What is an NFT: What It Means and How It Works?

What are NFTs? Why all the hype? Navigate the fascinating world of NFTs with our detailed guide. Learn what NFTs are, how they work, their uses, and the benefits they offer. Understand the tech behind, potential risks, and how they alter the digital landscape across various industries.

Introduction

If you've been keeping an eye on what’s going on in the digital finance world, or even just scrolling through your social media feeds, you've probably stumbled upon the term NFT. There is no doubt you heard of some weird pictures of apes that have been sold for tens of millions of dollars. It's a buzzword that's been going around the internet and causing a lot of excitement, misunderstanding, and some skepticism.

In the past couple of years, NFTs, or Non-Fungible Tokens, have emerged as the new sensation of the crypto world. They've managed to break free from the strictly blockchain concept and turn into a mainstream cultural phenomenon. Whether it's a digital artwork selling for a mind-blowing sum or a tweet turned into a digital asset, NFTs have been making headlines, leaving many to wonder, "What on earth is an NFT?"

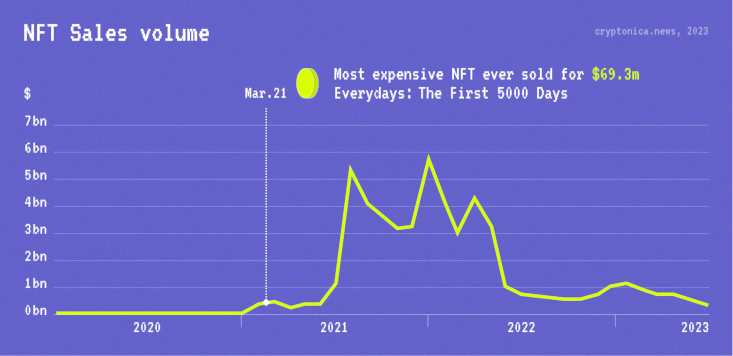

The NFT craze reached its peak between 2021 and 2022, a period that saw the meteoric rise of these unique digital assets. The world was captivated by the sense of FOMO (Fear Of Missing Out), heating up the activity of the NFT market. It was a time when digital artworks were being sold for astronomical prices. Even giant film studios like Paramount Studio and Disney Pictures delved into this gold rush with their Star Track and Marvel collections respectively.

However, as with all things that rise, a fall was inevitable. The once-sizzling NFT market began to cool down, and the value of many NFTs plummeted. The bear market has left a long shadow over the world of NFTs, and what was once the hottest topic of the investment world is now looked at with a more cautious eye.

The hype has died down, and the future of NFTs seems uncertain. But this doesn't mean that the NFT story is over. The world of NFTs is still rich with potential and opportunities. However, investing in NFTs requires a keen eye, a deep understanding of the market, and most importantly, the willingness to take a risk.

So, what's all the fuss about? What exactly is an NFT? Let’s try to figure it out in our guide.

What is NFT?

