Exploring Best Crypto Lending Platforms: Top 10 to Consider in 2023

Discover the top 10 crypto lending platforms with our comprehensive guide, understand how crypto lending works, its benefits, and risks.

What is Crypto Lending

Crypto lending has emerged as a key service in Web 3, widely adopted by various crypto exchanges and platforms. This service involves investors depositing their cryptocurrencies onto a platform, which then lends these assets to borrowers in return for interest payments.

These cryptocurrency lending platforms act as intermediaries, connecting lenders to borrowers. Lenders place their crypto in accounts that yield high interest, while borrowers obtain loans through these platforms. The platforms utilize the deposited crypto to fund these loans and manage interest rates for both borrowing and lending, thus regulating their net interest margins. To get a crypto loan, borrowers are required to pledge their cryptocurrency as collateral in exchange for immediate cash.

This arrangement is beneficial for all parties involved. Lenders earn interest on their deposits, borrowers gain access to liquidity or assets without resorting to conventional financial sources, and the lending platforms earn revenue by charging service fees to borrowers.

Crypto lending services are available on both centralized and decentralized platforms, but their fundamental principles are consistent across both types. Essentially, crypto lending functions similarly to traditional bank lending, but with crypto assets or fiat currency as the basis of transactions.

How Does Crypto Lending Work

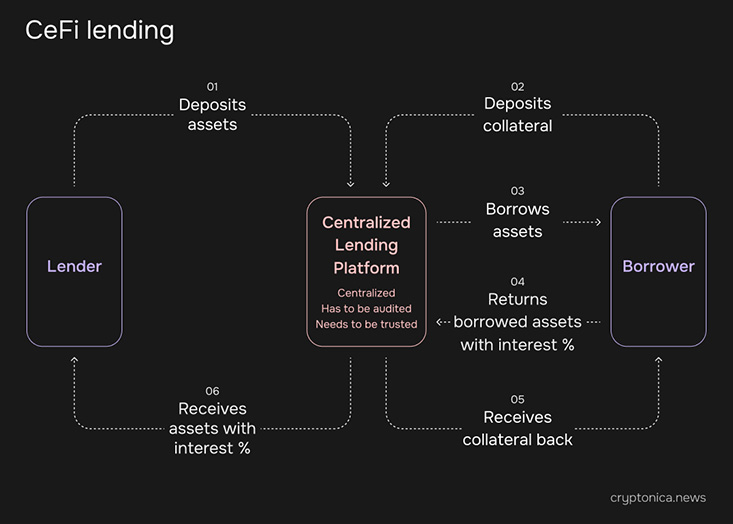

Crypto lending usually includes three key participants: the lender, the borrower, and a cryptocurrency lending platform. On one side, there's a crypto holder (the lender) willing to loan out their assets for regular interest income. On the other, a borrower seeks to access these funds, providing a security deposit, or collateral, in return. They must also pay interest rates and ultimately repay the entire loan. Finally, the crypto lending platform manages the whole process.

These platforms are categorized into two primary types: decentralized and centralized crypto lenders. Both types provide high-interest rate opportunities, and commonly, borrowers must provide collateral to obtain a crypto loan.

Generally, the amount of your crypto loan is determined as a percentage of your pledged cryptocurrency's value, known as the loan-to-value ratio.

The LTV ratio is a critical metric in crypto lending, representing the amount of the loan in relation to the value of the collateral. It's calculated as the loan amount divided by the value of the collateral, expressed as a percentage.

For example, if you provide $10,000 worth of crypto as collateral and receive a loan of $5,000, the LTV is 50%.

A lower LTV means less risk for the lender, as it provides a buffer against the volatility of the cryptocurrency market. Borrowers are often required to maintain a certain LTV ratio throughout the loan period.

Centralized Crypto Lending Platforms (CeFi)

Centralized crypto lending platforms operate much like traditional financial institutions but in the cryptocurrency domain. Users deposit their crypto assets into these platforms, which then lend these assets to borrowers. The platform acts as an intermediary, managing both the lending and borrowing processes. The centralized nature of these platforms means they have control over users’ deposited assets, and they are responsible for the security and proper functioning of the platform.

