What is LCX Exchange and How to Use Token LCX?

Find out everything you need to know about LCX Exchange including its advantages and Drawbacks and learn about how to use it effectively.

In the rapidly growing crypto market, LCX Cryptocurrency Exchange has emerged as a notable player in the market for trading cryptocurrencies with high liquidity and low cost. In this article, we will do an in-depth overview of this platform, and explore its features, service, trading fees, and disadvantages. So, if you are interested, stick with us and read this article till the end.

What is LCX Exchange?

Liechtenstein Cryptoassets Exchange or LCX in short is a centralized advanced Crypto trading platform based on the tokenization of assets, providing advanced cryptocurrency trading tools and resources. The Exchange was founded in 2018 by Monty C. M. Metzger and is headquartered in Vaduz with regional offices in Switzerland and India.

The core idea of launching this trading platform was to provide users with a secure, user-friendly and regulated environment for trading digital currencies. It aims to bridge traditional financial market and crypto space allowing everyone to freely participate. Not many people know, LCX is also partnered with Binance the #1 Crypto Exchange in the market and wanted to become one of the first licensed and security token Crypto trading platform. Just like other platforms, it also has native token called LCX token based on Ethereum Blockchain network that is used for subscribing platform services and earning special discounts and rewards.

Some of the popular features and services offered by LCX include, Centralized Exchange, DEX Aggregator, Launchpad, LCX Protocol and Oracles.

Services and Features

Spot Exchange

Spot trading is one of the product offered by LCX Platform, By utilzing spot trading feature, investors can buy and sell all major cryptocurrencies like BTC, ETH, Matic, ADA and many more at current price through Limit, Market and Stop Limit orders to benefit from short and long term price movements. Unlike other popular Crypto Exchanges, LCX Spot zone only offer trading of limited cryptocurrencies less than 50 in numbers with close to 100 trading pairs. According to platform, the reason behind supporting limited cryptos is to protect users from volatility of low market cap cryptocurrencies and mitigate potential risks of market collapse like in the case of FTT in November last year.

Additionally, Spot Exchange offered by LCX has a standard interface similar to other exchanges and features charts powered by Tradingview to allow its customers to conduct TA (Technical Analysis) directly on their order book page.

DEX

Liechtenstein Cryptoassets Exchange has something for everyone. In addition to the spot exchange, LCX also offers a decentralized exchange (DEX) known as the LCX Terminal or Fire Salamander. For users who prioritize privacy and want to trade in a decentralized way while enjoying benefits like high liquidity and low transaction cost then LCX Terminal is the best option. The platform promotes its DEX aggregator as the most powerful tool in the market with features like Basic Swap, Pro Swap, Limit and Market Orders, Decentralized Finance data across all major DEXs. One of the key differences between Spot Exchange and DEX Aggregator on the platform is that Decentralized Exchange is not limited in terms of the number of listed cryptocurrencies. However, compared to other popular DEXs like PancakeSwap, UniSwap, LCX Terminal doesn’t have high liquidity for low market cap coins/tokens and you might face slippage issues when swapping.

LCX Exchange Tiamonds

LCX Tiamonds which is referred to as Largest Diamond NFT Marketplace is an innovative feature introduced by the platform. These are security tokens that represent ownership in a basket of digital assets. Tiamonds provide investors with exposure to multiple cryptocurrencies while minimizing the risks associated with individual tokens. It offers a convenient way to diversify one's portfolio within the crypto space. Currently over 100 different NFTs are available on Tiamonds NFTs marketplace to trade. Similar to other NFTs, all Tiamonds diamonds Non-Fungible tokens are tokenized through Ethereum Blockchain making it simple for users to verify ownership of Non-Fungible tokens and trade as they like (Either via auction or fixed rate).

As an appreciation for owners of Tiamonds, the platform also distributes LCX tokens as incentives over time through its “Own to Earn'' model designed especially for Tiamonds Marketplace participants.

LCX Exchange Deposits and Withdrawals

Fees

When it comes to deposits and withdrawals on any Exchange, it's essential to understand the fees associated with it. The platform implements transparent fee structures, which vary depending on the type of transaction and currency involved. Currently, on LCX Exchange 0% Deposit fee is charged across all crypto markets. However, each deposit on the platform has minimum amount deposit requirements. In case of a deposit amount falling below minimum requirements, your funds won’t be credited.

As far as the question of withdrawal fees goes, it varies depending on the network a user is going to utilize and type of cryptocurrency. For example at the time of writing, withdrawal fee for ChainLink is 1 Link token and 0.0005 BTC for each bitcoin withdrawal.

Methods

Platform supports multiple methods for deposit and withdrawals to provide flexibility for users.

