10 Best Altcoins to Buy in 2023

What are the best crypto assets to repeat Solana’s and ETC’s success? Here are the best altcoins to buy, all their jackets and mugshots, and also information on where to buy them

Bitcoin became so popular because it gave people something extremely valuable: power, autonomy, and (sort of) stealth. The rule in this industry is: the more value you create, the more your tokens cost.

Altcoins (alternative coins) came after Bitcoin with the aim of repeating its success. None of them really did, except for YFI, which not only overtook Bitcoin in terms of price at the time, but took less than 2 months to do it instead of 10 years. It doesn’t really count though, because, compared to Bitcoin, it didn’t create much infrastructure (like Belle Delphine’s $30-a-jar bathwater, it only had sentimental value)

Other altcoins, like Ethereum, tried to give people something, like unprecedented ability to build whole ecosystems, or, like Monero, exceptional stealth. They did reasonably well to create utility, and people liked them. Their price grew, and people who bought them early on and sold later made money, sometimes in multiples of their starting capital.

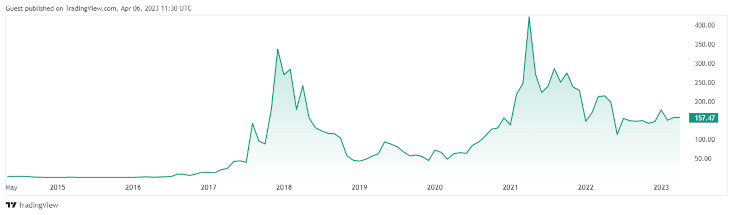

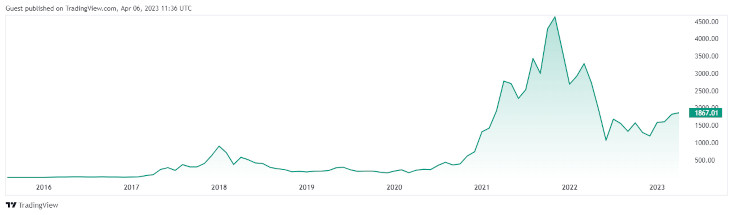

Are altcoins worth your time? Maybe, maybe not. We certainly have doubts about Ethereum’s future. However, so far it got early investors reasonable profits. On April 12, 2016 Ethereum cost $7.10 for one coin, and March 23, 2023, Ethereum was worth $1747.64. Which isn’t quite as impressive as Bitcoin’s 679 999 900% ROI, going from a tenth of a penny to $68 000, but impressive nonetheless.

Monero (XMR)

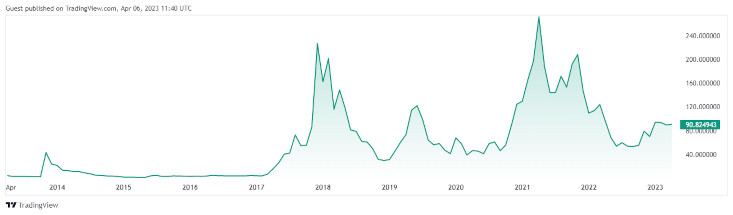

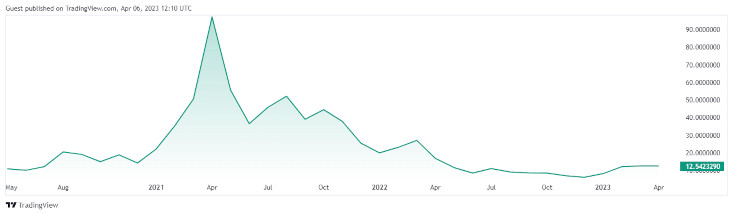

Source and Copyright: © TradingView

Source and Copyright: © TradingView

| Date of launch | April 2014 |

| Price | $157.47 |

| Market Cap | $2.876 billion |

| Rank | #24 |

| Blockchain | Monero |

| Supply | Unlimited |

| Purchase method | USDT, USDC, ETH, BTC, BUSD, Credit card |

Growth potential: why? This is a very exciting old-timer coin with insanely complex technology that has most hardcore crypto enthusiasts in ecstasy about its stealth capabilities. It’s much, much stealthier than Bitcoin and most other cryptos.