Users who deposit their cryptocurrencies are typically rewarded with interest payments, the rates of which are determined by the platform based on various factors like market demand and the asset type. Borrowers are required to go through a KYC (Know Your Customer) process and must provide collateral, usually in crypto, which often exceeds the value of the loan to mitigate the platform’s risk.

Decentralized Crypto Lending Platforms (DeFi)

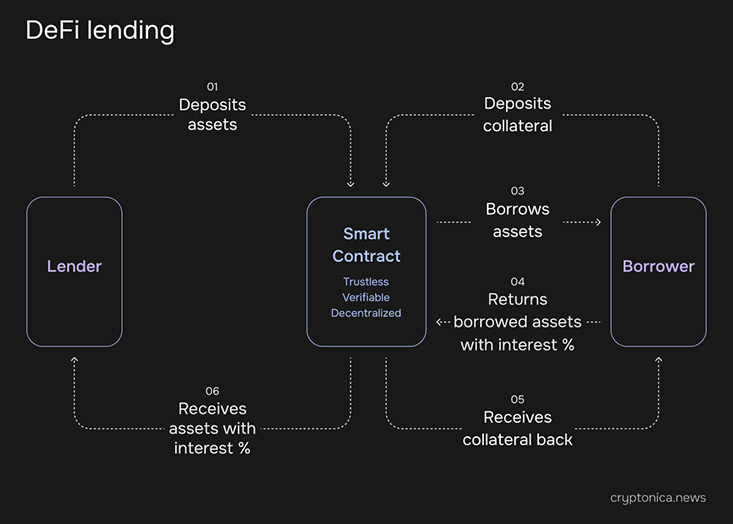

Decentralized crypto lending platforms, on the other hand, operate on the principles of Decentralized Finance (DeFi) and use blockchain technology to facilitate lending and borrowing without a central authority. In these platforms, smart contracts automatically manage the lending and borrowing terms, execution, and enforcement.

In DeFi lending protocols the lending and borrowing process is facilitated through lending pools, which serve as alternatives to traditional bank loan offices.

In this system, smart contracts aggregate assets from various lenders and allocate them to borrowers. Similar to traditional banking, where collateral is required for a loan, DeFi loans also require collateral. However, unlike traditional banking where physical assets are pledged, DeFi systems rely on cryptocurrency as collateral. This process is anonymous and digital. The borrower must provide collateral that exceeds the loan value, meaning the loan is overcollateralized.

Top 10 Crypto Lending Platforms 2023

There are numerous crypto lending platforms, both centralized and decentralized, that have gained popularity due to their features, reliability, and the range of services they offer. Here's a list of some of the most common and popular platforms in each category:

DeFi Lending Platforms

Aave

Source & Copyright: © Aave

It is impossible to make up a crypto lending platforms list without bringing up the name of AAVE, the leading decentralized crypto lending protocol.

Aave offers both stable and variable interest rates. Borrowers can choose between the two based on their preferences and market conditions. Stable rates provide predictability, while variable rates can fluctuate with market demands.

In terms of lending, every token supplied on Aave earns a yield, except for the Aave token itself, with most yields ranging from under 1% to 2.5%. The platform sets rates based on supply and demand, with supplied tokens going into a pool. As the borrowing demand increases, the borrowing APYs increase, benefiting suppliers for that token.

A unique feature of Aave is the flash loan, which allows users to borrow funds without collateral, provided that the loan is taken and repaid within the same transaction block.

