What Is a Cold Wallet? The Most Secure Crypto Custody

There are many different types of cold storage wallets available and this guide will help you choose the one that best suits your needs.

-

Table of Contents

- What Is a Cryptocurrency Wallet?

- What is a Cold Wallet?

- Does Crypto Grow In a Cold Wallet?

- How Do Cold Wallets Prevent Theft?

- Can a Cold Wallet Be Hacked?

- How are Cryptocurrency Hot Wallets Different From Cold Wallets?

- Types of Cold Wallets

- What happens if you lose a cold wallet?

- Why Do You Need a Cold Wallet?

- How to Choose a Cold Wallet?

- Frequently Asked Questions

Have you found yourself asking, "What is a cold wallet?" as you research crypto safety and security? When exploring the possibilities of crypto, self-custody is one of the most important topics to consider. Keeping cryptocurrencies safe is a challenge, and choosing the right wallet solution is essential. One of the safest options available today is cold storage wallets, which offer an extra layer of security by keeping private keys offline.

This article will explain what a cold wallet is, how it works, and why they have become so popular for crypto storage.

What Is a Cryptocurrency Wallet?

After purchasing cryptocurrency, the next thing you want to do is decide how and where to store your assets safely.

Unlike physical money, cryptocurrencies exist on a blockchain, necessitating specialized digital storage solutions known as wallets. These crypto wallets function similarly to traditional wallets in terms of holding funds, but the resemblance stops there.

Crypto wallets don't store cryptocurrency in the traditional sense like how physical wallets contain money. Instead, they offer digital security for your cryptocurrency holdings. Cryptocurrencies don't come as tangible items like coins or notes; they exist as a string of code within the broader blockchain.

These digital wallets consist of users' public and private keys which are strings of characters that allow holders to receive and transfer their crypto assets via the blockchain. They also interpret the public ledger to display the user's balance.

It's essential to understand that a cryptocurrency transaction doesn't equate to physically sending tokens between phones. When tokens are sent, the sender's private key authorizes the transaction, which is then relayed to the blockchain network. This network updates to display the new balances for both the sender and the recipient.

You can equate the public key to your bank account number—something you can share without compromising your funds. Conversely, keys consist of lengthy, unpredictable character strings. While you can distribute your public key similar to a bank account number, the private key—akin to your bank's password or PIN—should remain confidential. Every public key has a matching private key in public-key cryptography, and these pairs are vital for encoding and decoding data.

To put it succinctly, a wallet doesn't directly contain the user's cryptocurrency. It safeguards the keys that grant access to the coins situated on the public blockchain networks. For transactions, users authenticate their addresses with a distinct private key code. The efficiency and safety of this process often hinge on the type of wallet used.

Should you misplace your private key, your cryptocurrency access could be jeopardized. Hence, the bearer of the private key essentially controls the associated crypto.

What is a Cold Wallet?

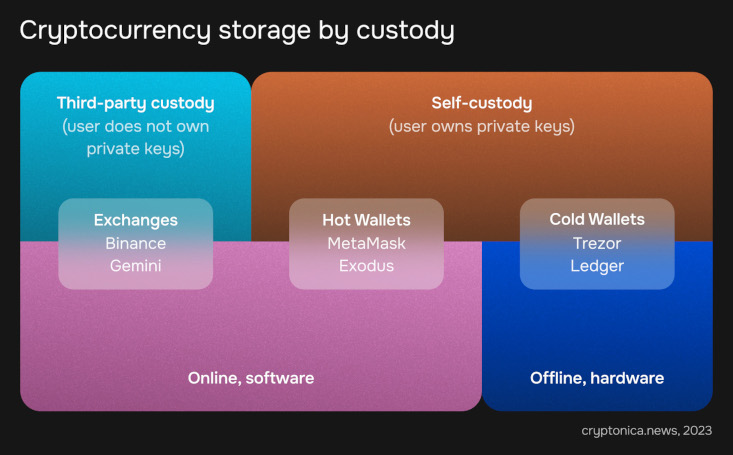

Crypto wallets largely fall into two main categories: hot wallets, which are internet-connected, and cold wallets, which remain offline. Both hot and cold storage methods provide users access to their digital assets, but they vary in terms of user interaction and safety measures.