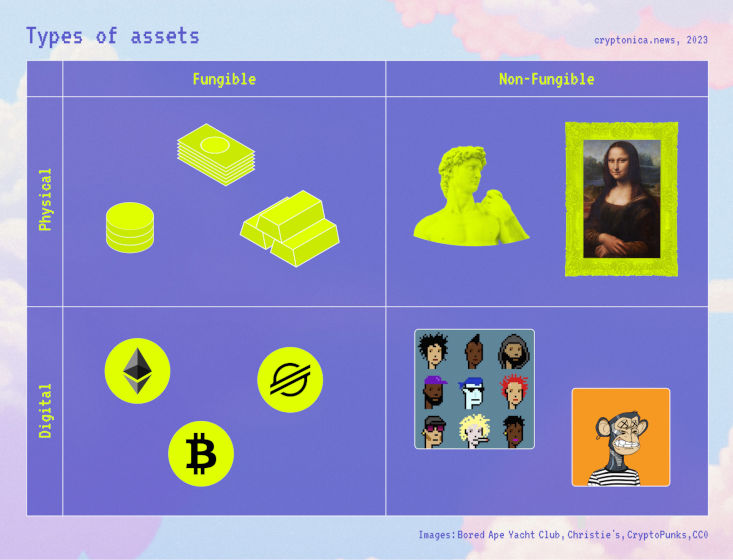

NFT stands for Non-Fungible Token. To understand what that means, let's break it down. In economics, a fungible item is something that can be exchanged on a like-for-like basis. Think of it as money - you can swap a $10 bill for two $5 bills, and it's still the same amount of money. Non-fungible, then, means it's unique and can't be replaced with something else. On the internet, these digital items can be anything from digital artwork and music to virtual real estate in digital worlds.

So, an NFT is a kind of digital asset. Each NFT has a digital signature that proves its authenticity and ownership, making each one unique. It's like owning an original painting in the digital world. You might be thinking, "But can't digital items be copied?". Yes, they can. But with NFTs, you have the certificate of ownership that proves you own the original.

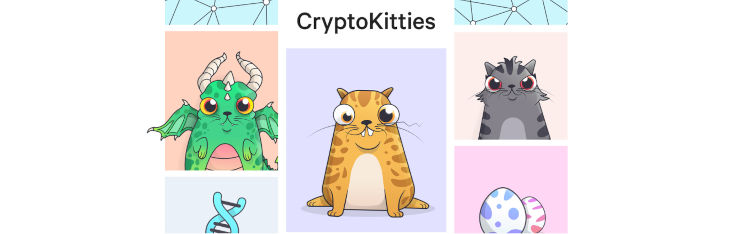

The concept of NFTs has been around for a while, but it wasn't until around 2017 that they started to gain traction. The first mainstream use of NFTs was CryptoKitties, a blockchain game on Ethereum that allows players to purchase, collect, breed, and sell virtual cats. Each CryptoKitty is unique and owned by the user, validated through the blockchain, and its value can appreciate or depreciate based on the market.

Source and Copyright © Сryptokitties

CryptoKitties was a hit, and it introduced the world to the idea of NFTs. But it was just the beginning. Since then, the NFT market has exploded, with artists, musicians, and content creators of all kinds.

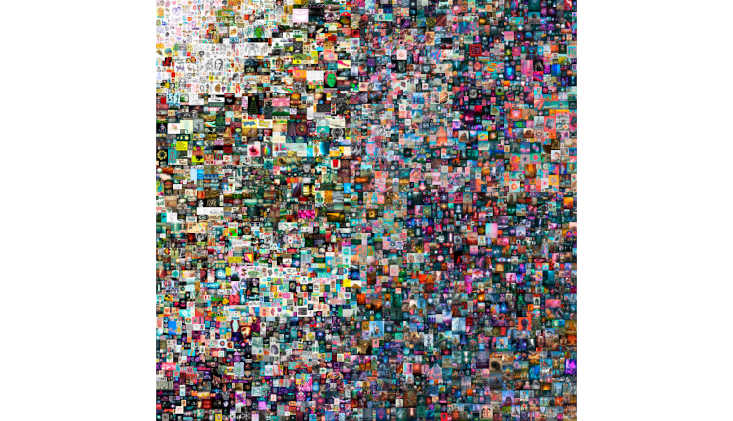

In 2021, digital artist Beeple made headlines when his NFT artwork, "Everydays: The First 5000 Days," sold at Christie's auction house for a staggering $69 million. This sale transformed NFTs into the mainstream, sparking a global conversation about the value of digital art and the future of NFTs.

Everydays: the First 5000 Days by Mike Winkelmann (a.k.a. Beeple)

Source and Copyright © Christie's images LTD / Beeple

How Does an NFT Work?

NFTs exist on a blockchain, which is a distributed public ledger that records transactions. You've probably heard of blockchain in the context of cryptocurrencies like Bitcoin or Ethereum. But unlike Bitcoin or Ethereum, where every coin is the same as every other coin, each NFT can be different from the next, this makes them non-fungible.