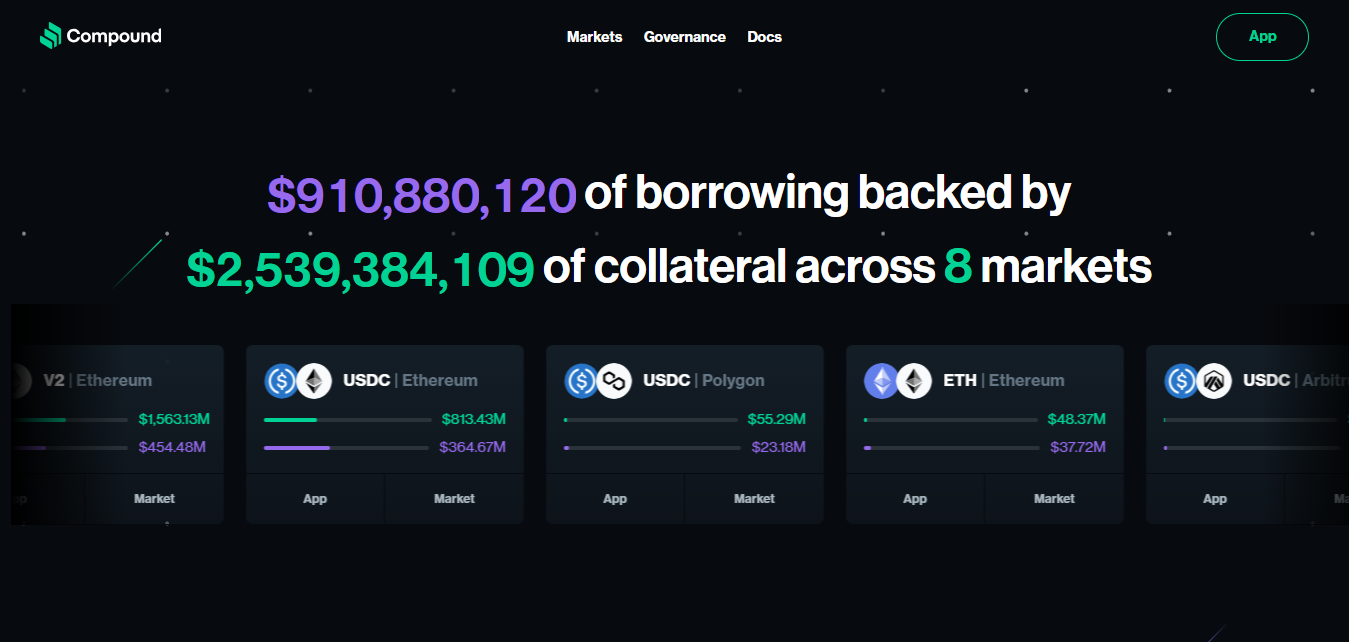

Compound Finance

Source & Copyright: © Compound Finance

Compound is another key player in the DeFi space, offering decentralized lending and borrowing services.

Compound adjusts interest rates algorithmically based on supply and demand within the protocol. Lenders contribute to supply pools from which borrowers can take loans, with interest rates fluctuating according to the pool's utilization rate.

When users deposit assets into Compound, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and accrue interest over time. They can be used or traded independently of the underlying asset.

Compound has been influential in the DeFi space, particularly in popularizing the concept of liquidity mining, where users earn additional tokens (in this case, COMP tokens, which are Compound's governance tokens) on top of the usual interest for lending and borrowing assets.

Alchemix

Source & Copyright: © Alchemix

Alchemix stands out in the DeFi space for its innovative approach to loans and debt repayment. Alchemix's primary feature is its self-repaying loan mechanism. Users deposit a cryptocurrency, like DAI, into the Alchemix protocol, which then uses these deposits to generate yield through other DeFi protocols. This yield is then automatically applied to repay the user's loan over time.

When a user deposits their assets, they receive a portion of their deposit's value in a synthetic asset, typically referred to as alUSD (if DAI is deposited). This synthetic asset can be used just like any other cryptocurrency for various purposes, including trading, lending, or as liquidity in other DeFi protocols.

A key benefit of Alchemix is that it mitigates the liquidation risk common in other lending platforms. Since the loans repay themselves over time, there's no need for the typical collateral liquidation processes seen in traditional crypto lending if the value of the collateral drops.