How does it feel to know that with other cryptos all your transactions are being watched? Thanks to RingCT, Monero is a privacy-centric cryptocurrency with more than 26,000 transactions per day. In contrast to Bitcoin, sensitive data about Monero transactions is not published on the blockchain.

Real anonymity is extremely important in these times of vicious crypto crackdowns.

Where to buy? Coinbase, Coinmama, Kraken, and Binance, P2P markets like Bitpapa and Bity. Keep an ear to the ground with new crypto trading platforms! They can be risky. Our information is not financial advice or recommendation, do your own research.

Ethereum (ETH)

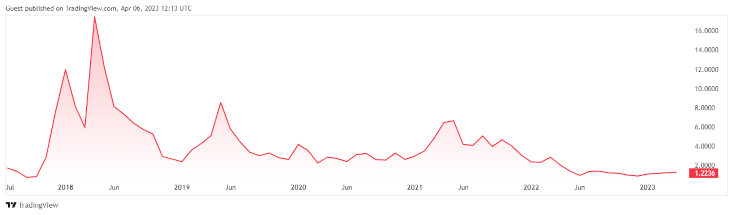

Source and Copyright: © TradingView

| Date of launch | 2015 |

| Price | $1967,96 |

| Market Cap | $228.363 billion |

| Rank | #2 |

| Blockchain | Ethereum |

| Supply | Unlimited |

| Purchase method | USDT, USDC, DAI, BTC, TRX, Credit card... |

Growth potential: why? Ethereum is a blockchain technology that is used to power many other crypto projects, like Binance Coin and Binance Smart Chain. Ethereum also has its own native utility token, called Ether.

On Ethereum, you can build decentralized applications (or "dapps") and use smart contracts, which are computer programs that can automate things like payments or money transfers. With smart contracts, users can save money on transaction fees because the contracts are self-executing.

The question these days is whether Ethereum is going to be investigated by the US government for being an illegally traded security (you may remember the sad story of Pavel Durov’s TON), so we’d probably hold off on buying tons of ETH for now. 12th of April marks the completion of Ethereum's full transition from proof-of-work (PoW) to proof-of-stake (PoS) network, and we’ll find out (from the Security and Exchange commission) soon enough whether POS equals Ethereum being a security. We’ll keep you in the know, of course, but for now let’s just say there’s a good chance of a pretty dramatic change in the crypto markets.

Where to buy? Bitcoin ATMs, cryptocurrency platforms like Binance and Coinbase, websites like Ethereum.org, Finbold, Nerdwallet.

Litecoin (LTC)

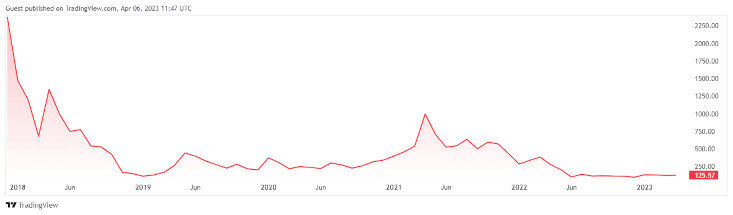

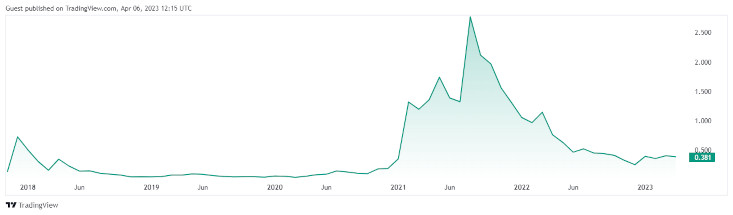

Source and Copyright: © TradingView

| Date of launch | October 2011 |

| Price | $88.82 |

| Market Cap | $6.597 billion |

| Rank | #13 |

| Blockchain | Litecoin |

| Supply | 84 million |

| Purchase method | USDT, USDC, BUSD, BTC, Credit card... |

Growth potential: why? Litecoin is very fast and cheap, making it popular with businesses, where there is a lot of profit to be made.

With over a 100 000 000 transactions, Litecoin is a cryptocurrency that was created in 2011 as a direct competitor to Bitcoin. Instant transaction confirmations and an impressive team (MIT graduate founder Charlie Lee is a former Google engineer) soon made it a success with businesses.