Meanwhile, cryptocurrencies are fungible tokens (you can exchange one Bitcoin for another Bitcoin, and you'll have the same thing). Each NFT has a unique digital signature, which means it can't be exchanged on a like-for-like basis.

The process of creating an NFT is known as minting. When an NFT is minted, a unique digital signature is assigned to the asset, and it's added to the blockchain. This process creates a record that verifies the asset's authenticity and ownership. The information stored in an NFT includes the identity of the owner, the unique data or attributes of the asset, and the transaction history of the asset.

When an NFT is purchased, the transaction is recorded on the blockchain. This record includes the buyer's and seller's wallet information and the price paid for the NFT. This transparent history allows anyone to verify the ownership and authenticity of the NFT. NFTs are bought and sold on various online marketplaces.

Owning an NFT means you have a blockchain entry that says you own a unique piece of data. However, owning an NFT doesn't necessarily mean you own the copyright to the asset. For example, if you buy an NFT of a digital artwork, you own a token that proves you possess a unique version of that artwork, but the artist can still retain the copyright and reproduction rights to the artwork.

NFTs are typically built on Ethereum's ERC-721 and ERC-1155 standards, which allow for the tokens to be interoperable with other services on the Ethereum blockchain. This means you can sell an NFT on one marketplace and then buy it on another, as long as they both support these standards.

What Are NFTs Used For?

NFTs have a wide range of uses in the digital world. Even tweets count. For instance, Twitter co-founder Jack Dorsey sold his first-ever tweet as an NFT for more than $2.9 million. Their unique nature and ability to prove ownership make them ideal for representing ownership or interaction with a wide variety of digital and even physical assets. Here are some of the most common uses for NFTs:

Digital Art

This is perhaps the most well-known use of NFTs. Digital artists can mint their artwork as NFTs, providing a blockchain-backed proof of authenticity and ownership. This has opened up a new market for digital art, allowing artists to sell their work directly to collectors without the need for galleries or auction houses.

Collectibles

Remember the buzz around CryptoPunks or Bored Yacht Club? That's an example of NFTs being used for digital collectibles. The Bored Ape Yacht Club (BAYC), is a collection of 10,000 unique digital apes. These apes, initially sold for about 0.08 Ethereum (ETH), have seen their value skyrocket, with some selling for hundreds of ETH.

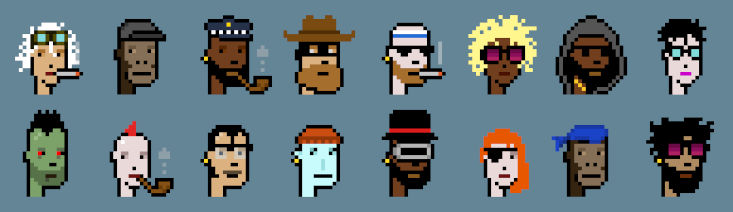

Source and Copyright © CryptoPunks / Yuga Labs

Then there's CryptoPunks, one of the first NFTs on the Ethereum blockchain. CryptoPunks are 10,000 algorithmically generated 24x24 pixel art characters. Originally available for free, CryptoPunks have sold for millions of dollars.

These are just two examples of how NFTs are being used for digital collectibles, creating a booming market and a new form of digital asset ownership.

Virtual Real Estate

In virtual worlds like Decentraland and Cryptovoxels, the land itself is represented by NFTs. Users can buy and sell parcels of virtual land, and the ownership is recorded on the blockchain. In February 2021, a parcel of land in Decentraland was sold for $1.5 million.

Music and Entertainment

Musicians and entertainers are also getting in on the NFT action. They're minting their music and performances as NFTs, providing a new way to sell their work and connect with fans. For instance, singer Grimes sold a collection of digital artworks and short videos as NFTs for more than $6 million. Kings of Leon also released their latest album as an NFT.