A cold wallet refers to a cryptocurrency wallet that remains isolated from internet networks and computers and doesn't authorize any smart contract interactions. These wallets offer offline storage, with private keys saved on physical devices. These physical devices can range from specialized hardware wallets, to even a piece of paper with your private key.

How Does a Cold Wallet Work?

Cold wallets primarily function as a secure vault for cryptocurrencies, ensuring no interactions outside of their own environment. When there's a need to transact, funds can be moved from the cold wallet to an online "hot wallet". This hot wallet manages the transactions and links to various Web3 platforms online. If certain funds become redundant, they can be relocated back to the cold wallet for extended storage. In essence, cold wallets serve as secure storage for long-term holdings, whereas hot wallets facilitate regular transactions.

To interact with online platforms, this hardware either needs to be physically connected or utilize a distinct QR code. This ensures the private key doesn't accidentally engage with online servers, minimizing unauthorized access risks.

Does Crypto Grow In a Cold Wallet?

Hot wallets come with the advantage of integrated functionalities, including exchange services, staking, and connections to decentralized applications. This allows users to maximize the potential of their cryptocurrencies and earn rewards.

Conversely, cold wallets are designed mainly for the long-term safekeeping of assets. However, cold wallets holders can still grow they crypto holding through cold staking or offline staking.

It might be difficult to find projects supporting offline staking since it's a relatively new concept in the crypto industry, while most of existing PoS projects support traditional online staking.

Cold staking is the process of participating in a Proof-of-Stake (PoS) consensus method and earning rewards, all while maintaining your crypto in a cold wallet. It enables users to to stake their cryptocurrency to a node operator instead of r of setting up a node themselves.

Offline staking's mechanics differ from traditional delegated staking systems, which generally need users to allocate their cryptocurrency to a specified group of validators. With this system, anyone can stake on behalf of others without accessing their coins.

How Do Cold Wallets Prevent Theft?

A cold wallet is essential because it reduces the risk of hackers stealing your funds. These solutions provide iron-clad security against online attack vectors such as software viruses, clipboard malware, and smart contract bugs.

When you use dApps and Web3, you often engage with smart contracts. Every interaction with a smart contract exposes your cryptocurrency wallet to the terms of that contract. If you overlook the details or approve something you're unsure about, you're essentially leaving your wallet's contents vulnerable.

Errors can occur, and sometimes, the details of smart contract transactions can be unclear, making even experienced crypto users susceptible to mistakes.

This is where cold wallets come in handy. These wallets are designed to reduce such risks. By maintaining an account that's shielded from these potential threats, you can confidently safeguard your most precious digital assets.

Given that a cold wallet never goes online and preserves your private keys in a disconnected setting, it guarantees that your keys are unreachable from afar. Not even the most adept cybercriminal can access a cold wallet, as it's completely isolated.

Additionally, cryptocurrency transactions are irreversible and often not covered by insurance policies as traditional finance. Users must take proactive measures to safeguard their assets, and a cold wallet is one of the most widely available options.

Can a Cold Wallet Be Hacked?

While cold wallets are among the most secure ways to store cryptocurrencies, they are not immune to risks. Here are some common risks associated with the usage of crypto cold wallets:

Cold wallets can suffer from physical damage like fire, water exposure, or general wear and tear. They can also be lost. If the cold wallet is lost or damaged, without a backup, the funds are gone forever.

Cold wallets, especially if they're known to hold substantial sums, can be targets for theft. Someone with physical access to a cold wallet can potentially access its funds. If your backup (often a seed phrase) is exposed or not stored securely, it can be used to access your funds.

When transacting, even if the cold wallet itself is secure, the device you're using to set up the transaction can be compromised. For instance, malware can manipulate the destination address of a transaction. Funds can be sent to an attacker's address without the user realizing until it's too late.

How are Cryptocurrency Hot Wallets Different From Cold Wallets?

Key Differences:

- Connectivity: The most fundamental difference is that hot wallets are online, while cold wallets are offline.

