Crypto Predictions for 2024: from Bitcoin’s Price Rise to Stablecoins Replacing Visa

From the anticipated impact of the Bitcoin halving, ETFs, and Price Rises to the proliferation of NFTs, DeFi, and the metaverse, many factors are set to influence the crypto market in 2024. What are the Crypto Predictions for 2024?

2024 is poised to be a transformative period for the cryptocurrency industry, marked by significant technological advancements, market dynamics, and regulatory developments. As the crypto landscape continues to evolve, it is essential to gain insights into the potential trends and predictions that will shape the industry's trajectory in the coming year.

Today we will provide a comprehensive overview of the top crypto predictions for 2024. From the “Year of the BTC” to the “wildest predictions.” Let’s go!

#1 2024 Is Going to Be a Bitcoin Year

The predictions for Bitcoin in 2024 are varied, reflecting a range of perspectives on BTC's future. The performance of Bitcoin in 2024 is expected to be influenced by a variety of factors, including approval of Spot Bitcoin ETFs, institutional adoption, halving, regulatory changes, and macroeconomic trends.

Bitcoin Price Predictions

Price forecasts for Bitcoin in 2024 vary, with some experts anticipating a significant rally. Predictions range from Bitcoin trading above $80,000 and setting a new all-time high to more aggressive price targets. Some experts foresee a potential Bitcoin rally in 2024, driven by factors such as interest rate stabilization and institutional adoption.

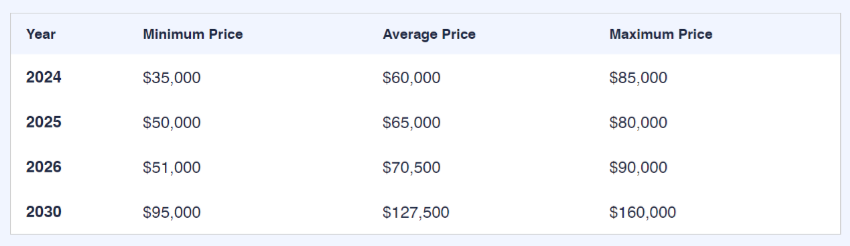

Techopedia predicts that Bitcoin will jump to an average price of $60,000 in 2024, thanks to the Halving event, and settle more in 2025 with an average.

Source and Copyright © Techopedia

Forbes article mentions that as 2024 begins, Bitcoin stands at $42,665, fueling the market with optimism. Several analysts have made bullish predictions for Bitcoin’s price in the next bull market. Renowned bitcoin analyst PlanB predicts a potential all-time high of $524,000 for Bitcoin.

VanEck, a global investment fund, has predicted that Bitcoin could reach new all-time highs by Q4 2024.

CNBC reports that commentators have given various price predictions for Bitcoin in 2024, ranging from $60,000 to $500,000. Industry executives have called the start of a new bull run, mainly predicated on two things — the bitcoin "halving" and the potential approval of a bitcoin. Bitwise Investments predicts that Bitcoin will trade above $80,000, setting a new all-time high in 2024.

Spot Bitcoin ETFs

Many traders and private investors are still hesitant to invest in the cryptocurrency market due to its high volatility, lack of legal framework, digital asset storage difficulties, and the risk of hacking commercial sites. Such financial instruments as ETFs may solve these fears and in perspective, other traders and investors.

For months, the talk of Bitcoin ETFs has dominated the crypto community, and their approval can influence the crypto market, including the BTC price. Some suggest that this discussion has also fueled Bitcoin's recent growth. As the approval is close, and this is not a prediction, we still need to list this point for the topic.

Here’s the article about the recent events in the Bitcoin ETFs issue. We’ve researched the topic and shared the latest market insights about it.

Bitcoin Halving 2024

It is another issue that creates and affects predictions for Bitcoin prices in 2024. Two fundamental principles underscore Bitcoin's scarcity. Firstly, there's a hard cap of 21 million bitcoins. The second principle is the halving. Every four years, the rate at which new bitcoins are introduced to the system is cut in half.

This halving event is important in managing the supply of new Bitcoins. It's a reason many view Bitcoin more as a store of value, similar to gold than just another fiat currency. As the halving approaches, media attention, speculation, and hype can influence buying behavior and potentially drive up the price in the short term. And also in the long term. Thus, see the article below to find out more about the price of BTC affected by halving.