Intellectual Property

NFTs can represent ownership of intellectual property rights. For example, a writer could mint an NFT of their book, representing a digital-first edition. In April 2021, the Italian artist Salvatore Garau sold an invisible sculpture, an NFT titled "Io Sono" (I am), for over $18,000. The buyer received a certificate of authenticity and the artist's statement that the sculpture exists in his imagination.

Fashion

In the world of fashion, NFTs are being used to create and sell virtual clothing for avatars in virtual worlds. Some fashion brands are also exploring the use of NFTs for proving the authenticity of their physical products. The Fabricant, a digital fashion house, sold a digital dress, represented as an NFT, for $9,500 in 2019. The buyer receives a 2D pattern cut and a 3D rendering of the dress.

In essence, NFTs have opened up a whole new world of possibilities for digital ownership. As the technology evolves, we can expect to see even more innovative uses for NFTs.

Benefits of NFTs

NFTs are more than just a digital trend; they offer several benefits that are transforming the way we interact with digital assets. Here are some of the key benefits:

Ownership That Can Be Proved

One of the most significant benefits of NFTs is that they provide provable ownership of a digital asset. Each NFT contains distinguishing information in its metadata that makes it unique. This information, combined with the transparency and immutability of the blockchain, allows anyone to verify the authenticity and ownership of the NFT.

Democratization of Art and Content Creation

NFTs are democratizing the art world and content creation in general. Artists and creators can mint their work as NFTs and sell them directly to consumers, bypassing traditional gatekeepers like galleries and publishers. This direct-to-consumer model can potentially lead to greater profits for artists and creators.

New Business Models

NFTs are enabling new business models. For example, artists can program royalties into their NFTs, allowing them to receive a percentage of sales whenever their art is sold to a new owner. This is a feature that's not possible with traditional physical art sales.

Digital Asset Monetization

NFTs provide a way to monetize digital assets in ways that weren't previously possible. For example, creators can now monetize digital art, music, podcasts, games, and other forms of content by minting them as NFTs.

NFT Scams Explained

NFT scams have become a significant concern in the digital art world. Here are some key points to understand:

Scammers may create fake listings for NFTs that they do not own. They use images and descriptions copied from legitimate NFT listings to trick buyers into purchasing worthless tokens.

Scammers may send emails or messages that appear to be from a legitimate NFT marketplace, asking for your login details. This trick is known as a phishing attack. Once they have these details, they can steal your NFTs or other digital assets.

Risk of pump and dump schemes. In these scams, a group of people artificially inflate the price of an NFT by buying it back and forth among themselves. Once the price is high enough, they sell the NFT to an unsuspecting buyer, who is then left with an overpriced asset that they cannot sell.

Another common fraudulent practice is a rug pull. This is when an artist or creator sells NFTs, often as part of a larger project, and then disappears after the sale, leaving buyers with worthless tokens.

Scammers may create fake marketplaces websites that look like legitimate NFT marketplaces. These sites may steal your information or trick you into buying fake NFTs.

To protect yourself from these scams, it's important to do your research before buying an NFT. Make sure the marketplace is legitimate, and be wary of deals that seem too good to be true. Always verify the identity of the seller and the authenticity of the NFT before making a purchase1.

How to Buy and Sell an NFT?

The first step to buying an NFT is to set up a digital wallet that supports cryptocurrency transactions. Each marketplace has its own specific requirements for crypto wallets. As of now, there isn't a single wallet that's universally accepted across all platforms. MetaMask is the most commonly used, but others like Formatic, Torus, Coinbase Wallet, and Portis are also in use.

Once your wallet is set up, you'll need to buy some cryptocurrency. Ethereum (ETH) is the most commonly used cryptocurrency for buying NFTs. You can purchase ETH from various exchanges like Coinbase or Binance, and then transfer it to your digital wallet.

Next, choose an NFT marketplace. Most NFT marketplaces function similarly to auction houses. You place a bid and then wait to see if you've successfully secured the NFT you've set your sights on. Examples of such marketplaces include OpenSea.io, SuperRare, Rarible, Blur and etc. Read our dedicated review if you want to explore the NFT marketplaces in more depth.

