams

Be skeptical of unsolicited offers. If you receive an unexpected message or offer, especially if it's too good to be true, treat it with caution. High-return guarantees with little to no risk are classic red flags.

If you encounter a supposed message from a known figure or entity in the crypto world, verify its authenticity. Cross-reference with official websites or other reliable platforms.

Never share personal information or financial details, especially in response to unsolicited requests. Scammers can use this information to manipulate or scam you further.

If you receive a message or call from a 'trusted entity' like a government agency or a utility company, never use the contact details they provide in that message. Instead, visit the official website or use previously known contact methods to verify any claims.

Approach crypto-related job offers with a discerning eye. If the employer requests a fee in cryptocurrency or tasks that involve uncertain financial transactions, consider it a potential scam.

Rug Pull Scam

In a rug pull scam, developers or initial promoters of a cryptocurrency project solicit funds from investors, typically by promoting a new token or DeFi project, only to "pull the rug out" from under them by abruptly withdrawing all the funds or rendering the token worthless, often disappearing without a trace.

The term metaphorically alludes to the idea of someone yanking a rug from underneath a person, causing them to fall unexpectedly.

Rug pulls are tricky because, until the moment of the scam, the project often appears legitimate. It might have an active online presence, detailed whitepapers, and even a vibrant community on platforms like Discord or Telegram.

Here's how it typically unfolds:

The developers introduce a new cryptocurrency or a DeFi project, often accompanied by slick marketing campaigns and enticing narratives of high returns revolutionary technology, or other enticing benefits.

As investors flock to the project, lured by its promise and the potential for profit, they purchase the token or invest in the project, leading to an increase in its value.

Developers might introduce hidden backdoors or functions in the smart contract code that allow them to drain funds or manipulate the project in unexpected ways.

After accruing a substantial amount in investments, the scammers suddenly withdraw all the liquidity or assets from the project, often converting their gains to a more stable cryptocurrency like Ethereum, Bitcoin or USDT.

The culprits often disappear, shutting down websites, social media accounts, and any other traces of the project.

How to avoid Rug Pulls

Investigate the project's team, read its white paper, and check for feedback or reviews from trusted community members. Join the project's Telegram, Discord, or other community channels. Ask questions and gauge the sentiment of the community.

If the project's team members are anonymous or have no verifiable online presence or history in the crypto space, it might be a warning sign.

Be wary of projects that are vague about their mission or provide little technical detail. Legitimate projects are typically transparent about their goals, strategies, and progress.

Check if the project's smart contract has been audited by a reputable firm. lack of audit or refusal to share audit results can be a warning sign.

Check the projects smart contracts. If they are not available for review or is locked in some manner, it may be a sign that there's something to hide.

The Ponzi Scheme

The Ponzi scheme, named after its most infamous proponent, Charles Ponzi, has been a notorious financial scam predating the emergence of digital currencies. It's a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. The scheme leads participants to believe that profits are coming from legitimate business activities when, in fact, they are coming from payments made by newer participants.

Here's how the Ponzi scheme typically operates:

The schemer promises high returns on investments, often significantly above the market rate. This attracts the first wave of investors. The scheme often lacks a legitimate business model and instead relies on maintaining the flow of new investments.

Early investors receive returns, which are not genuine profits but rather the principal of newer participants. The seemingly "successful" payouts attract more investors.

The scheme projects an image of consistency. Initial investors, after seeing regular profits (which are actually funds from new investors), often reinvest or tout the scheme to friends and family, further accelerating the influx of new capital.

Eventually, attracting more participants becomes unsustainable, or there's a significant number of withdrawal requests. Once the flow of new investors slows down or too many current investors demand their money back, the scheme collapses. The promoter often disappears, leaving behind a trail of financial devastation.

How to Avoid The Ponzi Scheme?

A legitimate investment opportunity will withstand scrutiny. Don't hesitate to ask for details and get answers. The schemer may dodge questions or provide vague answers about how the business generates such high returns.

Beware of pressure. Scammers may pressure you to decide quickly to avoid missing out. Always take your time to make informed decisions. Be wary of "guaranteed" high returns with little to no risk. Legitimate investments typically don't offer sure-shot profits.

Be suspicious about consistent returns: Investments fluctuate. If an investment consistently generates positive returns regardless of market conditions, it's a potential red flag.

Phishing Scam

Phishing, a cyber-attack method as old as the internet itself, has seamlessly integrated into the world of cryptocurrencies. This scheme retains its status as a preferred choice among scammers. This practice involves tricking individuals into revealing sensitive information, like passwords or private keys, by pretending to be a trustworthy entity.

Here's a breakdown of how phishing typically unfolds:

The scammer initiates contact, usually via email, but also through direct messages on social platforms, text messages, or even phone calls. The message often appears to come from a legitimate source, like a popular crypto exchange or wallet service.

The message usually includes a sense of urgency. Common narratives include winning prizes, fake airdrops, giveaways, issues with a wallet, security breaches, or the need for account verification.