#2 “Dog Coins” Destiny Is Condemn to Be Underperformed

There is an article about four main predictions for 2024 from Sean Williams, the author of the MotleyFool website since 2010. It discusses the prospects of two popular cryptocurrency tokens, Dogecoin (DOGE) and Shiba Inu (SHIB), and how they are expected to perform in the future. The writer believes that these "dog" coins will continue to underperform the overall crypto market. Although they had decent returns in 2023, they could not match Bitcoin's gains.

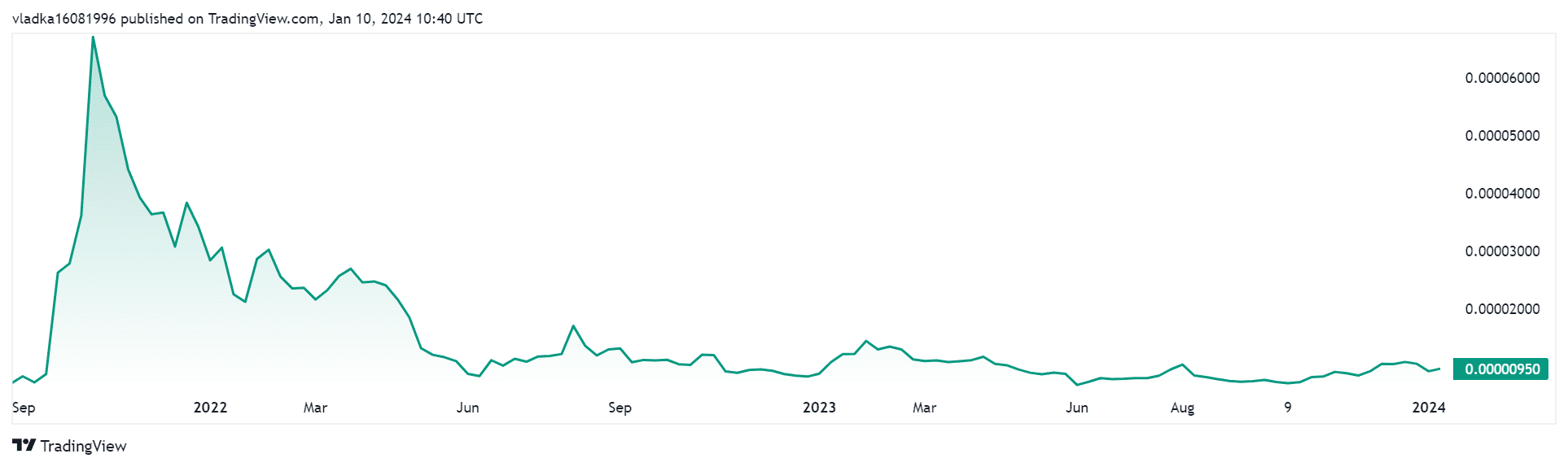

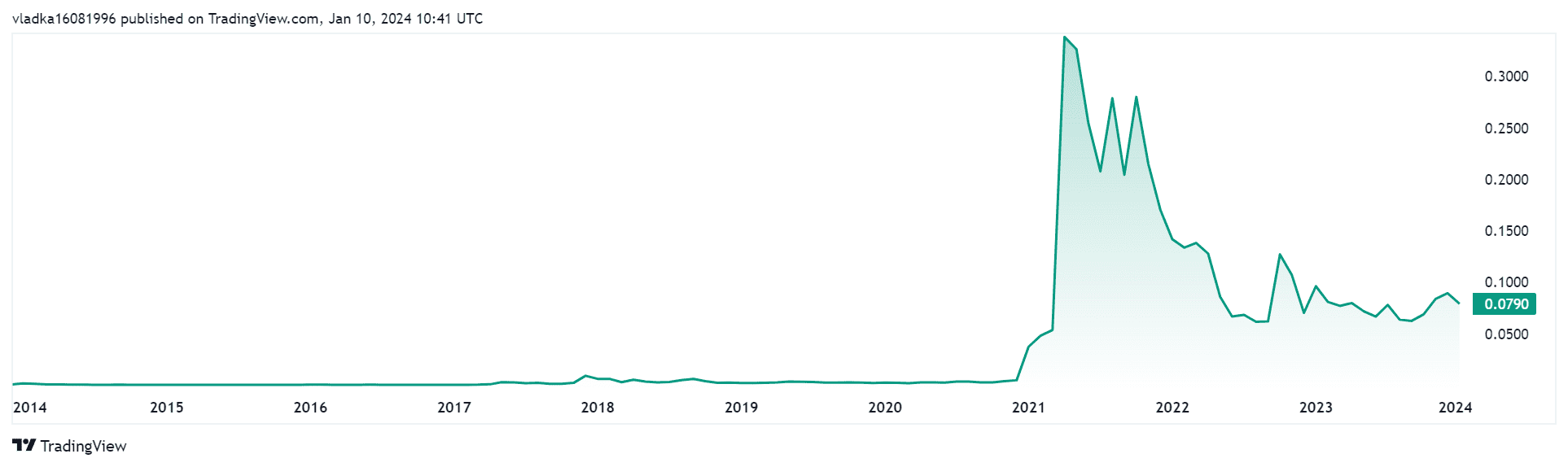

Source and Copyright © Shiba Inu on TradingView

According to the writer, the main issue with DOGE and SHIB is that they are payment coins, which means they can be used to pay for goods and services. However, many other cryptocurrencies also offer this feature, so they do not offer any unique value proposition. Furthermore, they lack real-world utility, as only a small number of companies accept them as payment.

Source and Copyright © DogeCoin on TradingView

The writer also warns investors about the risks associated with payment coins that experience massive price increases. Such coins usually lose a significant amount of their value in the years following their rally, with only a few exceptions like Bitcoin. Although DOGE and SHIB have already experienced significant price retracements, their valuations are still overinflated, according to the writer. The writer attributes the high valuations of DOGE and SHIB to social media hype, rather than any inherent value in these tokens.

#3 NFTs Are Coming Back!

While searching for the best, loudest, and most worthwhile predictions for the Crypto market in 2024, we’ve found the article "How NFTs Will Make a Comeback in 2024" on CoinDesk.com. It discusses the anticipated resurgence of NFTs in the coming year and their potential to drive Web3 adoption. The shift towards smaller, more affordable NFT products that target a broader consumer market, as well as the increasing involvement of established brands and companies in the NFT space will be made throughout the whole market.

