Prime Trust: A Deep Dive into Regulatory Issues and the Future of Client Funds

This article aims to delve into the details of the situation, examining the regulatory issues, potential consequences for client funds, and various viewpoints on the matter.

Prime Trust, previously a prominent player in the digital asset industry, is currently facing significant regulatory challenges.

The Nevada Financial Institutions Division has petitioned the court to put Prime Trust into receivership, citing that the company is operating in an "unsafe and unsound manner."

Historical Context

Prime Trust, a blockchain-driven trust company, was founded in 2016 in Las Vegas, Nevada. The company was established to provide solutions for cryptocurrency custody and offer various compliance solutions, including the full stack of private exemptions.

It quickly became a key player in the online capital formation sector, providing services for numerous platforms.

As digital assets gained traction, Prime Trust was there to provide custody and other services for emerging firms. The company was one of the few generating a positive result in a landscape where many were losing money.

Scott Purcell, the founder and former CEO of Prime Trust, was a regular presence at various crowdfunding and fintech events. Rumors circulated that he no longer held any equity in the company he founded. After his departure, a new CEO was appointed to lead Prime Trust.

Regulatory Roadblocks

The petition to place Prime Trust in receivership comes a week after the regulator issued a cease and desist order on the firm. The regulator claims that Prime Trust is facing a significant liquidity crisis and is unable to fulfill customer withdrawal requests.

As per the most recent filing, the company owes clients over $85 million in fiat currency but only possesses $2.9 million. Additionally, it has a crypto debt of $69.5 million, while its digital asset holdings amount to $68.6 million.

The regulator's primary goal is to conserve any remaining enterprise value in Prime for the benefit of its clients.

On June 21, it issued a cease-and-desist order to the company, instructing it to stop accepting fiat and cryptocurrency from both existing and new clients for custody purposes.

Consequences for Client Funds

The actions taken by the regulator have sparked concerns about the future of client funds.

The company's failure to meet all customer withdrawal requests due to a shortage of client funds has resulted in a significant liability on its balance sheet. The regulator alleges that Prime Trust has violated its fiduciary duties to its client base, thereby breaching Nevada trust laws.

Several companies that use Prime Trust as their regulated custodian, such as Stably and Securitize Markets, have been compelled to suspend some services and operations due to Prime Trust freezing withdrawals and deposits.

Varied Opinions and Future Ramifications

The situation has ignited a range of opinions and speculation about the future of Prime Trust.

Some believe the receivership could benefit distressed organizations by helping them avoid filing for bankruptcy protection.

Others express concern about the potential impact on the wider crypto and fintech industry, given Prime Trust's significant role in the sector.

BitGo, a digital asset financial services provider, had previously expressed intentions to acquire Prime Trust but recently decided to abandon these plans:

"After considerable effort and work to find a path forward with Prime Trust, BitGo has made the difficult decision to terminate the acquisition of Prime Trust," stated the company.

The Crypto Industry's Reaction

The issues surrounding Prime Trust have significantly disturbed the crypto industry. Prime Trust's role as a custodian was to protect clients' funds and assets. The alleged breach of fiduciary duties has raised questions about the security and reliability of similar institutions in the sector.

The situation has also underscored the importance of regulatory compliance in the crypto industry.

With the rapid expansion and increasing mainstream acceptance of cryptocurrencies, regulatory scrutiny is becoming more intense.

Firms operating in this space must ensure they are fully compliant with all relevant regulations to avoid similar situations.

Takeaways for the Fintech Sector

The Prime Trust case serves as a stark reminder for the fintech sector of the potential pitfalls of rapid growth without solid financial management.

Fintech firms, particularly those dealing with digital assets, must ensure they have strong financial controls in place and are adequately capitalized to meet their obligations.

Furthermore, the case highlights the importance of transparency in the fintech sector. Companies must be open and honest with their clients about their financial situation and any potential risks.

Market Response and Client Reactions

The news of Prime Trust's regulatory issues and potential insolvency has understandably caused a stir among its customers and the broader market.

TrueUSD, a stablecoin project that had a partnership with Prime Trust, was quick to reassure its users that it had "no exposure" to Prime Trust.

They emphasized that they had diversified their partnerships and maintained "multiple USD rails" elsewhere, ensuring the minting and redemption of TUSD were not affected.

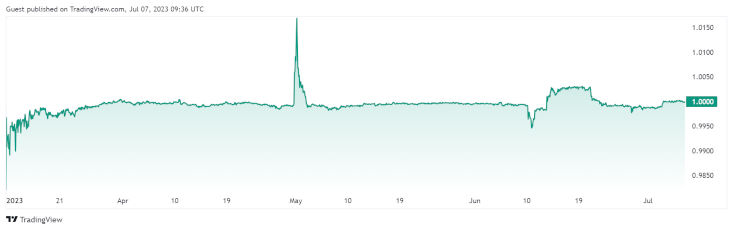

However, the situation has not been without its ripple effects. The recent volatility surrounding TrueUSD, triggered by Prime Trust’s regulatory issues, has sent ripples across loan markets and attracted attention from traders speculating on depegging scenarios.

Source and Copyright © TradingView

The variable borrow rate for TUSD has soared to over 30% APR, reaching even higher levels earlier in the day.

Moreover, a trader executed a multi-million dollar short on TUSD, borrowing $2 million in the stablecoin against $2.5 million in USDC collateral.

The Path Forward

The next steps for Prime Trust and its clients are uncertain. The receivership process will likely be a complex and lengthy one, with the primary goal of preserving any remaining enterprise value for the benefit of Prime Trust's clients. The company clients and industry stakeholders will closely watch the regulator's actions.

The situation also serves as a stark reminder of the risks associated with digital asset custody and the importance of robust financial management and regulatory compliance.

As the crypto and fintech sectors continue to evolve, firms must ensure they are adequately prepared to navigate the complex regulatory landscape and protect their clients' funds.