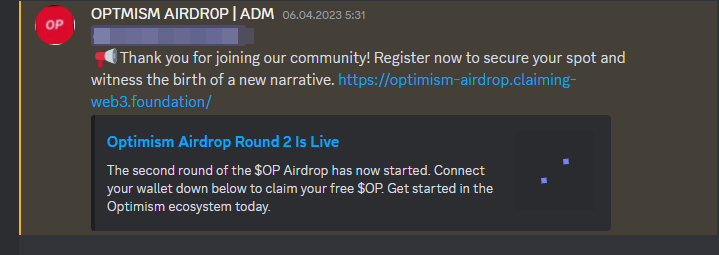

Source & Copyright: Lee Brook's Personal Discord

The communication will typically include a link directing the recipient to a fraudulent website or ask them to download an attachment. These fake websites often mirror legitimate platforms, prompting users to input their credentials or private keys.

Once the victim inputs their details, the scammer captures this information. This can grant them access to wallets, leading to unauthorized transfers and fund theft.

How To Avoid Phishing Scams?

Before acting on any communication, ensure it originates from a legitimate source. Avoid clicking on links in emails or messages. Instead, manually type the known website address into your browser.

If you're unsure about an email's legitimacy, contact the supposed sender directly using contact details from their official website, not the details in the suspicious email. Legitimate organizations won't ask you for sensitive data out of the blue.

Before entering any information, ensure the website's URL is correct. Look for the secure "https://" prefix and watch out for subtle misspellings or extra characters.

Use multi-factor authentication, because even if scammers obtain your login details, MFA can provide an additional security barrier.

What To Do If You Have Been Scammed

Falling victim to a cryptocurrency scam can be devastating, and it's essential to act quickly if you have made a payment or disclosed personal information.

Falling victim to a crypto scam can be devastating, but taking immediate and thoughtful action is essential. Here's a guide on what to do if you find yourself in this unfortunate situation:

Gather Evidence

Start by collecting all the information related to the scam, including wallet addresses, transaction IDs, correspondence (emails, chat logs, etc.), website URLs, and any other relevant data. Ensure you have visual evidence of all interactions, especially if they're on platforms or websites that might change or disappear.

Report to Authorities

While crypto transactions are often irreversible and cross borders, reporting the incident to your local authorities can still be valuable. They may escalate it to relevant cybercrime units. Depending on your jurisdiction, there might be specialized cybercrime or digital fraud units that handle such cases.

Contact Financial Institutions

If you transferred money from your bank to a scam platform, inform your bank immediately, since crypto fraudsters often sell the details they have captured to other criminals. If a credit card was involved, get in touch with the card provider.

Secure Your Devices and Accounts

If you shared any credentials or accessed suspicious links, change passwords for all your sensitive accounts immediately.

Ensure your device's antivirus and anti-malware software are up to date. Conduct thorough scans to check for any malicious software.

Reach Out to the Crypto Community

If you know the scammer's wallet address, report it to popular exchanges. They might flag or, in some cases, freeze the associated assets.

Share your experience on crypto forums, Discord, Reddit, and other platforms. Not only can community members offer advice, but your story might also prevent others from falling for the same scam.

Monitor Your Personal Information

If you've shared personal data, be vigilant for potential identity theft or other fraudulent activities targeting you.

Educate Yourself

Use this unfortunate experience as a lesson. Familiarize yourself with common scam tactics and red flags so you can avoid similar pitfalls in the future.

Conclusion

The blockchain universe, despite its unprecedented opportunities and innovations, is regrettably filled with crypto scams. These deceptions, in their multifaceted forms, can be difficult to identify and navigate at times. However, acquiring knowledge remains of paramount importance. Acquaint yourself with the red flags and complexities of these scams. By devoting time to comprehending and recognizing these dangers, you can protect your valuable crypto assets from cunning predators. Always keep in mind that in the world of cryptocurrency, your strongest allies are vigilance and knowledge.

Frequently Asked Questions (FAQ)

What is a crypto scam?

A crypto scam is a deceitful tactic where fraudsters aim to steal your digital assets, like cryptocurrencies or NFTs, by manipulating or misleading you.

What immediate steps should I take if I suspect I've fallen for a crypto scam?

Cease all communication with the suspected scammer, secure your legitimate accounts, monitor your digital wallets, report the scam to relevant authorities, and consider seeking legal advice.

Where can I report a suspected crypto scam?

Depending on your jurisdiction, you may report to local law enforcement, cybercrime units, or regulatory bodies overseeing financial transactions. Some countries also have dedicated platforms for reporting cybercrimes and scams.

Can I recover funds if I fall for a crypto scam?

Unfortunately, due to the irreversible nature of blockchain transactions, it's challenging to recover funds once they're lost to scams. However, always report the scam to law enforcement, as they may be able to track down and prosecute the scammers in some cases.

How can I detect a crypto scammer?

Identifying a crypto scammer often involves spotting red flags like unsolicited offers, too-good-to-be-true promises, aggressive tactics, and requests for sensitive information. Always cross-check and verify any claims, and trust your instincts. If something feels off, it's best to steer clear.