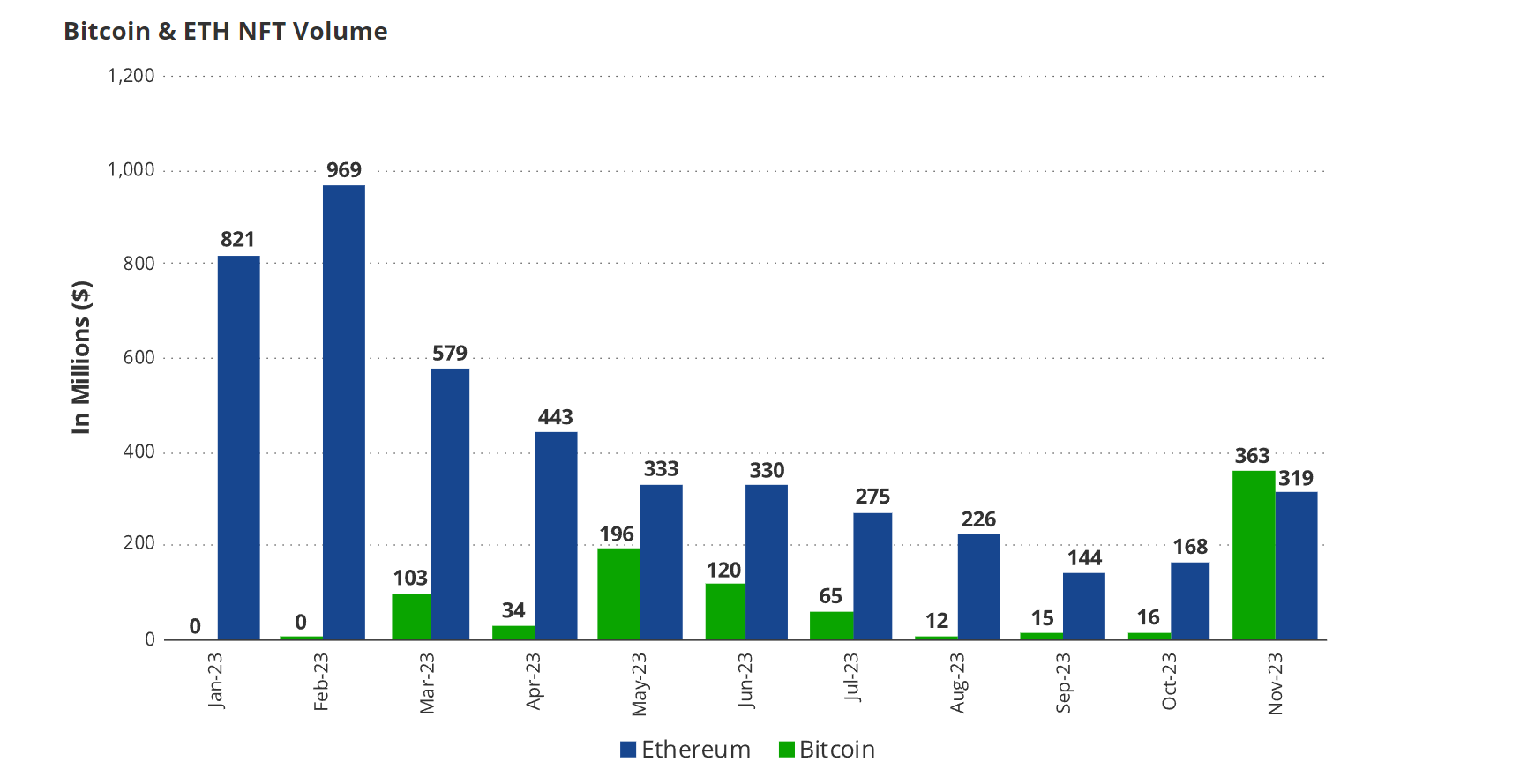

Speculators are returning to crypto, leading to an increase in monthly NFT volumes. Top NFT collections on Ethereum, improved crypto games, and new Bitcoin-based offerings are becoming more popular.

Source and Copyright © VanEck

Another important issue in NFTs returning to the market is in the direct value creation and practical use of NFTs, moving away from a sole focus on high-value assets and speculation. The potential for NFTs to serve as a means for companies and creators to engage their customers and build a community around their brands will be underlined and appreciated more than ever. CoinDesk predicts a positive outlook on the future of NFTs, citing their expected impact on the cryptocurrency landscape and broader economy. NFTs can shape the digital asset market in the coming year, and we’ll try to watch that out!

“The next wave of successful NFT products will likely look quite different from much of what we've seen before. Instead of focusing on a small quantity of high-value assets, many of these products will be produced in large quantities – and sold at more affordable prices, targeting the broader consumer market. They'll be focused on direct value creation, rather than speculation. And many customers will acquire and use these digital assets without even realizing they're running on crypto rails.”