These methods include:

- Bank Transfers: Customers can directly deposit or withdraw from regional banks on the platform. To do this, you would need to link your bank account to your LCX Exchange account by following the instructions provided on the platform to initiate a bank transfer. Just like in traditional markets, Bank transfers usually take up to 1-3 working days and for withdrawals you might be charged a fee of 20 EUR.

- Credit/Debit Cards: LCX Exchange also supports deposits using credit or debit cards. Users would need to add their card details by navigating the platform.

- Crypto Transfers: If you already hold cryptocurrencies, you can deposit them into your LCX Exchange account by transferring them from your personal wallet. Similarly, you can withdraw crypto from your LCX account to your personal wallet.

It's important to note that the availability of specific methods may vary depending on your geographic location and the regulatory requirements of that jurisdiction.

Step-by-Step Guide on How to Withdraw Funds from LCX Exchange

Source and Copyright © LCX

- Log in to the LCX Exchange account using credentials.

- Once logged in, navigate to "Wallet" section of the platform.

- Identify the cryptocurrency or fiat currency you wish to withdraw from the platform.

- Click on the "Withdraw button next to the chosen currency.

- You will be redirected to provide the destination address for the withdrawal. If you're withdrawing to a personal wallet, enter the wallet address.

- Specify the amount you want to withdraw. Don’t forget to pay close attention to applicable fees and minimum withdrawal requirements.

- Complete any additional security measures, such as two-factor authentication (if enabled) or email verification.

- Once you have reviewed and confirmed all the details, execute a withdrawal.

- Depending on the specific currency and network congestion, it may take some time for the withdrawal transaction to be processed and confirmed on the blockchain.

- Don’t forget to monitor withdrawal status provided by the platform for updates on the progress of your withdrawal.

Limits

One of the drawbacks of LCX is that it imposes limits on deposits and withdrawals to ensure security and comply with regulatory standards. These limits may vary based on factors such as your account verification level, the type of transaction (fiat or crypto). It's crucial to be aware of these limits as they may impact the amount you can deposit or withdraw within a specific time period.

LCX Exchange Trading Fees

Spot Trading Fees

Unlike other Crypto Trading platforms, Liechtenstein Crypto Assets Exchange charges trading fees based on percentage of order’s value a user wanted to execute and type of trade. In other words, with higher trading volume, you’ll be able to enjoy fee discounts. Currently, the platform charges a maker and takes a fee of 0.30% based on their trade value. However, for users holding LCX tokens, which is native token of the platform, the fee is reduced to 0.15% that’s almost 50% more than what a regulator trader is charged for trading on the platform. In comparison with some popular Exchanges like Binance and Bybit, users might have this fee of 0.30% a bit higher.

KYC (Know Your Customer)

Know Your Customer or KYC refers to a type of identity verification process which requires users to verify their identity by submitting identification documents such as National ID Card, Passport or Driving License photos and other relevant information. In order to trade on LCX and utilize other services offered by the platform, completing KYC is mandatory.

Supported Countries

LCX aims to serve a global audience, and its services are available to users in many countries worldwide including the United States. LCX Termincal which is considered a decentralized smart trading software to execute trades is available in almost all countries except where cryptocurrency trading is banned. However, it's important to note that certain countries or jurisdictions may have restrictions on services other than LCX Termincal or regulations that limit or prohibit access to LCX Exchange.

According to the platform, strict KYC measures taken by LCX are to ensure compliance with regulatory bodies around the world and protect users from fraudulent or illicit activities which can damage the overall user-experience reputation of the platform.

How to Start with LCX Exchange

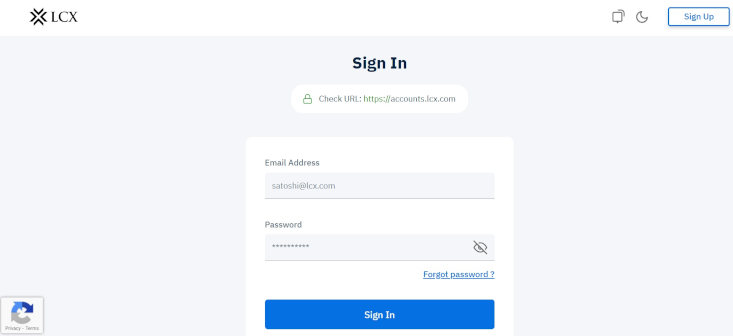

Source and Copyright © LCX

Registration and Activation

- To begin trading on LCX Exchange, users must first create an account by completing the registration process. If you are a newbie follow below steps to easily create an active account.

- Visit the official site of platform which and click on Sign-In button or directly visit this page

- Once, there click on Sign-up option

- When you click on the Signup button, it will redirect to a new page where you have to fill a form by providing information like Full name, email address, Referral Code (optional) and password you would like to use for loging into your account.