- Use Case: Hot wallets are ideal for daily transactions and small amounts, whereas cold wallets are better suited for long-term storage and larger amounts.

- Security: Cold wallets offer superior security due to their offline nature, while hot wallets, being online, are inherently more vulnerable.

- Accessibility: Hot wallets provide immediate access to funds and are typically more user-friendly. In contrast, cold wallets require more steps to access and transact.

Many people wrongly believe that cold wallet is just the "opposite" of hot wallet. A cold wallet does indeed create and safeguard your private keys in a setting disconnected from the internet, but it also has another important feature: it doesn't interact with smart contracts.

This distinguishing feature guarantees that a true cold wallet does more than just safeguard your keys offline; it also shields you from malicious smart contracts. You can think of it as being similar to a "savings" account where you store most of your funds securely without regularly conducting transactions.

A hot wallet on the other hand is a cryptocurrency wallet that is actively connected to the internet. It provides users with quick and convenient access to their funds for regular transactions. Hot wallets are always online, which is why they are referred to as "hot" — they're readily accessible anytime, anywhere, as long as there's an internet connection.

They often have intuitive interfaces, which makes them suitable for daily transactions and ideal for beginners. Many hot wallets offer integrated features like exchange services, staking, or connections to decentralized applications.

However being connected to the internet makes hot wallets vulnerable to various online threats such as hacking attacks, phishing schemes, malware, and more. Many web-based wallets and some mobile/desktop wallets operate under third-party services. If these services are compromised, users might lose their funds.

While hot wallets come equipped with security features, such as recovery seed phrases, their safety doesn't match the robustness of cold wallets that remain completely offline. However, hot wallets have the advantage of multi-device accessibility. So, if your primary device gets stolen or lost, funds can be retrieved using backup options like seed phrases. For cold wallets, although a lost device can be replaced or a compatible software wallet can be utilized with the recovery phrase, the initial hardware device is still necessary.

Types of Cold Wallets

Hardware Wallets

Hardware wallets fall under the category of cold wallets and are typically a physical device that resembles a USB stick. The main principle of such wallet is to keep the private keys separate from internet-connected devices.

Hardware wallets generate private keys offline and never expose them to a computer or the internet. All transactions are signed within the device itself. This means that when you want to send crypto, the transaction's details are sent to the hardware wallet, signed internally, and then the signed transaction is sent out, all without the private key ever leaving the device.

Most hardware wallets come with a small screen and physical buttons. The screen displays transaction details and the recovery phrase during setup, ensuring this sensitive information never appears on a potentially compromised computer. Physical buttons are used to manually confirm transactions, adding another layer of security.

| Hardware Wallet Pros | Hardware Wallet Cons |

| Private keys are stored offline, making them immune to online hacking attempts | Unlike hot wallets, hardware wallets can be pricy |

| Funds can be recovered using a seed phrase, even if the hardware wallet is lost or damaged | Accessing funds for daily trading or spending is less convenient |

| Many hardware wallets support a vast array of cryptocurrencies | If the seed phrase is lost and the device is damaged or lost, the funds are unrecoverable |

How To Use a Hardware Wallet?

- Initialize the device, set a PIN, and note down the recovery phrase provided.

- Connect the device to a computer or smartphone, access the respective coin's application on the device, and get the public address to receive funds.

- Using the associated wallet software on your computer or phone, input the transaction details. The transaction will be sent to the hardware wallet for confirmation. After verifying the details on the hardware wallet's screen, confirm the transaction using the physical buttons.

Paper Wallets

Paper wallets are where you record your private key and corresponding address as QR codes and print them on a piece of paper. Users can then transact with the wallet by sending cryptocurrency to and from the paper wallet address. Paper wallets were one of the first hardware wallets to exist, and were popular around 2013 and 2014.

In paper wallets, the public and private keys are generated offline, typically using specific software or websites designed for this purpose. It's a straightforward cost-effective cold storage solution without the complexities of electronic hardware.