Litecoin has very low transaction fees, allowing users to transfer money quickly and easily. A lot of uptime in the business is a big plus, plus remarkable market cap is a sign of success. It also had a so-called fair launch, which is an honest way to create a crypto, with no pre-allocation to the team, and no ICO.

Where to buy? Exchanges like Coinbase, Changelly, or Bybit, apps like PayPal, also Litewallet.

Bitcoin Cash (BCH)

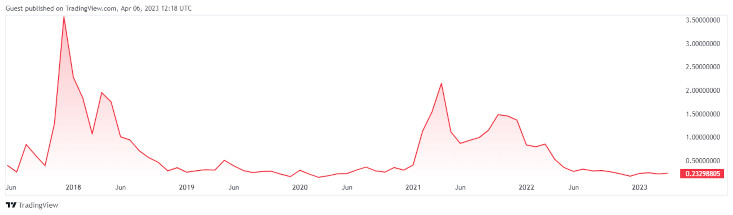

Source and Copyright: © TradingView

| Date of launch | August 2017 |

| Price | $122.57 |

| Market Cap | $2.4 billion |

| Rank | #28 |

| Blockchain | Bitcoin Cash Protocol, SmartBCH |

| Supply | 21 million |

| Purchase method | USDT, USDC, BUSD, BNB, LTC, DOT, BTC, Credit card... |

Growth potential: why? Bitcoin Cash has very low fees, meaning it’s very cost effective for users to send and receive money. Its transaction speed is much faster than Bitcoin’s. It’s inflation-resistant (which is useful in the age of 6% inflation), able to process more transactions a second than Bitcoin. Plus a few more cool security add-ons.

Bitcoin Cash is a fork of the original Bitcoin cryptocurrency. It was created in 2017 with the goal of providing faster and cheaper transactions compared to Bitcoin.

It allows for up to 8 MB block sizes, which can process transactions in seconds. It also supports both SegWit and Smart Contracts, which make it much more secure than other cryptocurrencies.

With only a handful of full-time developers, Bitcoin Cash is quickly becoming one of the most popular altcoins available.

Where to buy? A bitcoin ATM from Coin ATM Radar, credit card, bank transfer, a crypto exchange, sites like Bitcoin.com.

Ripple (XRP)

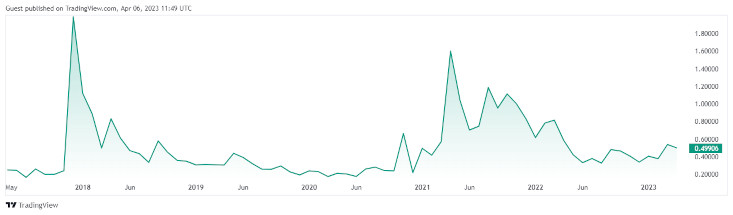

Source and Copyright: © TradingView

| Date of launch | 2012 |

| Price | $0.49 |

| Market Cap | $25,77 billion |

| Rank | #6 |

| Blockchain | Ripple |

| Supply | 100 billion |

| Purchase method | USDT, USDC, BUSD,ETH, ADA, DAI, Credit card... |

Growth potential: why? Built to work with banks; if it succeeds, potential for adoption is monstrous.

Ripple is a cryptocurrency that was released in 2012 and has gained popularity over the years. It is different from other cryptocurrencies because it is a payment protocol, meaning it is designed to help facilitate global money transfers.

Ripple works with banks and payment providers to transfer funds quickly and cheaply. Transactions are settled in seconds and can be done from any country in the world.

The advantages of using Ripple include very low fees, which is why it’s so popular for international payments.

Unlike other cryptocurrencies, there is no need for miners to validate transactions on the Ripple network. Instead, there is a network of “validators” which are only a handful of trusted organizations that verify transactions. This makes the network much faster. There are centralization concerns.

Risks. You may remember us mentioning the SEC. The Securities and Exchange Commission (SEC) is a federal regulatory agency that aims to protect investors. It regulates securities, stocks, options, and other forms of investments. The SEC has already started scrutinizing the cryptocurrency market because of its rapid growth in recent years. Some investors are concerned about investing in Ripple due to their run-ins with the SEC. SEC’s lawsuit against Ripple is, sadly, about, you guessed it, unregistered securities trading.