– Scott Kominers, Steve Kaczynski for CoinDesk

#4 Stablecoin Settlements to Surpass Visa

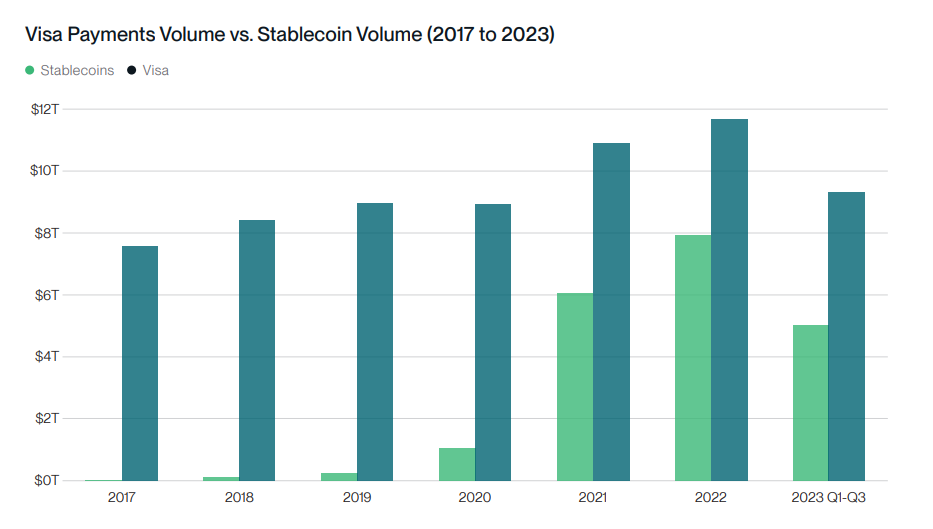

Stablecoins, which are cryptocurrencies designed to maintain a stable value, have become one of the most popular applications of digital currencies. In just four years, their market worth has grown from almost nothing to $137 billion.

With the crypto market rebounding and stablecoins being increasingly used for payments and remittances, we predict that 2024 will be another significant year of growth for stablecoins. We anticipate that stablecoins will settle more transactions than Visa, which may seem far-fetched, but they are already very close to achieving this milestone.

Source and Copyright © Bitwise Investments Research

#5 3 Wildest Predictions from Analysts and Enthusiasts on X

Elon Musk’s Token Launch

Twitter's rebrand as X sparked speculation about crypto integration due to Elon Musk's interest. However, in August, Musk tweeted that X will never launch a token, and nothing substantive has come from the hype. But, who knows, maybe Musk will come up with something like this in 2024. His denials are not always true.

BONK Will Reach $10 Billion Market Cap

BONK, a Solana-based dog coin, which we analyzed in our Scamometer rubric, saw the biggest rally of 2023 after being listed on Coinbase. It has surged by 300% in the last 30 days and now has a market cap of over $1 billion. People in X predict it to overcome $10 billion!

JPMorgan Will Tokenize a Fund

JPMorgan has been exploring opportunities in the real-world assets sector. Its blockchain division, Onyx, conducted tests to tokenize portfolios on permissioned blockchains.

However, in a recent Senate Financial Services Committee hearing, JPMorgan CEO Jamie Dimon expressed a contrasting opinion about cryptocurrencies, stating that they could be shut down.

Summary

In summary, the predictions for Bitcoin in 2024 reflect a mix of bullish and cautious outlooks, with experts highlighting the potential impact of regulatory changes, institutional adoption, and macroeconomic trends on its performance. The varied nature of these predictions underscores the dynamic and complex nature of forecasting Bitcoin's performance in the year ahead.

The predictions about the “Dog coins” show that more meme coins will underperform in comparison to traditional digital assets. It means that we need to focus on the fundamental crypto market and follow the main trends underlined by experienced investment funds, analysts, traders, and crypto-enthusiasts.

What about the NFTs coming back? The trend for making NFTs more conscious and functional is a great comeback for the industry that has almost been zero-profit in 2023. We’ll see what’s going to happen, but this prediction seems to be promising!

The next prediction with the stablecoins replacing Visa is an interesting one. Will people be more likely to use USDT and USDC than Visa or fiat money? Time will show, but the trend is underlined by several authoritative funds and media.

The funniest predictions are also the topic for discussion, because the Elon Token, JP Morgan tokenizing, and BONK reaching a $10 billion market cap are insane and simultaneously not. The crypto world is an unpredictable one, and the market can shock you anytime! Thus, we’ll see what it prepares for us.

In the end, it is also important to note that these predictions are not guarantees but represent informed estimates based on market trends and analysis. The crypto industry is known for its volatility and is subject to various external factors, so investors should approach these predictions cautiously and conduct their research before making any investment decisions.

FAQ

Is it possible to predict cryptocurrency prices?

Predicting cryptocurrency prices is a complex task due to the numerous factors that can influence their value. While it is possible to attempt to forecast some movements in the cryptocurrency market, it requires a good understanding of both fundamental and technical analysis.

What are some key predictions for the crypto sector in 2024?

Some key predictions for the crypto sector in 2024 include the potential for Bitcoin to reach $100,000, the expectation for at least one publicly traded miner to increase in value by 10x, and the anticipation for Stacks to double in value and become one of the top 20 most valuable cryptocurrencies.

How will cryptocurrencies grow in importance in the future?

Predictive studies suggest that cryptocurrencies will grow in importance in the future, particularly in financing various transactions and settlements.