There are two primary ways to sell NFTs: trading an NFT you've previously purchased or selling an NFT you've minted yourself. Both methods come with associated costs, including gas fees and final sale service fees determined by the marketplace.

NFTs that you've previously purchased can be resold on the secondary market, much like any other asset. To do this, ensure that the NFT you wish to sell it in your crypto wallet and listed for sale on your chosen marketplace. While the value of your NFT may appreciate over time, it's important to remember that the long-term or even short-term value of NFTs is not guaranteed.

When selling a minted NFT, depending on the platform, you can either set a fixed "Buy Now" price or define the auction rules, such as a reserve price. In some cases, you may receive royalties every time your NFT is resold in the future. However, as with previously acquired NFTs, the long-term or short-term value of your minted NFTs cannot be guaranteed.

How are NFTs Taxed?

The taxation of NFTs is a complex issue that varies depending on the jurisdiction. However, in many countries NFTs are generally treated as property for tax purposes. Here's a general overview of how NFTs are taxed:

Purchase of NFTs

When you purchase an NFT, there's typically no immediate tax implication. The purchase price of the NFT becomes your cost basis in the asset.

Sale of NFTs

When you sell an NFT, you may be subject to capital gains tax. This is calculated based on the difference between your cost basis (the original purchase price) and the sale price. If the NFT has increased in value, you'll have a capital gain, which is taxable. If it has decreased in value, you'll have a capital loss, which may be used to offset other capital gains.

Capital Gains Tax Rates

The rate at which capital gains are taxed depends on how long you've held the NFT. In the U.S., for example, if you've held the NFT for more than a year, it's considered a long-term capital gain, which is typically taxed at a lower rate than short-term capital gains (assets held for a year or less).

Income from NFTs

If you create and sell NFTs as part of a business, the income you receive may be considered self-employment income, rather than capital gains. This can have different tax implications and may be subject to additional taxes, such as the self-employment tax in the U.S.

Gifts and Inheritance

If you give an NFT as a gift, you may be subject to gift tax if the value of the gift exceeds the annual gift tax exclusion amount. If you inherit an NFT, the cost basis of the NFT is typically stepped up to the fair market value at the time of the original owner's death, which can impact the calculation of capital gains when the NFT is later sold.

Please note that this information is a general guide and may not apply to your specific situation. Always consult with a tax professional for advice on your specific circumstances.

FAQ

Are NFTs Safe?

FTs are generally safe to buy and sell due to the security of blockchain technology. However, like any investment, they come with risks, including price volatility and potential scams. Always do your research before making a purchase.

Should I Buy NFTs?

Whether you should buy NFTs depends on your personal interests and financial situation. NFTs can be a unique way to support artists or invest in digital assets, but they also come with risks. It's important to understand these risks and consider them carefully before making a purchase.

How Is an NFT Different from Cryptocurrency?

NFTs and cryptocurrencies both exist on the blockchain, but while cryptocurrencies like Bitcoin are fungible and identical to each other, NFTs are unique and cannot be exchanged on a like-for-like basis.

What does Non-fungible Mean?

Non-fungible means that something is unique and can't be replaced with something else. In the case of NFTs, each token has unique information or attributes that set it apart from any other token, making it impossible to exchange on a like-for-like basis.

Why are NFTs Getting So Much Attention?

NFTs are getting a lot of attention because they open up new possibilities for digital ownership and investment. They allow digital artists to monetize their work in new ways and provide unique opportunities for collectors and investors.

What Makes an NFT Valuable?

The value of an NFT is largely determined by its uniqueness and the demand for it. This can be influenced by factors such as the reputation of the creator, the significance of the work, and the desire of collectors to own it.

Will NFTs Transform the Art World?

NFTs have the potential to significantly impact the art world by providing artists with new ways to monetize their work and offering collectors a new form of digital ownership. However, like any new technology, their long-term impact is still uncertain and depends on how they are adopted and used over time.

Jack Dorsey Binance Ledger MetaMask