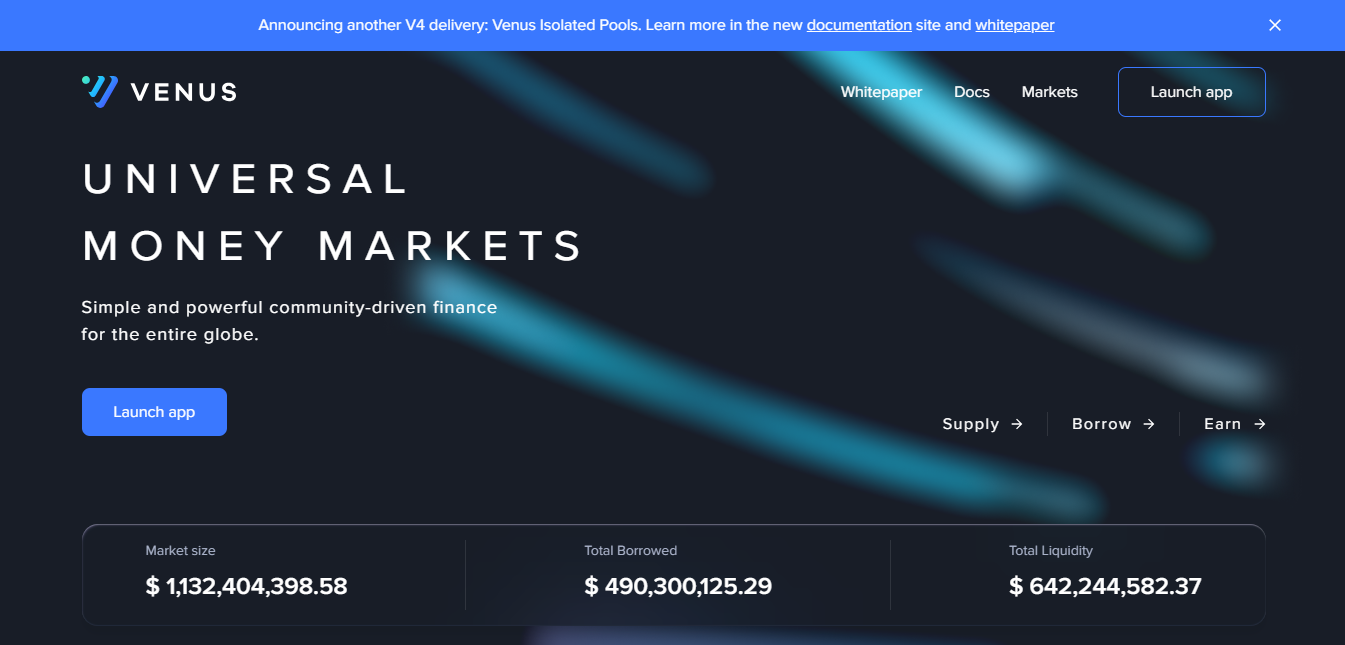

Venus Protocol

Source & Copyright: © Venus Protocol

Venus Protocol is a DeFi platform that operates on the BNB chain. Venus allows users to supply various cryptocurrencies as collateral to earn interest and to borrow against their collateral.

One of Venus's unique features is the creation of synthetic stablecoin VAI, which is pegged to the value of the U.S. Dollar. Users can mint these stablecoins by providing collateral to the Venus platform.

The platform adjusts interest rates based on market demand and supply dynamics, ensuring a balance between borrowers and lenders. This means interest rates can fluctuate in response to changes in the market.

Maker DAO

Source & Copyright: © MakerDAO

MakerDAO is a prominent DeFi platform known for its role in pioneering the concept of decentralized stablecoins and lending services . MakerDAO operates as a DAO on the Ethereum blockchain, and all protocol-related decisions are made via collective voting by holders of its governance token, MKR.

MakerDAO is best known for creating Dai, a stablecoin pegged to the US dollar. Unlike other stablecoins backed by fiat in bank accounts, Dai maintains its stability through smart contracts and collateralization with other cryptocurrencies.

Users can create DAI by locking their cryptocurrency into a smart contract known as a Collateralized Debt Position (CDP). This process involves over-collateralization to ensure stability, meaning the value of the collateral is higher than the value of DAI borrowed.

If the collateral value in a CDP falls below a certain threshold, it can be liquidated to ensure Dai remains adequately backed. MakerDAO and DAI are widely integrated across the DeFi ecosystem, with DAI being used in various platforms for lending, borrowing, trading, and liquidity provision.