Author's opinion: We’re tempted to quote our jiu-jitsu coach who once said about our kumite opponents: “Niki, if you break all your toys, you’ll have nothing to play with”, but that wouldn’t be an accurate assessment. So for now let’s just say that it’s beginning to look like the US is going to see a massive outflow of crypto trading because of its draconian crypto laws. Which will be great for the most developed countries in the world like Malta and Switzerland who have been welcoming it with open arms for years, and thus have been seeing dramatic economic benefits, and not so great for the US with its history of deafening Dollar crises and not much to fall back on. Still, that is just a guesstimate.

.

Where to buy? Exchanges like eToro, Kraken, Huobi Global.

Stellar (XLM)

Source and Copyright: © TradingView

| Date of launch | 2014 |

| Price | $0.11 |

| Market Cap | $$2,8 billion |

| Rank | #26 |

| Blockchain | Stellar |

| Supply | 50 billion |

| Purchase method | USDT, USDC, BUSD, ETH, BTC, Credit card... |

Growth potential: why? The goal is to get all of the world’s financial systems to join forces, which would make them stronger. Stellar is one of the more technologically savvy systems, which is always useful since advanced technology inevitably means success in this industry.

Stellar is an open-source payment platform that makes it easy and cost-effective to send money all over the world. It's a decentralized system, meaning that there’s no central authority or server overseeing the system.

With Stellar, you can quickly and securely send payments to any person or business in any currency, without needing to go through a bank or payment processor.

Stellar also has some unique features like asset issuance, distributed order books, and path-payments systems, atomic cross-chain transfers, and smart contracts. All these features make it an attractive platform for businesses.

Where to buy? Exchanges like Binance, OKX, Deepcoin, Bybit, Bitrue, Kraken, and KuCoin.

NEO (NEO)

Source and Copyright: © TradingView

Source and Copyright: © TradingView

| Date of launch | February 2014 |

| Price | $11.5 |

| Market Cap | $884 million |

| Rank | #61 |

| Blockchain | NEO |

| Supply | 100 million |

| Purchase method | USDT, USDC, BUSD, ETH, BTC, BNB, Credit card... |

Growth potential: why? Quantum-computer-proof blockchain, support of 10 000 transactions a second, low fees.

NEO, formerly known as AntShares, is a blockchain platform and cryptocurrency that was founded in 2014 by Chinese blockchain developer Da Hongfei.

It is often referred to as the "Chinese Ethereum," due to its similar functions and technology.

The NEO network allows for the creation of a variety of decentralized services, such as token exchanges, voting systems, and crowdfunding projects.

Unlike many other cryptocurrencies, NEO has two separate tokens: NEO and GAS. NEO is used to represent ownership of the network while GAS is used to pay fees associated with transactions. These fees are very low, with only a handful of GAS needed to send transactions through the network.

NEO has also gained traction because it is designed to be resistant to quantum computing, which could potentially pose a security threat to some other blockchains.

This is an open source project, meaning anyone can contribute to the development of the network.

Where to buy? CEX.IO, Upbit, other exchanges on Coin Insider.

EOS (EOS)

Source and Copyright: © TradingView

| Date of launch | 2018 |

| Price | $1.08 |

| Market Cap | $1.331 billion |

| Rank | #42 |

| Blockchain | EOS Network |

| Supply | Unlimited |

| Purchase method | USDT, USDC, BUSD, ETH, BTC, Credit card... |

Growth potential: why? No transaction or gas fees, high TPS.

EOS is one of the most popular altcoins on the market and it is often compared to Ethereum. It’s a blockchain platform, but it has a few unique features that set it apart. For example, it does not charge users for executing transactions, and it has very low fees for running applications on its network. EOS can process thousands of transactions per second (4 000 at peak capacity).

EOS requires only a handful of validators to run the network, making it much faster and more reliable than other blockchains. There are concerns about centralization.

Where to buy? Exchanges like Binance.

Cardano (ADA)

Source and Copyright: © TradingView

Source and Copyright: © TradingView

| Date of launch | 2017 |

| Price | $0.38 USD |

| Market Cap | $13,207 billion |

| Rank | #7 |

| Blockchain | Cardano |

| Supply | 45 billion |

| Purchase method | USDT, USDC, BUSD, ETH, BTC, CAKE, Credit card... |

Growth potential: why? Peer-reviewed academic approval means extremely high standards of quality. Remarkable team, including notable mathematician Charles Hoskinson. Very energy-efficient.