To facilitate ease of use, both the public and private keys are often printed as QR codes. The public key QR code can be scanned to receive funds, while the private key QR code can be scanned to spend or transfer funds.

| Paper Wallets Pros | Paper Wallets Cons |

| Paper wallets are immune to online hacking attacks | Paper wallets are susceptible to damage from water, fire, or wear and tear |

| You can generate a paper wallet quite easily using various reputable online services | Not convenient for frequent trading or spending |

| Creating a paper wallet costs nothing | Not all cryptocurrencies support paper wallets |

How To Use a Paper Wallet?

- Use a trusted paper wallet generator. Download the tool and run it on an offline, malware-free computer to ensure security. Print the generated public and private keys or QR codes.

- Share the public key or scan the public key QR code to receive funds.

- To spend or transfer cryptocurrency from a paper wallet, you'll need to "import" the private key into a software or online wallet. Once this is done, you can initiate transactions.

Air-Gapped Wallets

An air-gapped wallet refers to a cryptocurrency wallet stored on a device that has never been connected to the internet and never will be., The term "air-gap" originates from network security, where systems are physically isolated from potentially unsecured networks, including the internet.

Since the device never connects to the internet, remote attacks are rendered impossible. This provides a strong shield against an ever-growing list of online threats.

transactions are prepared on an online device, transferred to the air-gapped device for signing with the private key, and then the signed transaction is transferred back to an online device for broadcasting to the network.

While technically any device could be used as an air-gapped wallet (like an old smartphone or laptop), dedicated hardware, like specific USB devices designed for offline data storage, can also be used.

|

Air-Gapped Wallets Pros |

Air-Gapped Wallets Cons |

| Since the wallet never connects to the internet, it is immune to phishing attacks and malware. | Air-gapped wallets are less convenient for frequent transactions or trading. |

| Many air-gapped wallets support a variety of cryptocurrencies. | Setting up and using an air-gapped wallet securely may be challenging, especially for less tech-savvy users. |

| Funds can typically be recovered using a seed phrase, even if the air-gapped wallet is lost | To access funds or sign transactions, physical access to the wallet is necessary |

How To Use an Air-Gapped Wallet?

- Choose a device, install a cryptocurrency wallet software, and generate a new wallet with its public-private key pair.

- Like any other wallet, use the public key to receive funds.

- Prepare the transaction on an online device without signing it.

- Transfer the unsigned transaction to the air-gapped device using a medium like a USB drive or QR codes.

- Sign the transaction on the air-gapped device.

- Transfer the signed transaction back to the online device and broadcast it to the network.

What happens if you lose a cold wallet?

Losing a cold wallet can initially seem alarming due to the potential risk of losing access to your stored cryptocurrencies. However, the impact of this loss largely depends on whether you have responsibly backed up the wallet’s critical information. If you have securely backed up your private keys or recovery seed phrase you should be able to restore access to your funds by importing this information into a compatible wallet software or another hardware device. On the other hand, if you have not created a backup or lose access to it, the cryptocurrencies stored in the cold wallet would be irretrievably lost, as the private keys are required to authorize transactions and access the funds.

Why Do You Need a Cold Wallet?

A cold wallet is an indispensable tool for anyone looking to enhance the security of their cryptocurrency holdings, especially for long-term investments or significant amounts of assets. They serve as a secure vault, ensuring that your private keys—critical for accessing and transacting your cryptocurrencies are kept safe and out of reach from potential online threats. Cold wallets are also immune to exchange hacks, giving users full control and ownership of their assets without relying on third-party services.In addition to security, cold wallets also come with recovery options, allowing users to regain access to their funds even in the event of device loss or failure, provided that they have securely backed up their recovery seed phrase.

How to Choose a Cold Wallet?

Choosing the best crypto cold wallet depends on various factors related to your personal needs, investment size, and proficiency level. In summary, your choice should strike a balance between security, usability, and cost. Here's a list of considerations to guide your decision.

Ensure the cold wallet supports the specific cryptocurrencies you hold or intend to acquire. Some wallets might support only Bitcoin, while others may support a wide range of altcoins.

Assess the ease of use. If you're a beginner, you might want a wallet with an intuitive interface. For tech-savvy individuals, advanced features might be more appealing.

Look for added security layers such as PIN protection, biometric authentication, secure element chips (for hardware wallets), and tamper-proof seals (to know the device hasn't been tampered with during shipping).