Centralized Crypto Lending Platforms

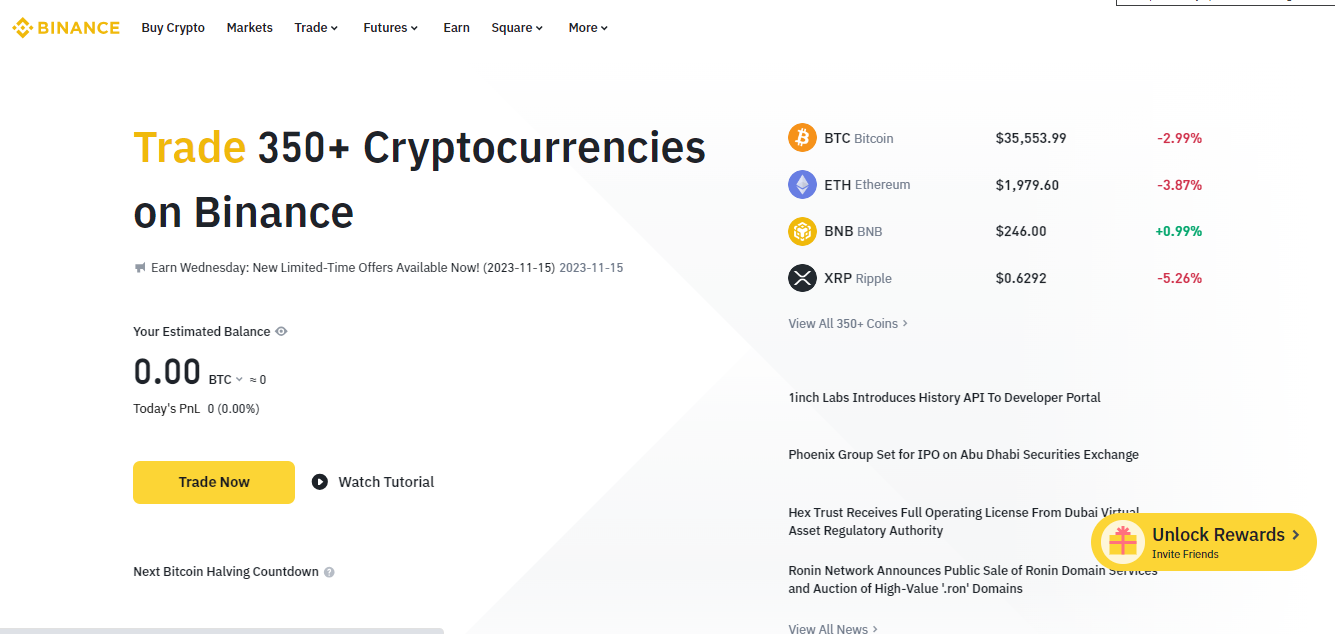

Binance

Source & Copyright: © Binance

Binance, one of the world's largest cryptocurrency exchanges, also offers a lending feature as part of its suite of financial services. It supports the largest number of cryptocurrencies of all the leading lending sites, with more than 180 cryptos to choose from.

Binance offers two main types of lending products: fixed deposits and flexible deposits. Fixed deposits have a set term and generally offer higher interest rates, while flexible deposits allow users to withdraw their funds at any time, offering lower, variable interest rates.

The interest rates on Binance Lending vary depending on the asset and the type of lending product chosen. Fixed deposit terms can range from a few days to months, with the interest rate typically predetermined for the term's duration.

NEXO

Source & Copyright: © NEXO

NEXO is a well-known centralized cryptocurrency platform that offers a range of financial services, including crypto lending. NEXO allows users to secure instant loans in fiat currencies or stablecoins by collateralizing their cryptocurrency assets. This feature enables users to access liquidity without selling their crypto holdings as low as 0% and no extra fees.

The platform offers one of the higher Loan-to-Value (LTV) ratios in the market and supports a broad array of cryptocurrencies as collateral.

Borrowers on NEXO have flexibility in loan repayment, with options to pay interest-only or repay part of the principal at any time. In addition to lending, NEXO offers an interest-earning account where users can earn interest on their deposited cryptocurrencies and fiat currencies. The interest rates can be up to 16%, which is compounded compounded daily.

Source & Copyright: © Crypto.com

Crypto.com is a comprehensive cryptocurrency platform known for its wide array of services, including a crypto credit service where users can deposit cryptocurrency as collateral and receive a loan in the form of a stablecoin or fiat currency. The exact LTV ratio depends on the type of cryptocurrency used as collateral, but typically is up to 50%.

Crypto.com offers flexibility in loan repayments, allowing users to repay their loans at their convenience within the agreed loan term.

The lending service is integrated with the broader Crypto.com ecosystem, which includes a crypto exchange, debit card services, and an earn program where users can earn interest on their crypto holdings.