Cardano’s infrastructure is very well thought through. With its dual-layer architecture that includes smart contracts for transactions, which uses evidence-based methods grounded in scientific philosophy, academic theory, and finalized via peer-reviewed research, it’s a formidable crypto that has deserved recognition across the industry.

Cardano emphasizes “providing a more balanced and sustainable ecosystem that better accounts for the needs of its users as well as other systems seeking integration” and is therefore more focused on providing services to developing countries.

All of these features make Cardano one of the most promising altcoins to invest in for the long-term.

Where to buy? Coinbase, Crypto Radar, and NerdWallet.

IOTA (MIOTA)

Source and Copyright: © TradingView

| Date of launch | 2015 |

| Price | $0.2334 |

| Market Cap | $648,753 milion |

| Rank | #79 |

| Blockchain | IOTA |

| Supply | 2,7 billion |

| Purchase method | USDT, USDC, BUSD, ETH, XPR, Credit card... |

Growth potential: why? Aims to provide a bridge between the machine economy and the human economy.

IOTA is a cryptocurrency that was created to support the Internet of Things (IoT). It was designed to enable machine-to-machine (M2M) transactions with very low fees and is one of only a handful of cryptocurrencies that use a directed acyclic graph (DAG) instead of a blockchain. There are no fees, blocks, or miners.

The primary benefit of using IOTA is that it can process microtransactions faster and more efficiently than any other cryptocurrency. Transactions on the IOTA network are free and have no limit, making it ideal for micropayments and the internet of things.

Additionally, the IOTA network is secure, tamper-proof, and decentralized. This makes it resistant to data breaches and cyber-attacks. Finally, IOTA has partnered with a number of industry leaders, which has helped it to gain wider adoption.

Where to buy? IOTA website, eToro, Kraken, Bitpanda, and KuCoin exchanges.

Unique Use Cases

AXS (Axie Infinity Shard, which is a truly unfortunate name) is a play-to-earn gaming token, which allows you to create and (hopefully) sell metaverse assets and do governance, plus trading them is an option.

You can see how interest in blockchain and gaming has caused a rise in its popularity:

Source and Copyright: © TradingView

Source and Copyright: © TradingView

| Date of launch | 2018 |

| Price | $8,66 |

| Market Cap | $1.004 billion |

| Rank | #54 |

| Blockchain | Axie Infinity |

| Supply | 270 million |

| Purchase method | USDT, USDC, BNB, ETH, WETH, Credit card... |

Summary

With 8000+ coins out there, it’s not easy to make an educated choice. Here’s our 2 Bitcoin’s worth: follow Michael Saylor’s rule and do 100 hours’ worth of research if you’re going to pick a coin to make you rule them all. Our article is a great start. We’ve done 99% of the work for you by selecting the best of the best. Now you’re on your own.

Remember to look for utility, transparency, a good team, and a good reputation. Diversify, ask around, and don’t invest more than you can afford to lose! Don’t trade and drive.

FAQ

Which altcoin will explode in 2023?

We’d definitely say that a coin’s potential is all about the team. The quality of the infrastructure definitely depends on the brilliant minds behind the code. Charles Hoskinson, who is the person more or less in charge of the project, is a brilliant mathematician, plus all the work by Cardano gets rigorously audited by the academic community. Peer-reviewed academic research? Sounds like a great foundation for success!

What are the risks of buying altcoins?

Cryptocurrency is a new, volatile market. There are plenty of coins with the potential to go to the moon and there are many more that have been created by fraudsters looking for an easy way to steal money from unsuspecting investors. One thing you need to be aware of when buying altcoins is that they may not have the same security as bitcoins, or a reputable company behind them. There's no telling what can happen in crypto markets so if you're thinking about buying an altcoin it's important to do your research.

What is the best altcoin to buy right now?

In the short term, it might seem like a good idea to buy some cheap coins with low volume on an exchange or at one of many crypto events happening around the world. But remember that in the long-term you want your altcoin to have the same foundations that made Bitcoin great: brilliant minds, incorrigible principles, and a stark desire to make the world a better place for everyone.

NB Beware of bugs in projects that haven’t been around for more than 10 years. Not investment advice.

Charles Hoskinson Charlie Lee Michael Saylor Binance Bitfinex Bitrue Bitstamp ByBit Kraken KuCoin Ledger OKX Upbit