Ensure the wallet provides an easy and secure backup and recovery mechanism, like mnemonic seed phrases.

Good customer support can be invaluable, especially if you encounter issues. A strong community around a product can also offer peer help and advice. Research online reviews, testimonials, and potential reported vulnerabilities. Consider the reputation of the wallet provider in the crypto community.

Set a budget. While security is paramount, there's a wide range of prices for hardware wallets, so find a balance between cost and features.

The most Popular Crypto Cold Wallets

Hardware Wallets

Ledger Nano S is one of the most affordable and popular hardware wallets, supporting a wide range of cryptocurrencies. Ledger Nano X is an upgraded version of the Nano S, with added features like Bluetooth connectivity for mobile device use and a larger screen.

Trezor One is a pioneering hardware wallet with robust security features, supporting numerous cryptocurrencies.Trezor Model T is an advanced version with a touchscreen, additional coin support, and enhanced security measures.

KeepKey is a user-friendly hardware wallet with a large display, offering an easy-to-use interface and supporting a variety of cryptocurrencies.

Air-Gapped Wallets

Ellipal Titan is a completely air-gapped hardware wallet, eliminating the need for USB, WiFi or Bluetooth, protecting crypto assets against remote and network attacks

The NGRAVE ZERO is considered one of the more premium and secure options in the market of air-gapped wallets. The device operates entirely offline, incorporates biometric measures such as fingerprint scanning and uses True Random Number Generator (TRNG).

Paper Wallets

The most popular paper wallet generators are WalletGenerator.net, bitaddress.org, paper.dash.org and many other.

What Is the Easiest Cold Storage Wallet to Use?

Determining the "easiest" cold wallet to use can be subjective and depends on an individual’s familiarity with technology and specific needs. However, one of the cold wallets often praised for its user-friendly interface is the Ledger Nano series, particularly the Ledger Nano X. The device features a straightforward setup process and an easy-to-navigate interface, making it accessible even for crypto beginners.

Which One Is the Best Cold Wallet?

The "best" cold wallet ultimately depends on what you prioritize. If you value ease of use and broad cryptocurrency support, the Ledger Nano X might be the top choice. If you prioritize open-source software and are willing to navigate a steeper learning curve, the Trezor Model T could be more suitable. For those looking for the utmost security and are willing to pay a premium, the NGRAVE ZERO offers a compelling option.

Are Crypto Cold Wallets Worth It?

Crypto cold wallets are widely considered worth the investment for individuals looking to securely store substantial amounts of cryptocurrencies or hold digital assets as a long-term investment. By keeping the private keys offline, cold wallets provide a robust shield against online hacking attempts, phishing scams, and other digital threats, offering an unparalleled level of security compared to hot wallets. While they may come with a higher upfront cost, especially for hardware wallet options, the peace of mind and added security layer they offer often outweigh the expense. Furthermore, the ability to backup and recover the stored assets ensures that users can regain access to their funds even in the event of device loss or failure, provided they have responsibly backed up their recovery information. For users who prioritize the safety of their digital assets, investing in a cold wallet is generally deemed a prudent and worthwhile decision.

Frequently Asked Questions

Is cold storage best for cryptocurrency?

Cold storage is considered one of the safest methods for storing cryptocurrency, especially for long-term holding. It minimizes the risk of online hacks but may not be as convenient for frequent trading or spending.

How to transfer crypto to a cold wallet?

To transfer crypto to a cold wallet, generate a receiving address from your cold wallet and send the crypto from your hot wallet or exchange account to this address.

Can a cold wallet be hacked?

While cold wallets are highly secure, they are not completely impervious to attacks. Threats can occur if the setup or recovery processes are compromised, or if the physical device is stolen and the PIN is cracked.

What happens if you lose a cold wallet?

Losing a cold wallet can result in the loss of your funds if you do not have a backup of the private keys or seed phrase. With a proper backup, you can restore access to your assets.

How to sell crypto from a cold wallet?

To sell crypto from a cold wallet, you need to transfer the crypto to an exchange or a hot wallet connected to an exchange, and then proceed to sell it on the platform.

KeepKey Ledger MetaMask Trezor