- After filling out the form correctly agree to terms of service of the platform and click on the Signup button.

After registering, you will receive an email containing an activation link. Click on the link to verify your account and activate it for trading.

Account Verification

Once an account is active, the next step is to complete the account verification process. LCX Exchange follows a Know Your Customer (KYC) procedure to ensure compliance with regulations and enhance security as previously explained. To complete the verification, you will need to provide identification documents to confirm your identity. Typically, you will be asked to upload a scanned copy or a high-quality photo of your passport, Nationality Card or driver's license. Follow the instructions provided by LCX Exchange for submitting the necessary documents.

Once details are submitted for verification, wait for a few hours as the LCX support team will manually review your identity documents. When submitted details are verified, you will gain access to the full range of features and functionalities offered by Liechtenstein Cryptoassets Exchange.

How LCX Compares to Competitors

LCX Exchange distinguishes itself from other cryptocurrency exchanges in several key ways:

- Compliance and Security: As previously explained, the Exchange prioritizes compliance with regulations set by Security Exchange Commission U.S. and other regulatory bodies around the world. It operates within a regulated framework, providing users with a secure environment for trading digital assets.

- Advanced Trading Terminal: The platform offers an advanced trading terminal that provides traders with advanced tools and features for executing trades, analyzing market trends, and managing their portfolios effectively which you might not be able to access on traditional centralized crypto trading platforms.

- Competitive Fees: Although in comparison with top crypto trading platforms like Bitget, ByBit and Binance, trading fees on LCX Exchange might be a bit high for some users. But considering average fees charged on average trading platforms, LCX offers competitive fees for trading activities.

- Limited Supported Cryptocurrencies: Even though LCX Exchange supports almost all popular cryptocurrencies for trading from Bitcoin to Ethereum, Matic and many more, allowing users to access diverse trading options and participate in various digital asset markets. But in comparison with its competitors, supported cryptocurrencies listed on LCX platform are limited in numbers and some professional traders might find it unsuited as they might not have many choices to diversify their portfolio with low market cap gems.

Conclusion

In the end, we would say LCX Exchange provides a secure and user-friendly platform for trading popular cryptocurrencies. With its spot exchange, Decentralized Aggregator (LCX Terminal), and innovative LCX Tiamonds, users have access to a comprehensive suite of trading options. The platform's focus on compliance, security, advanced trading tools, and competitive fees sets it apart from many other exchanges in the market. Whether you are a beginner or an experienced trader, exploring LCX Exchange can be worth it. However, in order to ensure steady growth in future there is a lot of work needed for the platform to do from listing new and innovative cryptocurrencies to offering futures and contracts trading and more. Before make a decision about this exchange do your own research.

Frequently Asked Questions

What fiat currencies does LCX Exchange support?

At the time of writing, LCX Exchange only supports EUR for trading activities on its platform.

However, the firm aims to add support for more fiat currencies including USD in the future.

Can I trade with leverage on LCX Exchange?

Unfortunately, LCX currently doesn’t support leveraged trading of any type. The platform primarily focuses on providing a secure, highly liquidated environment for spot trading.

Where is LCX located?

LCX Exchange is based in Liechtenstein, a sixth smallest nation located in between Austria and Switzerland, known for its favorable blockchain laws and regulations. It operates under the regulatory framework set by the Liechtenstein Financial Market Authority (FMA). Additionally, the firm also has regional offices in Switzerland and India.

Is LCX Exchange legit and safe?

Yes, LCX Exchange is considered a legitimate and safe platform for trading cryptocurrencies because of its strict KYC and Security measures. It operates under the supervision of the Liechtenstein Financial Market Authority and follows strict regulatory compliances to maintain transparency of its business. Despite this, in any case before investing using this exchange, do your own research and be prepared for financial losses, because this is a cryptocurrency high-risk market.

Are US investors allowed on LCX Exchange?

While LCX Terminal is available in all countries including the USA, the availability of LCX Spot Exchange to US investors may vary based on regulatory requirements and restrictions. It is advisable for US investors to review the platform's terms and conditions or consult legal advice before interacting with exchange.

Does LCX Exchange have a native token?

Yes, LCX platform has its native token called LCX Token. The LCX Token plays a vital role in the LCX ecosystem and offers various benefits to token holders, such as reduced trading fees and exclusive access to certain features.

Is LCX Exchange regulated?

Liechtenstein Cryptoassets Exchange is regulated by the Liechtenstein Financial Market Authority (FMA). This regulatory oversight ensures that the firm complies with the necessary laws and regulations to protect users' funds and maintain a secure trading environment.