YouHodler

Source & Copyright: © YouHodler

YouHodler is a financial service that offers a range of cryptocurrency-focused products, with a focus on crypto-backed loans.

One of the notable features of YouHodler is its high loan-to-value (LTV) ratios, which can go up to 90% depending on the asset. This is higher than many other crypto lending platforms.

Besides lending, YouHodler offers savings accounts where users can earn interest on their cryptocurrency holdings. The platform supports a range of cryptocurrencies for its savings accounts, providing competitive interest rates up to 12%. The minimum amount required to open a saving account is $100.

Multi HODL and Turbocharge are unique features for crypto trading. Multi HODL allows users to leverage their assets to potentially increase profits, while Turbocharge is designed to help users take loans to buy more cryptocurrency, amplifying their investment potential.

OKX

Source & Copyright: © OKX

OKX stands as one of the world's foremost crypto exchanges featuring crypto loans. Among the loan options offered to customers of OKX crypto exchange are Flexible and Fixed loans. The Flexible Loan, distinct for its lack of a fixed term and predetermined interest rate, accommodates over 120 varieties of crypto assets as collateral. It operates with a market-driven interest rate, subject to hourly updates.

Fixed loans are basic types of loan on the OKX exchange. Here borrowers can only access USDT loans, with four different types of crypto assets eligible for use as collateral. The interest rates for these loans are determined by the borrowed amount, the collateral value, and the loan period. Generally, higher collateral and extended loan durations lead to lower liquidation levels.

Why Do You Need a Crypto Loan

The concept of taking out a crypto loan despite needing to provide crypto as collateral might seem strange at first, but there are several reasons and benefits for doing so.

Some borrowers use crypto loans to gain leverage in their investments. By using their existing crypto as collateral, they can borrow additional funds to invest in more cryptocurrency or other assets, hoping to earn a return higher than the interest they need to pay on the loan.

Borrowers might not want to sell their current cryptocurrency holdings due to a belief that their value will increase in the future. By taking out a loan with their crypto as collateral, they can access liquid funds for immediate needs or opportunities without having to sell their holdings.

Imagine you own a valuable painting. You need cash but don't want to sell the painting because you believe it will be worth more in the future. Instead, you take a loan using the painting as collateral. In the crypto world, if you hold Bitcoin or another cryptocurrency and expect its value to rise, you might not want to sell it. Taking a crypto loan lets you access cash (or stablecoins) while retaining your crypto assets.

Some traders take out crypto loans to short sell the borrowed cryptocurrency. They do this by borrowing a certain cryptocurrency, selling it at the current market price, and then hoping to buy it back later at a lower price to repay the loan, keeping the difference as profit.

What Are the Crypto Lending Risks

The first thing that borrowers have to consider when taking out the loan is the risk of liquidation. Liquidation is a significant concern in crypto lending due to the inherent volatility of cryptocurrencies. Prices can swing dramatically in short periods, increasing the likelihood of liquidation.

Liquidation occurs when the value of the collateral falls below a certain threshold relative to the loan amount. This is closely tied to the Loan-to-Value (LTV) ratio.

Each lending platform has its own set of rules for liquidation. Typically, a liquidation is triggered when the LTV ratio reaches a certain level (70%, 80%, etc.). Often, platforms provide warnings or margin calls to the borrower when the LTV ratio approaches the liquidation threshold. This gives the borrower a chance to add more collateral or pay back part of the loan to bring the LTV ratio back down.

If the borrower does not act and the collateral value continues to decline past the trigger point, the platform will automatically initiate a liquidation process. This typically involves selling the collateral on the open market to recover the loan amount.

In decentralized platforms, liquidations are executed automatically by smart contracts leaving little room for negotiation or delay. As a result, the borrower can lose a significant portion, if not all, of their collateral.

Final Words

Before engaging in crypto lending, it's essential for both lenders and borrowers to thoroughly research the lending platforms, interest rates, loan terms, and fees across different platforms. Crypto lending can be a legit option for those aiming to earn passive income or acquire loan without liquidating crypto assets, but it requires careful consideration of risks. The approach to crypto lending should be cautious and well-informed, particularly in understanding platform-specific risks and the volatility of the cryptocurrency market.